Earlier today, the USD Index moved little lower ahead of the outcome of the Federal Reserve’s meeting later in the day, which resulted in a drop under the level of 95. Despite this move, USD/CHF is consolidating around a support/resistance line. Will we see invalidation of earlier breakdown?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (stop-loss order at 1.4785; initial downside target at 1.4056)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

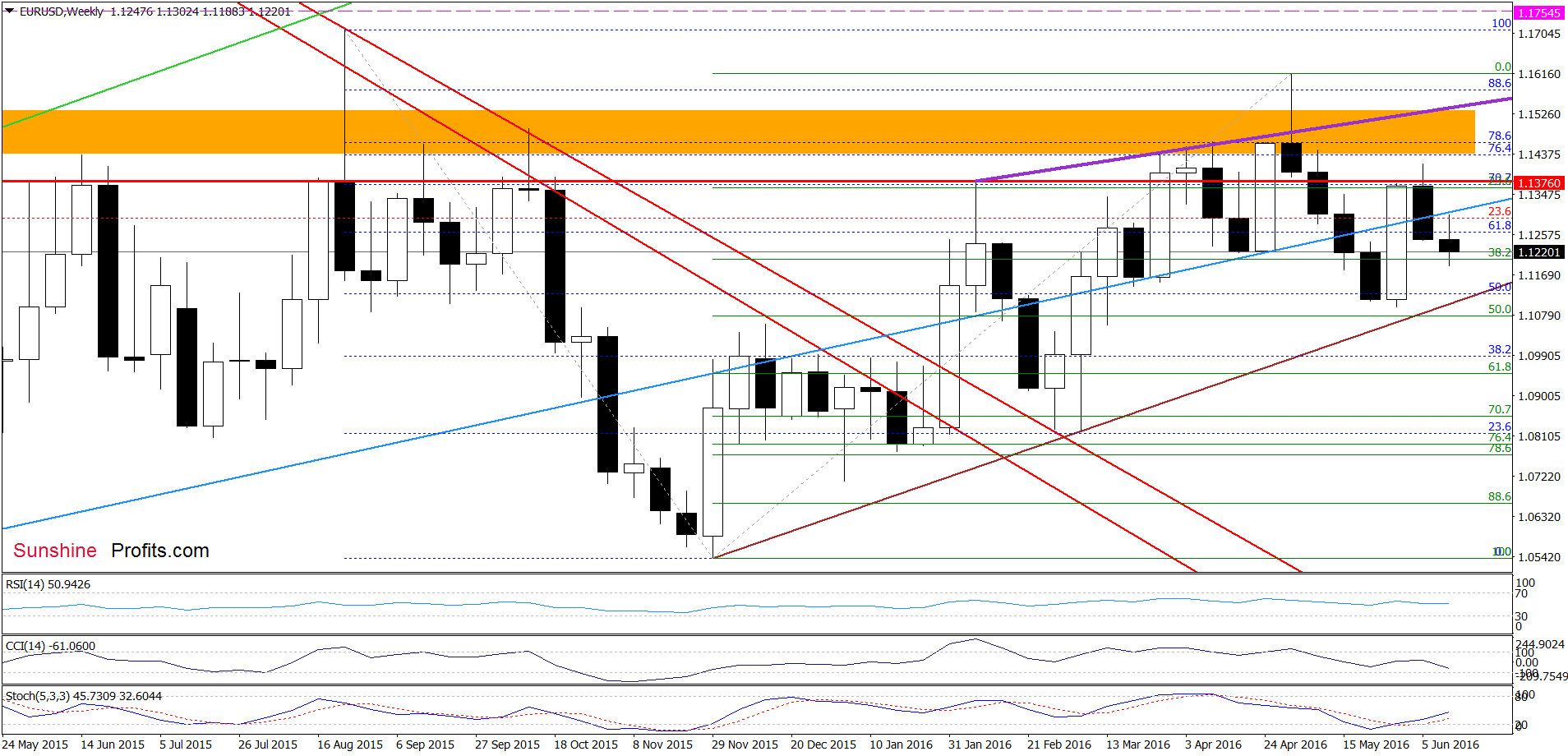

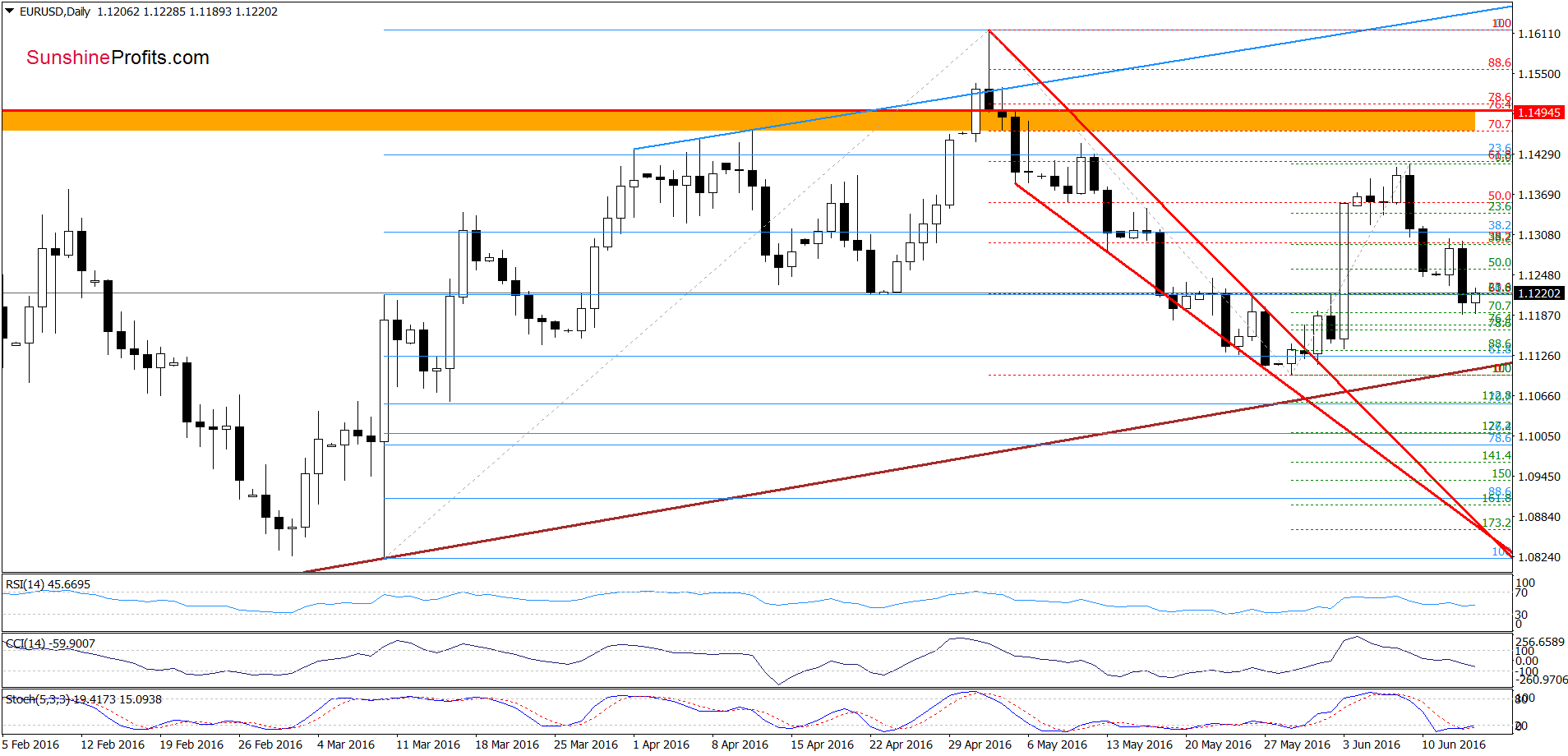

EUR/USD

Looking at the daily chart, we see that EUR/USD extended losses and reached the 70.7% Fibonacci retracement yesterday. Earlier today, this support encouraged currency bulls to act, which resulted in a rebound. Despite this move, the pair remains under the previously-broken 61.8% retracement, which suggests that another attempt to move lower can’t be ruled out. Therefore, if the pair declines once again, the next target would be the brown rising support line based on the Dec and Mar lows.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

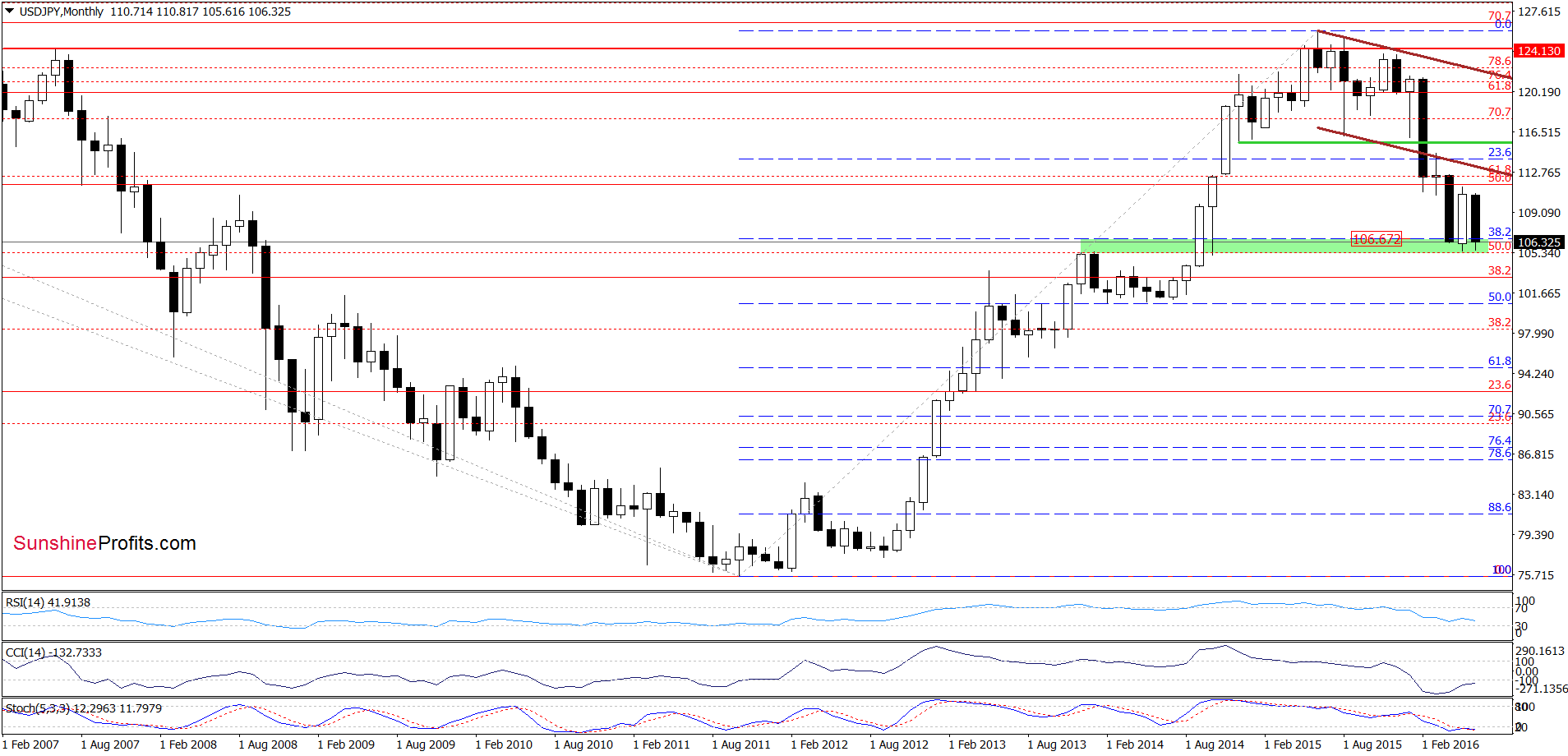

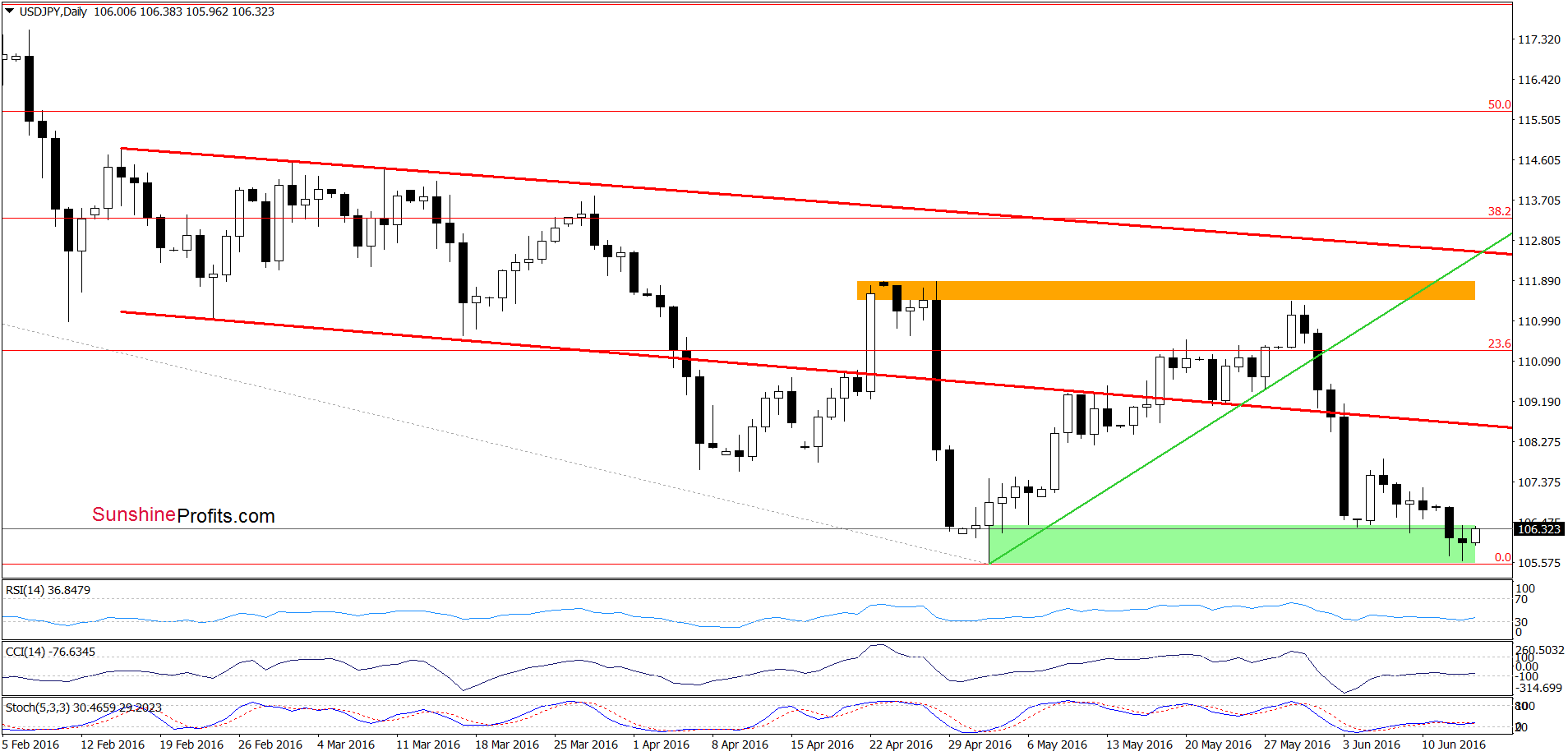

USD/JPY

From today’s point of view, we see that USD/JPY moved lower and reached the green support zone (marked on the monthly chart), approaching the May low. As you see, this area was strong enough to stop currency bears at the beginning of the previous month, which suggests that we may see similar price action in the coming days – especially when we factor in buy signals generated by the daily CCI and Stochastic Oscillator. If this is the case and the pair rebounds from here, we’ll see a test of the last week’s high of 107.89.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

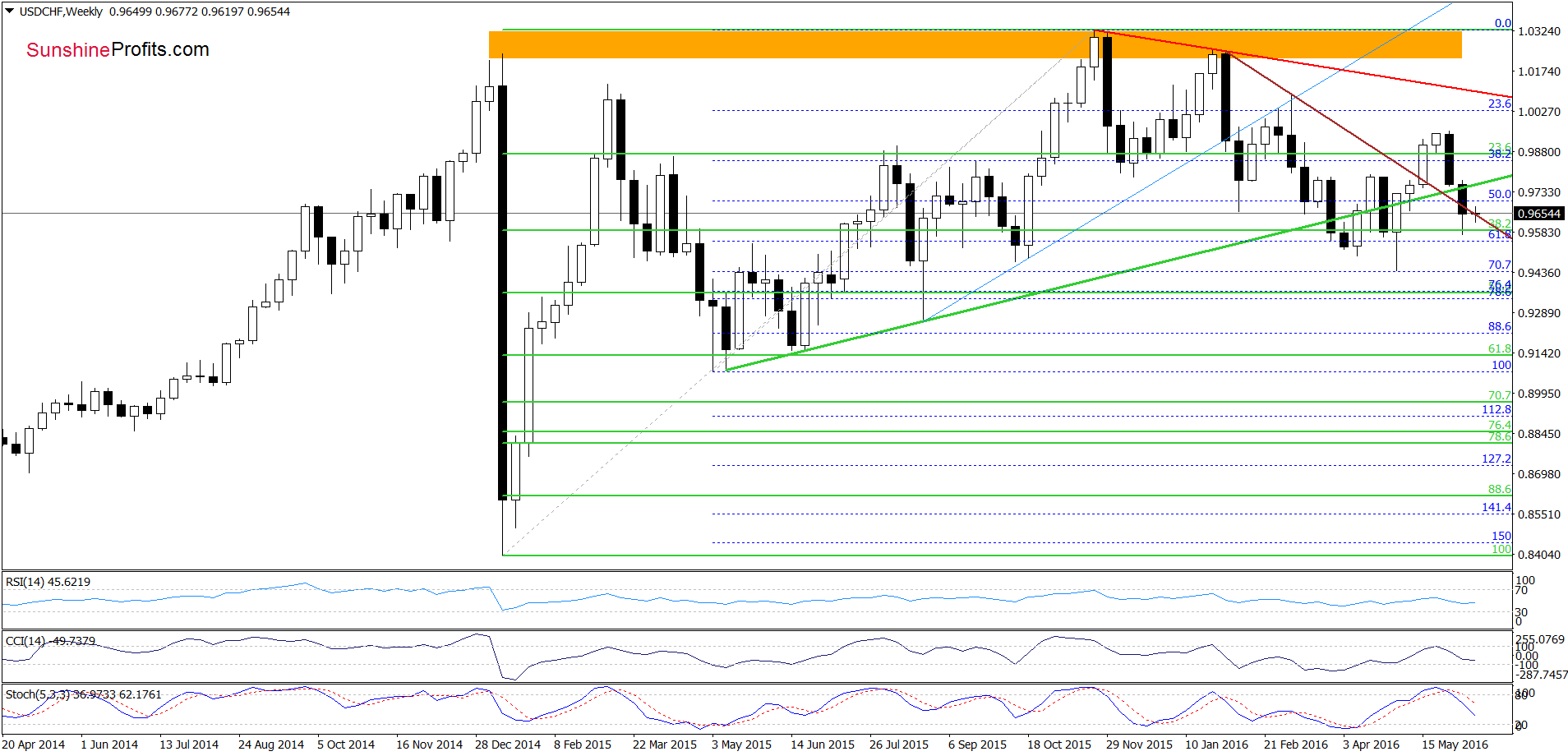

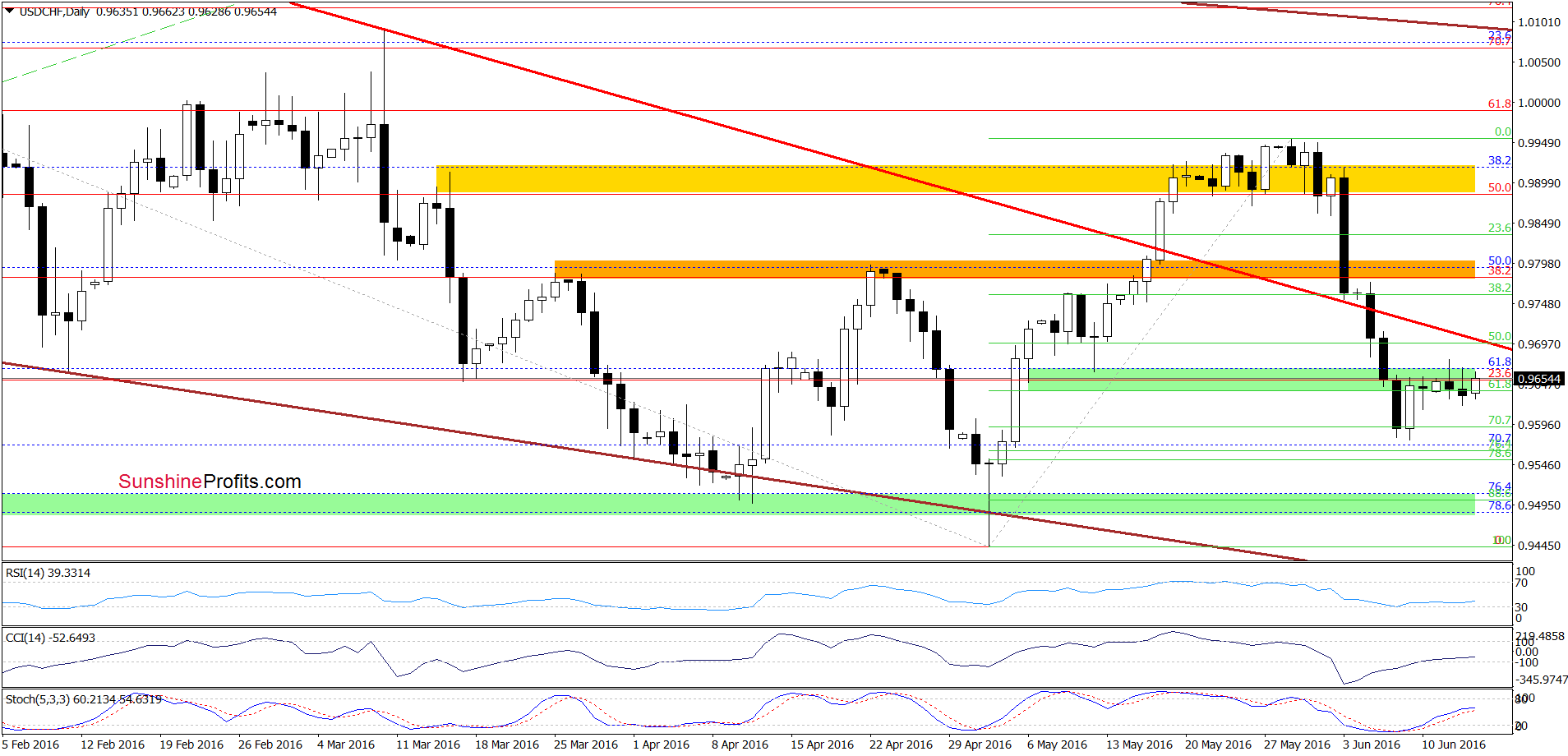

On the above charts, we see that USD/CHF is consolidating around the 61.8% Fibonacci retracement (marked on the daily chart) and the brown declining resistance line (seen on the weekly chart). However, buy signals generated by the indicators are still in play, supporting currency bulls and another attempt to move higher. If this is the case, and the exchange rate increases from here, we’ll see (at least) a comeback to the red declining resistance line in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts