Earlier today, the greenback moved little lower against the basket of major currencies, but the U.S. currency still remains above the level of 101. What impact did this drop have on its Australian counterpart?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

Quoting our Friday’s alert:

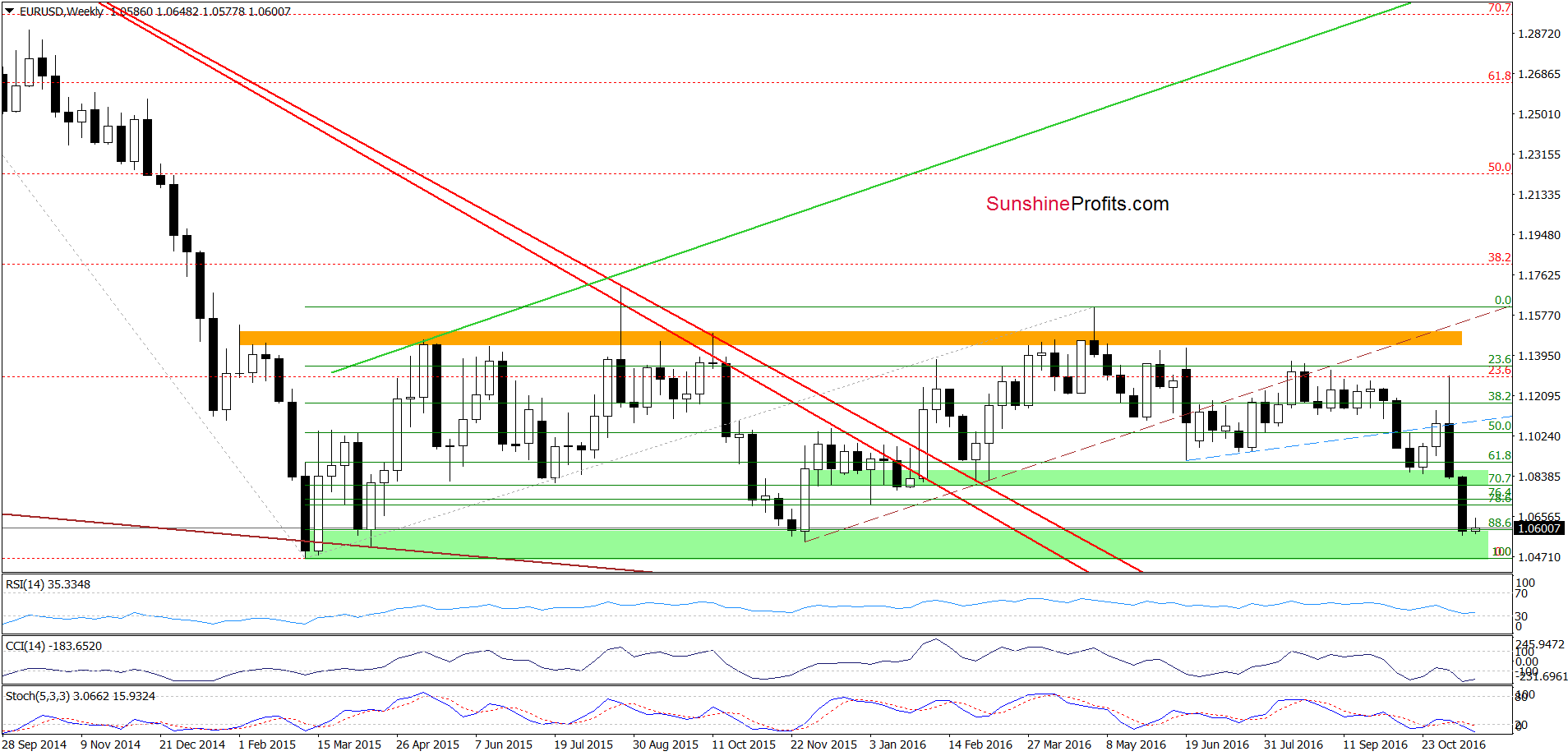

(…) EUR/USD reached the key green support zone based on the Mar, Apr and Nov 2015 lows, which could stop declines in the coming week – especially when we factor in the current position of the daily and weekly indicators.

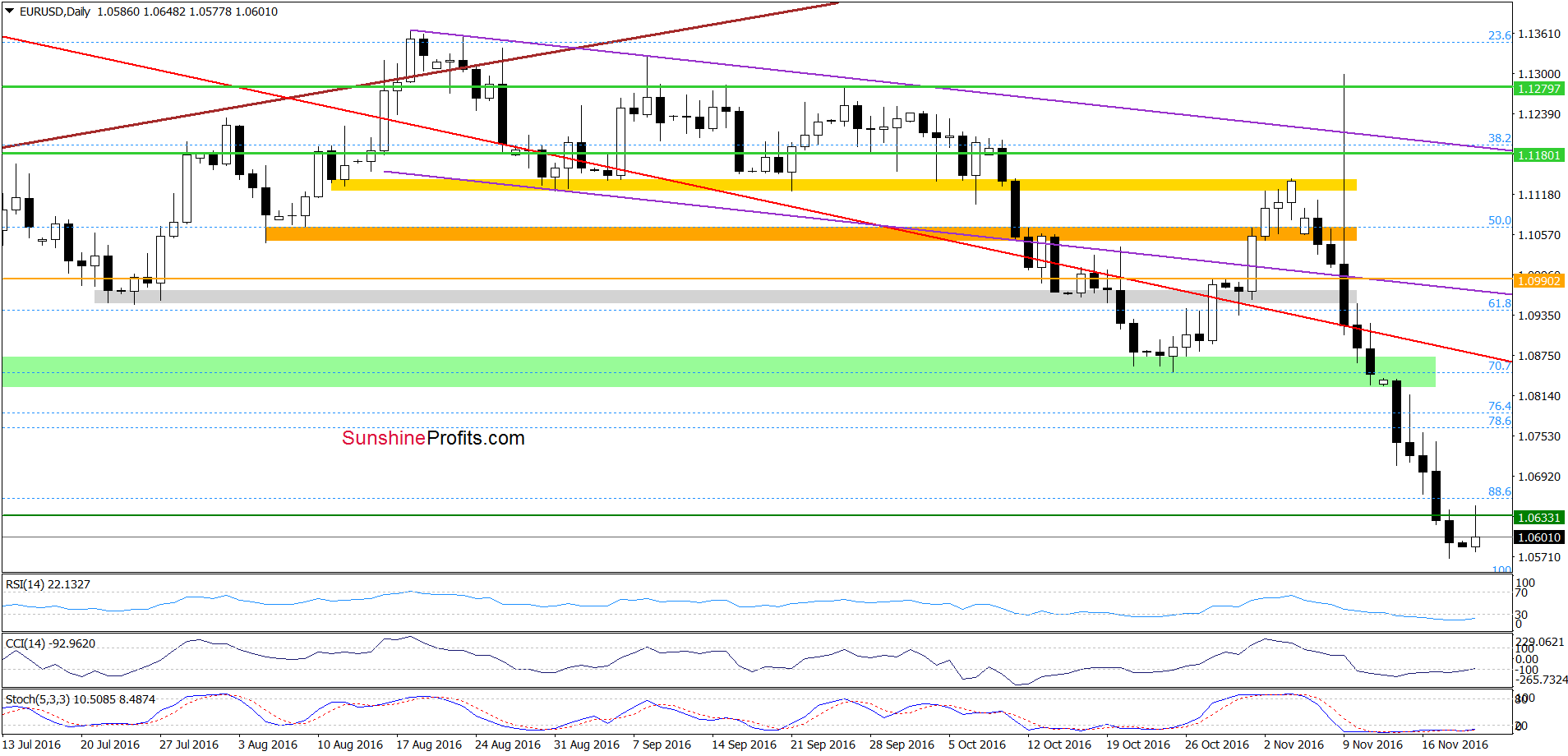

On the above charts, we see that the green support zone encouraged currency bulls to act, which resulted in a small (barely visible from the weekly perspective) rebound. Nevertheless, daily indicators suggest that further improvement and higher values of EUR/USD are just around the corner. If this is the case, we may see an increase to the previously-broken green support zone based on the late Jan, late Feb and early March lows (around 1.0814-1.0825) in the coming week.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

Quoting our previous commentary on this currency pair:

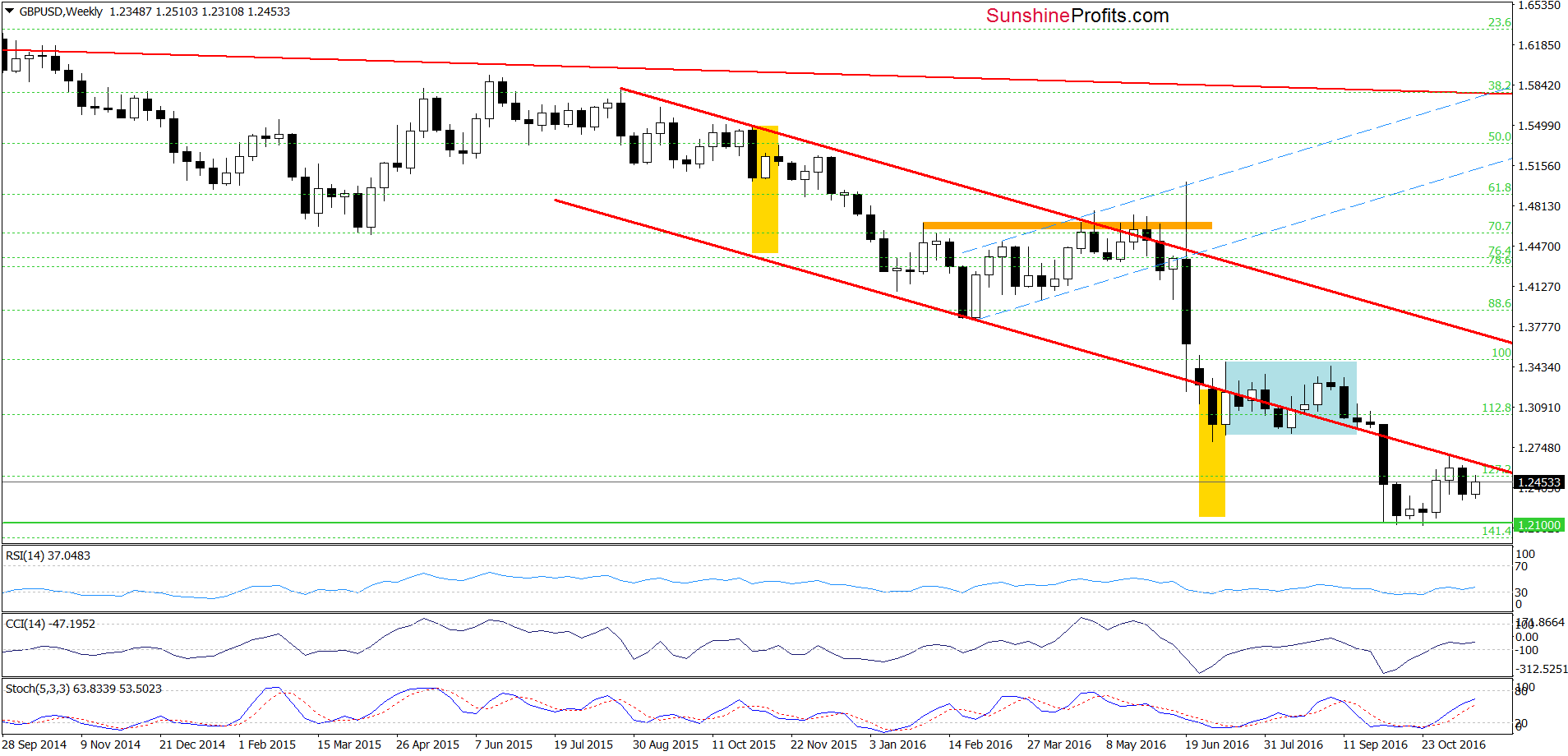

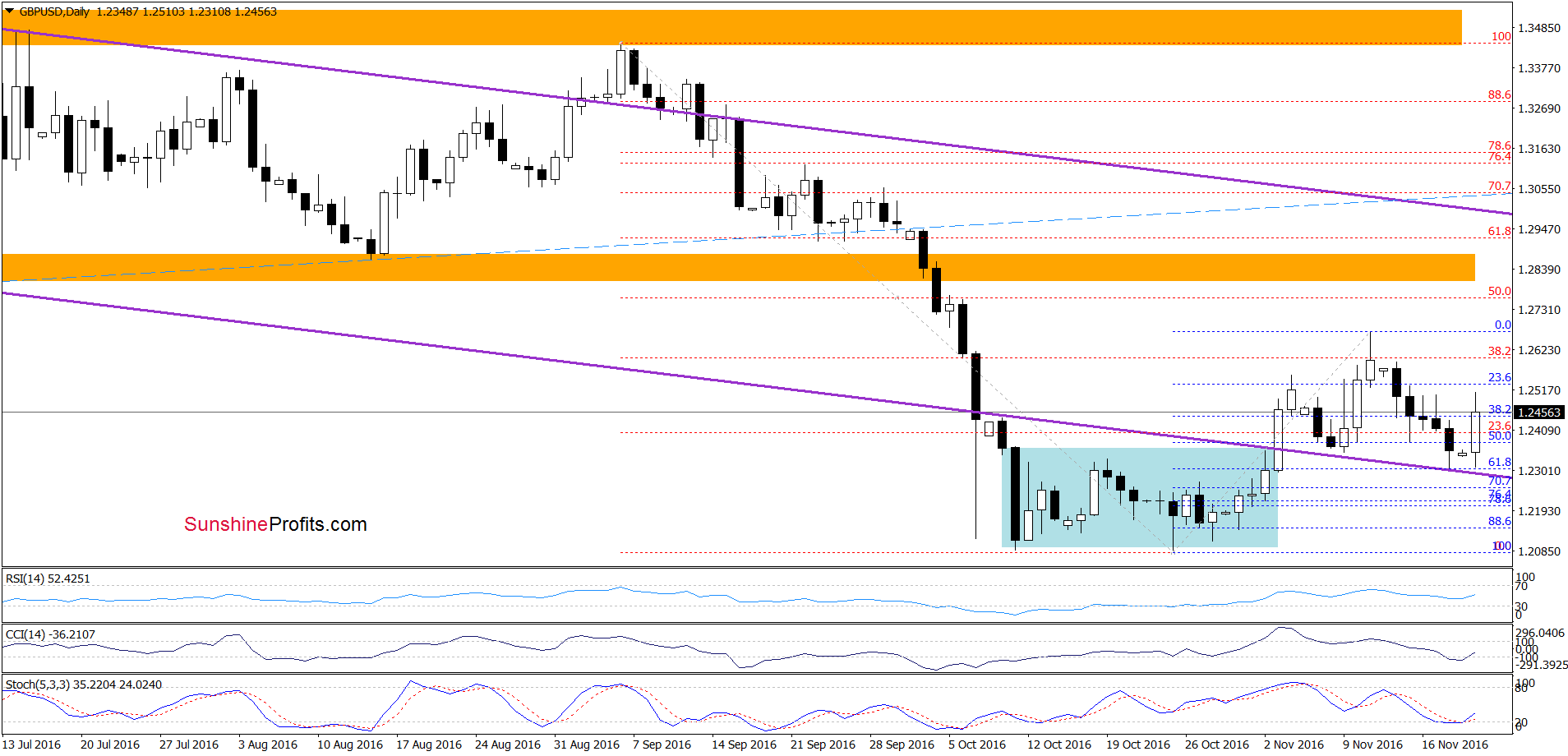

(…)What’s next? Taking into account the proximity to the purple support line and the 61.8% Fibonacci retracement (based on the Oct-Nov upward move), it seems that currency bulls will push GBP/USD higher in the coming week.

From today’s point of view, we see that the situation developed in line with the above scenario and GPB/USD rebounded earlier today. Additionally, the CCI and Stochastic Oscillator generated buy signals, which suggests further improvement and a test of the previously-broken lower border of the red declining trend channel (marked on the weekly chart) in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

On Friday, we wrote the following:

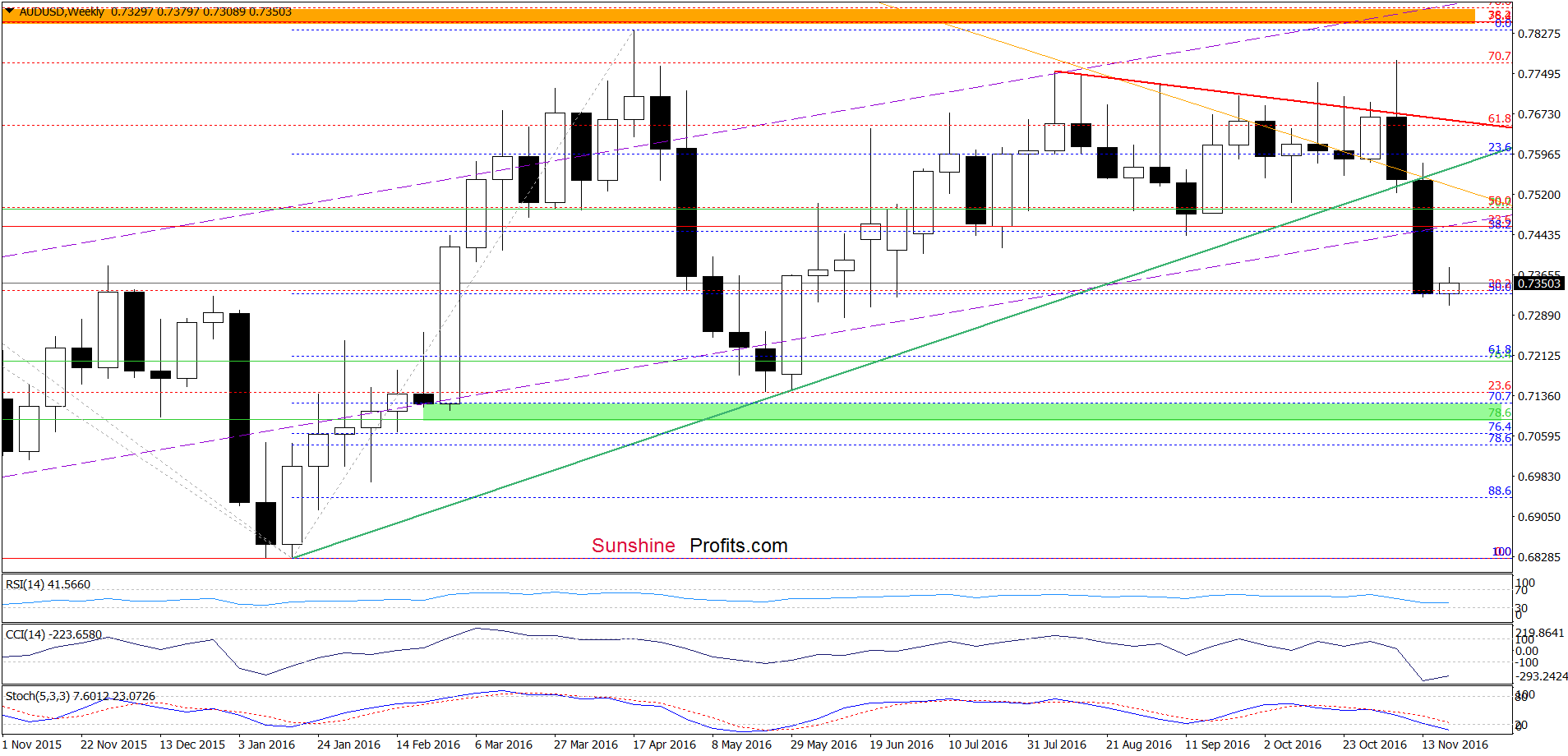

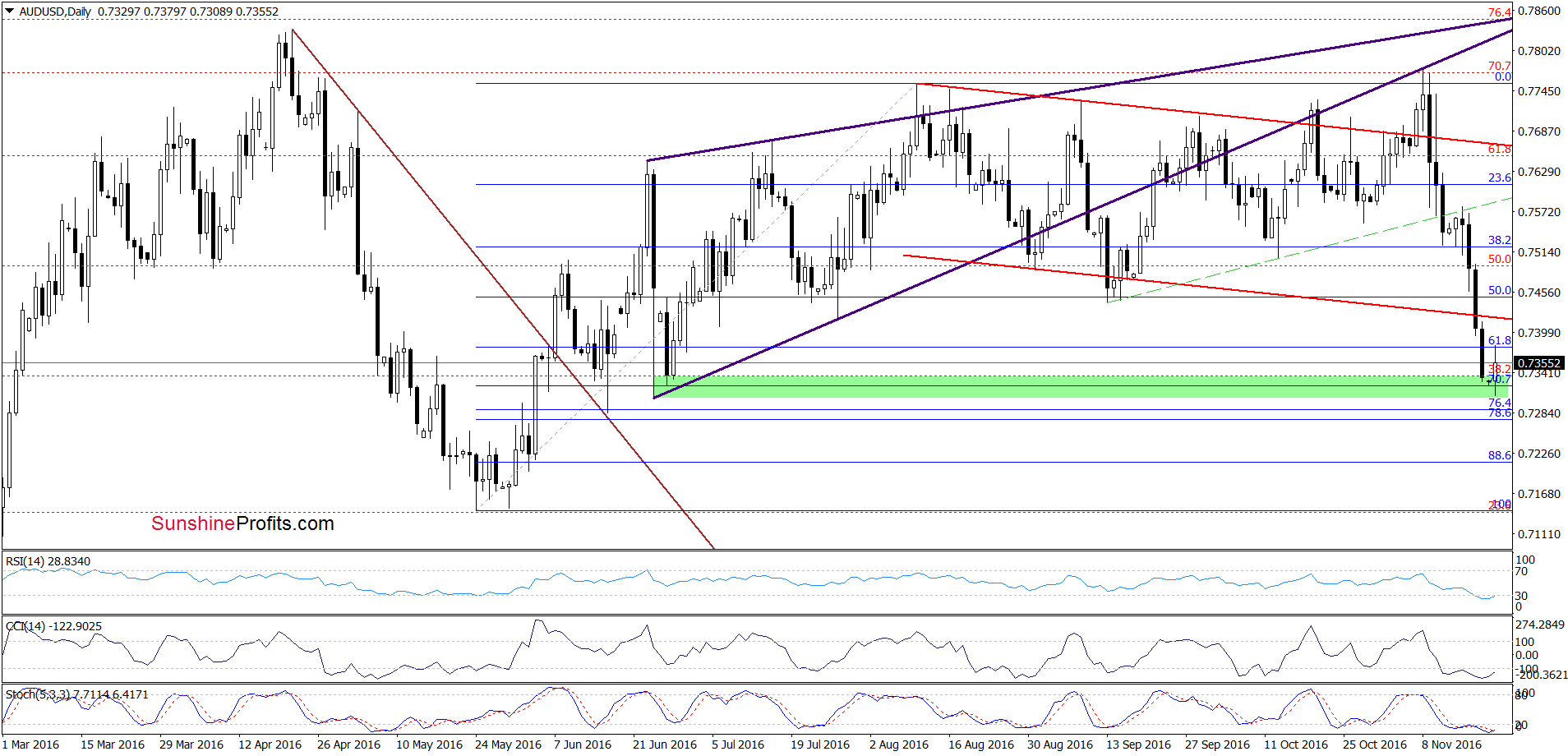

(…) the exchange rate dropped not only under the mid-Sep lows, but also below the 61.8% Fibonacci retracement (based on the May-Nov upward move), which suggests a test of the green support zone (created by the late Jun lows and the 70.7% retracement) in near future. Nevertheless, the current position of the daily indicators suggests that reversal in the coming week is likely (in our opinion, such price action will be more reliable if they generate buy signals).

On the daily chart, we see that the situation developed in tune with our assumptions and AUD/USD moved higher earlier today. Although this is a positive event, we still believe that further improvement will be more likely and reliable if daily indicators generate buy signals. In this case, the exchange rate will likely climb to the previously-broken mid-Sep lows (around 0.7440-0.7449) and the 50% Fibonacci retracement.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts