Despite the release of mostly positive U.S. data, the greenback moved lower against other major currencies. How did this move affect the technical picture of the euro, the pound and the Canadian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: snone

- GBP/USD: none

- USD/JPY: none

- USD/CAD: long (a stop-loss order at 1.2949; the initial upside target at 1.3302)

- USD/CHF: none

- AUD/USD: none

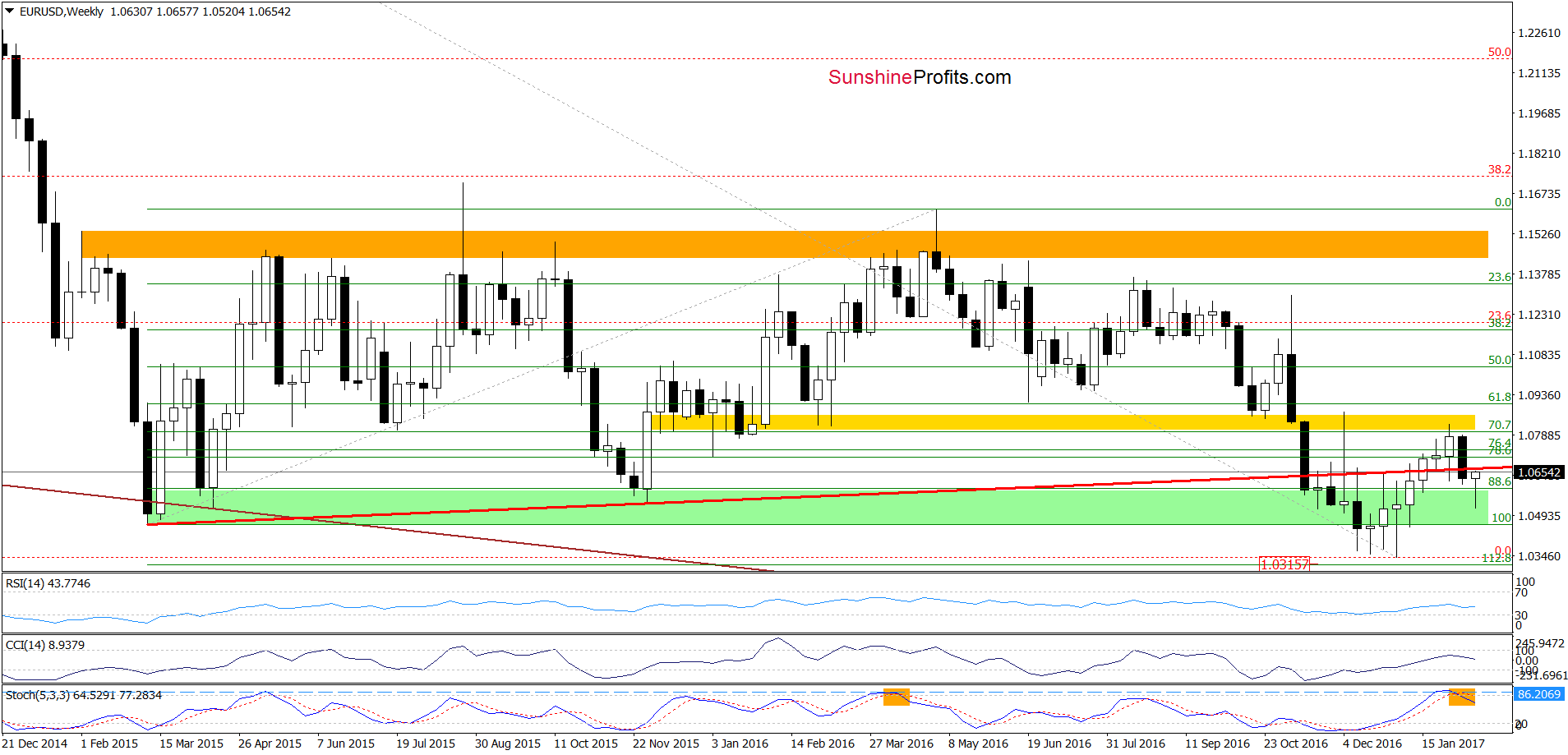

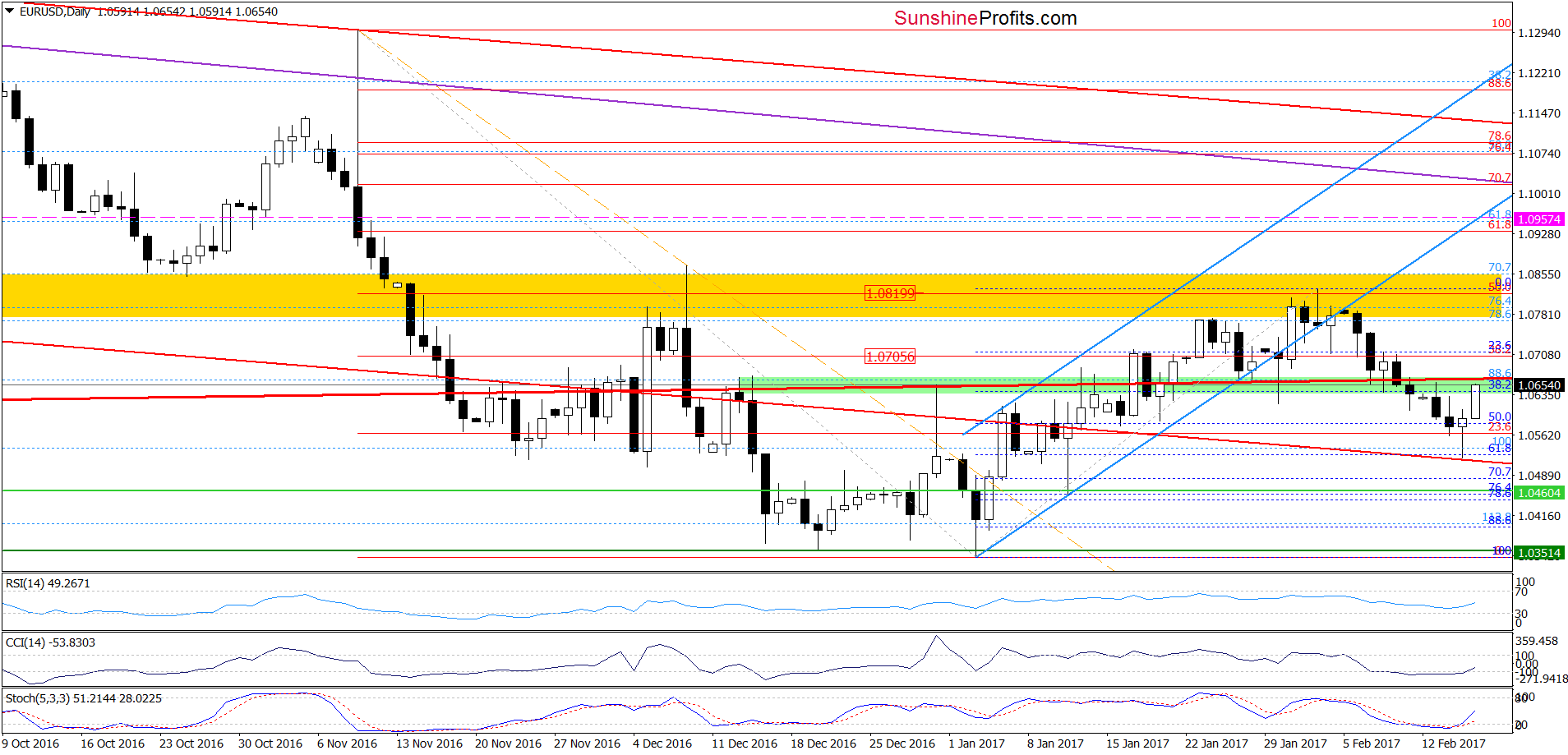

EUR/USD

Looking at the charts, we see that EUR/USD extended losses and dropped to the 61.8% Fibonacci retracement based on the January-February upward move, which triggered a rebound to the green zone and the long-term red line. Such price action looks like a verification of the earlier breakdown, but taking into account buy signals generated by the indicators it seems that currency bulls will try to push the exchange rate higher. Therefore, closing short positions is justified from the risk/reward perspective.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

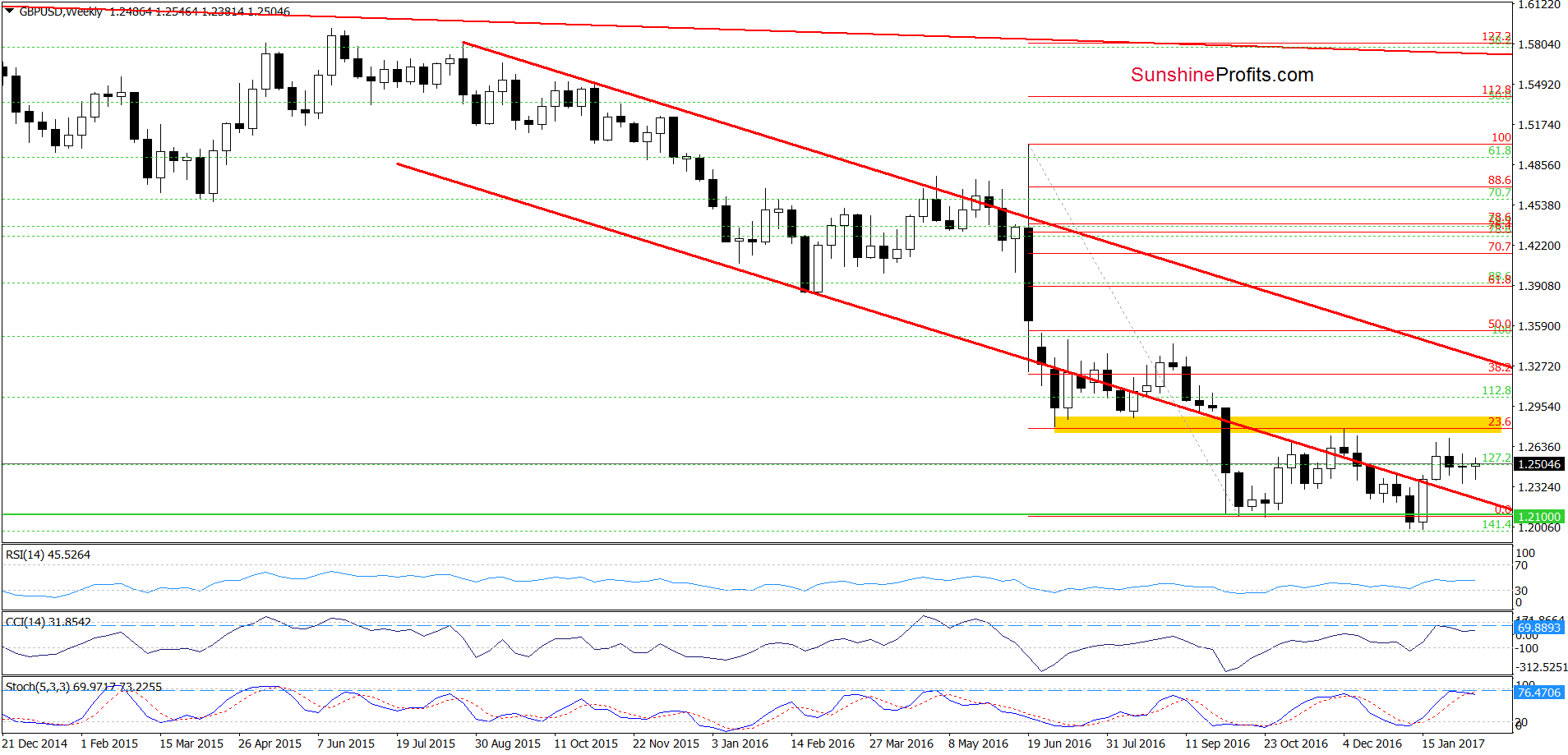

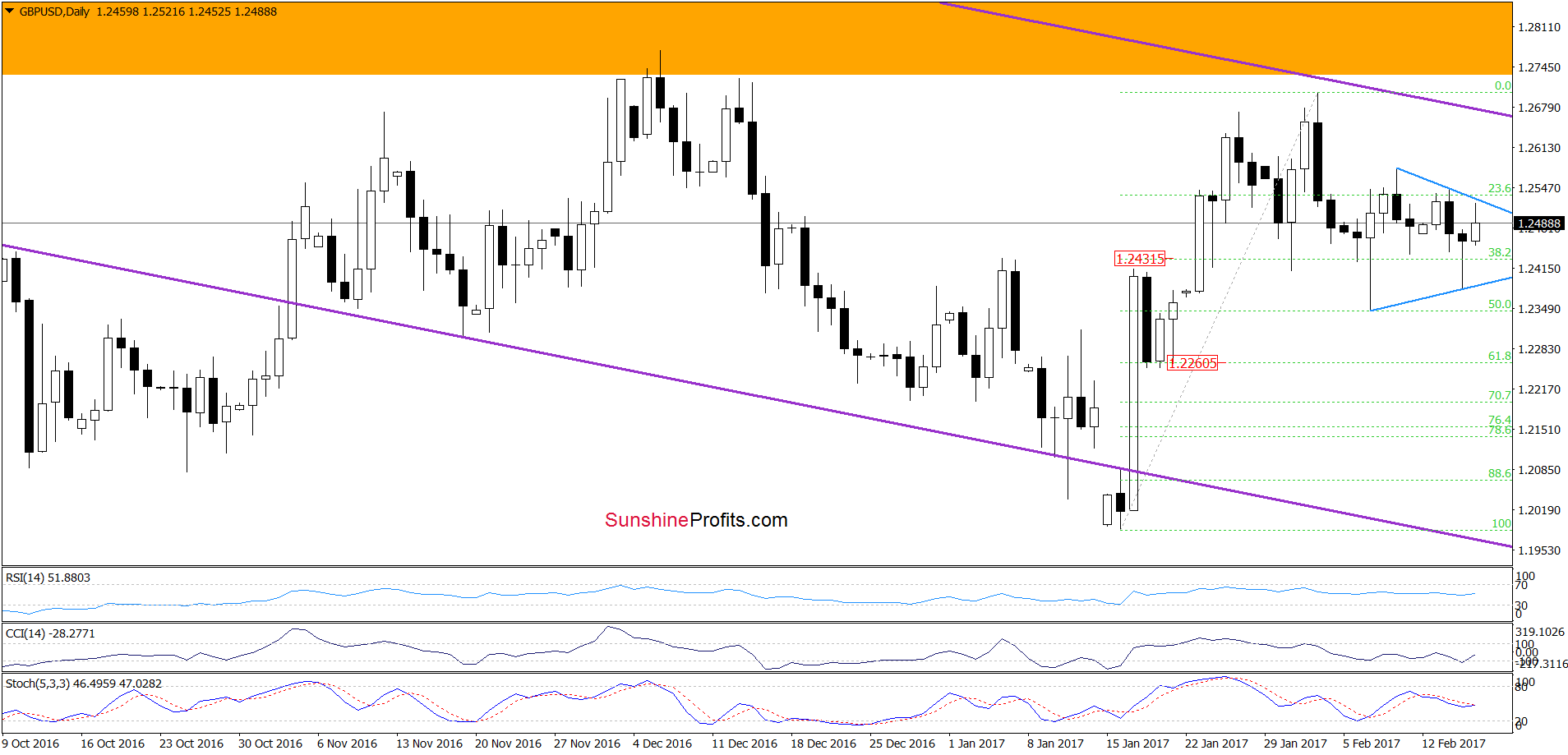

GBP/USD

On the daily chart, we see that GBP/USD is currently trading in a triangle, which suggests that a breakout above the upper line of the formation or a breakdown below the lower line will indicate the direction for further moves.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

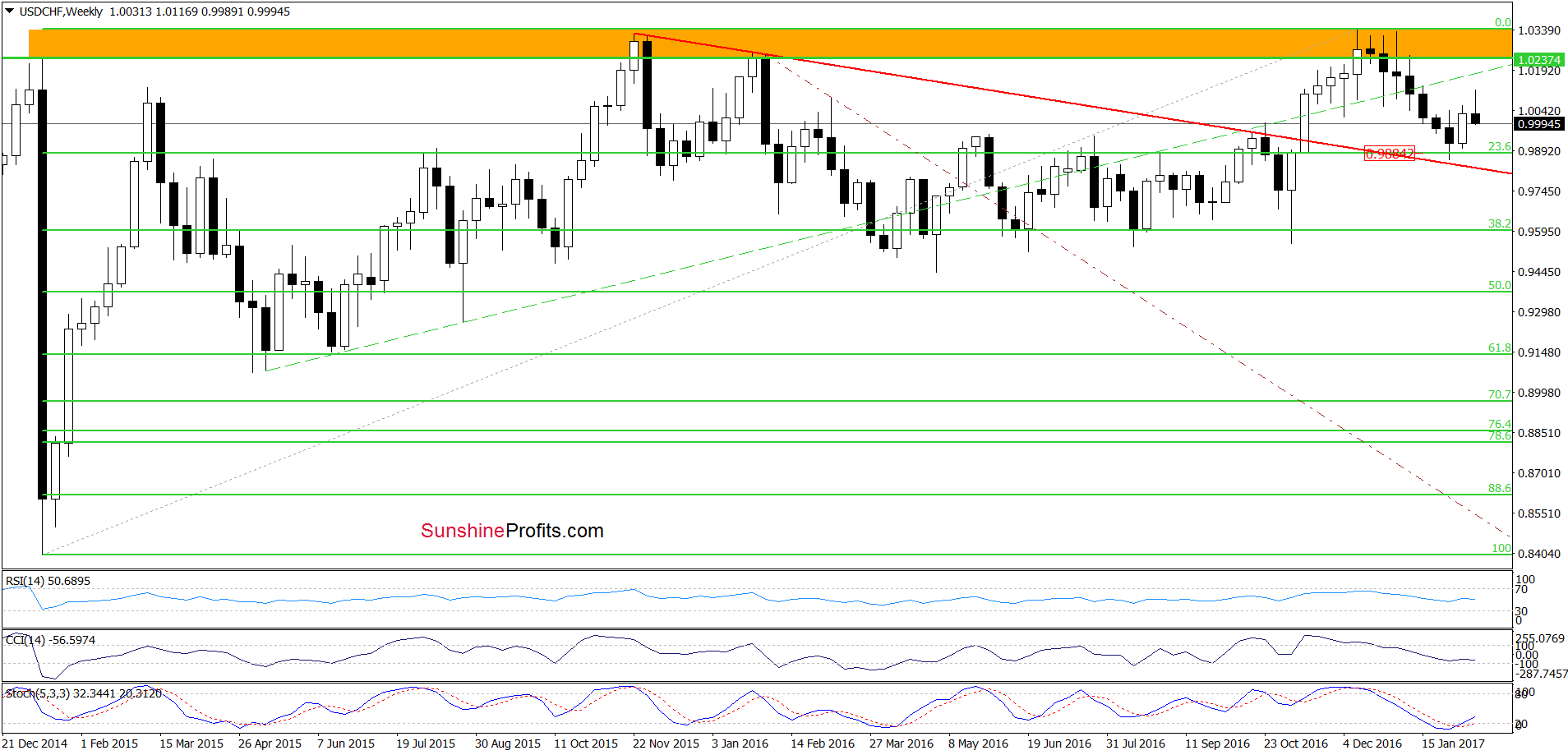

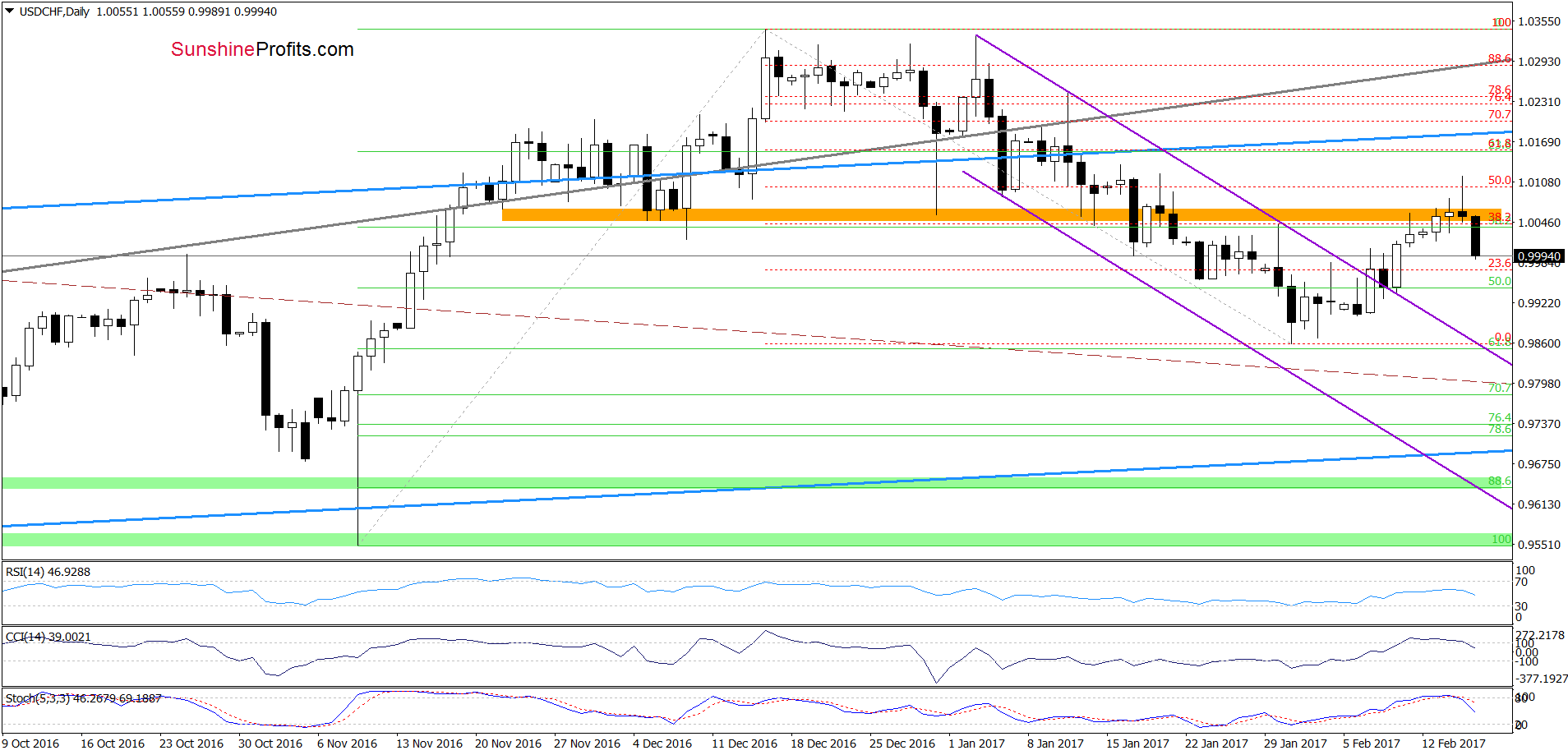

USD/CHF

On the daily chart, we see that USD/CHF reversed and decline, invalidating the earlier breakout above the orange zone, which is a negative sign. Additionally, the CCI and the Stochastic Oscillator generated the sell signals, which suggests that we may see a test of the recent lows. Therefore, closing long positions is justified from the risk/reward perspective.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts