Although preliminary reading showed that the U.S. GDP increased by 2.9% in the third quarter (compared to earlier quarter), the USD Index gave up some of yesterday’s gains, which pushed EUR/USD higher. But did this increase change anything in the short-term picture of the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: short (a stop-loss order at 1.0000; initial downside target at 0.9841)

- AUD/USD: short (a stop-loss order at 0.7769; initial downside target at 0.7542)

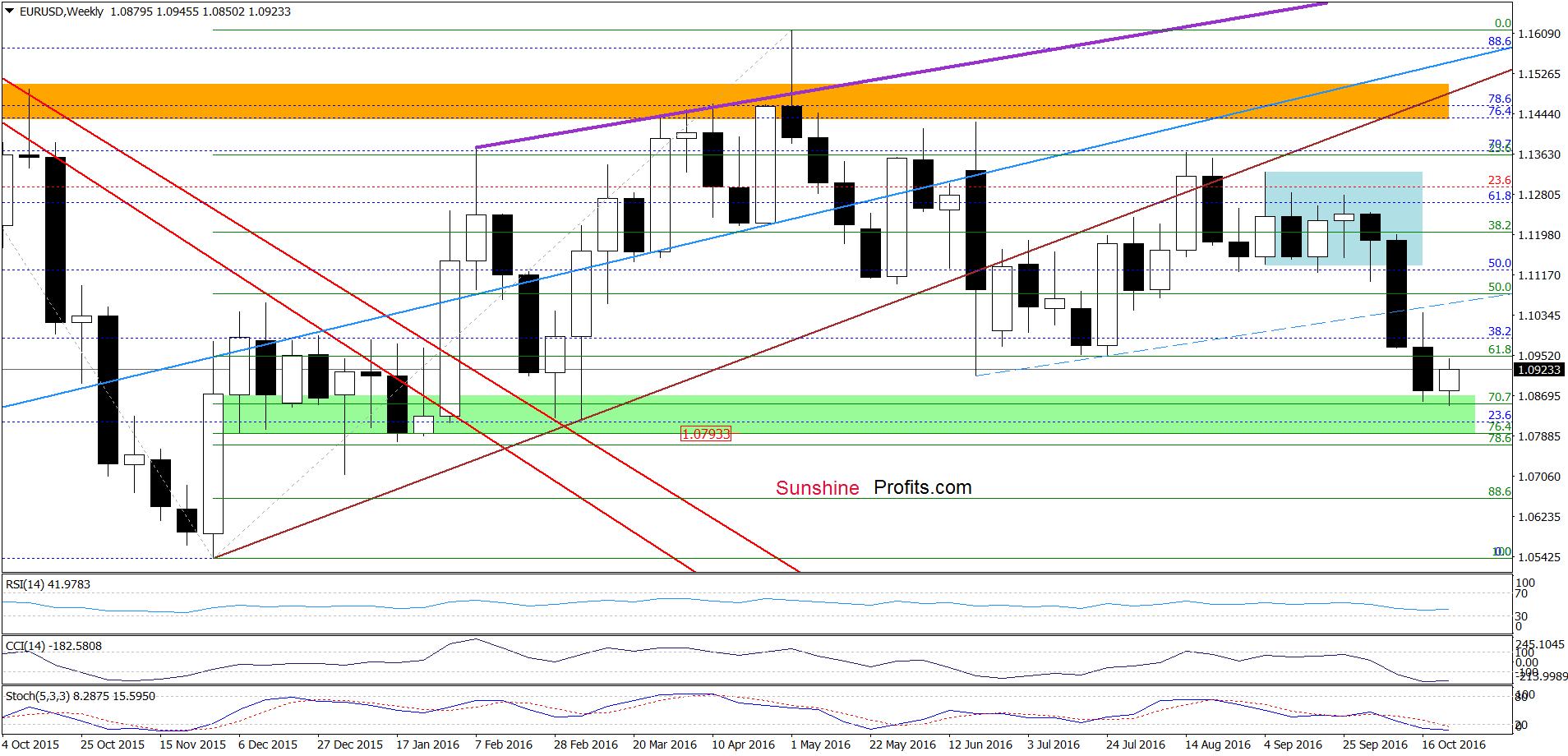

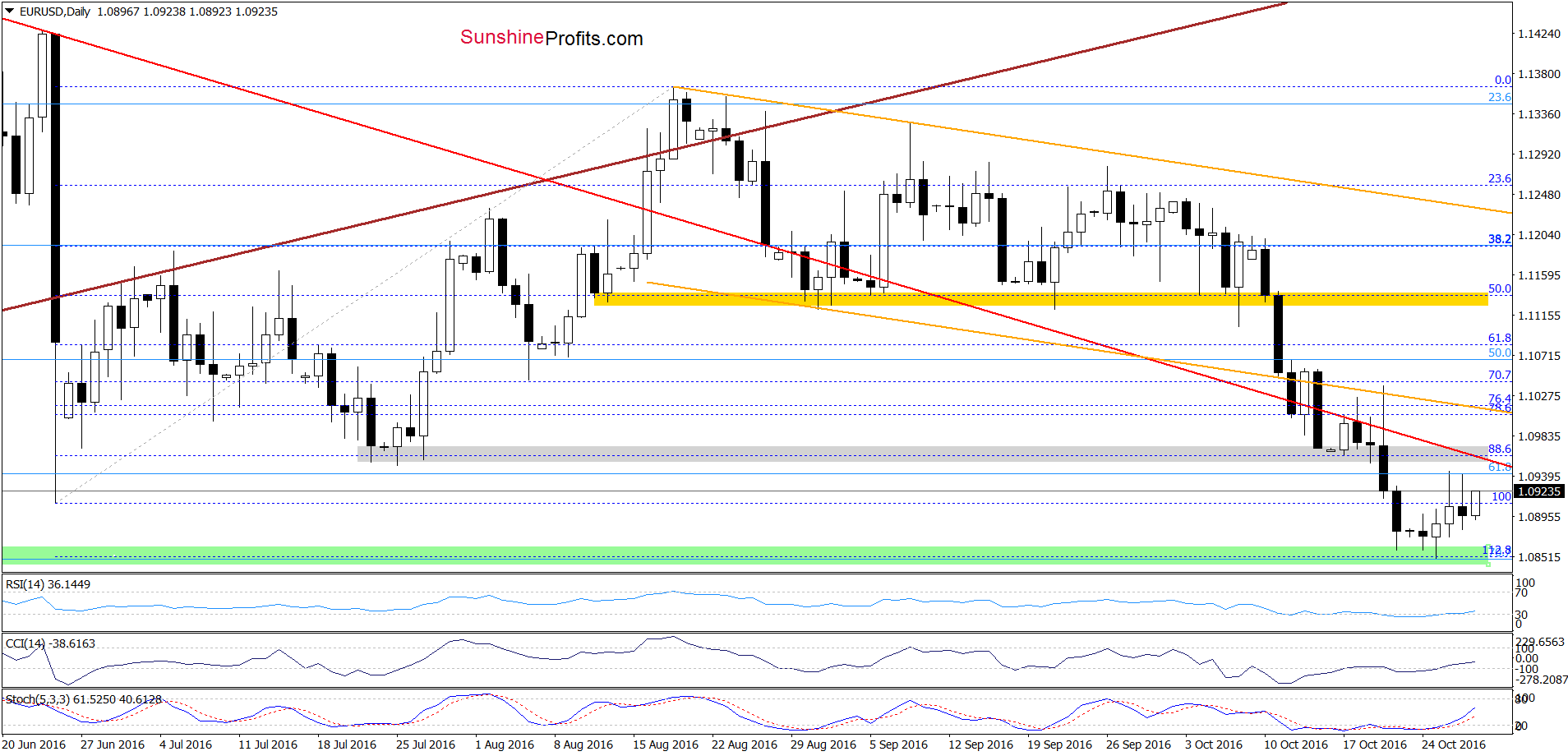

EUR/USD

From today’s point of view, we see that EUR/USD is still trading between Wednesday’s levels, which means that what we wrote back then is up-to-date also today:

(…) the green support zone in combination with buy signals generated by all daily indicators encouraged currency bulls to act, which resulted in a rebound above 1.0900. Taking these facts into account, we think that the pair will extend gains and climb to the previously-broken grey zone and the red declining resistance line in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

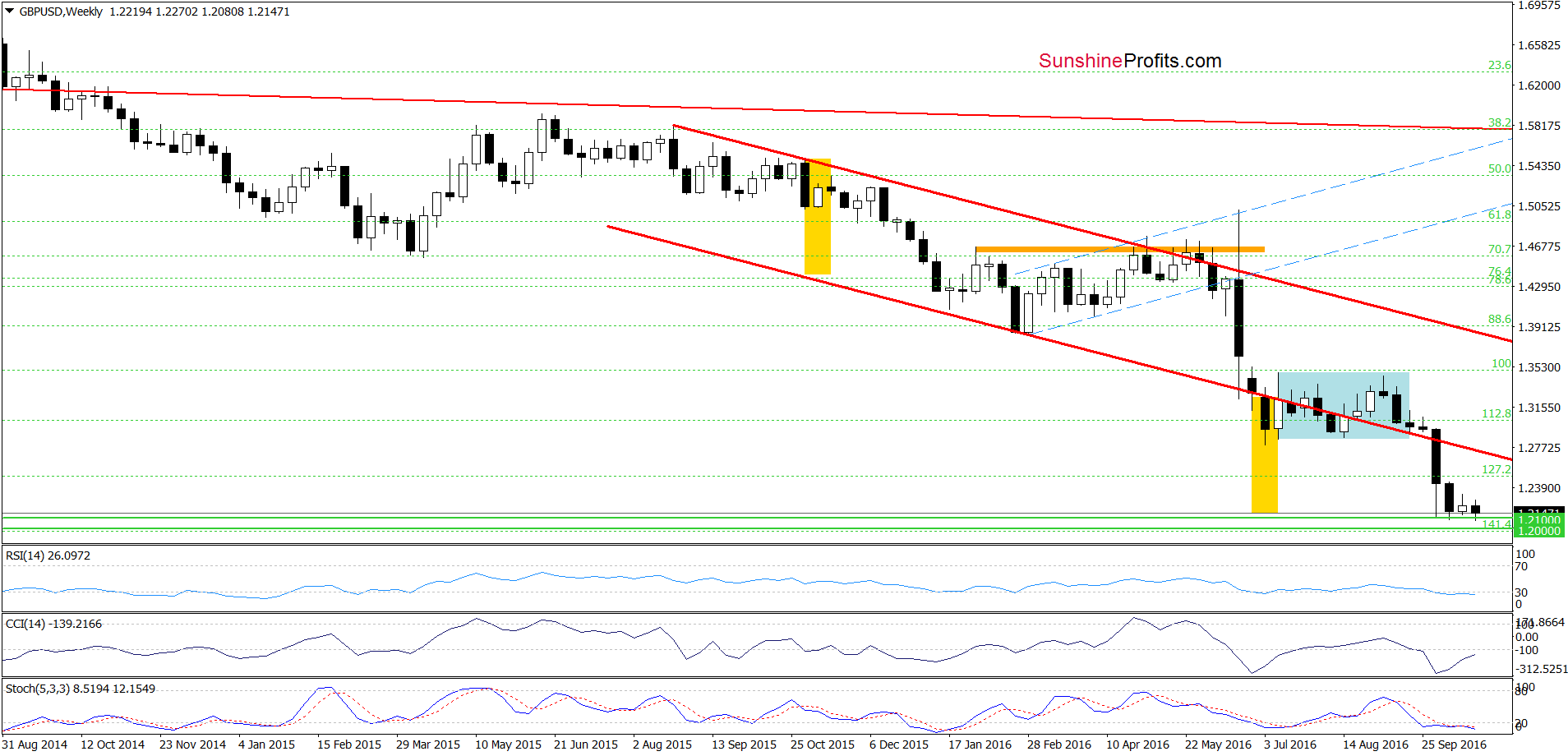

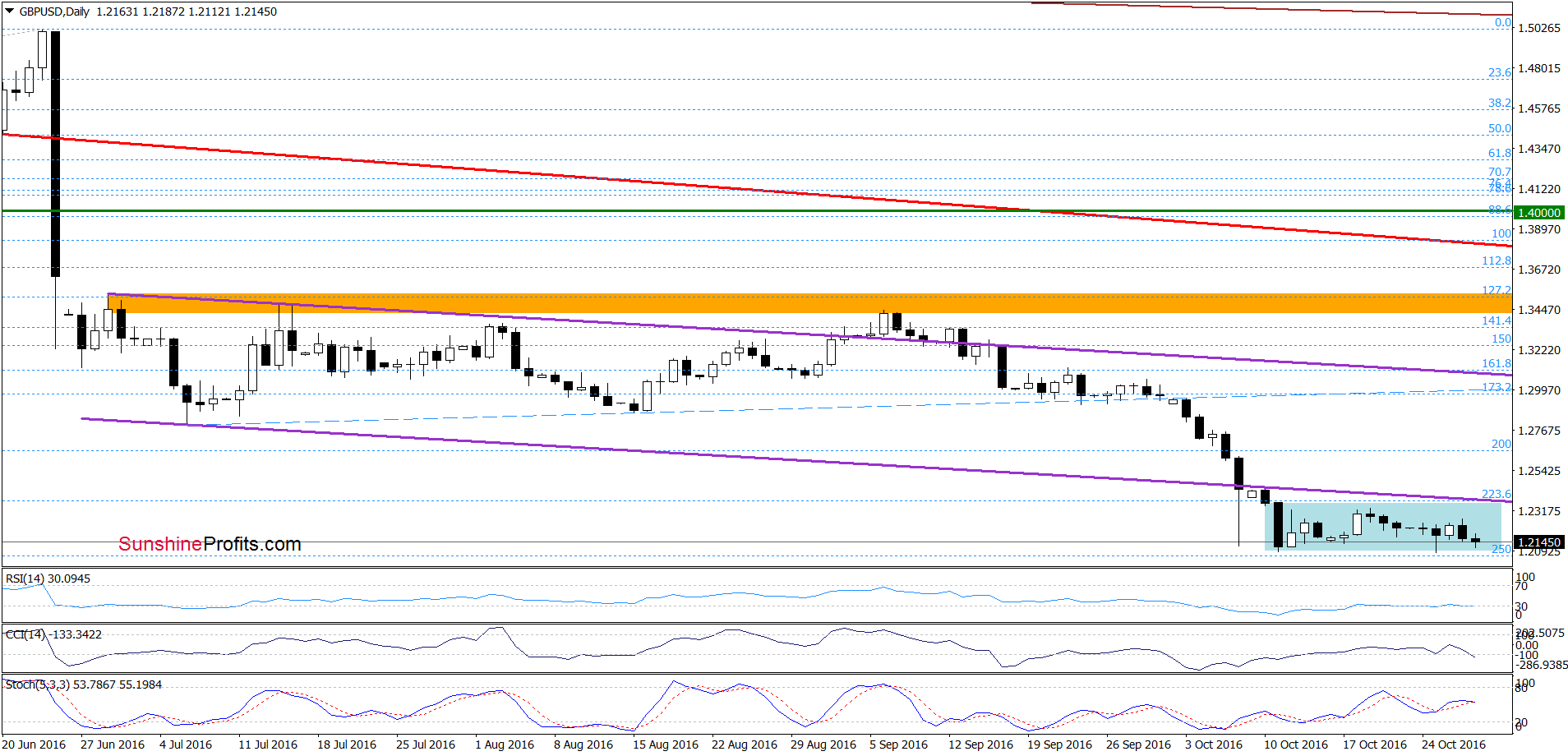

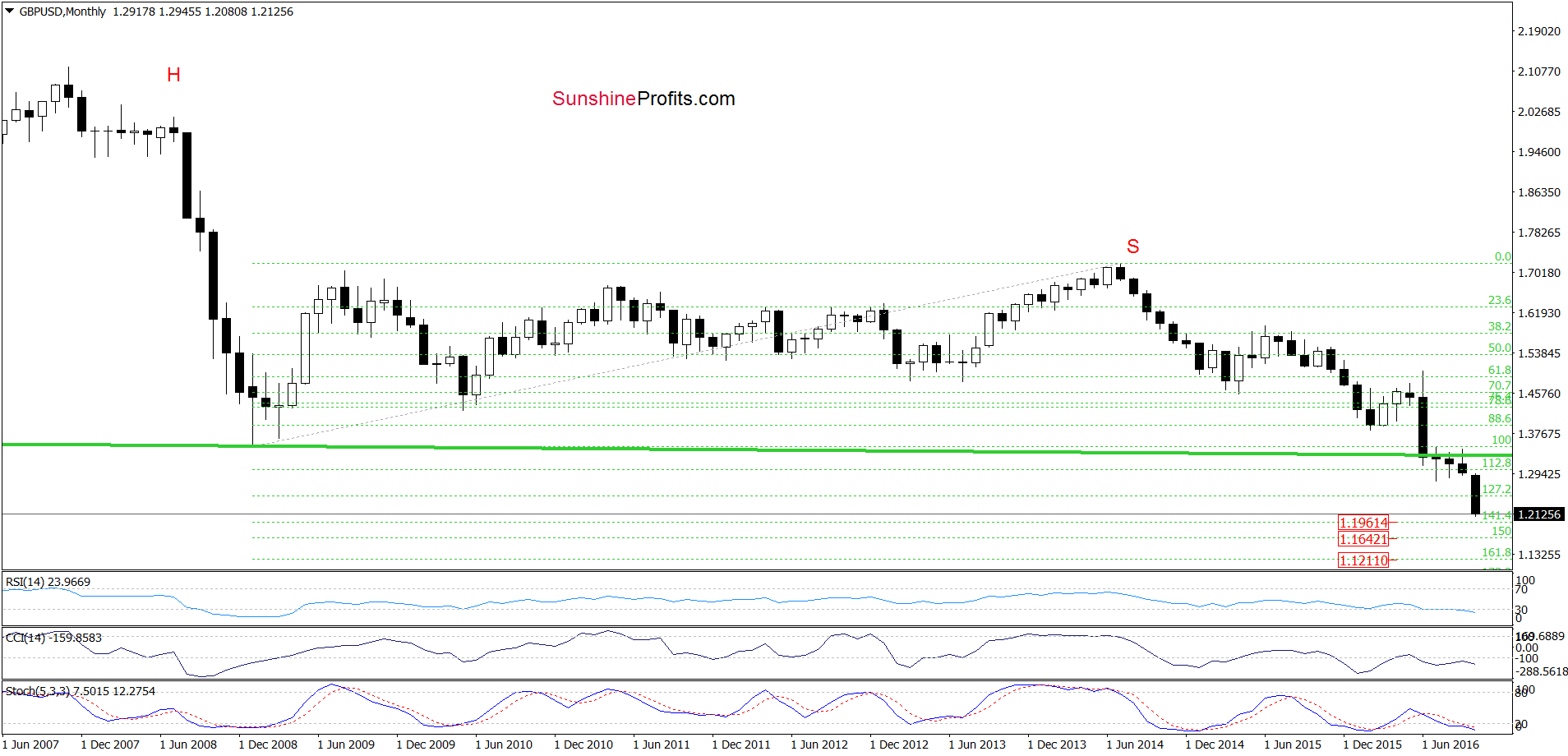

GBP/USD

On the above charts, we see that although daily indicators generated buy signals in previous days, currency bulls didn’t use them to push GBP/USD to higher levels, which resulted in a reversal and a drop to recent lows and the level of 1.2100. As you see, this area was strong enough to stop declines several times in the past, which could result in another rebound – even to the lower border of the purple declining trend channel. Nevertheless, if currency bulls fail and their opponents manage to successfully break below these support levels, we’ll see a test of the barrier of 1.2000 in the coming week.

What could happen if it is broken? Let’s examine the long-term chart and find out.

From this perspective, we see that if GBP/USD extends losses the next downside target would be around 1.1961 (the 141.4% Fibonacci extension), 1.1642 (the 150% extension) or even at 1.1211, where the 161.8% extension is.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

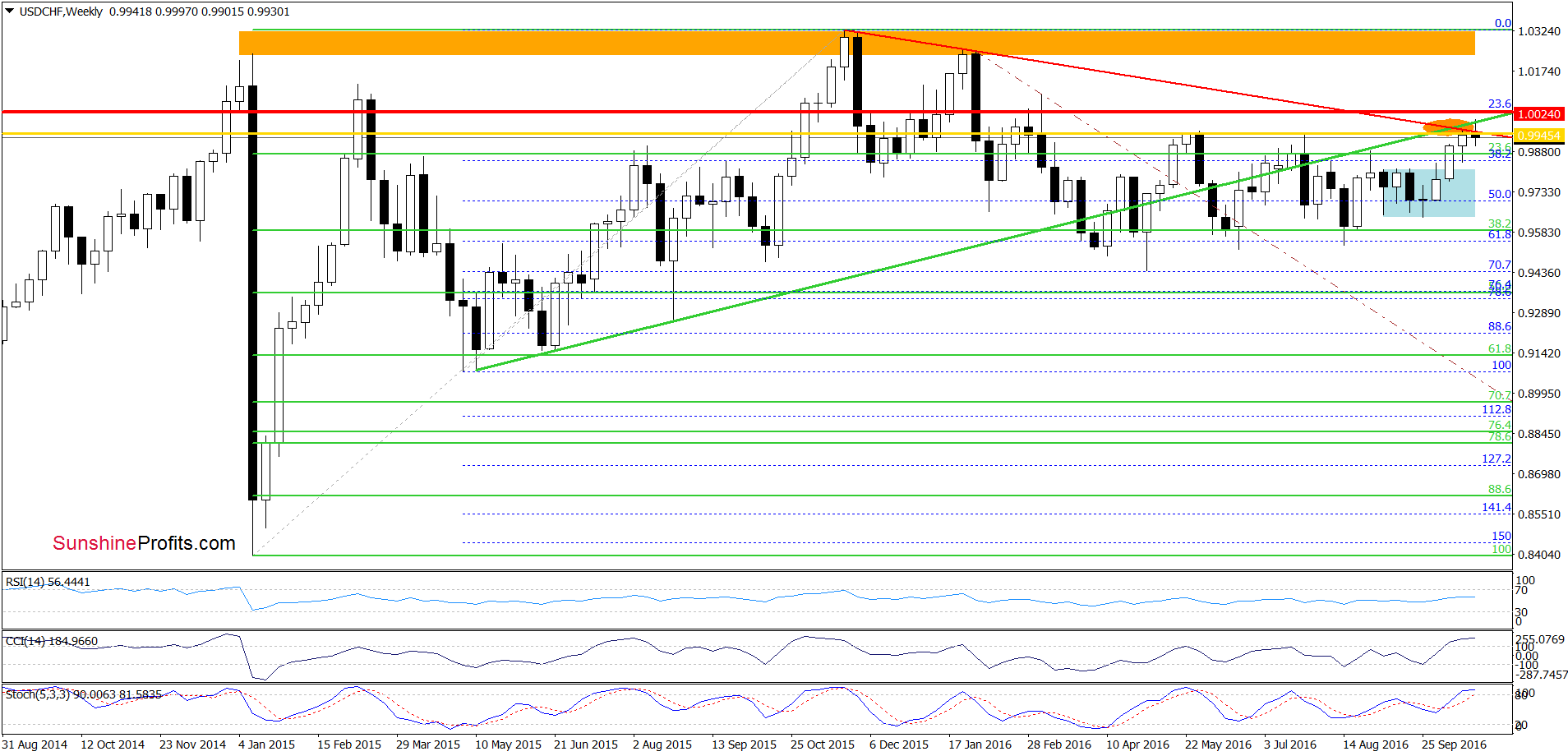

USD/CHF

On the weekly chart, we see that the key resistance zone created by the long-term red declining resistance line based on the Nov and Feb highs, the green rising line based on the May and Aug 2015 lows and May and Jul highs (marked with orange ellipse) continues to keep gains in check.

Having said the above, let’s examine the very short-term picture.

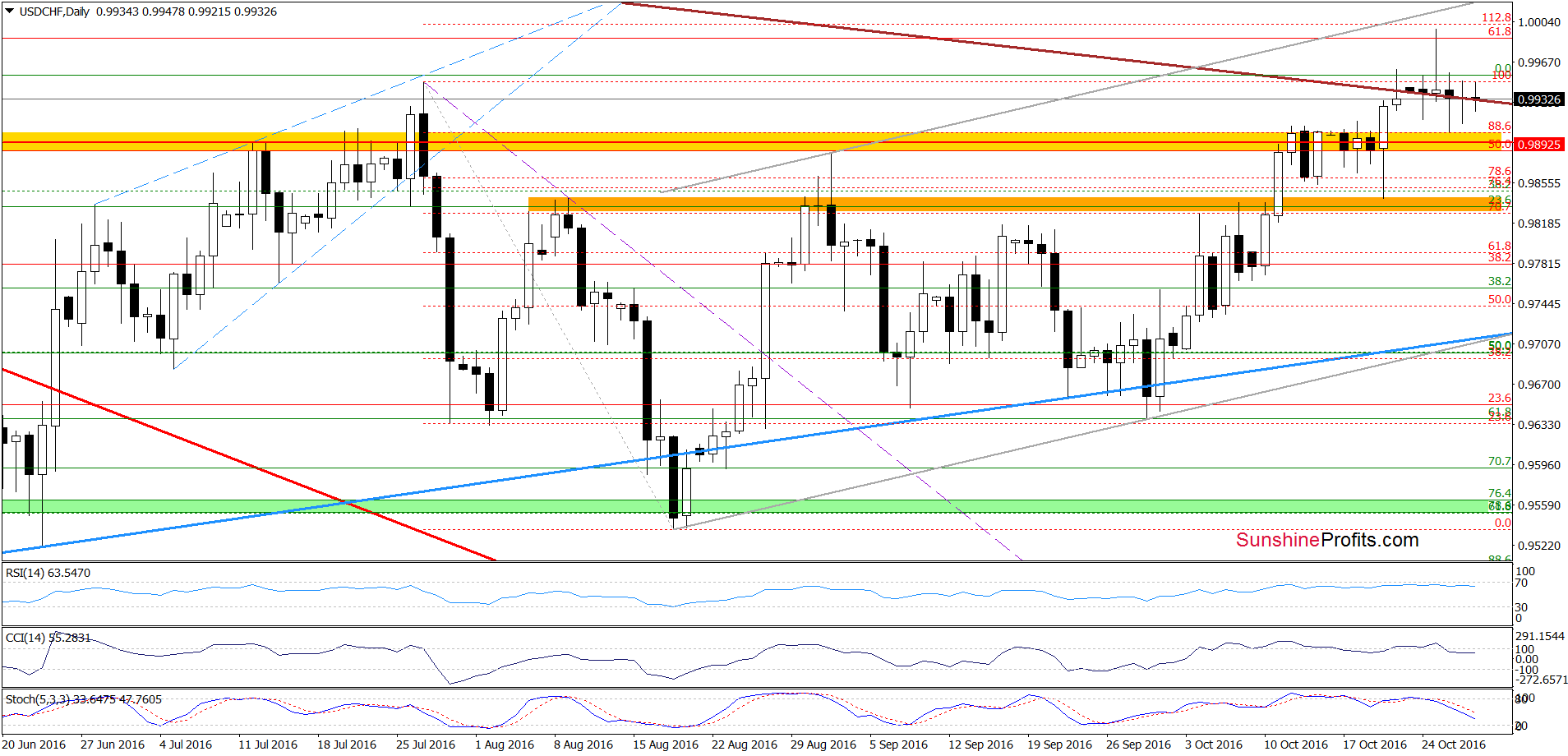

From this perspective, we see that although USD/CHF moved little higher and broke above the brown resistance line (the red resistance line seen on the weekly chart), this improvement was only temporary and the exchange rate erased some of earlier gains, which in combination with sell signals generated by the CCI and Stochastic Oscillator and the medium-term picture suggests further deterioration in the coming week. Therefore, if the pair moves lower from current levels the initial downside target would be around 0.9841, where the last Thursday’s low is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.0000 and initial downside target at 0.9841) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts