Earlier today, the USD Index moved higher ahead minutes from the Federal Reserve’s April meeting, which will be released later in the day. Thanks to this increase, the index climbed to the highest level since Apr 25, which pushed EUR/USD under 1.3000. Will we see further declines?

In our opinion the following forex trading positions are justified - summary:

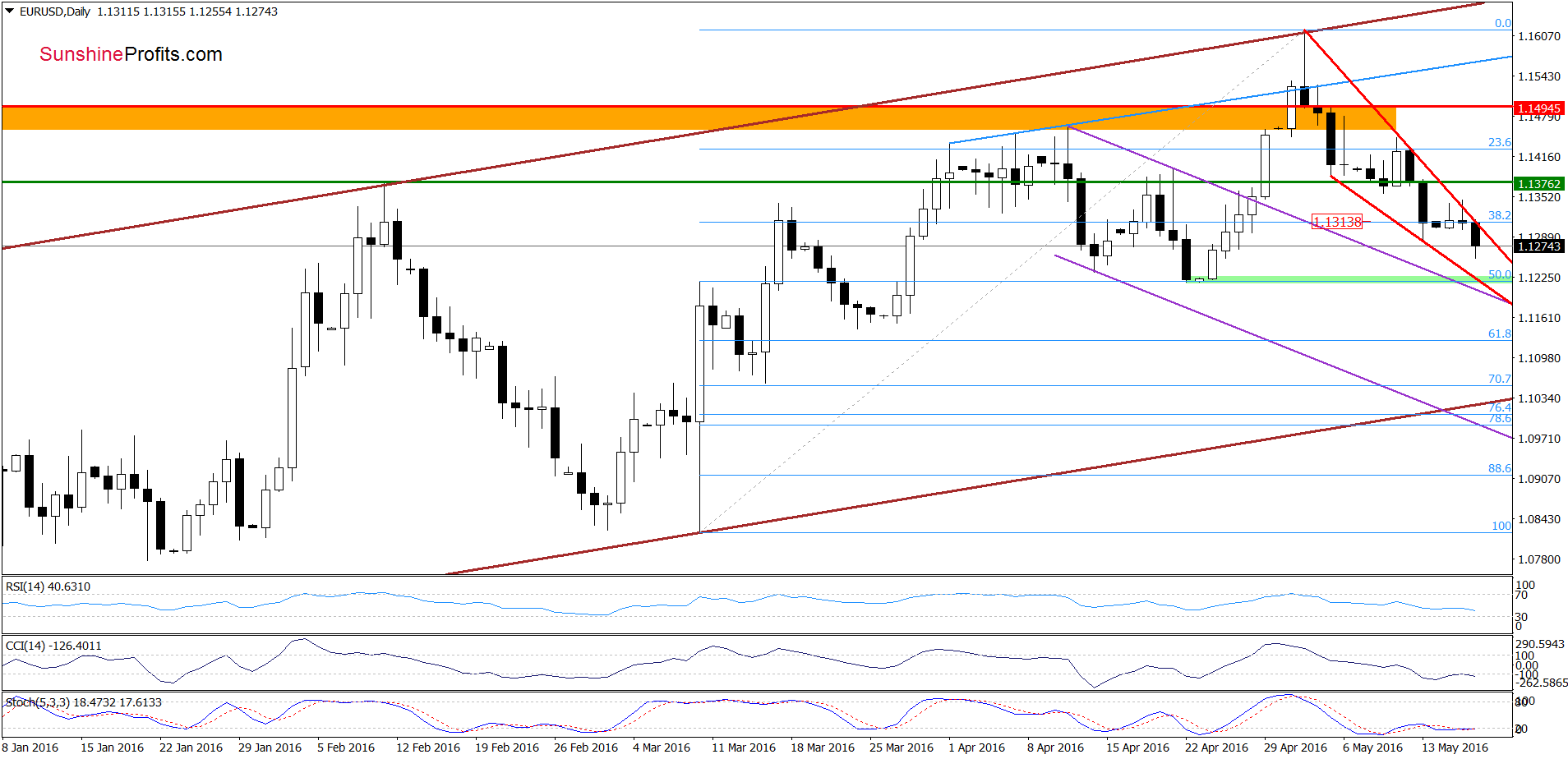

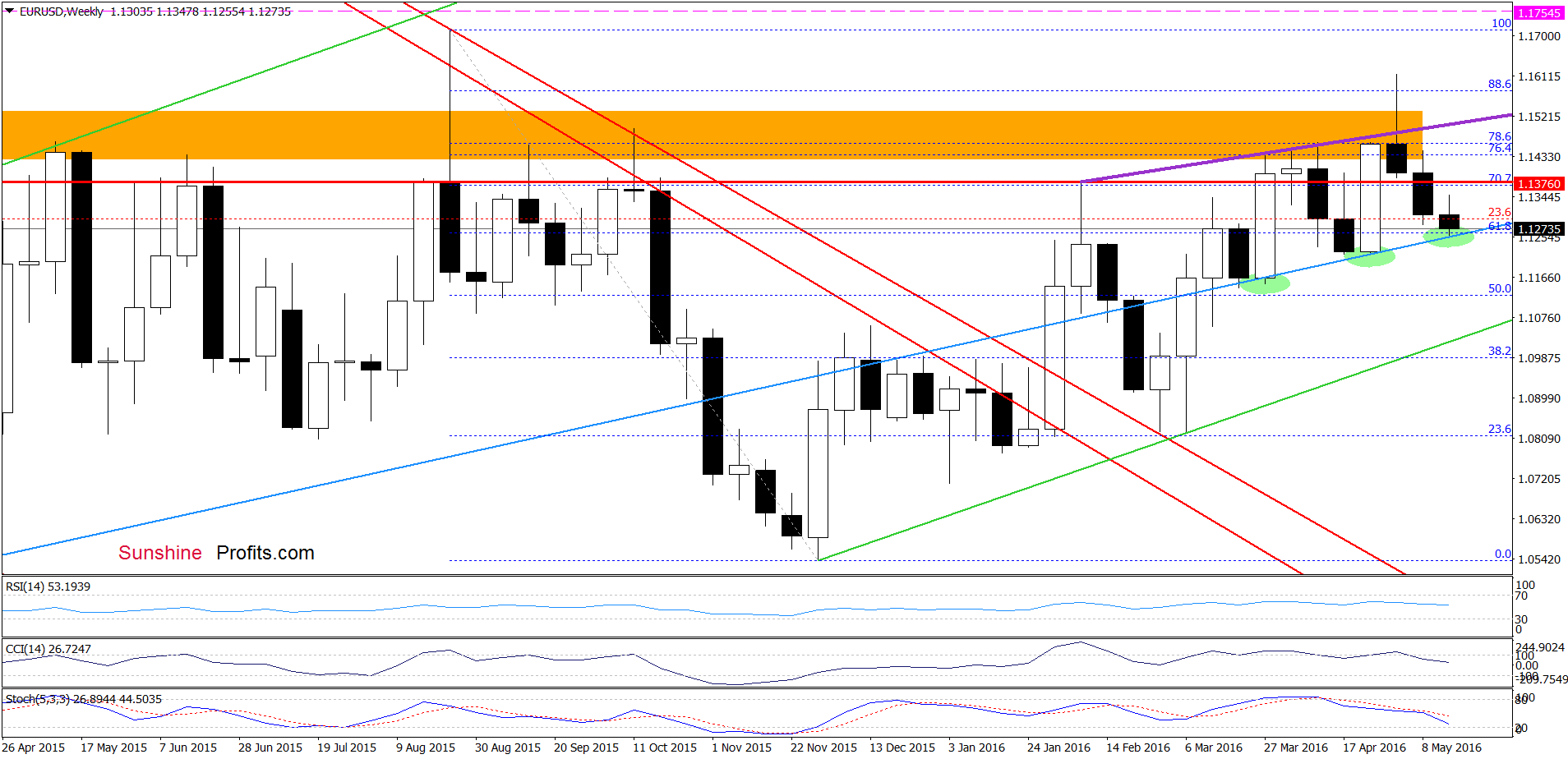

EUR/USD

From today’s point of view, we see that the upper border of the red declining wedge encouraged currency bears to act earlier today, which triggered another downswing. In this way, EUR/USD approached the green support zone, which in combination with the current position of daily indicators suggests that we may see a rebound from this area in the coming days. Additionally, there is one more bullish signal on the weekly chart below. Let’s check it.

On the weekly chart, we see that EUR/USD declined to the blue support line based on the March and Apr 2015 lows – similarly to what we saw at the end of March and then at the end of Apr. In both previous cases, this support was strong enough to stop declines and trigger a bigger upswing, which suggests that we may see similar price action this week. Taking all the above into account and combining it with uncertainty around today’s minutes from the Federal Reserve’s April meeting, which will be released later in the day, we believe that closing short positions and taking profits off the table (we opened short positions when EUR/USD was around 1.1515) is justified from the risk/reward perspective at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

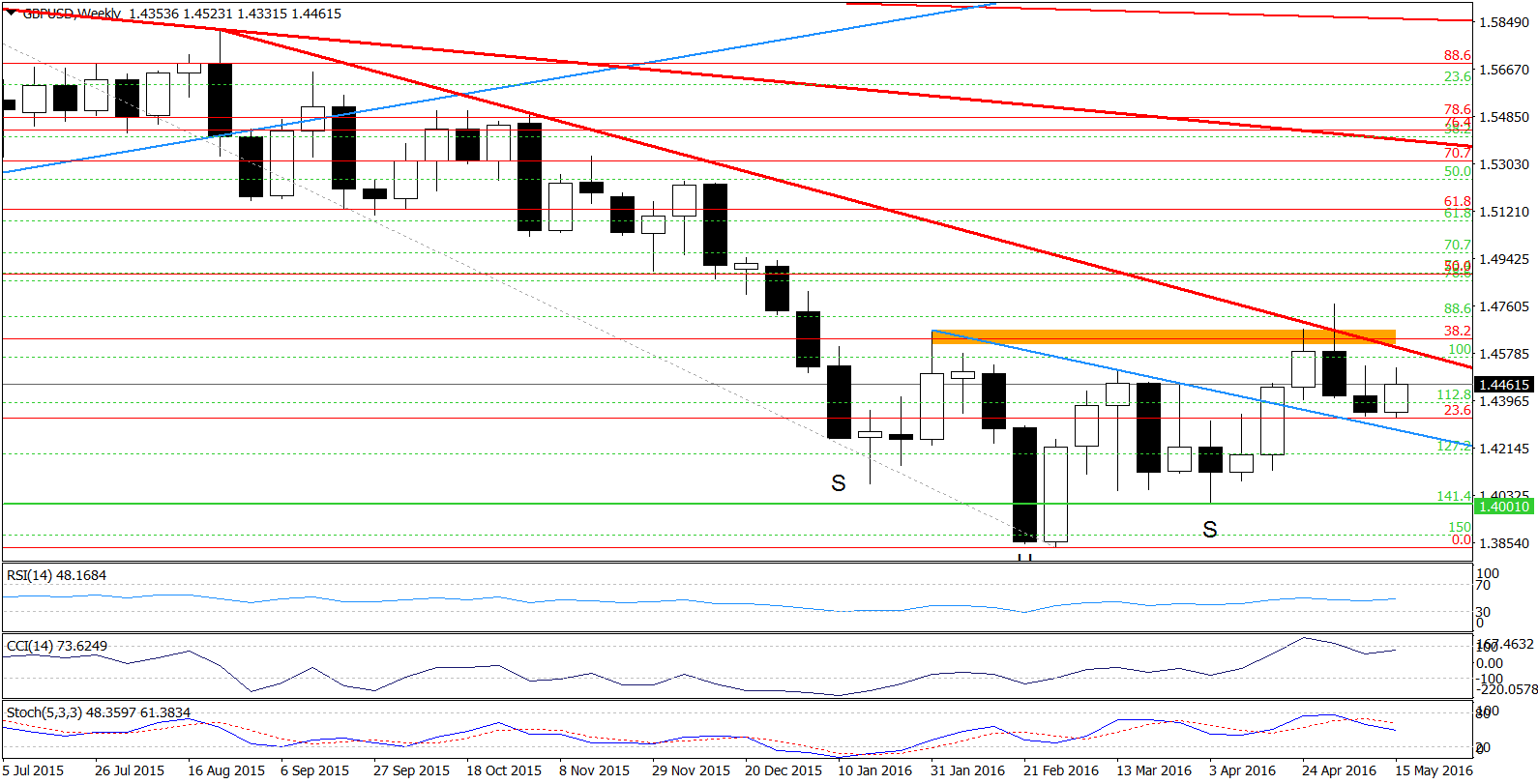

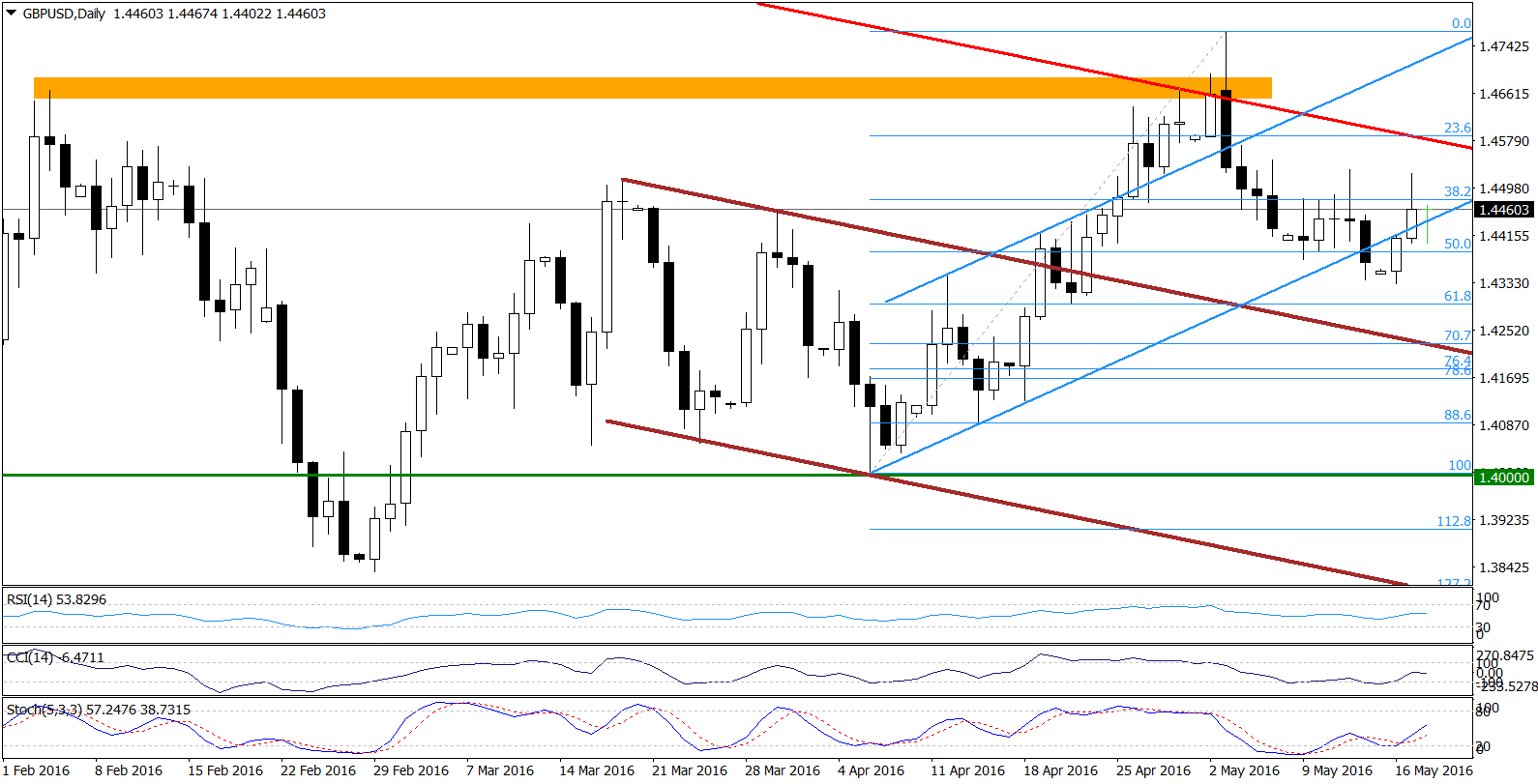

GBP/USD

On the daily chart, we see that GBP/USD reversed and rebounded, invalidating earlier breakdown below the blue rising support line and the 50% Fibonacci retracement. Additionally, the CCI and Stochastic Oscillator generated buy signals, which suggests further improvement in the coming days. Therefore, closing short positions is justified from the risk/reward perspective at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

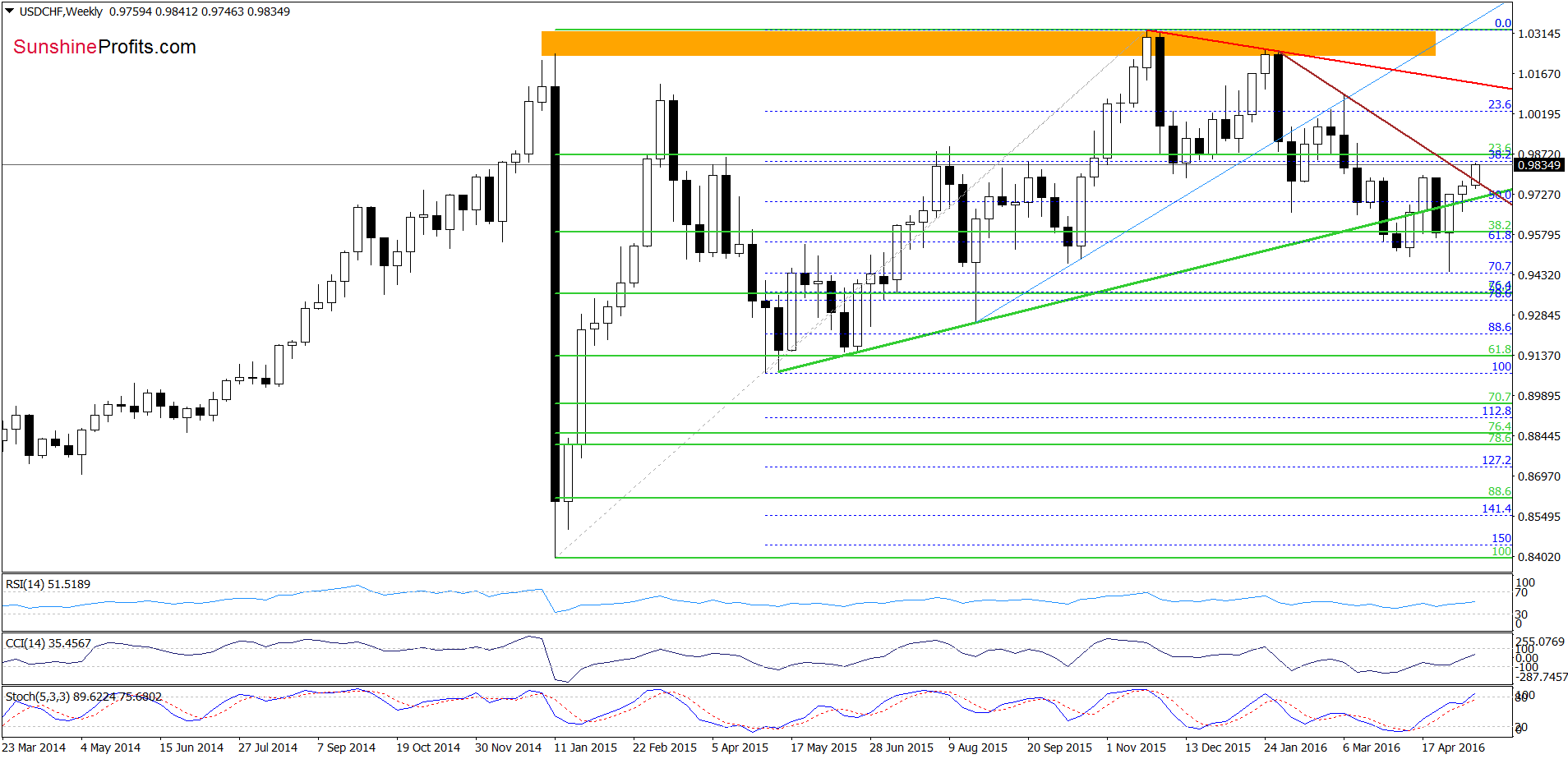

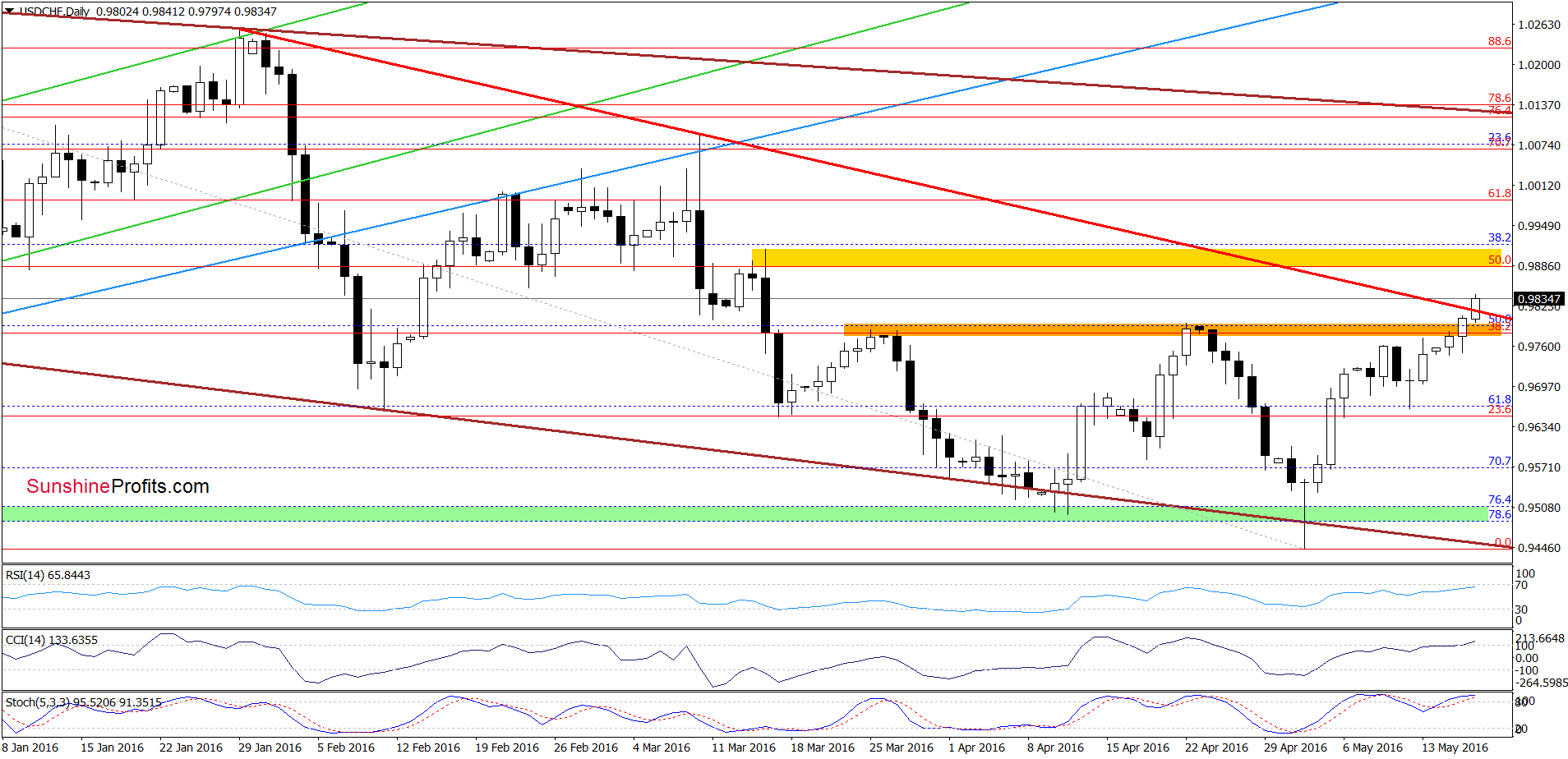

USD/CHF

Looking at the charts, we see that USD/CHF moved higher once again and broke above the orange resistance zone created by the previous highs, the 38.2% Fibonacci retracement (based on the entire Nov-May downward move) and the red declining resistance line based on previous highs. Although this is a positive signal, which suggests further improvement and a test of the yellow resistance zone (created by the 50% retracement and the mid-March highs), we think that such price action would be more reliable if we see a daily closure above these levels. Additionally, we should keep in mind that the CCI and Stochastic Oscillator are overbought, while the RSI approached the level of 70, which increases the probability of reversal in the coming day(s).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts