Earlier today, official data showed that core durable goods orders rose more-than-expected, which in combination with solid U.S. jobless claims numbers (below 300,000 for 90 straight weeks) supported the U.S. currency and pushed EUR/USD to the lowest levels since almost a year. Will we see further declines?

In our opinion the following forex trading positions are justified - summary:

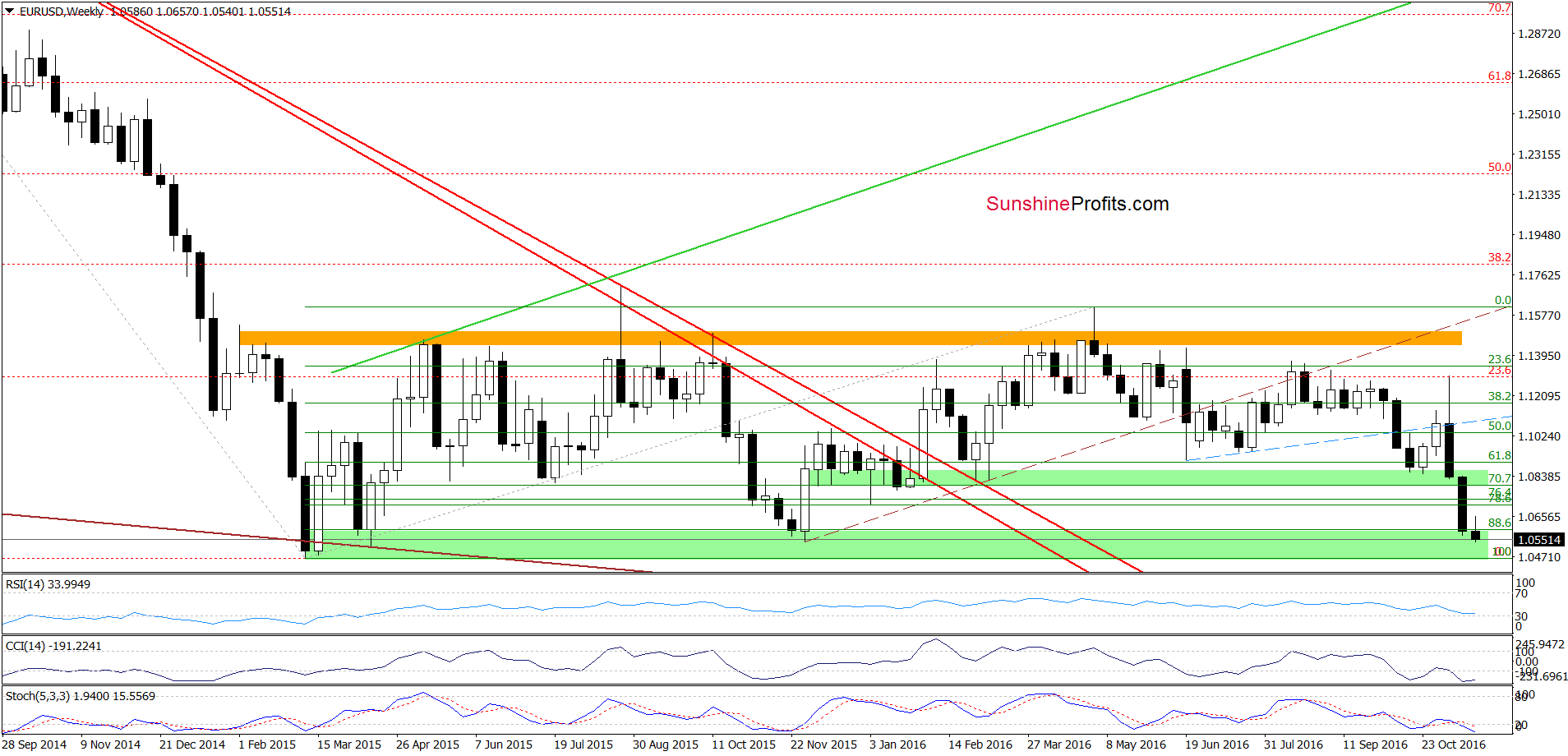

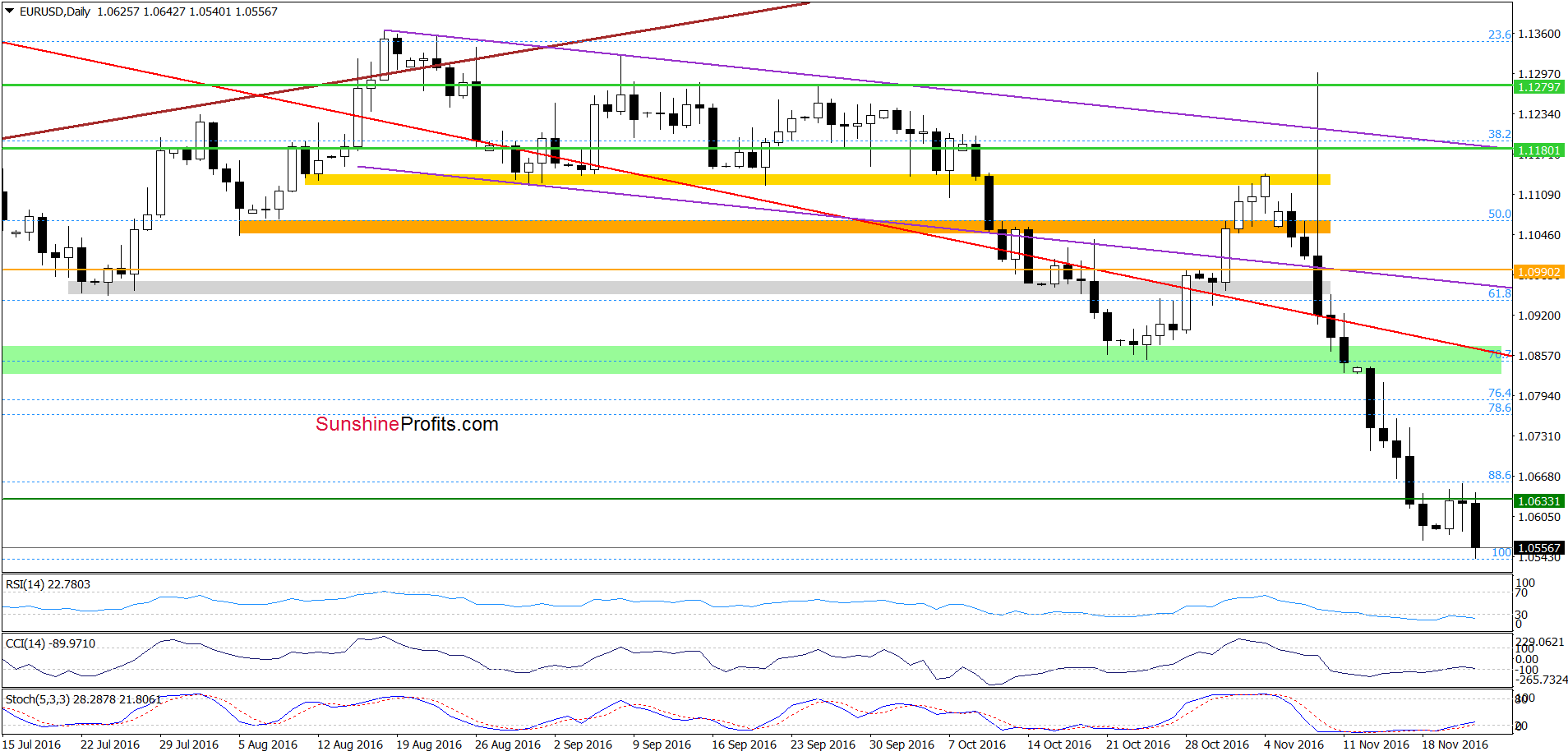

EUR/USD

On the daily chart, we see that after two unsuccessful attempts to move higher, EUR/USD declined and reached the Nov 2015 low, which could stop further deterioration – especially when we factor in buy signals generated by the CCI and Stochastic Oscillator. Nevertheless, even if this support level fails, the space for drops seems limited as March and Apr 2015 lows (the lower border of the green support zone marked on the weekly chart) are quite close to current levels.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

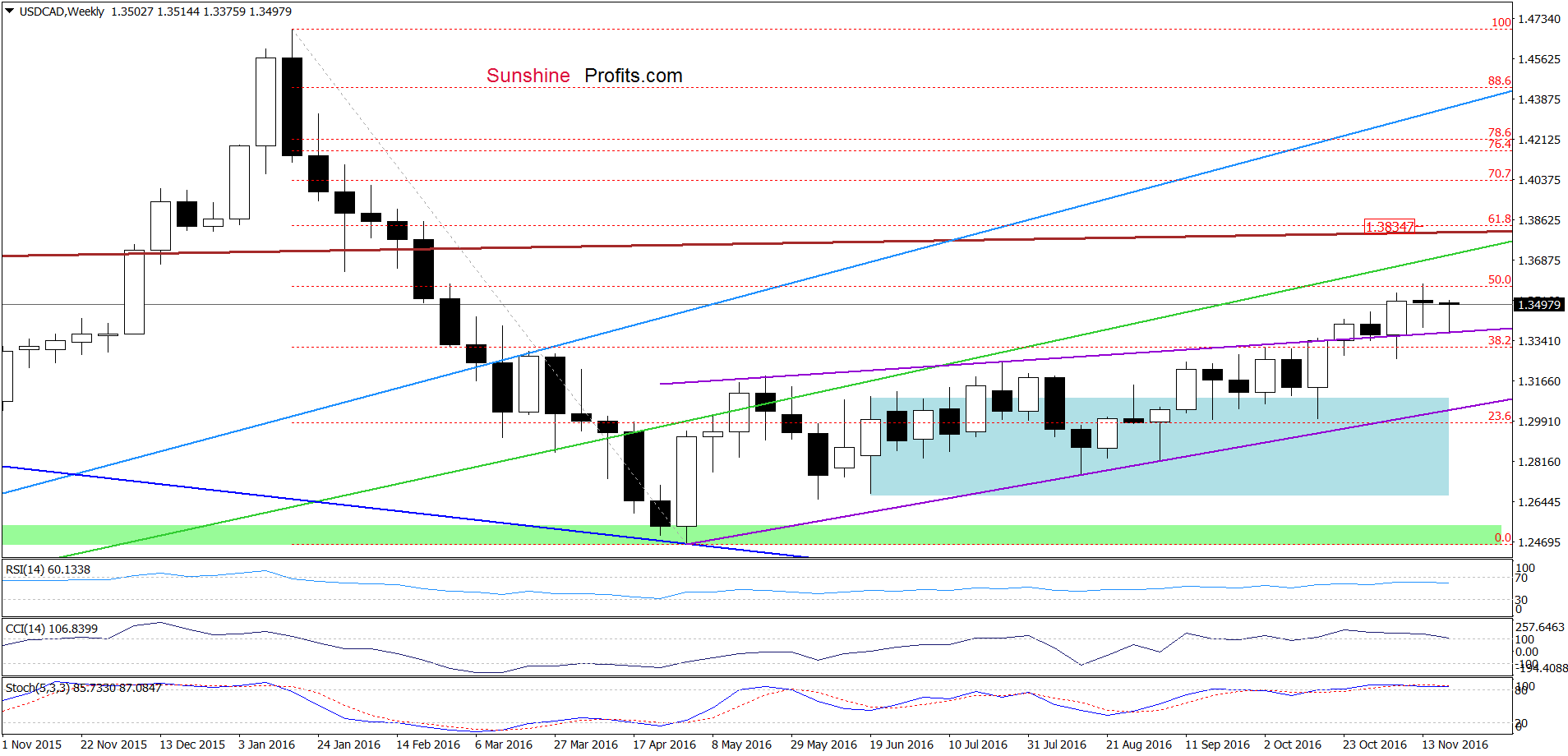

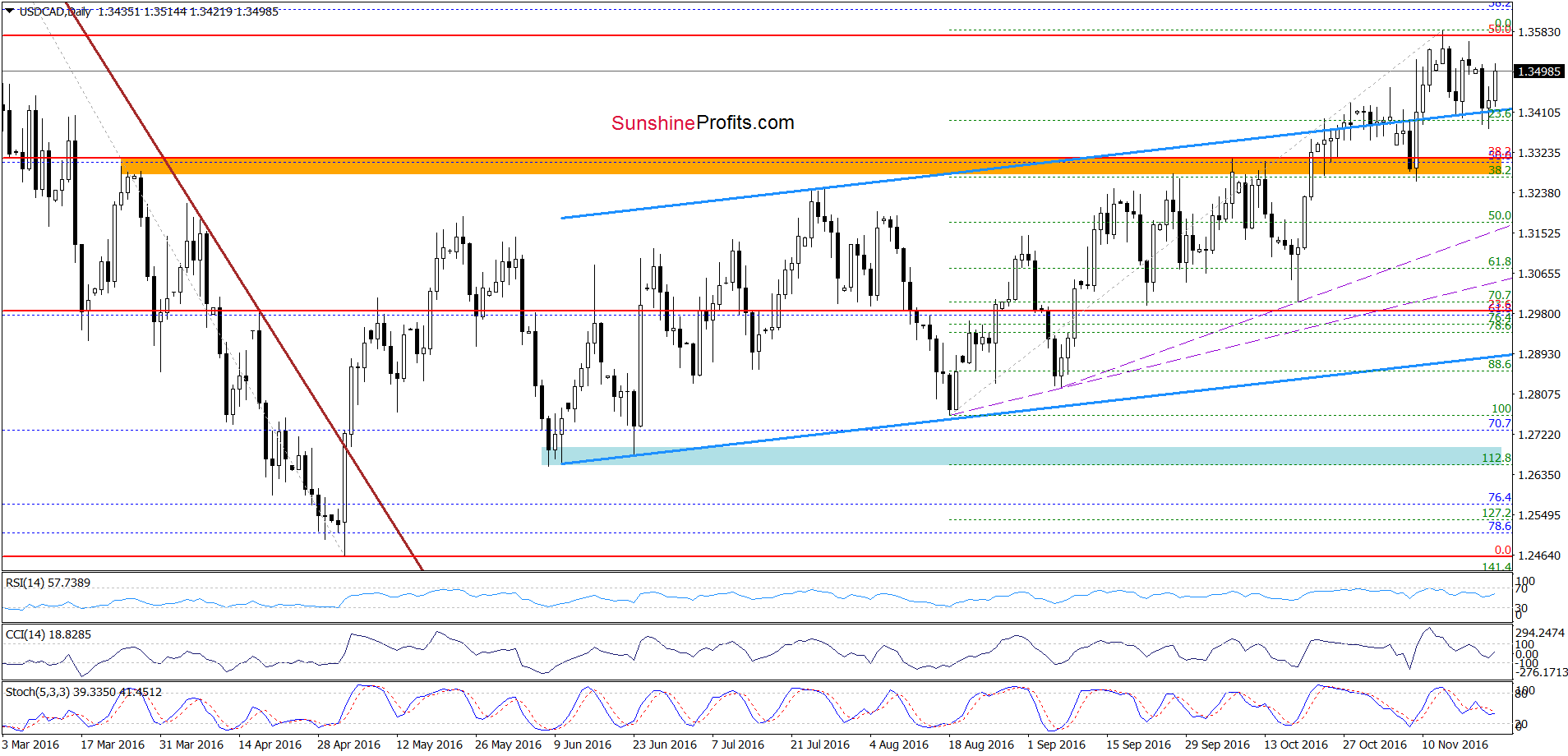

USD/CAD

Looking at the weekly chart, we see that the upper border of the purple rising wedge stopped currency bears once again and triggered a rebound. What impact did this move have on the very short-term chart? Let’s check.

From this perspective, we see that although USD/CAD dropped below the upper border of the blue rising trend channel, currency bulls didn’t give up and pushed the pair higher, which resulted in an invalidation of earlier breakdown. This positive event triggered further improvement earlier today, which in combination with the medium-term picture suggests a re-test of recent highs and the 50% Fibonacci retracement (based on the entire Jan-May downward move) in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

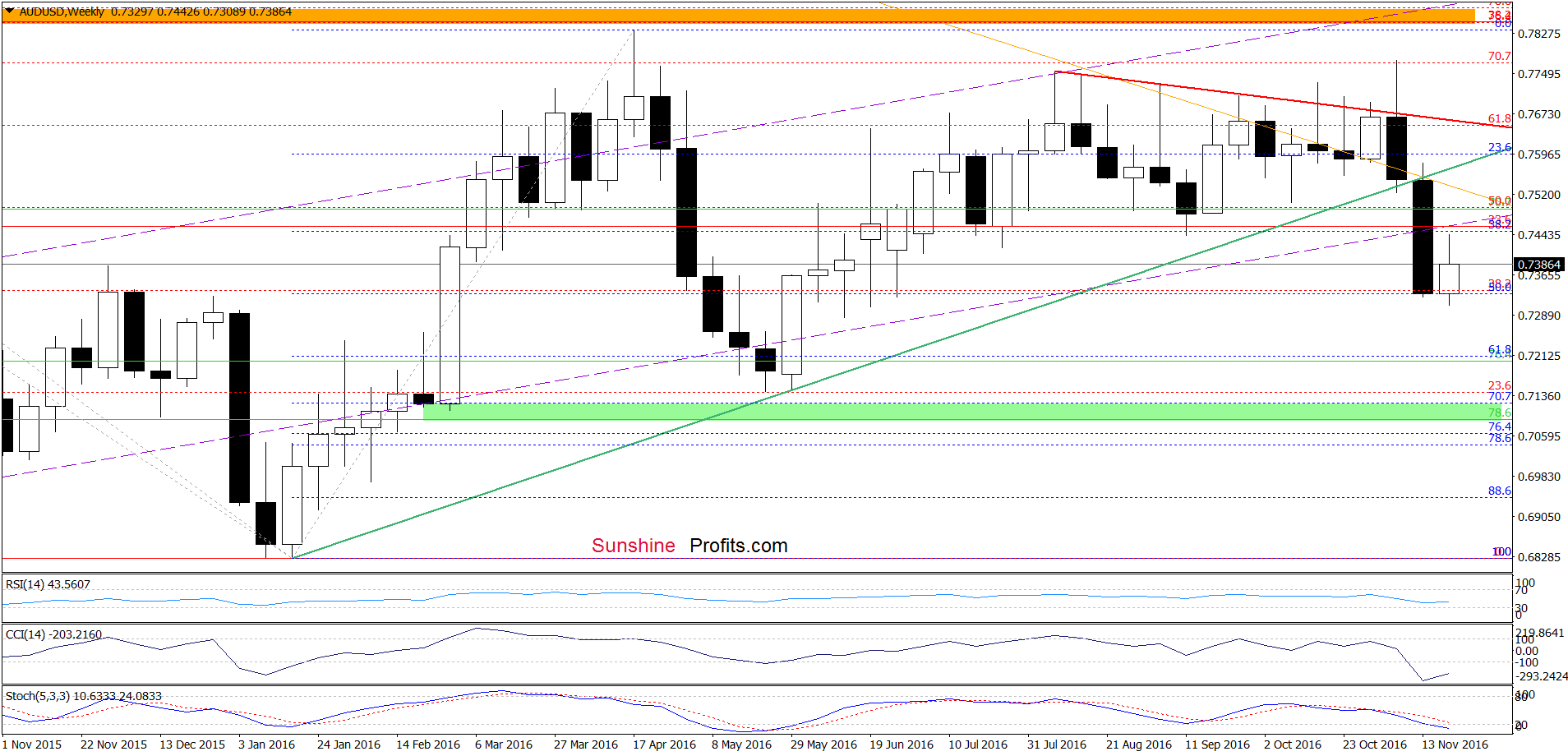

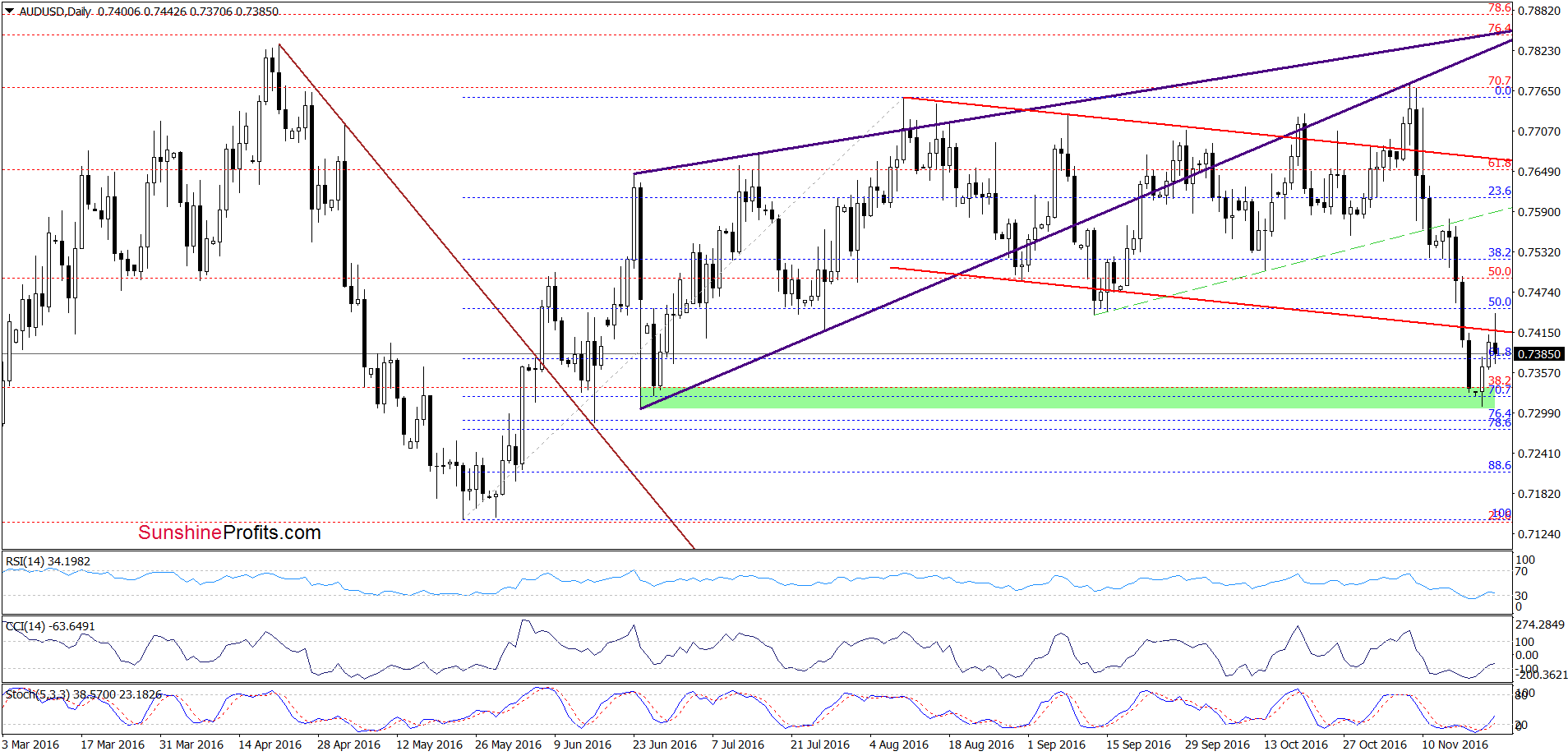

AUD/USD

Quoting our Monday’s alert:

(…) further improvement will be more likely and reliable if daily indicators generate buy signals. In this case, the exchange rate will likely climb to the previously-broken mid-Sep lows (around 0.7440-0.7449) and the 50% Fibonacci retracement.

As you see on the daily chart, the situation developed in line with the above scenario and AUD/USD reached our initial upside target earlier today. Despite this improvement, a strengthening greenback pushed the exchange rate lower, which looks like a verification of the breakdown under mid-Sep lows. If this is the case, we’ll likely see a re-test of the green support zone in the coming days. Nevertheless, buy signals generated by the indicators remain in place, suggesting that another attempt to move higher is just around the corner.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts