Yesterday, the Commerce Department reported that new home sales increased by 16.6% in the previous month, which pushed the USD Index to its highest level since Mar 29. Although the index moved little lower earlier today, it still remains around yesterday’s peak. What impact did this increase have on the euro, Canadian and Australian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (stop-loss order at 1.4785; initial downside target at 1.4220)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

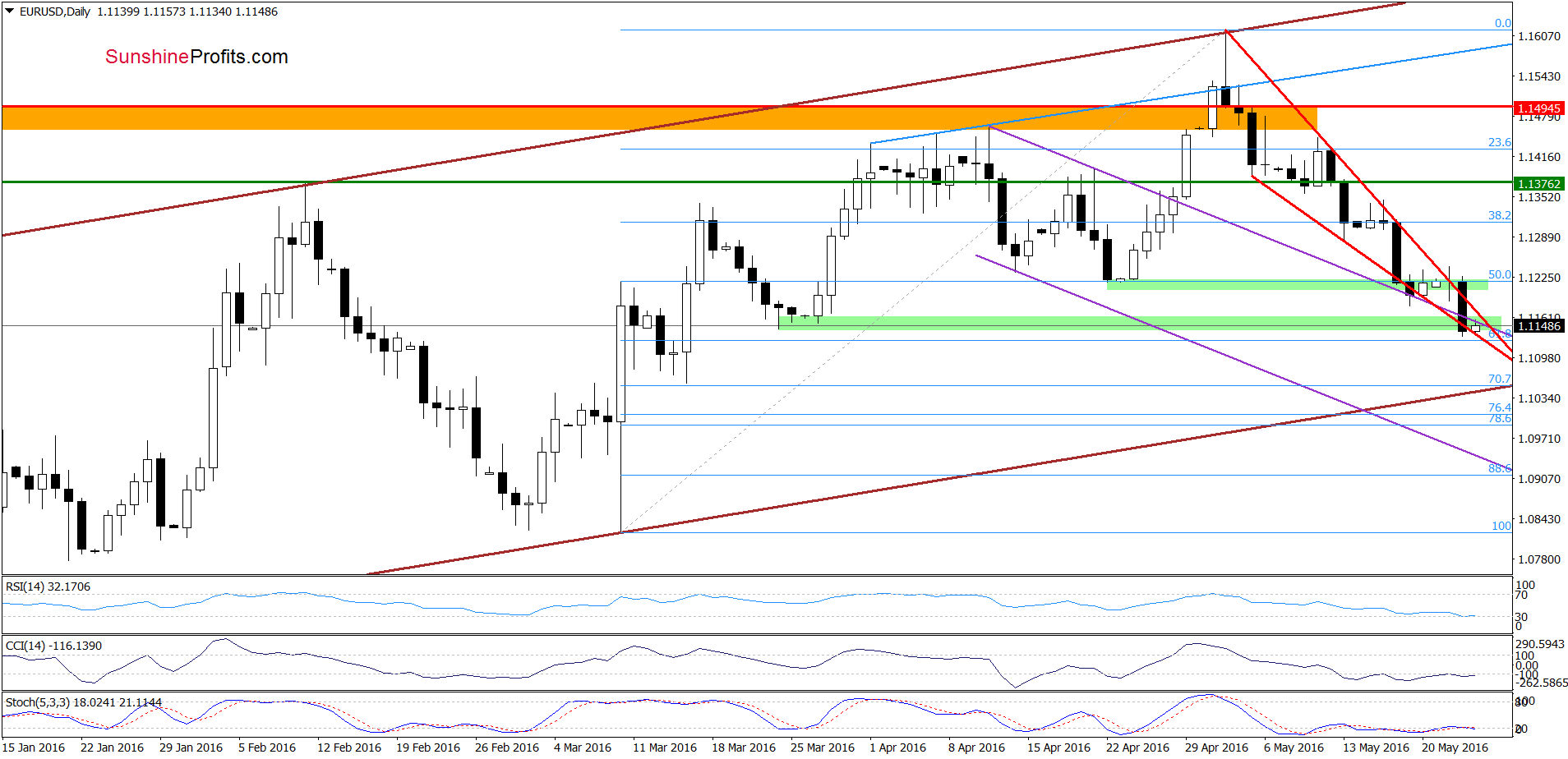

The situation in the medium-term hasn’t changed much as EUR/USD is still trading under the previously-broken support/resistance line based on the March and Apr 2015 lows. Today, we’ll focus on the very short-term changes.

On the daily chart, we see that EUR/USD moved lower once again and dropped slightly below the green zone (created by the late Mar lows and the lower border of the red wedge) yesterday. Despite this deterioration, the proximity to the 61.8% Fibonacci retracement encouraged currency bulls to act, which resulted in a comeback to the declining wedge earlier today. Additionally, the current position of the CCI and Stochastic Oscillator suggests that the space for declines may be limited and reversal is just around the corner. Nevertheless, in our opinion, a bigger upward move would be more likely and reliable if the exchange rate closes one of the following days above the upper border of the declining wedge (currently around 1.1187).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

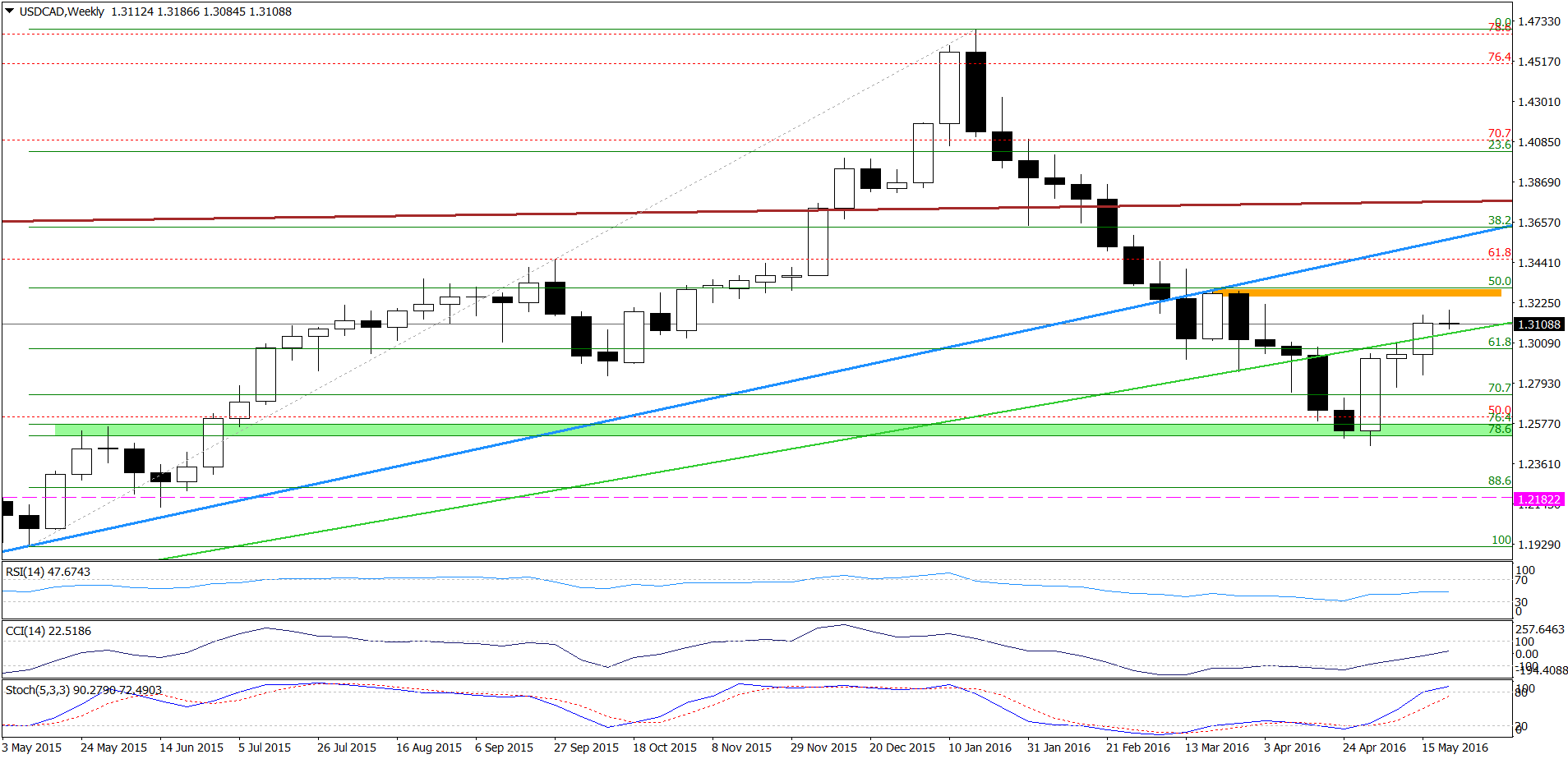

On the weekly chart, we see that the situation remains almost unchanged as USD/CAD is still trading above the previously-broken green support/resistance line. This suggests that invalidation of the breakdown under this line and its positive impact on the exchange rate is still in effect. Additionally, buy signals support further improvement and a test of the orange resistance zone created by the late-Mar highs (around 1.3283-1.3294) in the coming days.

Will the very short-term picture confirm this pro-growth scenario? Let’s check.

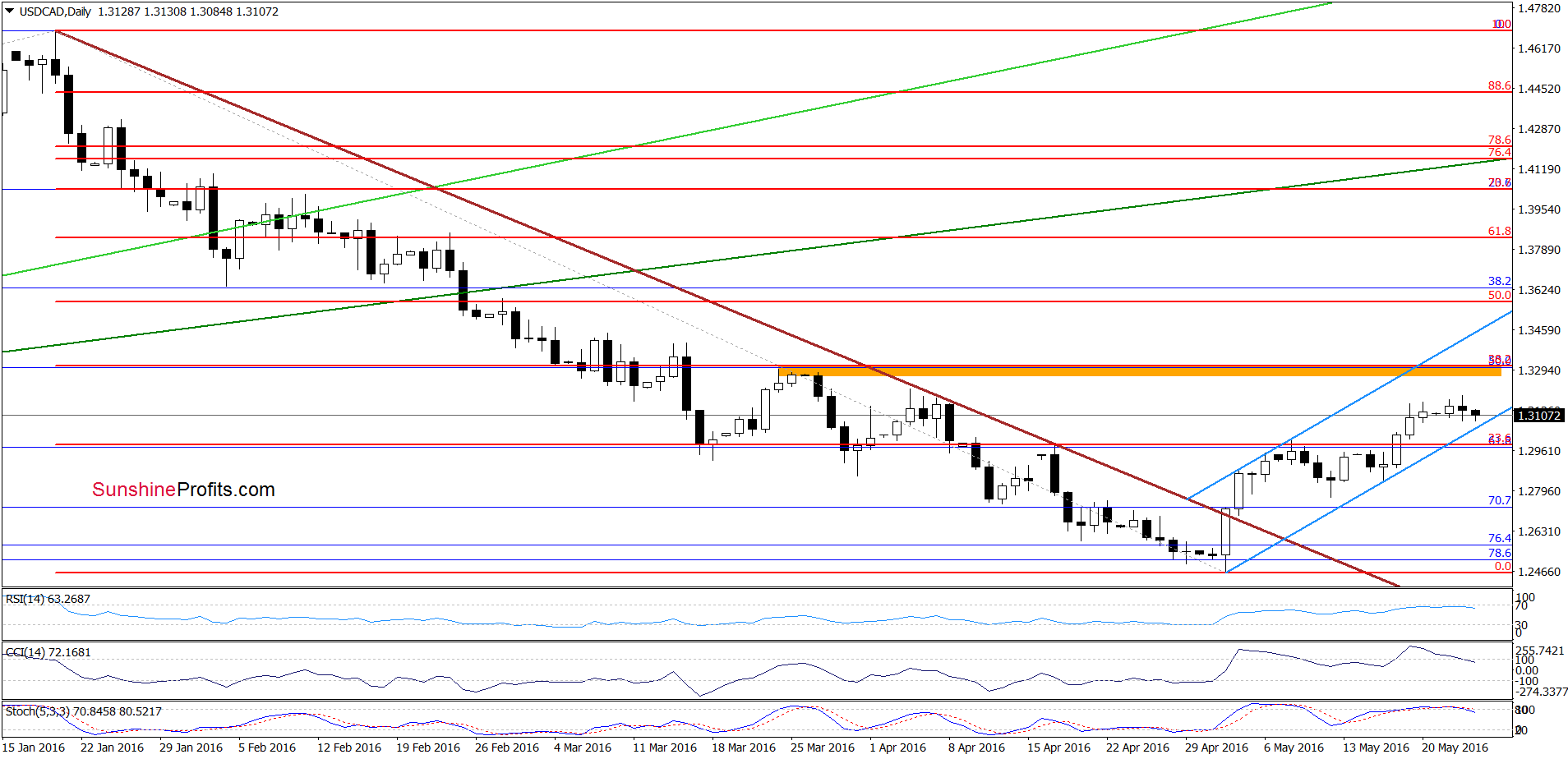

Quoting our Monday’s alert:

(…) USD/CAD broke above the resistance zone (…), which resulted in increase to the Apr highs. (…) taking into account the current position of the indicators (the CCI and Stochastic Oscillators are overbought, while the RSI approached the level of 70), we think that this area will be strong enough to stop further improvement and trigger a correction n the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and USD/CAD pulled back in recent days. Taking this fact into account and combining it with sell signals generated by the CCI and Stochastic Oscillator we think that the pair will likely test the strength of the lower border of the blue rising trend channel in the coming days. If this support is broken, the next downside target would be the barrier of 1.3000 or even area around 1.2770-1.2835, where the mid-May lows are.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

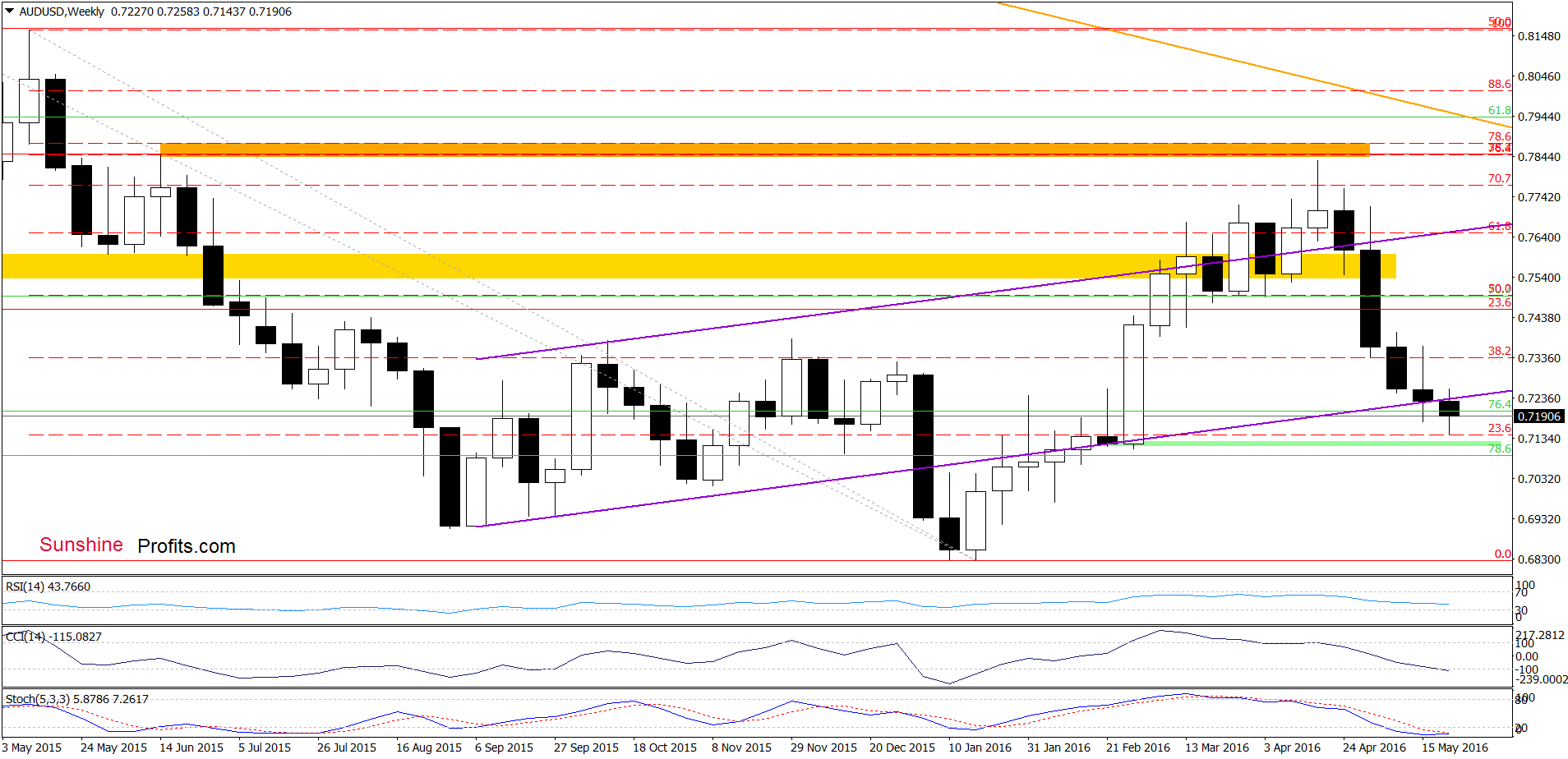

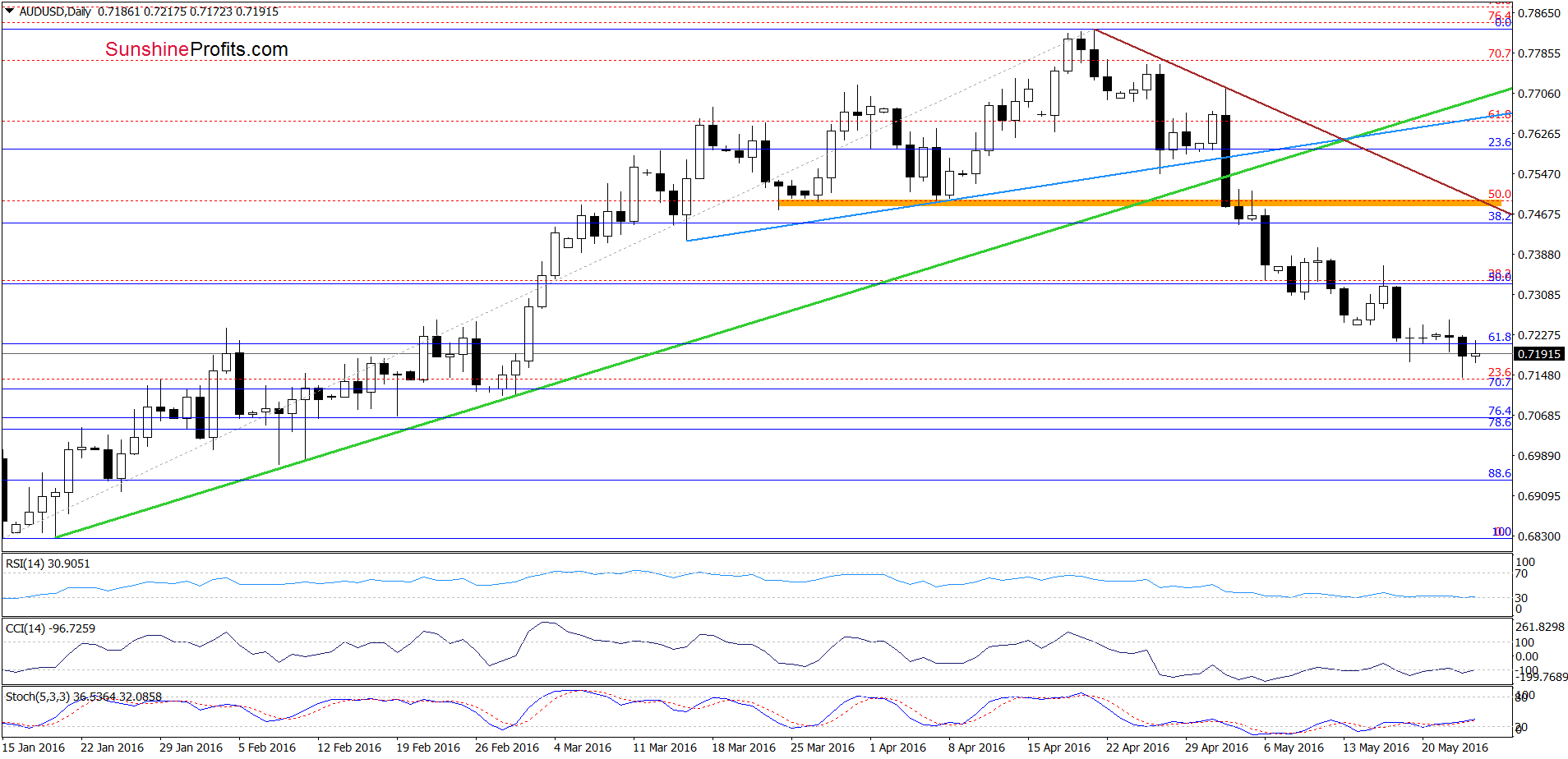

On the weekly chart, we see that AUD/USD extended losses under the lower border of the purple rising trend channel, which is a bearish signal that suggests further deterioration in the coming days. Nevertheless, the exchange rate approached the green support zone created by the late-Feb lows and the CCI and Stochastic Oscillator are oversold, which increases the probability of reversal in the coming days.

Having said the above, let’s check what we can infer from the daily chart.

From this perspective, we see that the situation has deteriorated slightly as AUD/USD slipped under the 61.8% Fibonacci retracement (based on the entire Jan-Apr upward move) yesterday. Despite this deterioration, currency bulls didn’t give up and pushed the pair higher, which in combination with the current position of daily and weekly indicators, suggests that the space for declines may be limited and reversal is just around the corner. Therefore, if the exchange rate reverses, the initial upside target would be around 0.7400 (the May 11 peak).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts