Earlier today, the greenback increased to a three-week high against the yen after yesterday’s minutes of the U.S. Federal Reserve's latest policy meeting refreshed expectations for a June interest rate hike. In this way, USD/JPY reached the first Fibonacci retracement, but will it stop currency bulls in the coming days?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

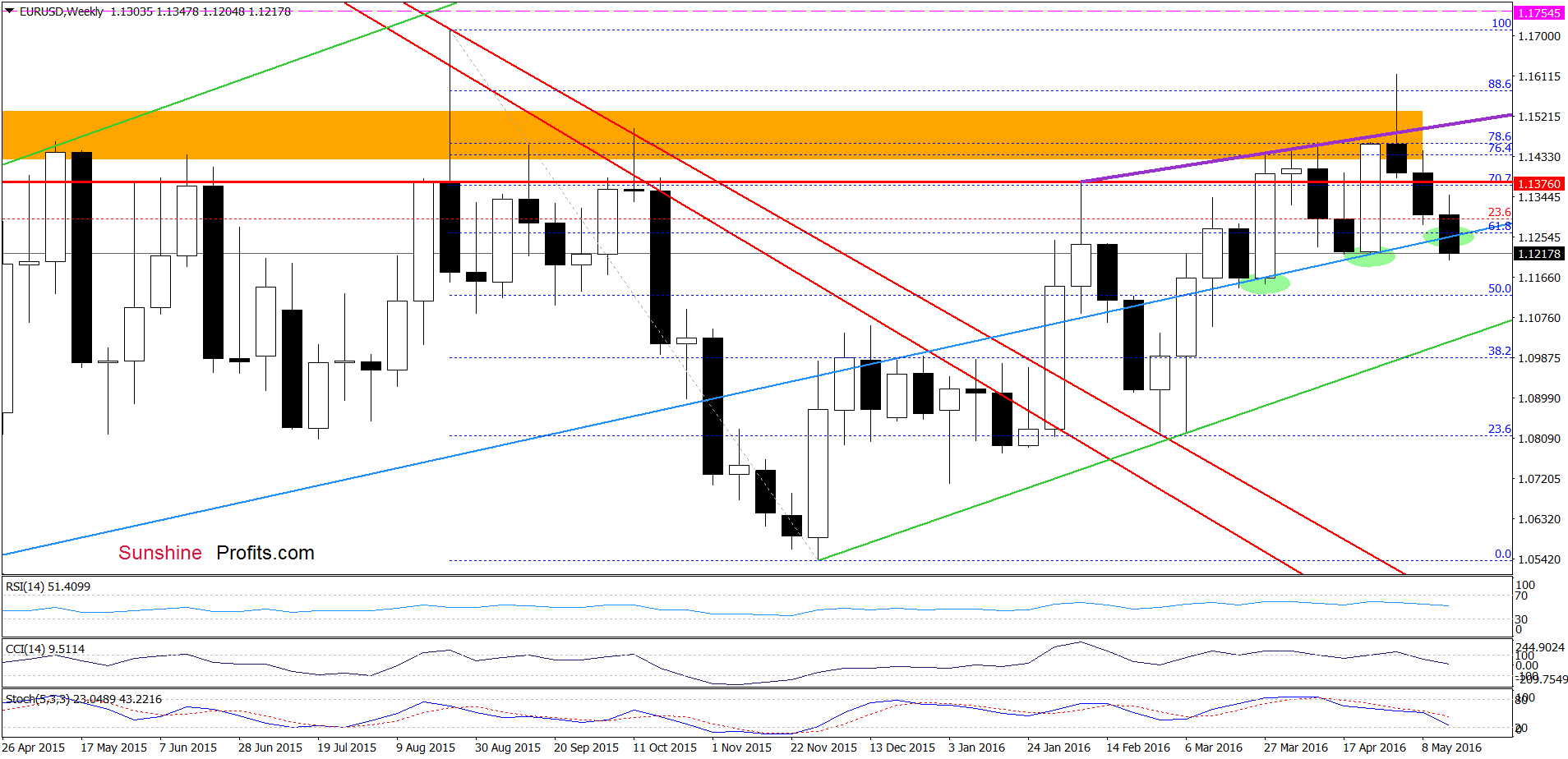

The first thing that catches the eye on the weekly chart is breakdown below the blue line based on the March and Apr 2015 lows. Although this is a negative signal that suggests further deterioration, we think it would be more reliable if we see a weekly closure under this line. Until this time reversal and rebound can’t be ruled out – especially when we factor in the current situation in the very short term.

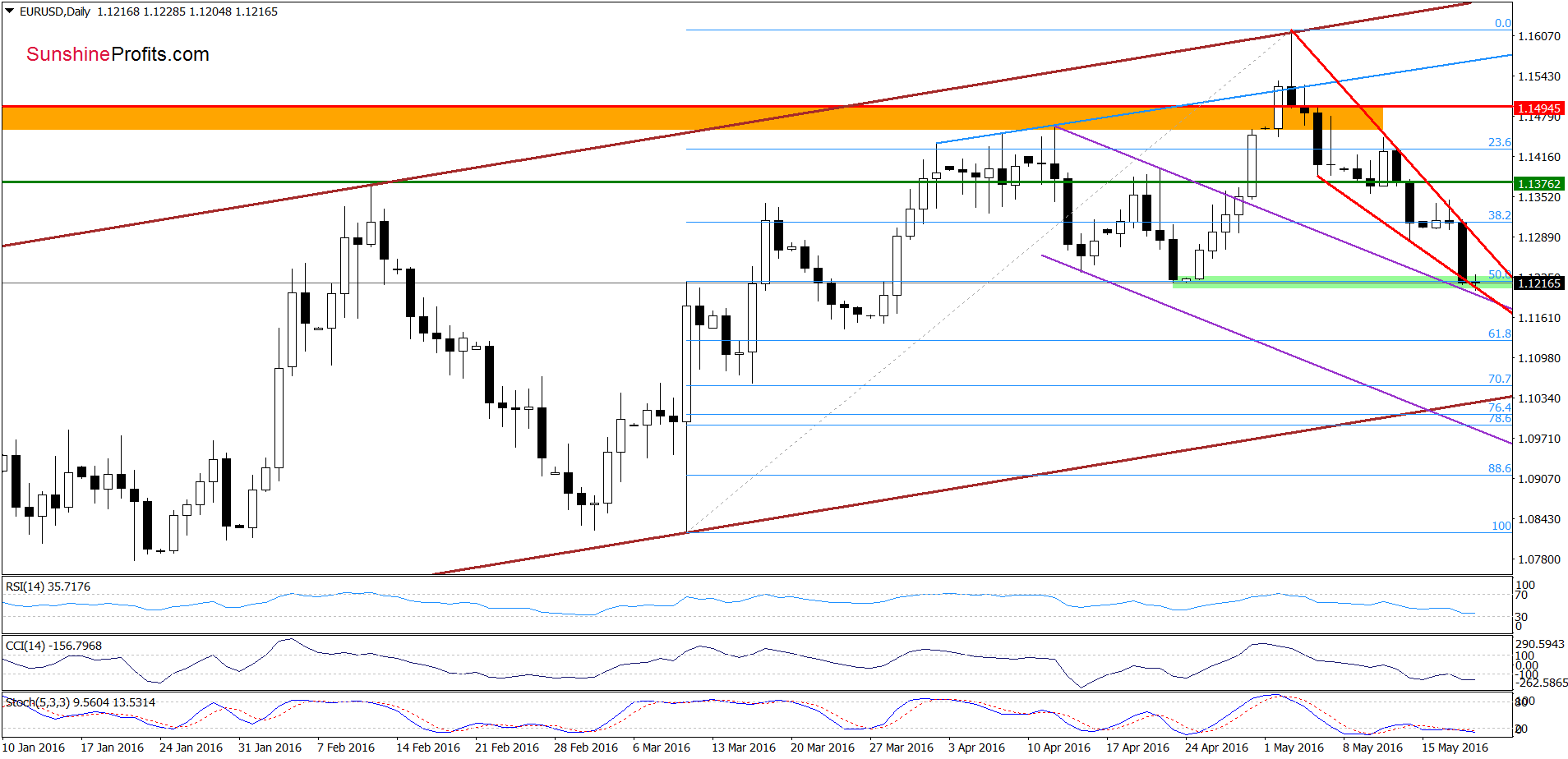

On the daily chart we see that EUR/USD moved lower once again and reached the green support zone created by the Apr lows and the 50% Fibonacci retracement. In this area is also lower border of the red declining wedge and the purple support line based on the Apr highs, which in combination with the current position of daily indicators suggests that we’ll likely see a rebound from this area in the coming day(s). If this is the case, and we see such price action, the initial upside target would be around 1.1287, where the upper border of the red declining wedge currently is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

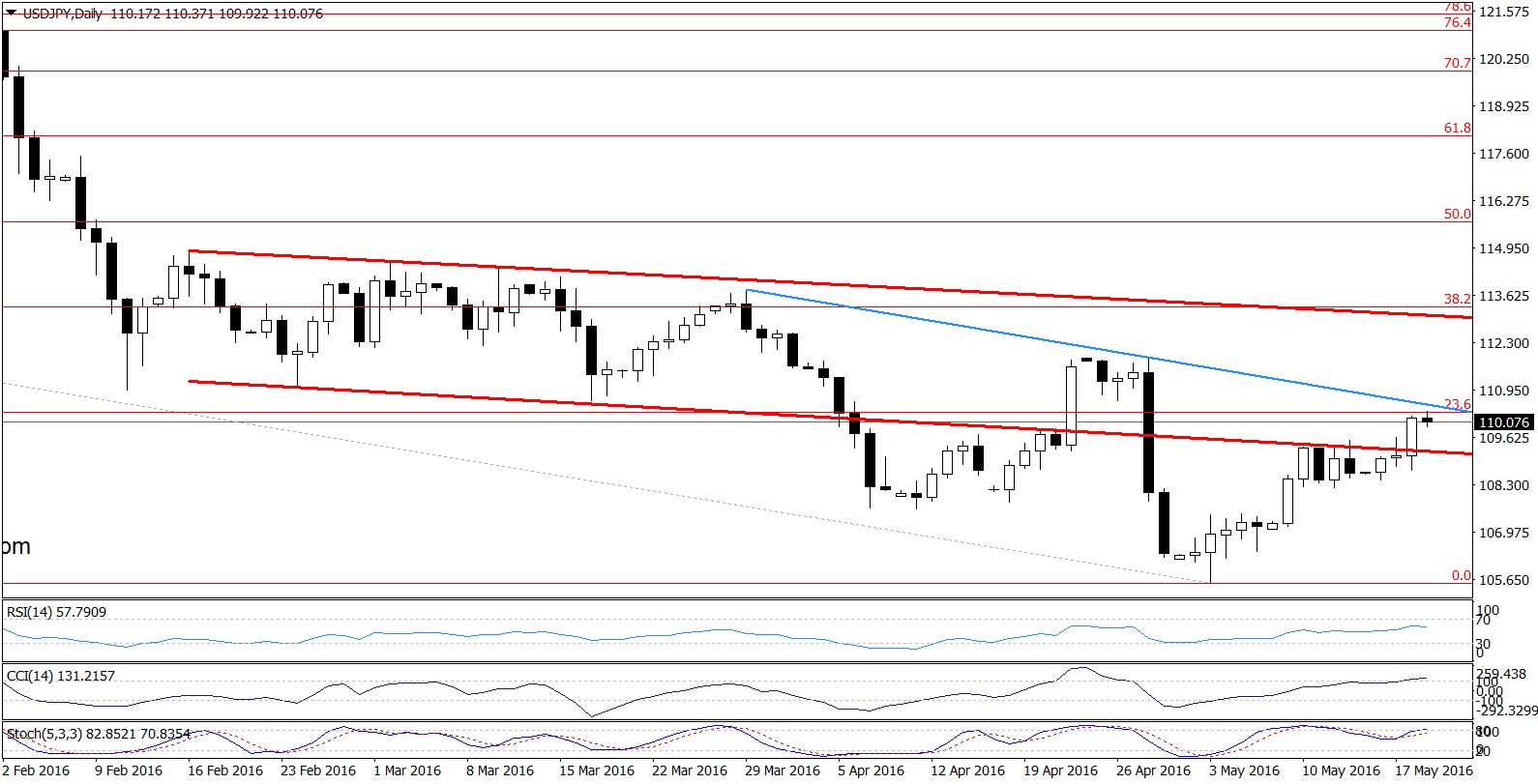

On the daily chart, we see that USD/JPY extended gains and came back above the lower red resistance line, which triggered further improvement and a climb to the 23.6% Fibonacci retracement based on the entire Jun 2015-May 2016 downward move. As you see, in this area is also blue resistance line based on the previous highs, which in combination with the current position of the indicators (the CCI and Stochastic Oscillator are overbought) may encourage currency bears to act in the coming days.

Are there any other factors that may trigger a reversal in the coming days? Let’s examine the weekly chart and find out.

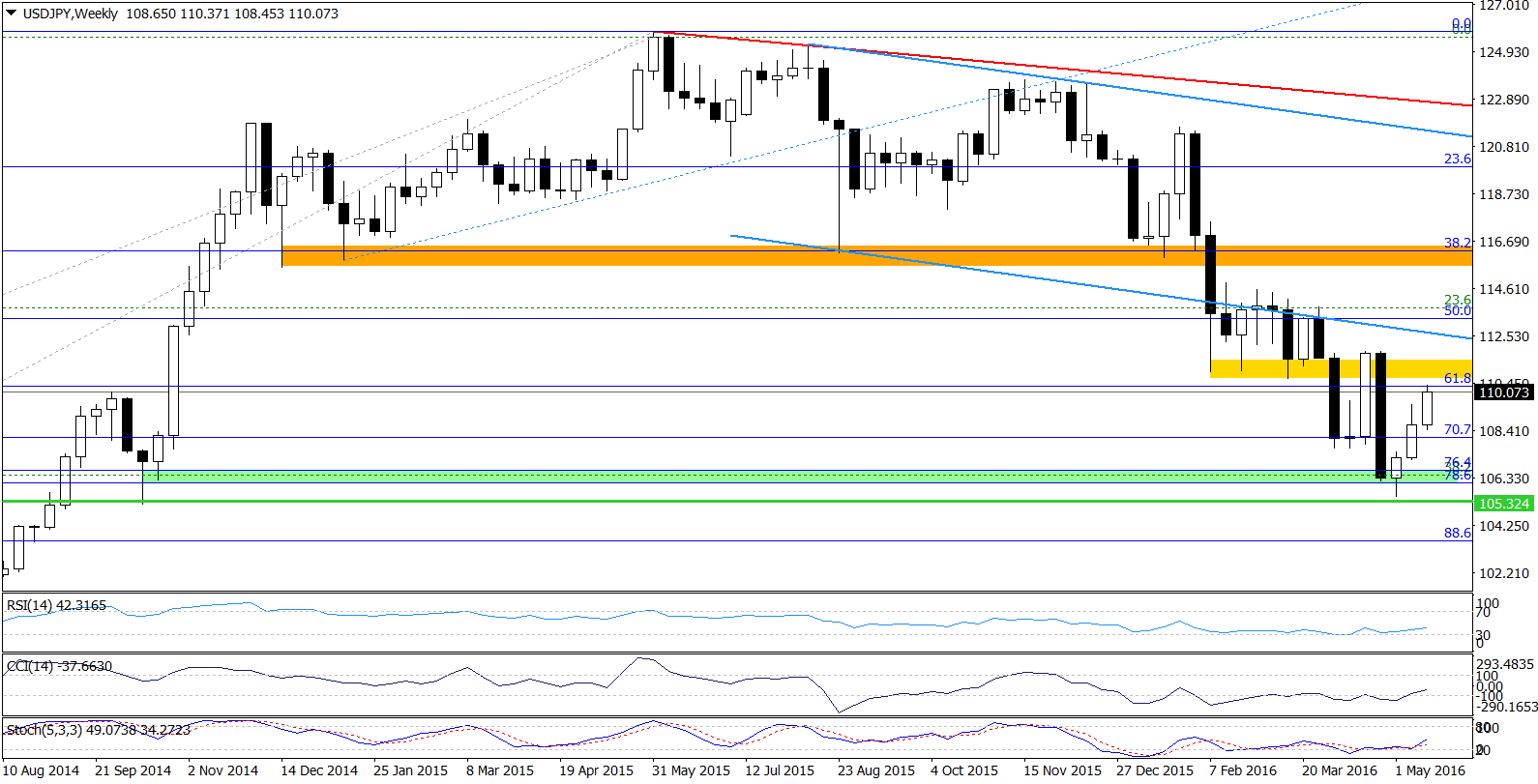

From this perspective, we see that the recent upward move approached USD/JPY to the yellow resistance zone created by the Feb and March lows, which may paus further rally in the coming week.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

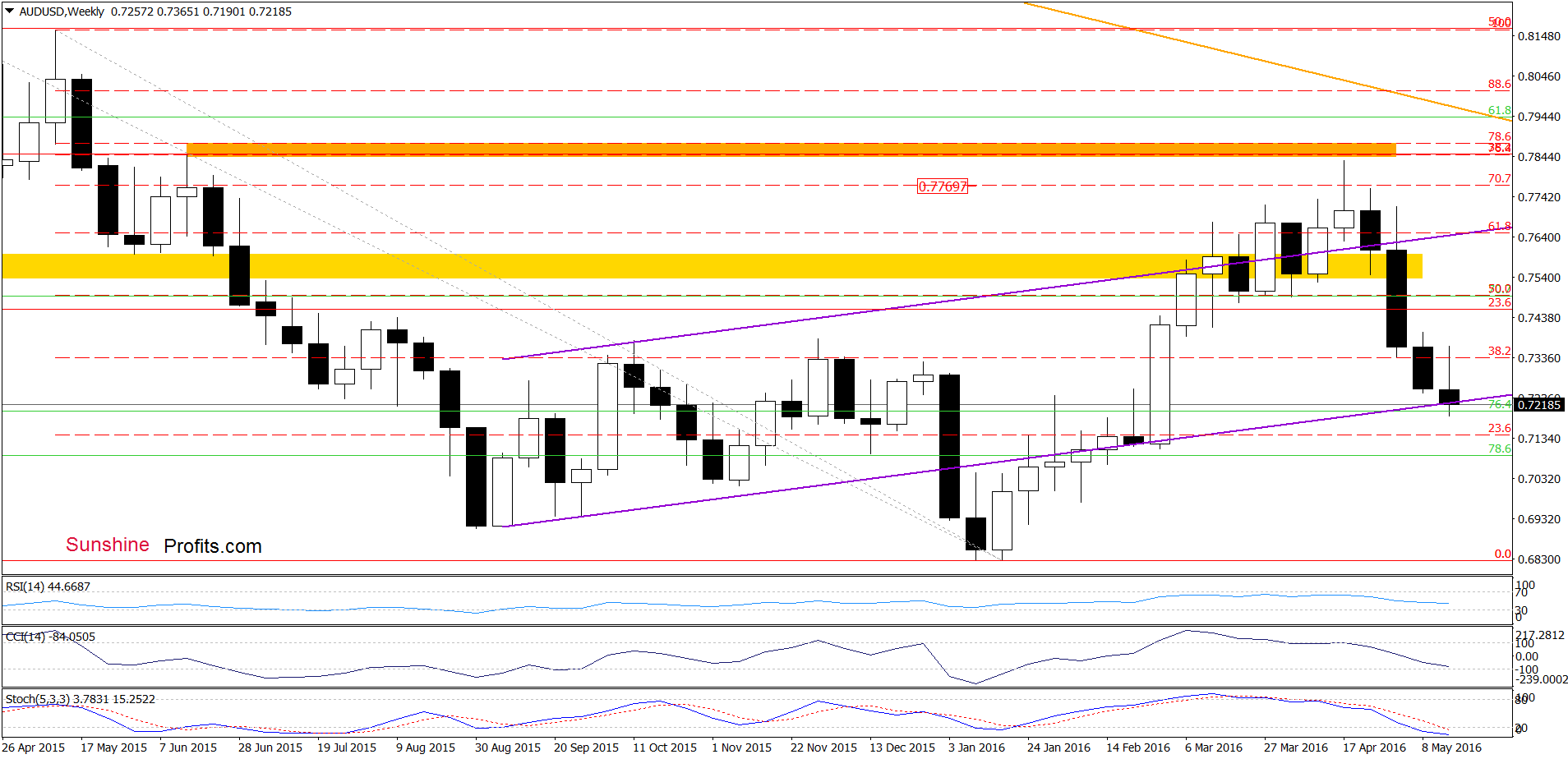

Looking at the weekly chart, we see that AUD/USD extended losses and dropped to the previously-broken lower border of the purple rising trend channel, which can trigger a rebound in the coming days.

Will the very short-term picture give us more clues that support this scenario? Let’s check.

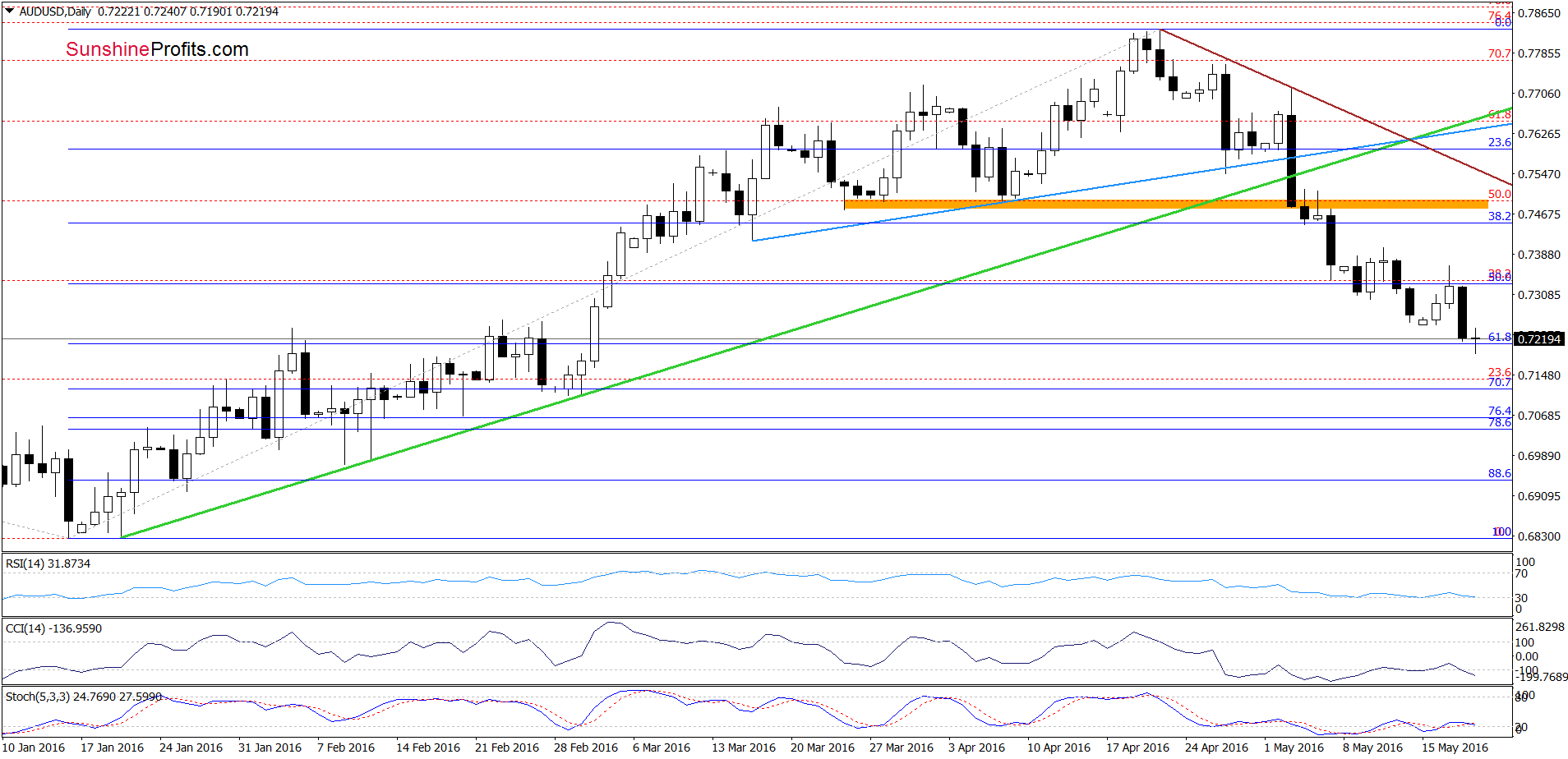

From this perspective, we see that AUD/USD moved lower once again and reached the 61.8% Fibonacci retracement based on the entire Jan-Apr upward move. Taking this fact into account and combining it with the medium-term picture and the current position of daily indicators, it seems that the space for declines is limited and reversal is just around the corner. Therefore, if the exchange rate reverses, the initial upside target would be the last week’s high of 0.7400.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts