Yesterday, EUR/USD extended losses and slipped to the lowest level since Jun 27 ahead the ECB's Governing Council's first monetary policy meeting after Brexit. Earlier today, the exchange rate rebounded slightly, but is the worst already behind currency bulls?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss at 1.1236; initial downside target at 1.0708)

- GBP/USD: short (a stop-loss at 1.3579; initial downside target at 1.2519)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

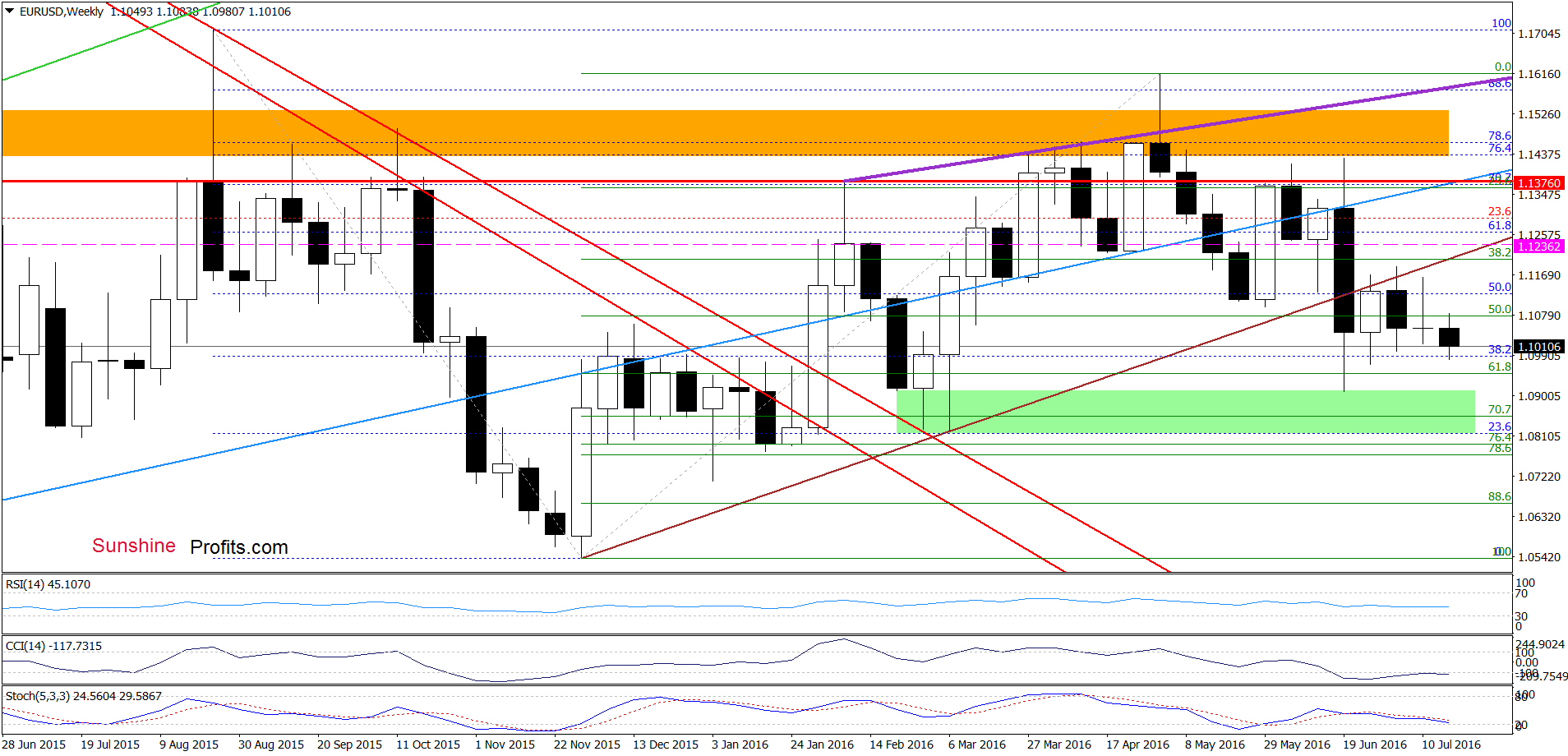

From the medium-term perspective, we see that EUR/USD is still trading in a narrow range between the green support zone (created by the late Feb and early Mar lows and reinforced by the 70.7% Fibonacci retracement) and the reviously-broken brown rising resistance line. Taking this fact into accout, we think tha another bigger move will be more likely if we see a breakdown under the green zone or invalidation of the breakdown under the brown line. Until this tme short-lived moves in both directions should not surprise us.

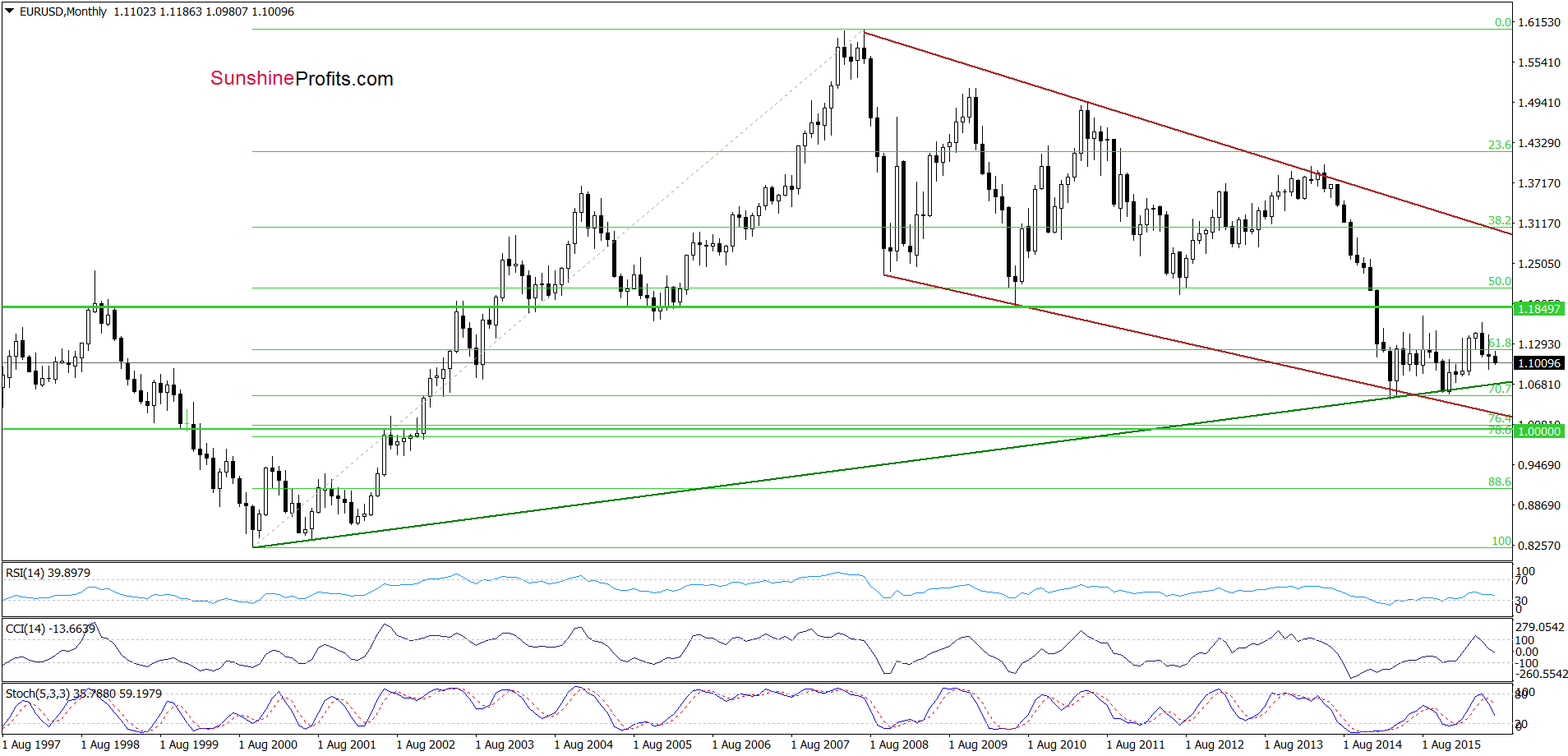

Nevertheless, the long-term picture below suggests that further declines are just a matter of time. Why?

Because sell signals generated by the indicators remain in place, supporting further deterioration and a re-test of the strength of the long-term green support line (currently around 1.0708) in the coming week(s).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1236 and initial downside target at 1.0708 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Last Wednesday, we wrote the following:

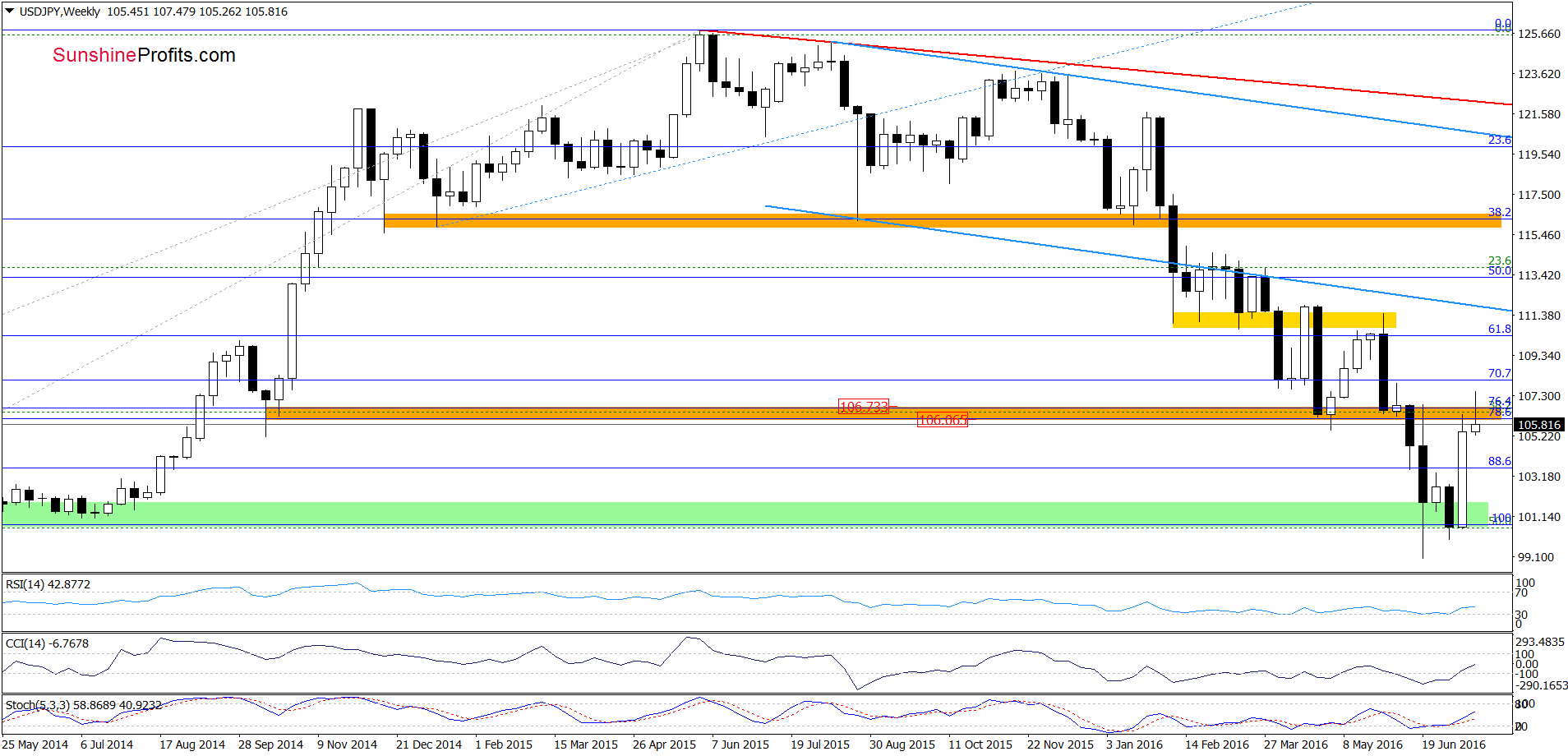

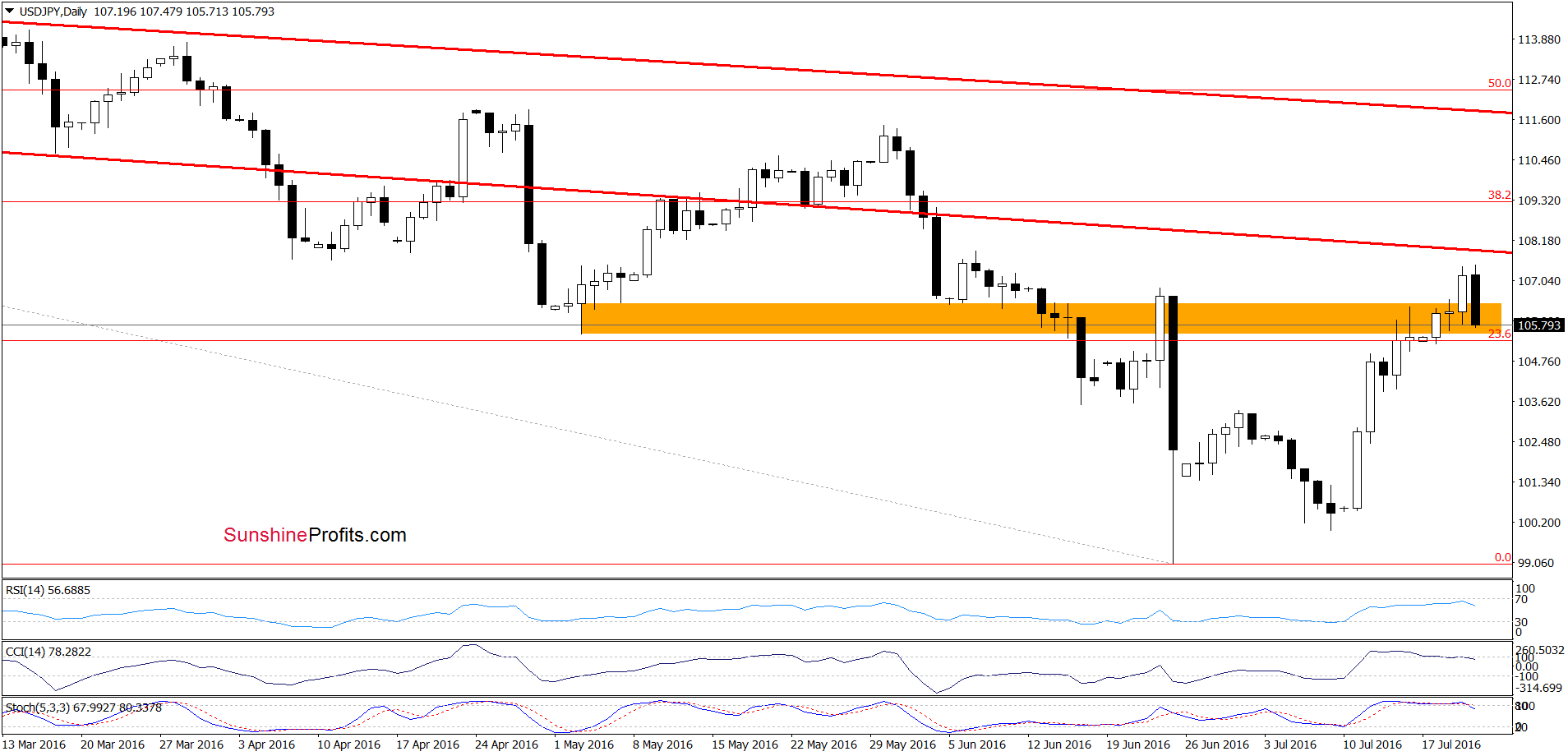

(…) all daily indicators generated buy signals, supporting further improvement. As a result, USD/JPY extended gains earlier today, which suggests that we’ll see a test of the orange resistance zone (around 106.06-106.73) in the coming day(s).

From today’s point of view, we see that currency bulls not only took USD/JPY to our upside target, but also managed to push the pair above it. Despite this improvement, the exchange rate reversed and declined earlier today, which suggests that if USD/JPY closes today’s session under the orange zone, we’ll see further deterioration in the coming weeks. In this case, the initial downside target would be around 104.2, where the 38.2% Fibonacci retracement (based on the Jun-Jul upward move) and mid- Jul lows are. This pro bearish scenario is also reinforced by the current position of daily indicators, which generated sell signals, supporting lower values of USD/JPY in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

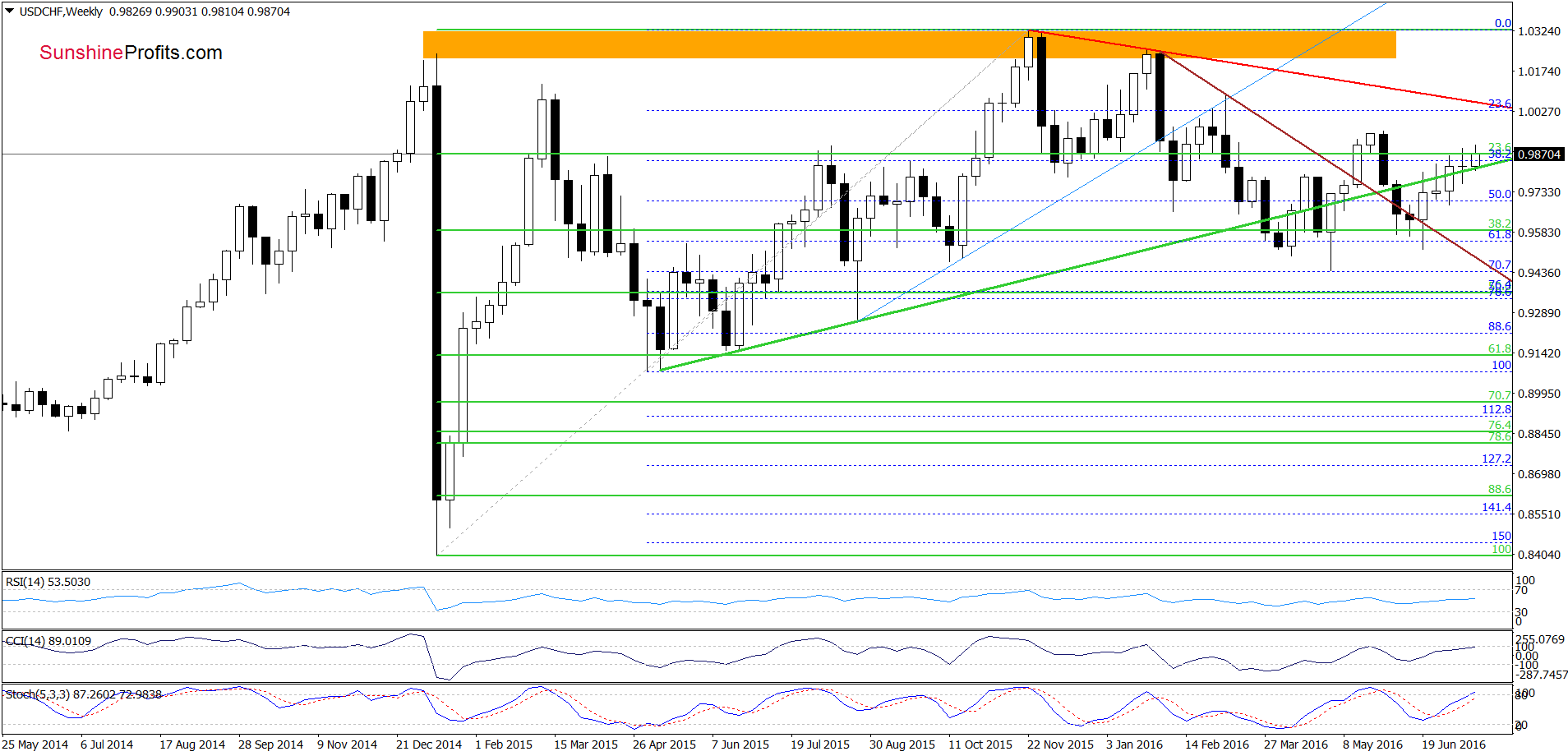

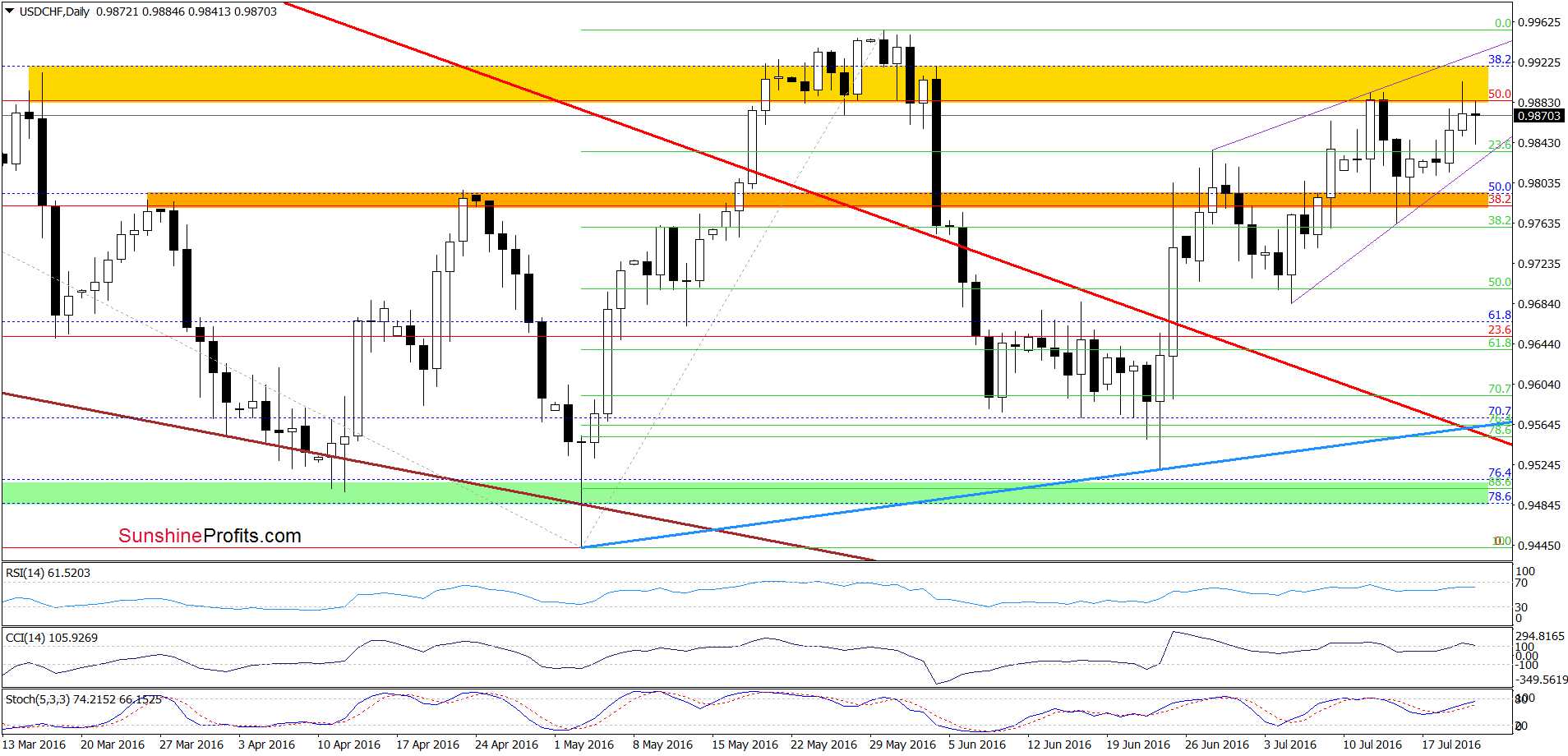

USD/CHF

On the daily chart, we see that USD/CHF bounced off the orange zone and increased to the yellow resistance area once again. Although this is a positive event, we should keep in mind that this resistance was strong enough to stop currency bulls in the previous week and earlier in May. Additionally, all indicators are very close to generating sell signals, which suggests that reversal and lower values of USD/CHF are just around the corner. If this is the case, and the pair declines, the first downside target would be the previously-broken orange zone, which serves now as the nearest support. If it is broken, we may see declines to around 0.9683, where the Jul 5 low is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts