When determining the trajectory of the main currency pairs, the key thing to keep in mind at this time is the USD Index and the possible changes in it. Consequently, this is what we focus on in today’s alert.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3346; initial downside target at 1.2876)

- USD/CHF: none

- AUD/USD: none

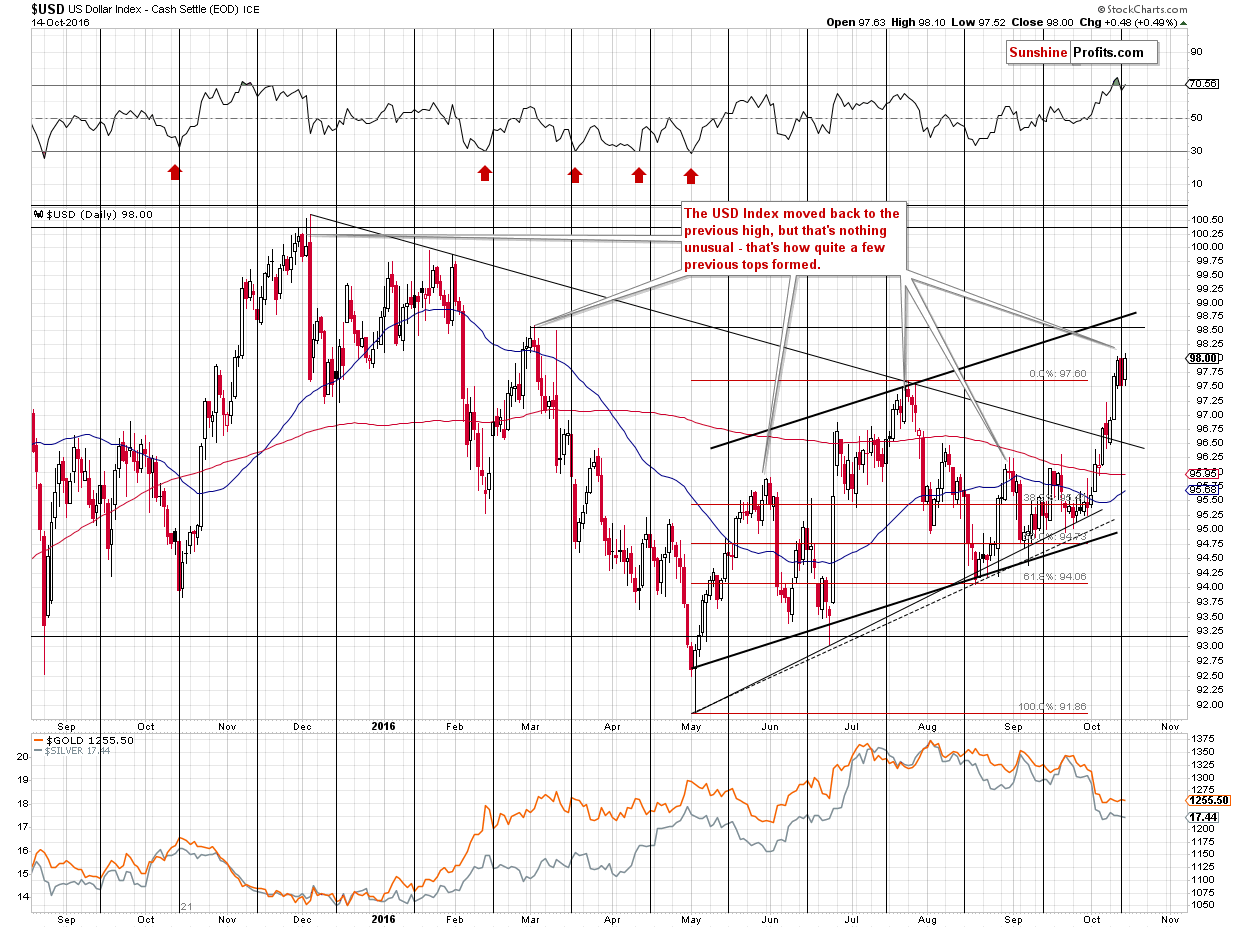

Let’s move right to the USD Index chart (chart courtesy of http://stockcharts.com).

In short, the back and forth movement after a sharp rally is the way the USD Index used to top many times in the past. In fact, most tops in the recent past were formed this way. Consequently, Friday’s rally to the previous high (the fact that it moved a bit above Wednesday’s high is rather irrelevant) doesn’t change much. The USD Index is still likely to reverse relatively soon and it is still possible that another short-term upswing (to 98.50 or so – the March highs) will be seen before the bigger correction starts.

Consequently, it seems that we’ll see a turnaround in most currency pairs as well, but we’ll wait for additional confirmations before opening trading positions. The only exception is the USD/CAD pair which is closely aligned with the performance of the crude oil market.

Taking into account the outlook for both crude oil and the USD Index, and – naturally – taking into account the technical picture for the USD/CAD pair, it seems that this is the only pair that has a risk-to-reward ratio favoring a position. In other major currency pairs, the risk seems to be too big to have an open position at this time.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts