Earlier today, the Australian dollar slipped to the lowest level since Aug 2 against the greenback as Friday’s comments by Federal Reserve Chair Janet Yellen supported the U.S. currency. Thanks to these circumstances, AUD/USD slipped under the medium-term support line, but will we see further deterioration in the coming week?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (a stop-loss at 1.3579; initial downside target at 1.2519)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

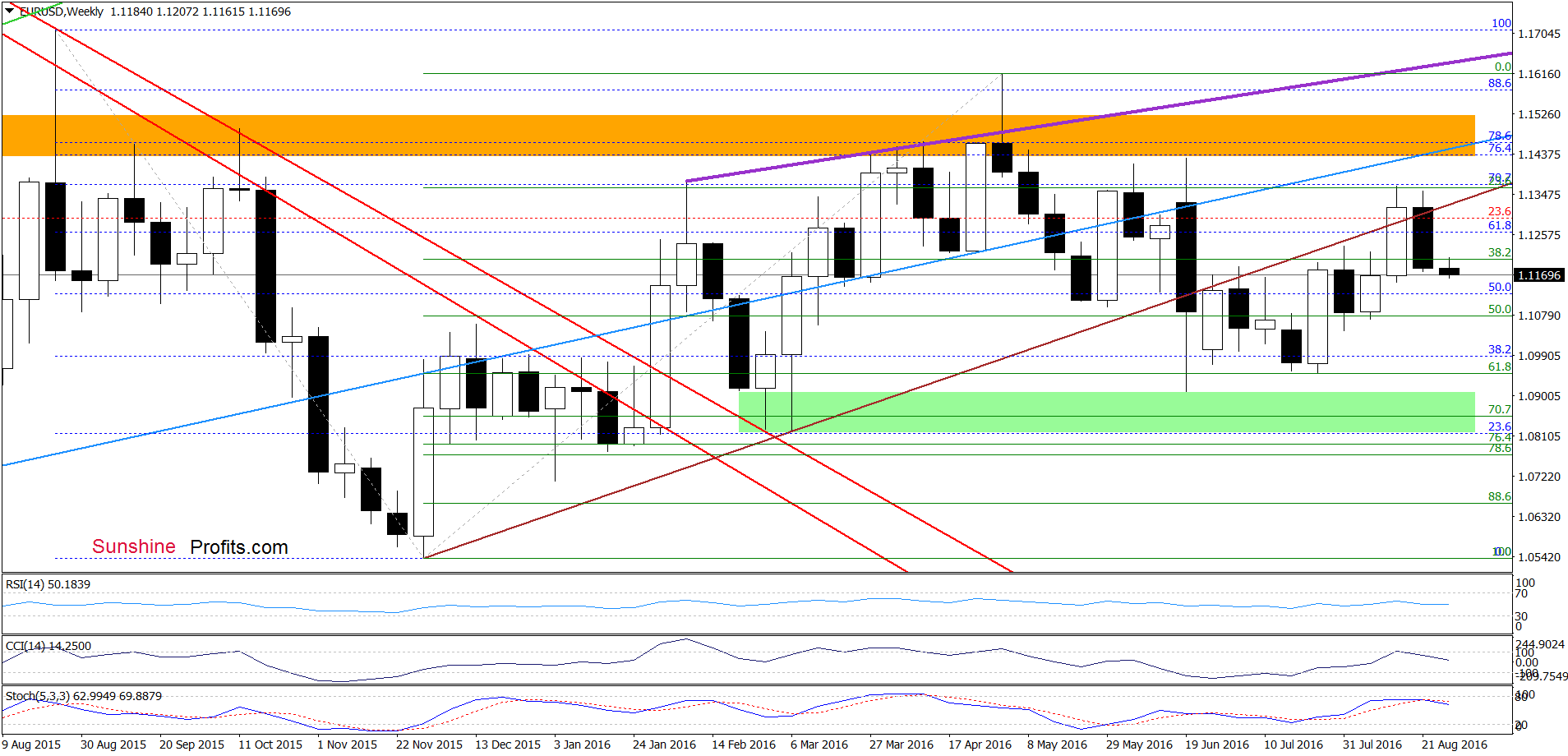

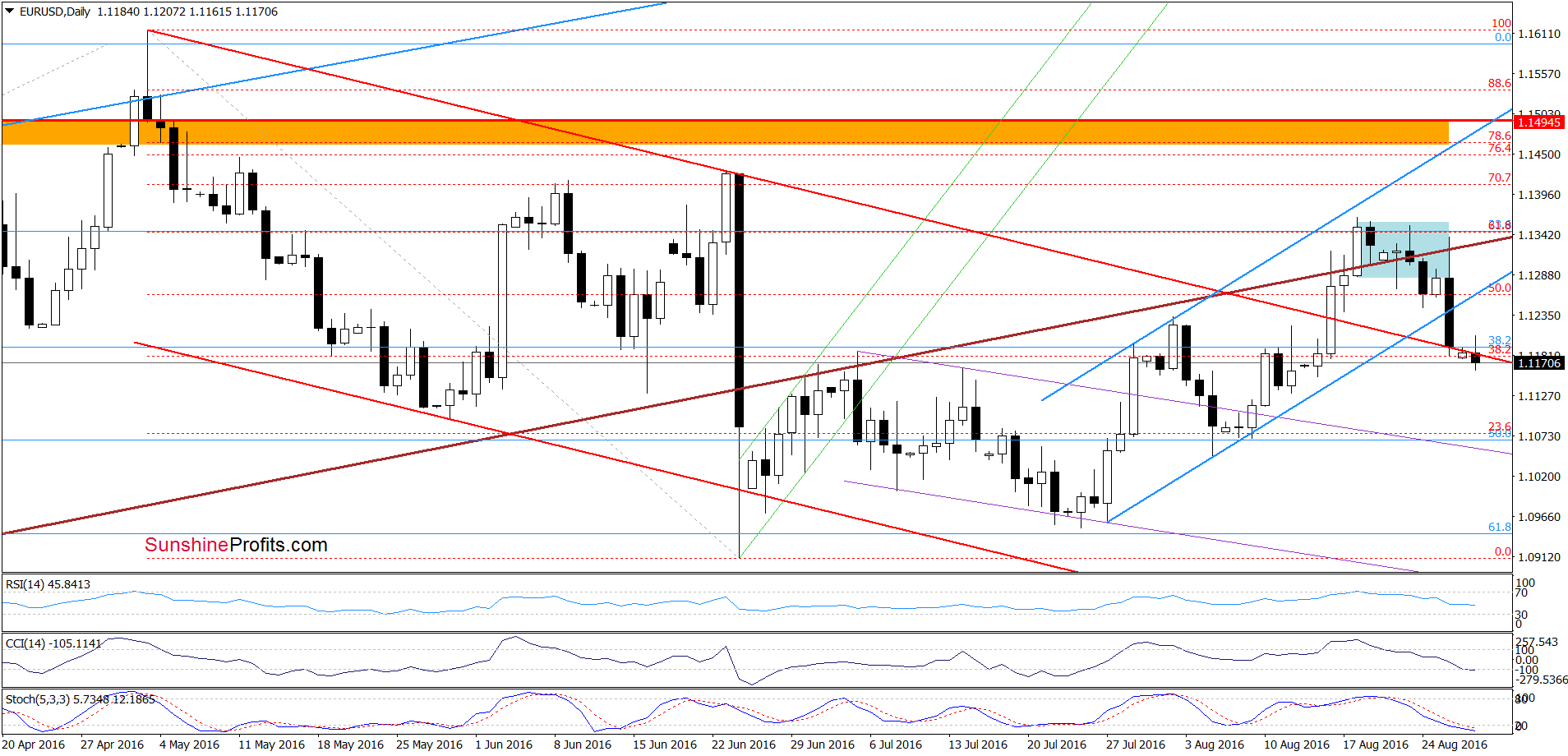

EUR/USD

On Friday, we wrote:

(…) although EUR/USD moved little higher earlier today, the pair remains under the medium-term brown resistance line. Additionally, sell signals generated by the indicators are still in play, suggesting lower values of the exchange rate and a test of the lower border of the blue rising trend channel in the coming day(s).

From today’s point of view, we see that the situation developed in line with our assumptions and the exchange rate extended losses. With sharp Friday’s move, the pair not only slipped to our first downside target, but also reached the upper border of the red declining trend channel. Earlier today, EUR/USD declined also under this support, which suggests further deterioration in the following days – especially if the pair closes today’s session under this line. In this case, the exchange rate will likely drop to around 1.1083, where the next support zone (created by the 61.8% Fibonacci retracement based on the entire Jun-Aug upward move and the Aug lows) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

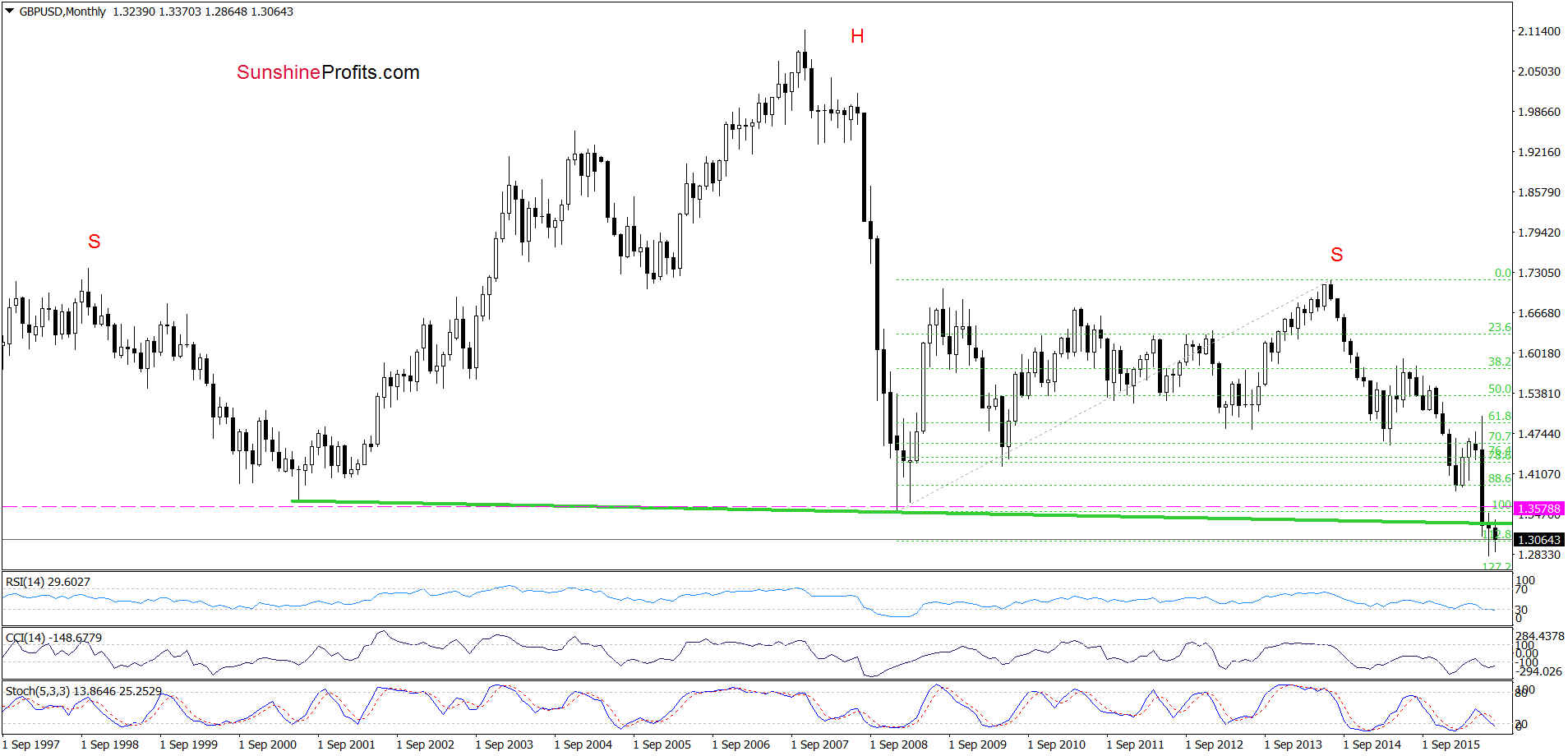

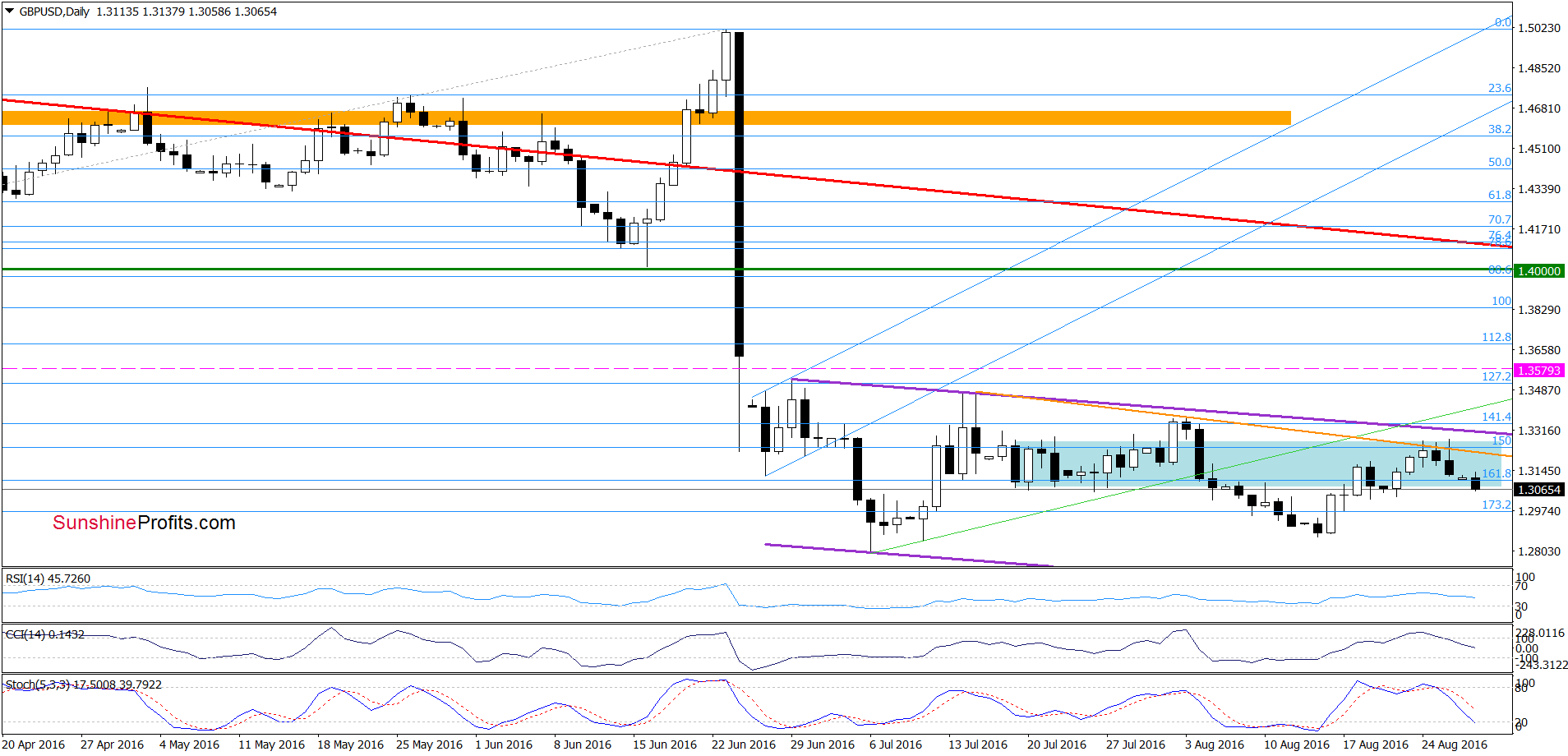

GBP/USD

Looking at the monthly chart, we see that the overall situation in the long term hasn’t changed much and remains bearish as the exchange rate is still trading under the previusly-broken neck line of the head and shoulders formation. This means that as long as there won’t be invalidation of the breakdown belw this key line another attempt to move lower is more likely than not.

Will the very short-term picture confirm this scenario? Let’s examine the daily chart and find out.

Quoting our previous alert:

(…) although GBP/USD increased slightly earlier today, the pair remains under the orange resistance line based on recent highs. Additionally, the CCI and Stochastic Oscillator generated sell signals, which suggests that lower values of GBP/USD are still ahead us. If this is the case, and the pair declines from here, we’ll see (at least) a test of the last week’s lows.

On the daily chart, we see that currency bears pushed the pair lower as we had expected. Additionally, sell signals generated by the indicators are still in play, supporting further deterioration. This means that our Friday’s target would be in play in the coming days. If it is broken, we may see a decline to around 1.2864, where the mid-Aug low is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): Short positions (with a stop-loss at 1.3579 and the initial downside target at 1.2519) are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

In our last commentary on this currency pair, we wrote the following:

(…) although AUD/USD rebounded earlier this week, the long-term orange resistance line, the late-Apr high, the 70.7% Fibonacci retracement and the current position of the indicators continue to support currency bears, suggesting that even if the pair moves higher once again (…) further deterioration is just around the corner.

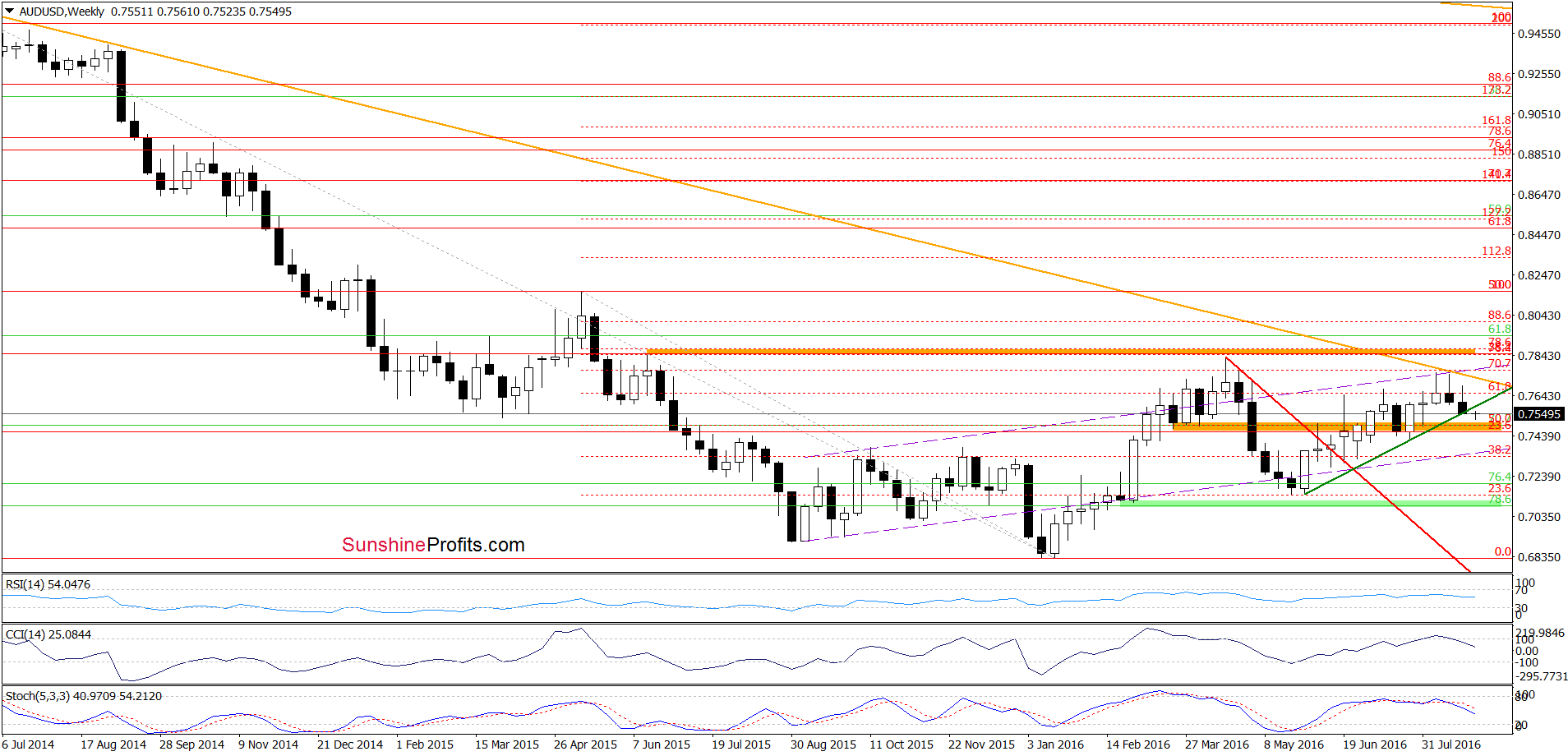

As you see on the weekly chart, the situation developed in tune with our scenario and AUD/USD declined in the previous week, reaching the medium-term green support line. Earlier today, the pair extended losses, dropping below this line, which is a bearish signal that suggests lower values of AUD/USD in the coming week – especially when we factor in sell signals generated by the indicators.

Are there any short-term technical factors that could hinder the realization of the above scenario? Let’s check.

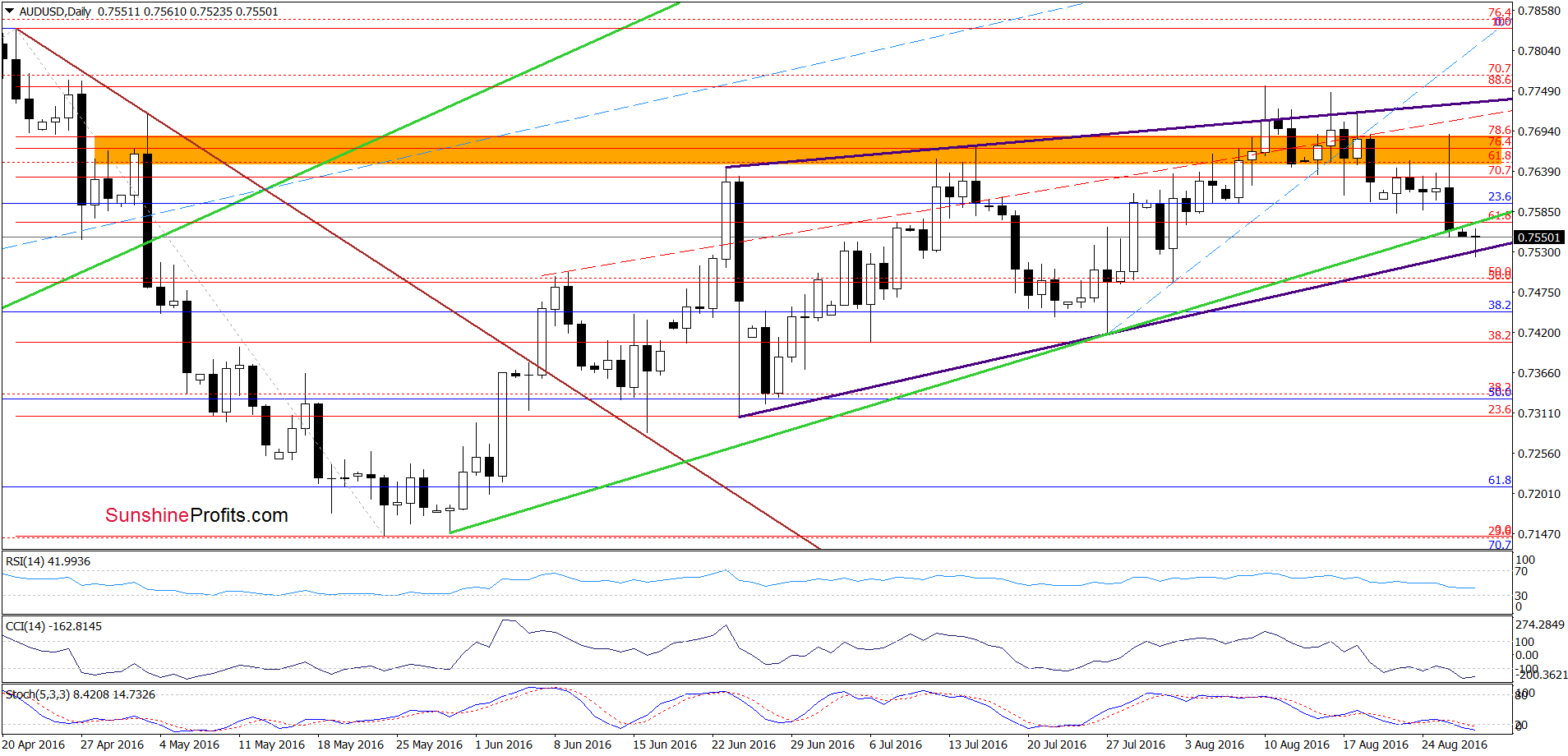

From today’s perspective, we see that AUD/USD the orange resistance zone created by the Fibonacci retracement levels encouraged currency bears to act, which resulted in a sharp decline on Friday. Thanks to this drop, the exchange rate reached the green support line based on the previous lows. Earlier today, the pair moved lower once again and tested the lower border of the purple rising wedge. Taking this fact into account, and combining it with the current position of the indicators (they are very close to generating buy signals), it seems that the pair will reverse and rebound in the coming days. If this is the case, the exchange rate will test the previously-broken medium-term green line. If it is broken, the next upside target would be around 0.7613, where the 38.2% Fibonacci retracement (based on the recent downward move) is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts