Earlier today, the USD Index rebounded and re-approached the recent highs as investors awaited the Janet Yellen’s speech later in the day. What impact did this increase have on the technical picture of EUR/USD, USD/JPY and USD/CHF?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: short (a stop-loss order at 1.3346; initial downside target at 1.2876)

- USD/CHF: none

- AUD/USD: none

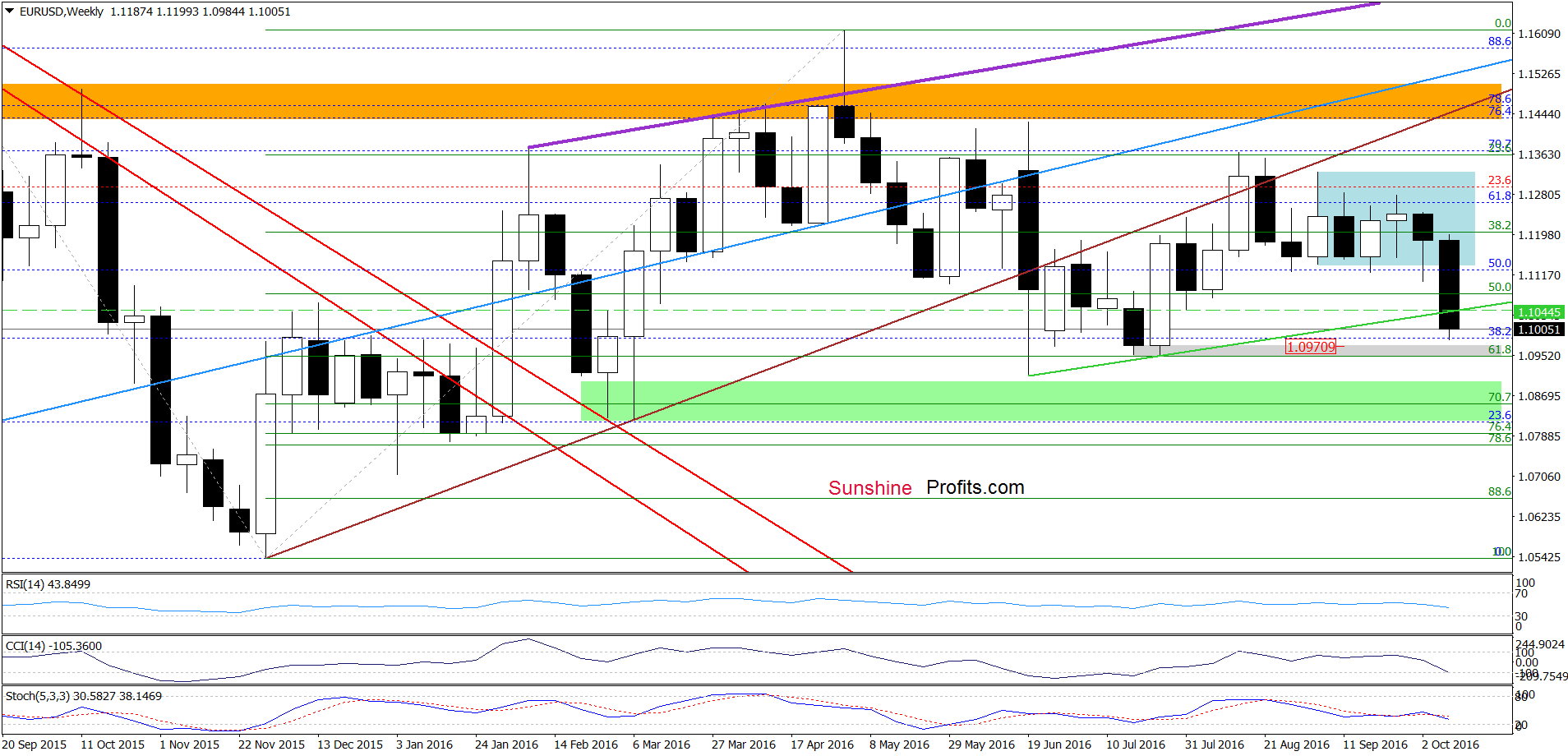

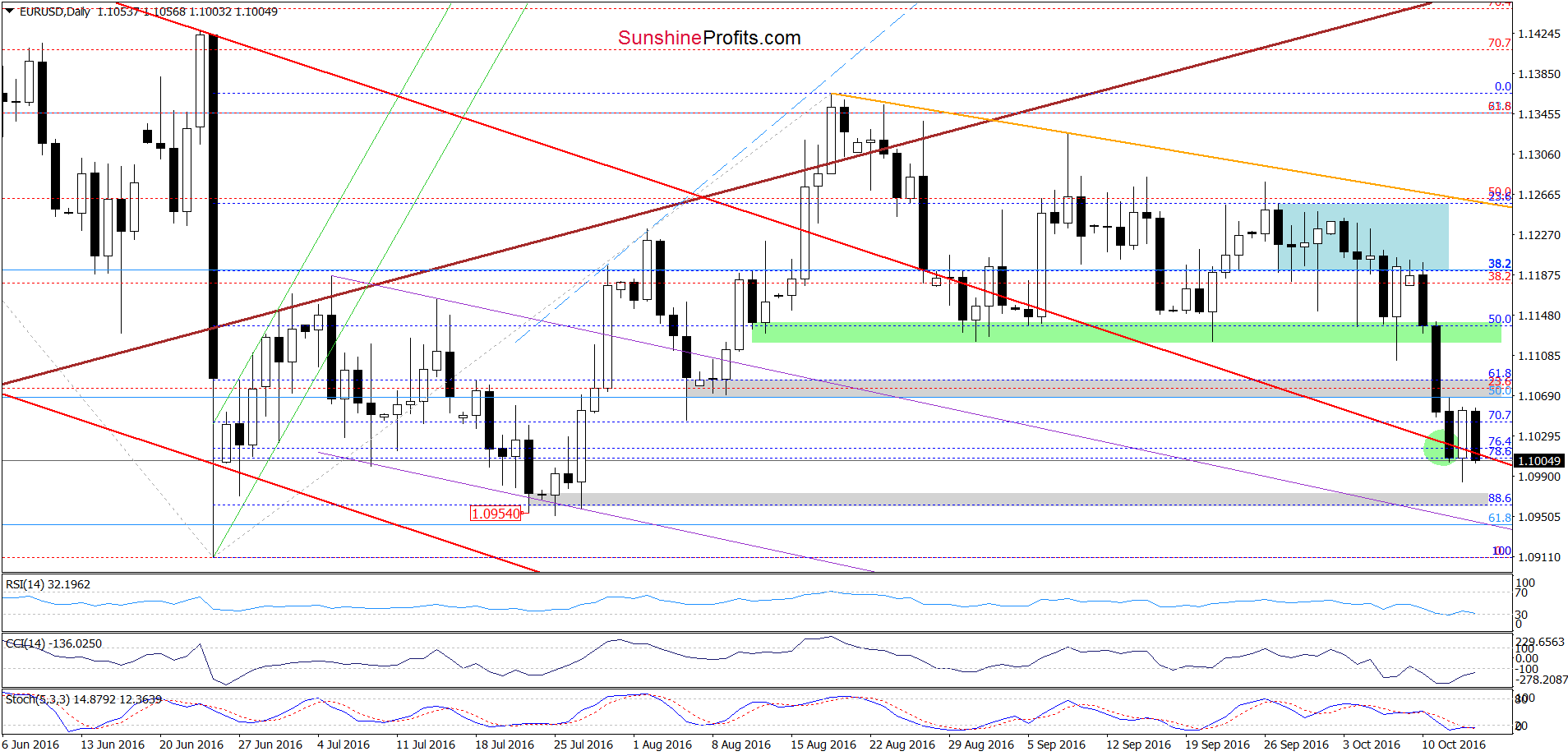

EUR/USD

On the daily chart, we see that although EUR/USD invalidated earlier breakdown under the red declining line (based on the May and Jun highs) and the support zone created by the 76.4% and 78.6% Fibonacci retracement levels yesterday, currency bears didn’t give up and showed their claws once again, which resulted in a comeback below these levels. Such price action doesn’t bode well for the exchange rate, suggesting that our Wednesday’s commentary is up-to-date also today:

(…) the CCI remains extremely oversold, which suggests that reversal in the coming days should not surprise us. Nevertheless, as long as the sell signal generated by the Stochastic Oscillator remains in play another downswing can’t be ruled out. Therefore, (…) we may see a decline even to the next grey support zone (created by the 88.6% Fibonacci retracement and late Jul lows) around 1.0954-1.0971.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

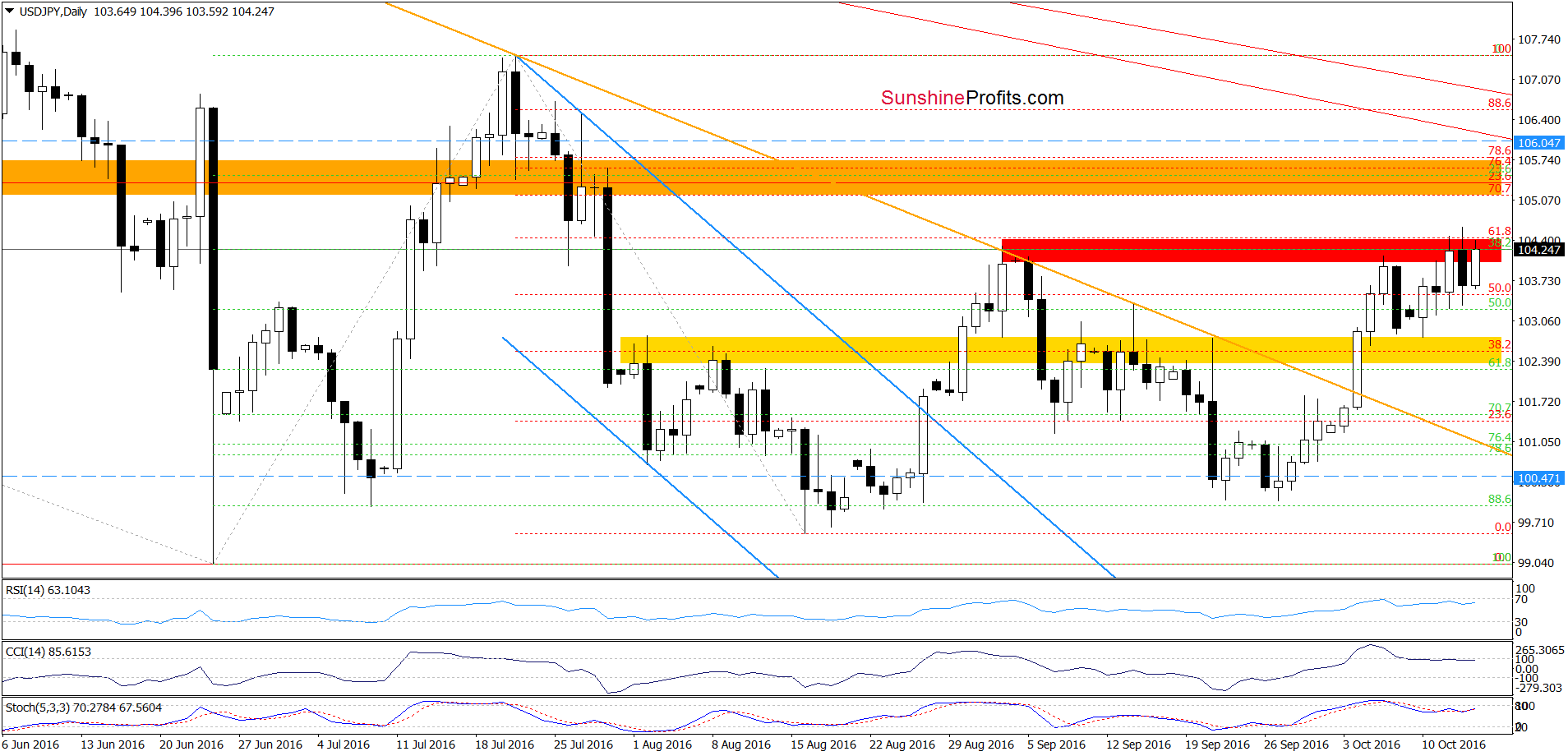

USD/JPY

The situation in the long- and medium term hasn’t changed much as the exchange rate remains above the green support zone and the green support line based on the Jun and Aug lows. Today, we’ll focus on the very short-term changes.

On the daily chart, we see that although USD/JPY rebounded once again earlier today, the red resistance zone continues to keep gains in check. This means that our last commentary on this currency pair remains valid:

(…) Will we see a breakout above it [the red resistance zone]? In our opinion, it is unlikely. Why? As you see, sell signals generated by the indicators remain in play, supporting currency bears and lower values of the exchange rate. Therefore, we think that another reversal from this area should not surprise us. If this is the case and we see such price action, the initial downside target would be the yellow zone. However if it is broken, USD/JPY may test the previously-broken orange declining line, which serves now as another support.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

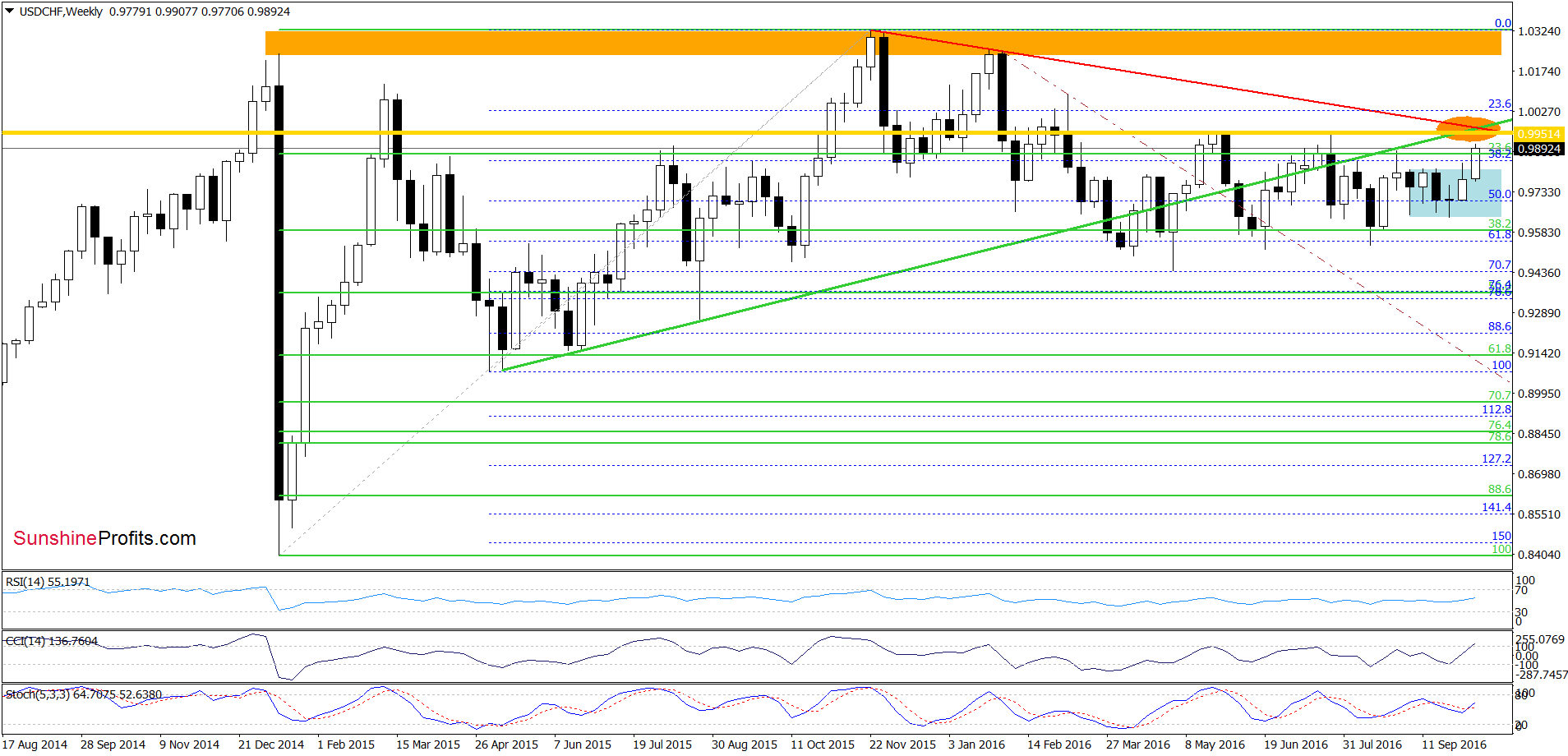

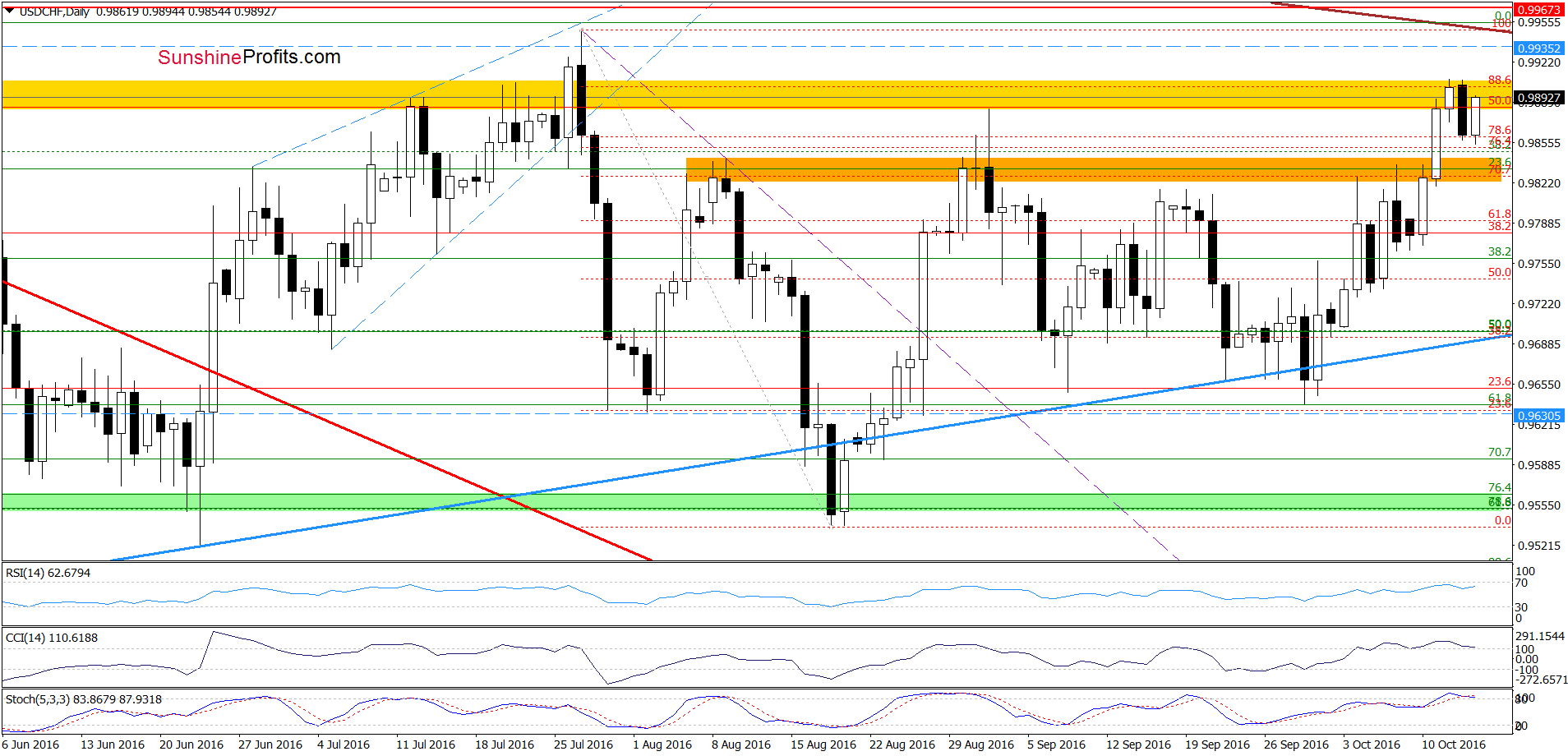

USD/CHF

From today’s point of view, we see that the yellow resistance zone triggered a pullback yesterday. Despite this drop, currency bulls pushed the pair higher earlier today, which will likely result in a re-test of Wednesday’s high. At this point it is worth noting that even if the exchange rate moves little higher, the space for gains seems limited as the key resistance zone (marked with orange ellipse on the weekly chart) created by the long-term red declining resistance line (based on the Nov and Feb highs), the green rising line (based on the May and Aug 2015 lows) and May and Jul highs is quite close (currently around 0.9950-0.9960). Additionally, the CCI and Stochastic Oscillator are very close to generating sell signals, increasing the probability of reversal in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts