Earlier today, the USD Index extended gains and climbed above 98.60, breaking above the Feb and Mar highs. As a result, EUR/USD declined under short-term support levels. How low could the exchange rate go in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (a stop-loss order at 104.84; initial downside target at 101.02)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: short (a stop-loss order at 0.7769; initial downside target at 0.7542)

EUR/USD

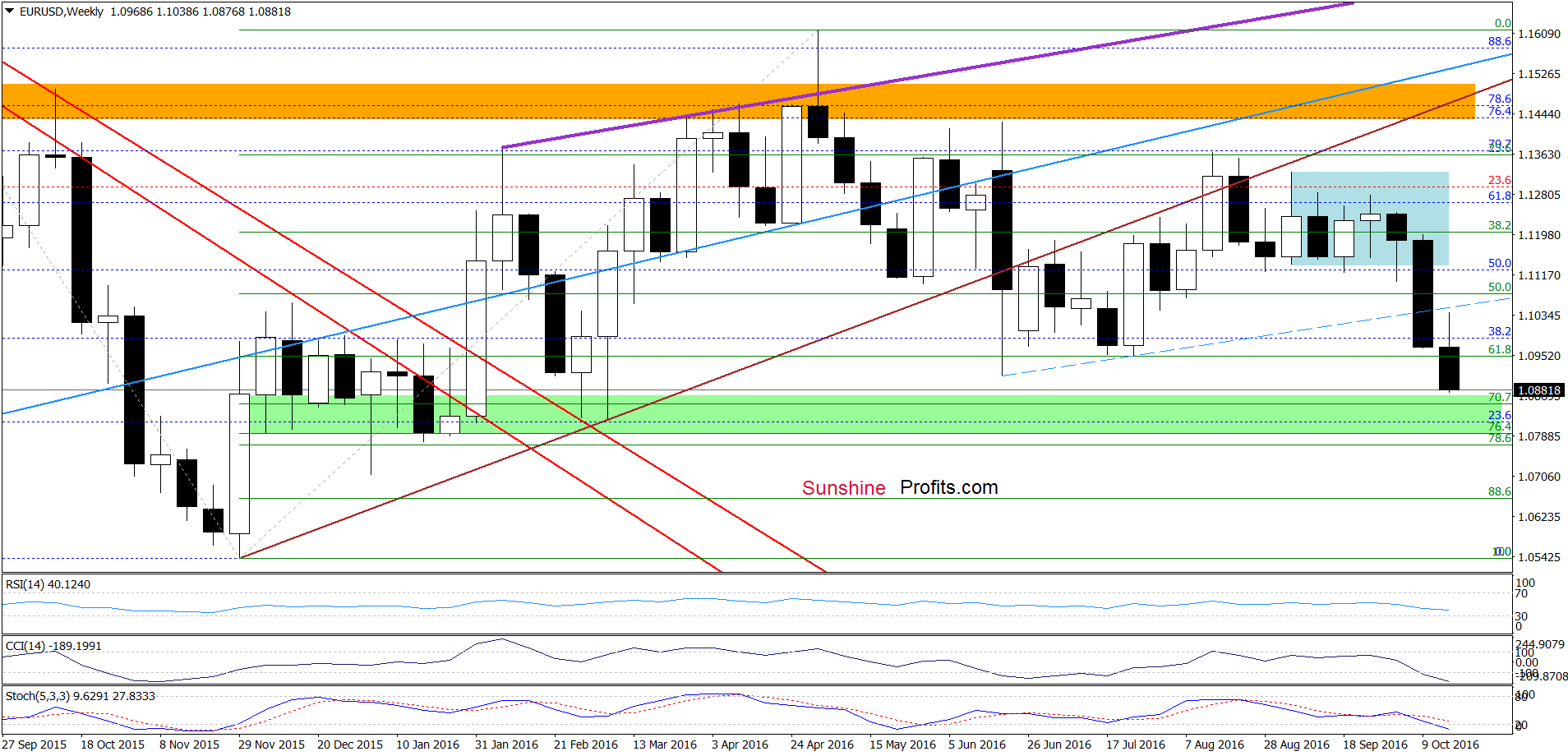

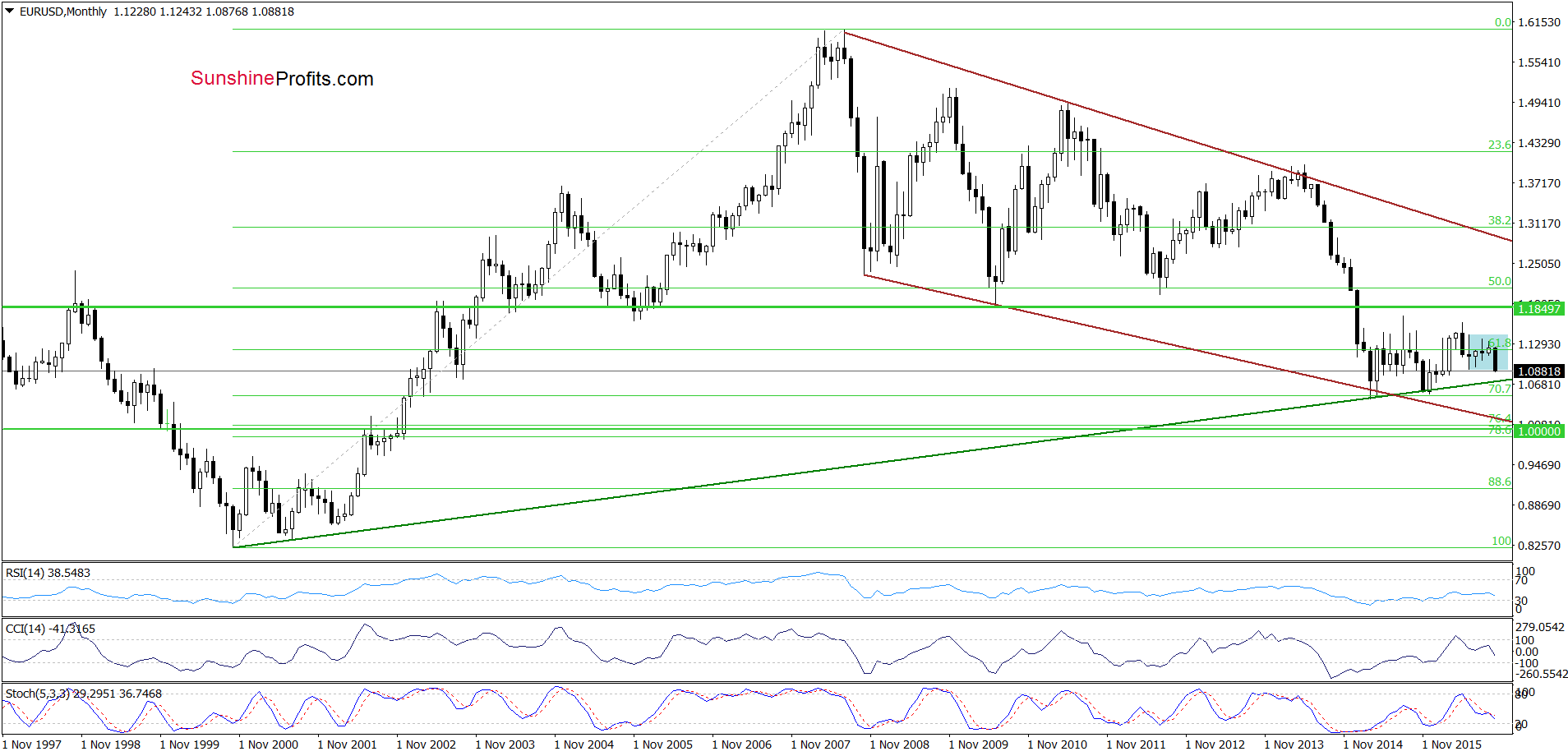

Looking at the weekly chart, we see that EUR/USD extended losses and slipped under Jul lows, which is a negative signal that suggests further deterioration and a test of the green support zone (maybe even the lower border of this area) created by the 76.4% Fibonacci retracement (based on the Nov 2015-May 2016 upward move), mid-Dec, mid-Jan and Feb lows (around 1.0793-1.0871) in the coming week.

Nevertheless, if it is broken, EUR/USD will likely re-test the strength of the long-term green support line marked on the chart below.

From the long-term perspective, we see that this key support line was strong enough to stop currency bears in Mar, Apr, Nov and Dec 2015, which suggests that we may see similar price action in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

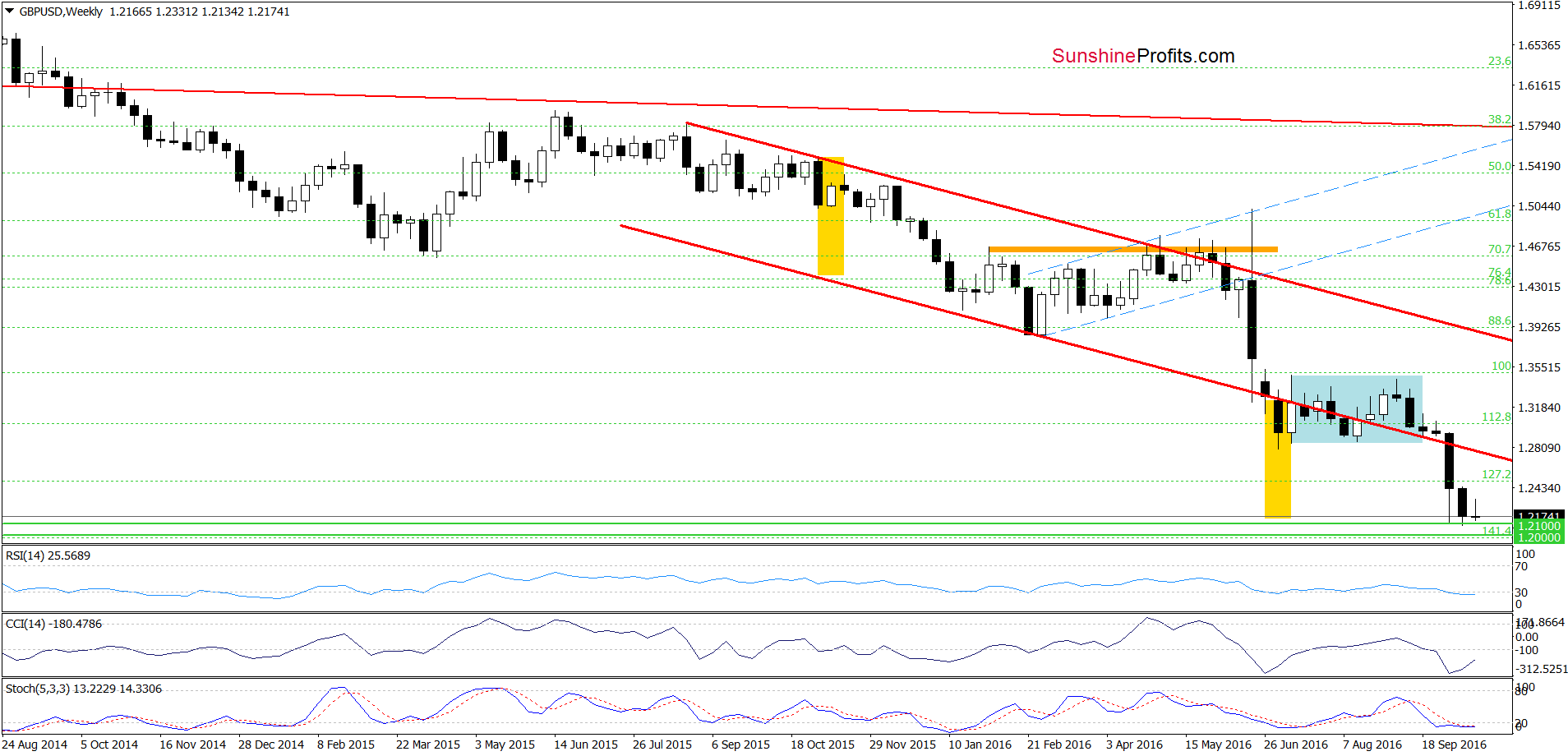

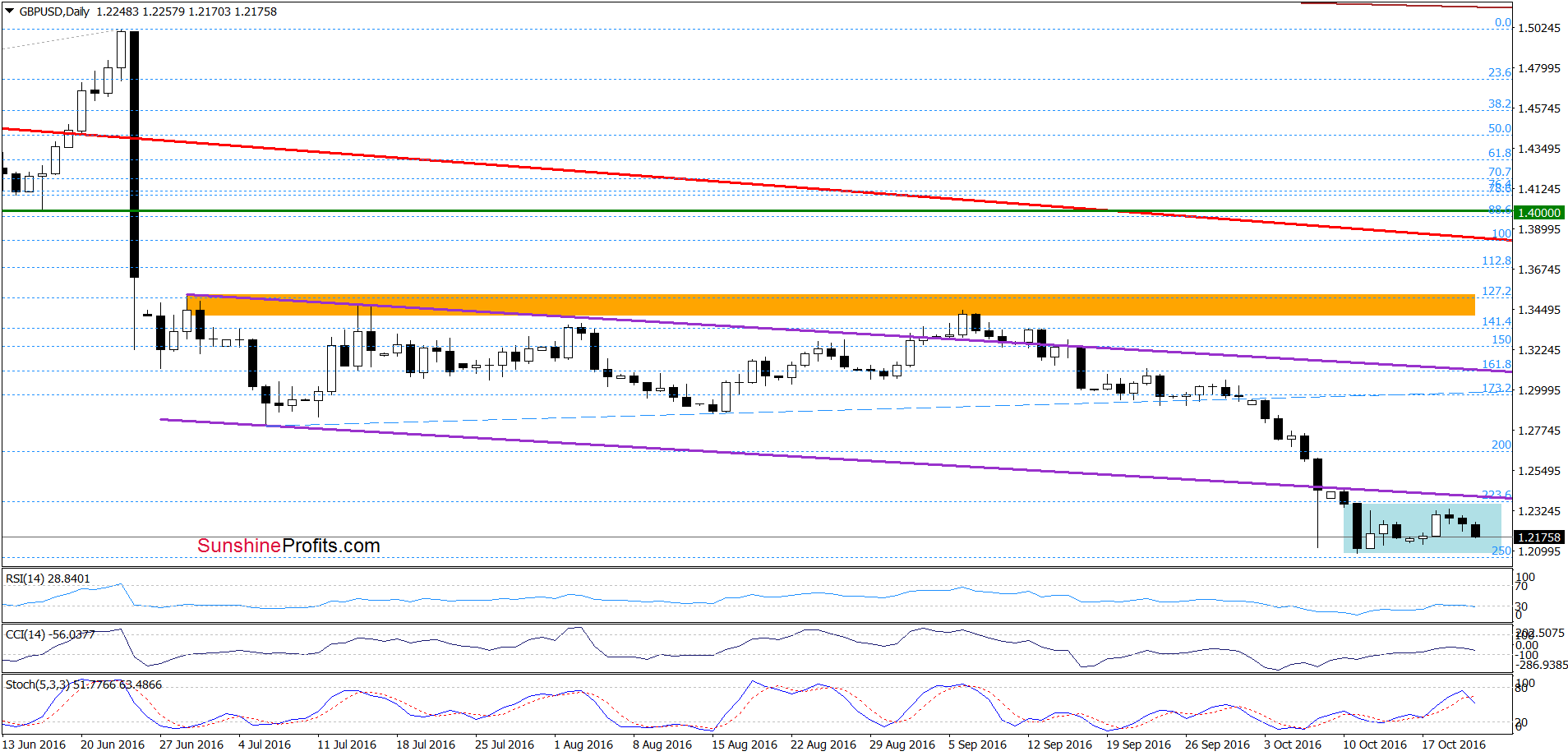

From this perspective, we see that although GBP/USD moved little higher in the first half of the week, the proximity to the previously-broken lower border of the purple declining trend channel encouraged currency bears to act, which resulted in a pullback. Taking this fact into account and combining it with a sell signal generated by the Stochastic Oscillator, we think that the pair will likely test the lower border of a blue consolidation in the coming week.

Finishing today’s commentary on this currency pair, it is worth keeping in mind that not far from recent lows currency bulls have two important allies - the barrier of 1.2000 and 1.2100, which could trigger another rebound (both marked on the weekly chart).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

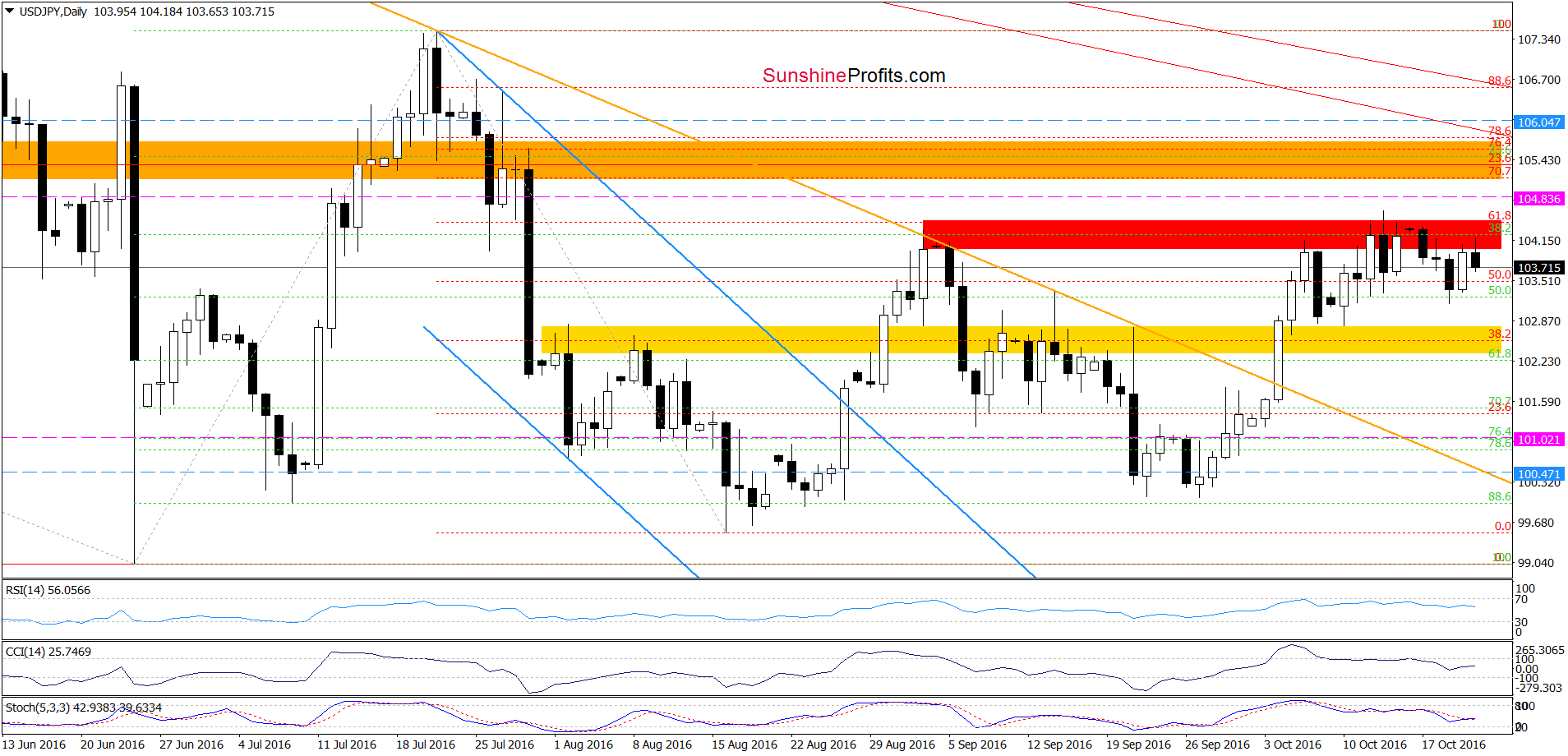

The situation in the long- and medium term hasn’t changed much as the exchange rate remains above the green support zone and the green support line based on the Jun and Aug lows. Today, we’ll focus on the very short-term changes.

Looking at the daily chart, we see that although USD/JPY rebounded yesterday, the red resistance zone continues to keep gains in check, which suggests that our downside target from our last Wednesday’s alert will be in play in the coming day(s):

(…) the initial downside target would be the yellow zone. However if it is broken, USD/JPY may test the previously-broken orange declining line, which serves now as another support.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 104.84 and initial downside target at 101.02) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts