Yesterday, the USD Index extended gains and climbed above the Apr highs, which pushed USD/CHF to the next resistance zone. Will it manage to stop currency bulls in the coming week?

In our opinion the following forex trading positions are justified - summary:

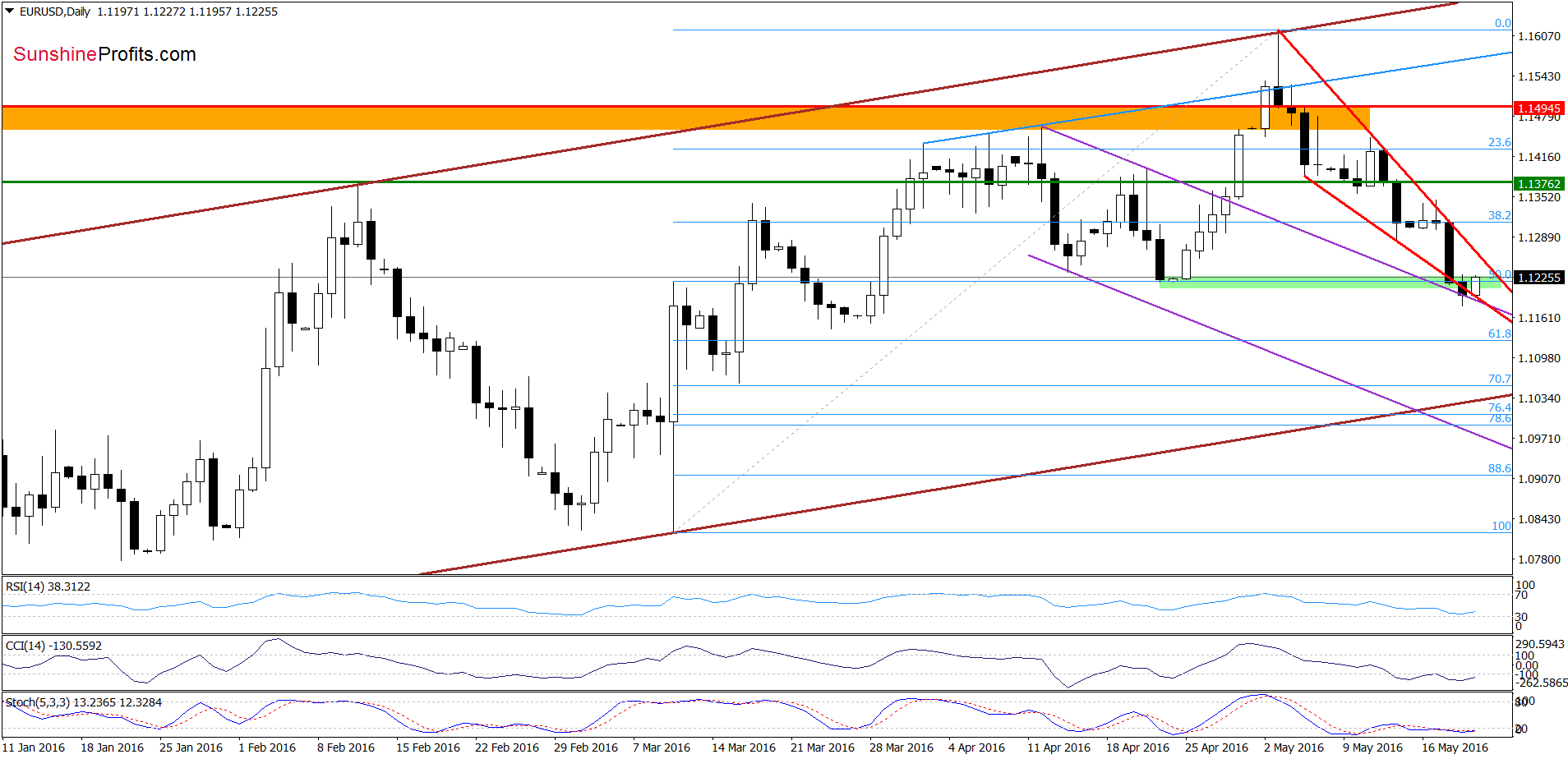

EUR/USD

The situation in the medium-term hasn’t changed much as EUR/USD is still trading under the previously-broken support/resistance line based on the March and Apr 2015 lows. Today, we’ll focus on the very short-term changes.

Yesterday, EUR/USD extended declines and slipped slightly below the green support zone created by the Apr lows and the 50% Fibonacci retracement. Despite this drop, the combination of the lower border of the red declining wedge and the purple support line based on the Apr highs encouraged currency bulls to act earlier today, which resulted in a climb above the previously-broken levels (potential invalidation of the breakdown). Although this is a positive sign, we think that it would be more reliable if the exchange rate closes today’s session above them. Nevertheless, please keep in mind that the current position of daily indicators suggests that we’ll likely see a rebound from this area in the coming week.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

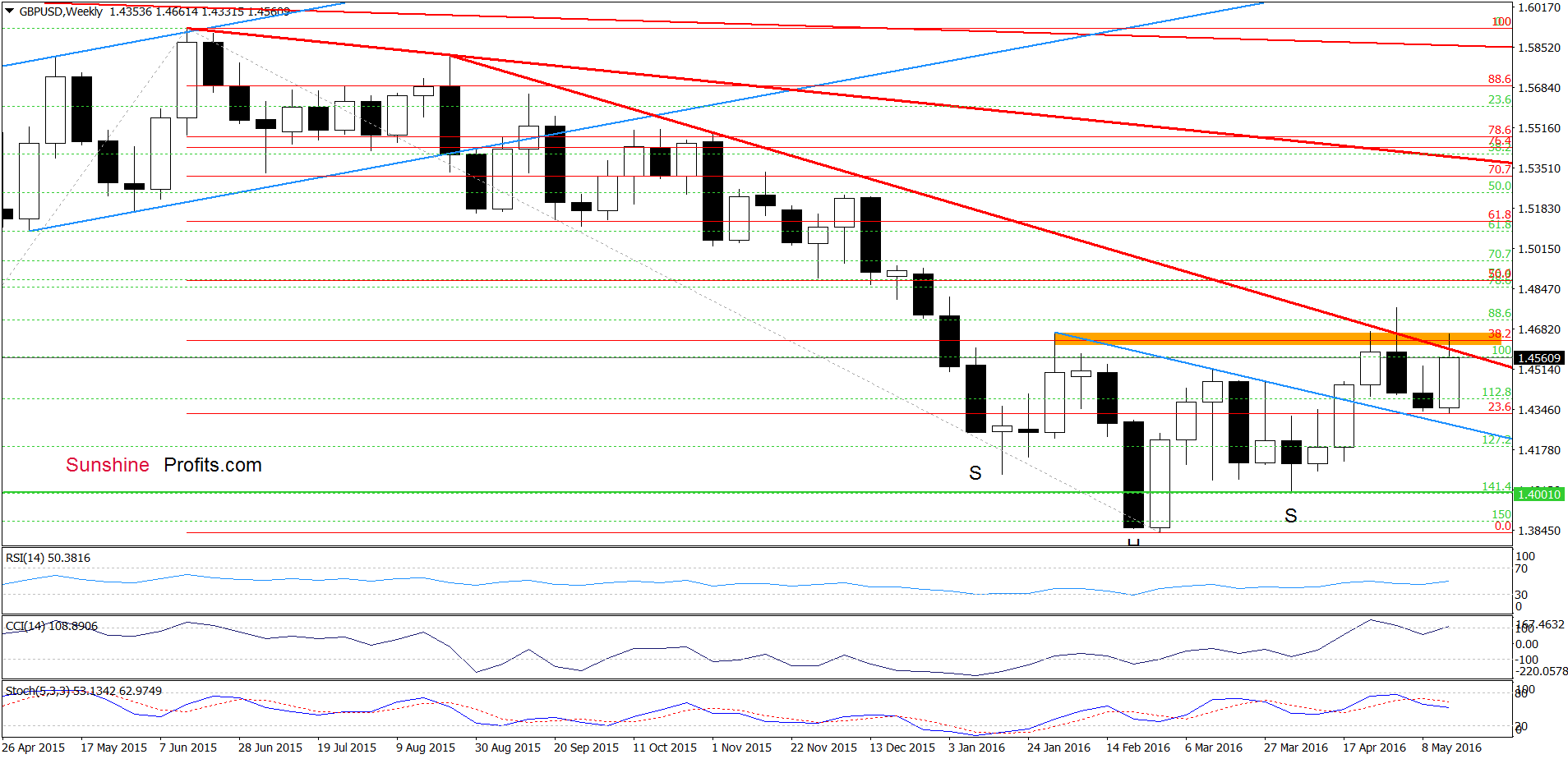

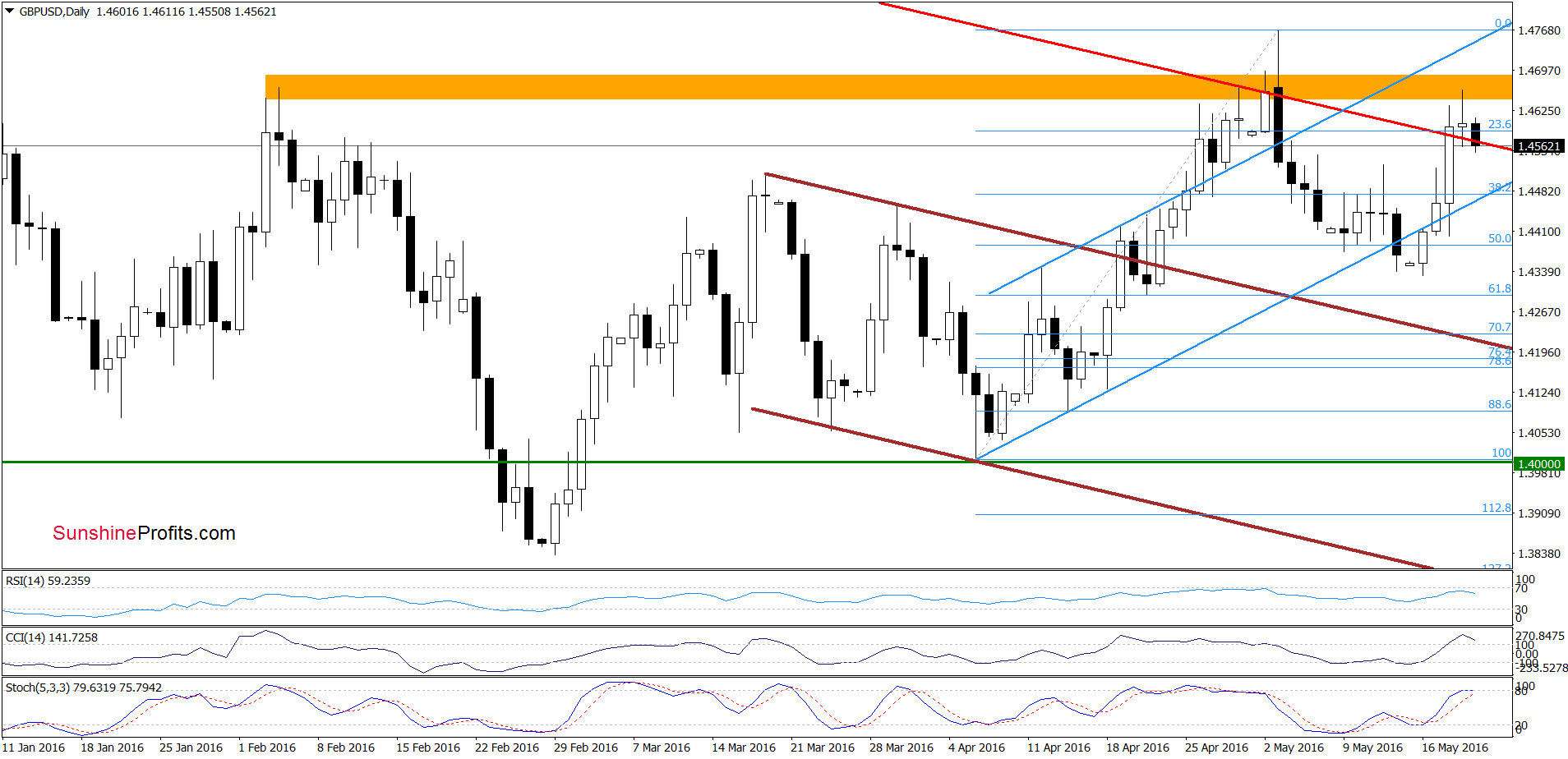

GBP/USD

On Wednesday, we wrote:

(…) GBP/USD reversed and rebounded, invalidating earlier breakdown below the blue rising support line and the 50% Fibonacci retracement. Additionally, the CCI and Stochastic Oscillator generated buy signals, which suggests further improvement in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and the exchange rate climbed above the long-term red declining resistance line and reached the orange resistance zone marked on the charts. Despite this improvement, GBP/USD gave up some gains in the following days, which resulted in a drop under this important line and invalidation of earlier breakout. Nevertheless, this negative signal would be more believable if the pair closes today’s session under the red line. Additionally, in our opinion, further deterioration will accelerate if the CCI and Stochastic Oscillator generate sell signals. If we see such price action, we’ll consider re-opening short positions in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

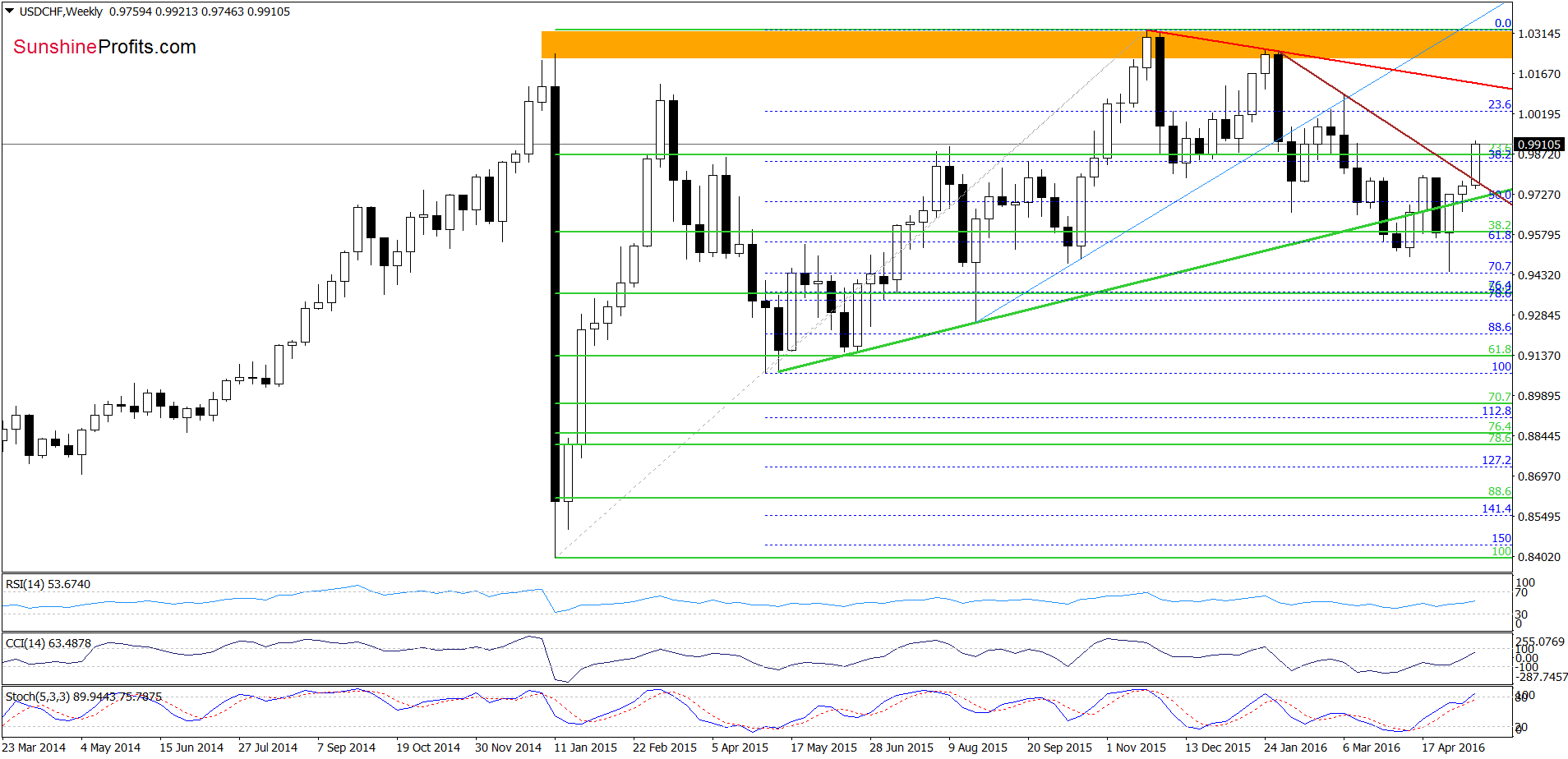

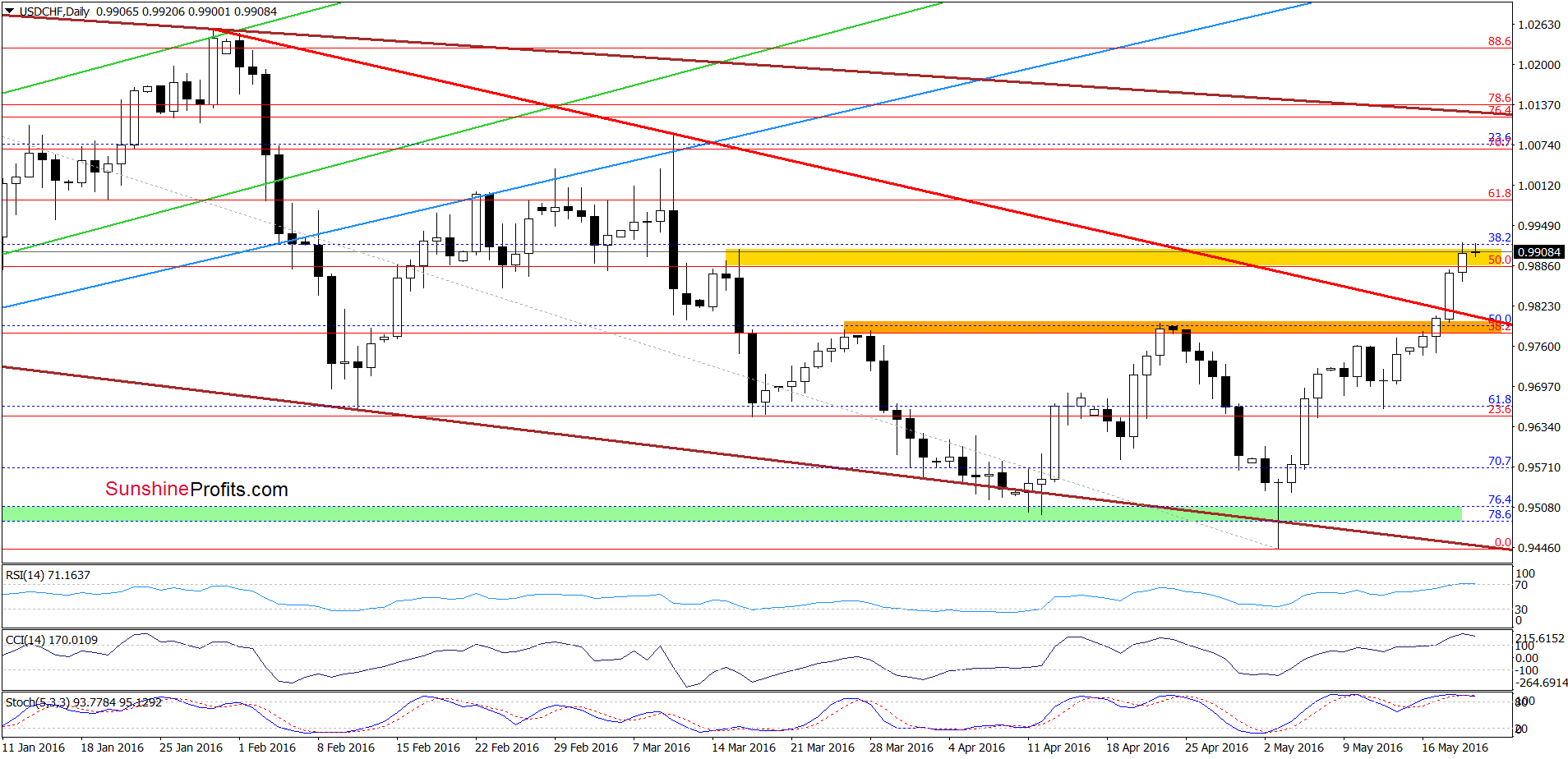

USD/CHF

Quoting our Wednesday’s commentary:

(…) USD/CHF moved higher once again and broke above the orange resistance zone created by the previous highs, the 38.2% Fibonacci retracement (based on the entire Nov-May downward move) and the red declining resistance line based on previous highs. Although this is a positive signal, which suggests further improvement and a test of the yellow resistance zone (created by the 50% retracement and the mid-March highs), we think that such price action would be more reliable if we see a daily closure above these levels.

On the above charts, we see that currency bulls pushed USD/CHF higher as we had expected. With this upward move, the pair reached our initial upside target, which in combination with the current position of all indicators increases the probability of reversal in the coming week.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts