Earlier today, official data showed that British manufacturing output dropped by 1.9% in March from the same month a year earlier, which was the steepest annual fall since May 2013. Thanks to these disappointing numbers, GBP/USD slipped under 1.4400, but did this drop change anything in the short-term picture of the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1754; initial downside target at 1.1222)

- GBP/USD: short (stop-loss order at 1.4819; initial downside target at 1.4303)

- USD/JPY: none

- USD/CAD: long (stop-loss order at 1.2182; initial upside target at 1.3000)

- USD/CHF: none

- AUD/USD: none

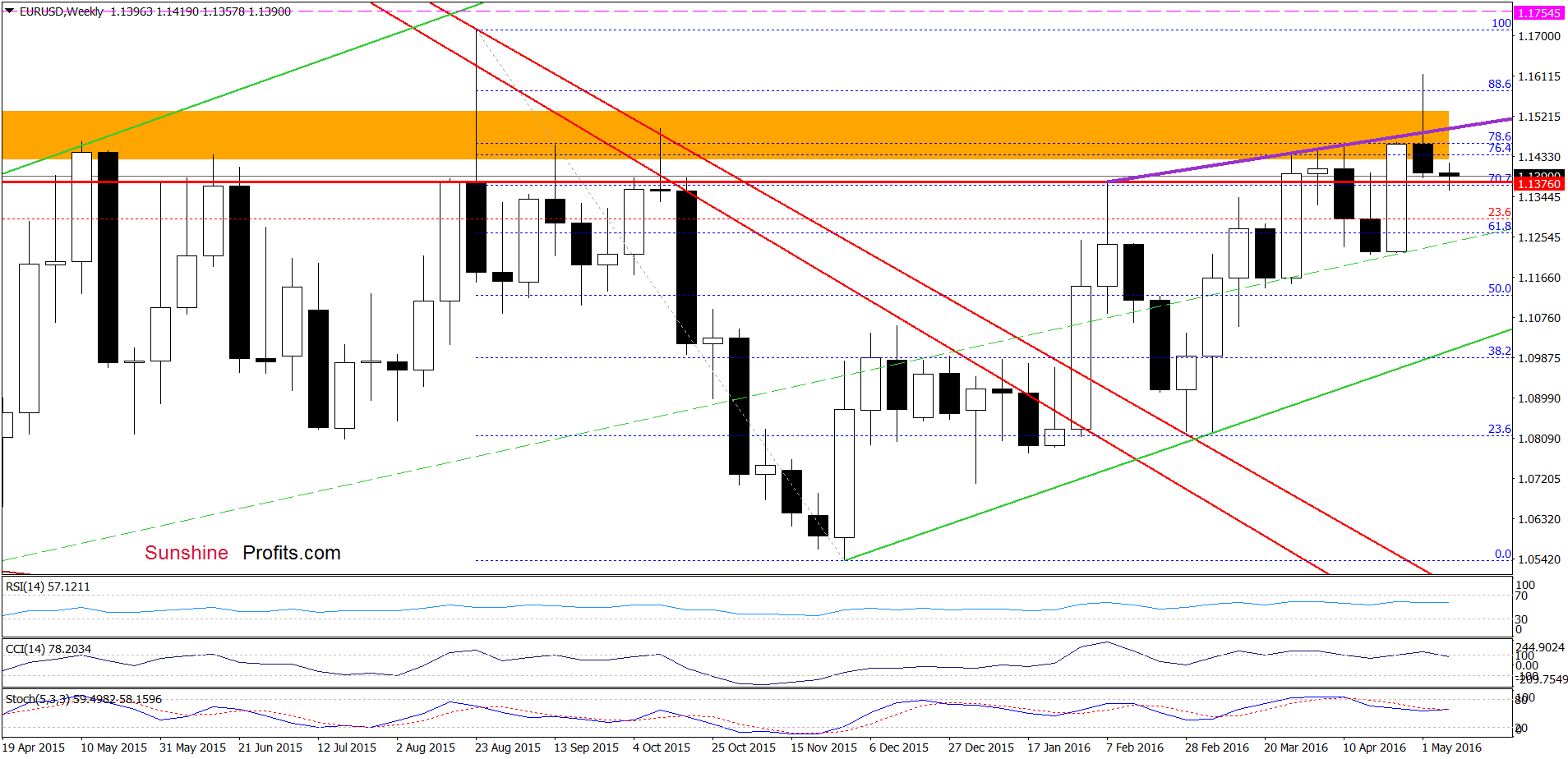

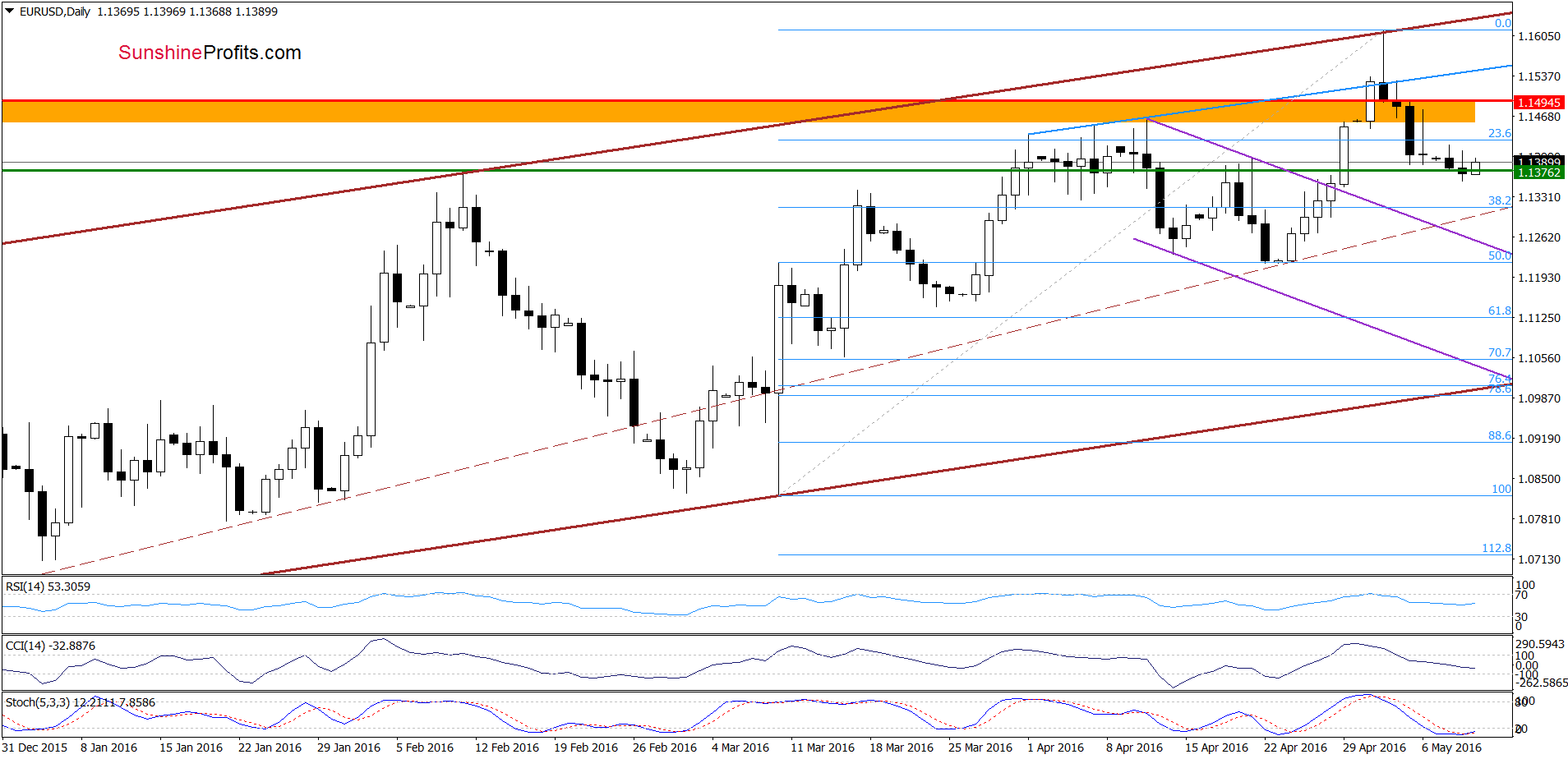

EUR/USD

Looking at the charts, we see that the green horizontal support line based on the Feb high triggered a small rebound earlier today. Despite this move, EUR/USD is still trading under the key resistance area, which suggest that another attempt to move lower is likely. If this is the case and the exchange rate drops under the Feb high, the next downside target would the upper border of the purple declining trend channel.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1754 and the initial downside target at 1.1222) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

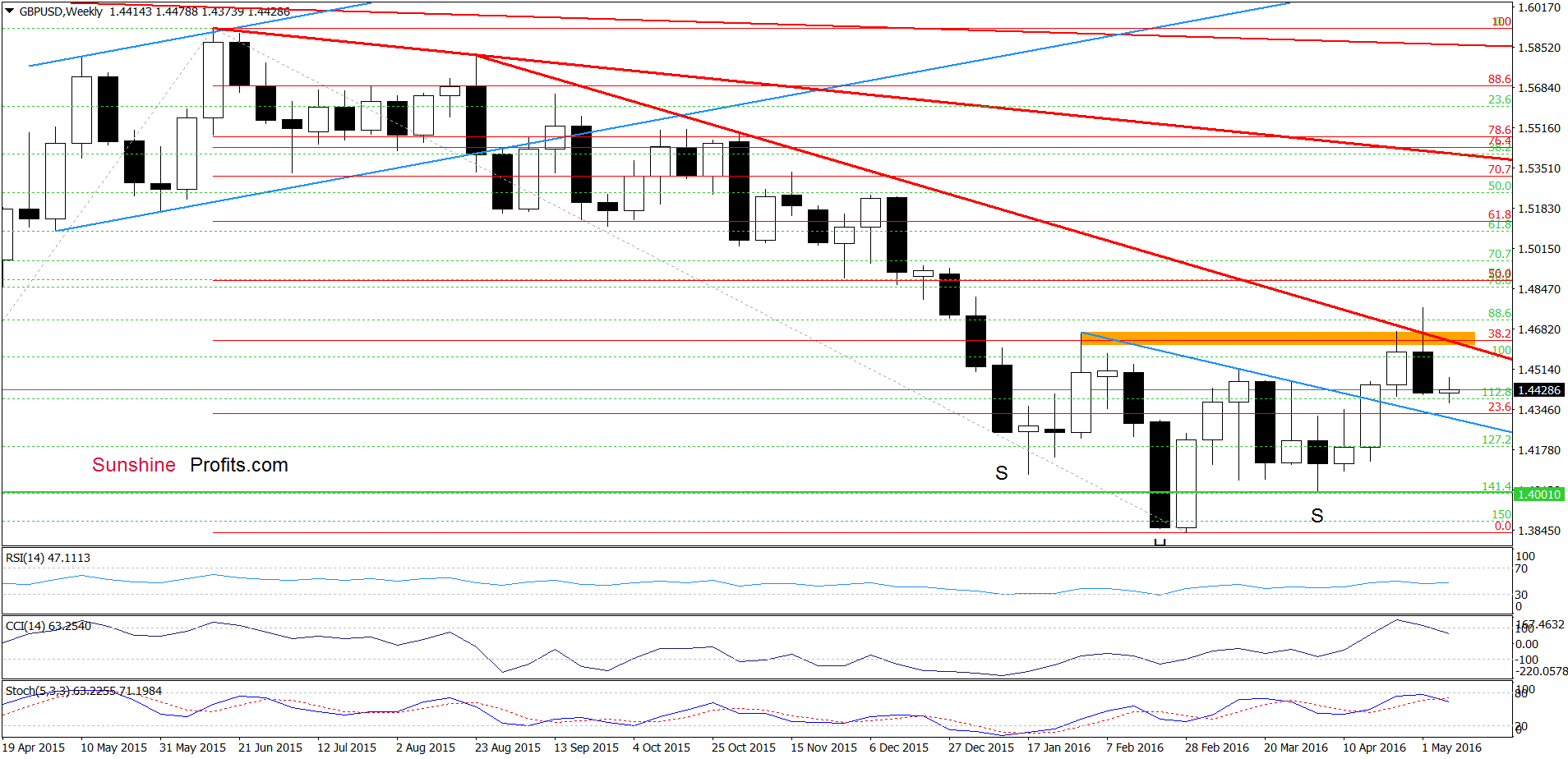

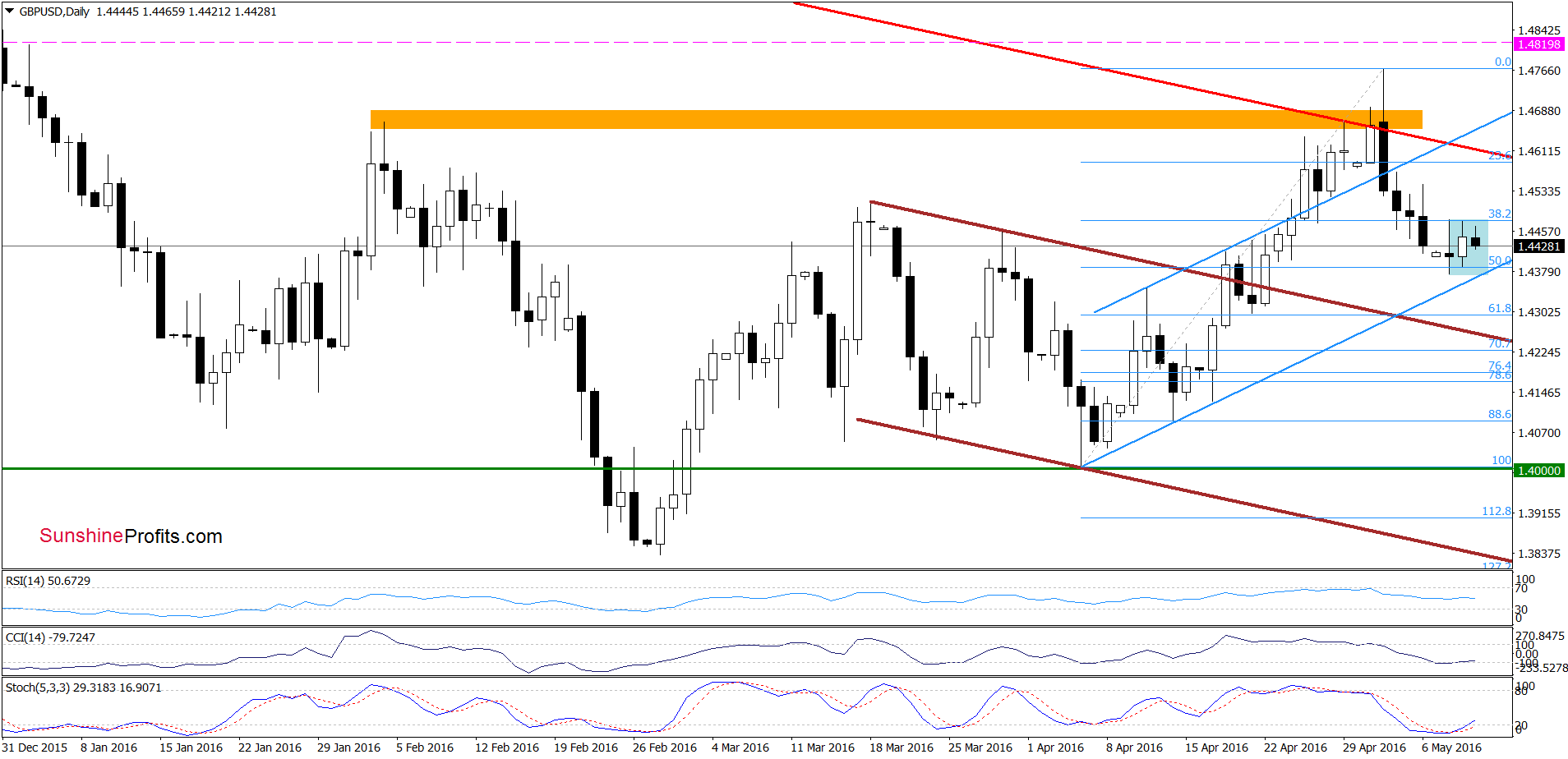

GBP/USD

As you see on the charts, GBP/USD remains in the blue consolidation between the 38.2% and 50% Fibonacci retracement levels, slightly above the lower border of the blue rising trend channel. This means that a breakout above the upper line of the formation or a breakdown under the lower border will indicate the direction of another bigger move. Although the current position of the daily indicators suggests that reversal is just around the corner, sell signals generated by the weekly indicators continue to support currency bears and lower values of the exchange rate in the coming week(s). Therefore, if GBP/USD declines once again, we’ll likely see test the previously-broken neck line of reverse head and shoulders formation and the 61.8% Fibonacci retracement.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.4819 and the initial downside target at 1.4303) are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

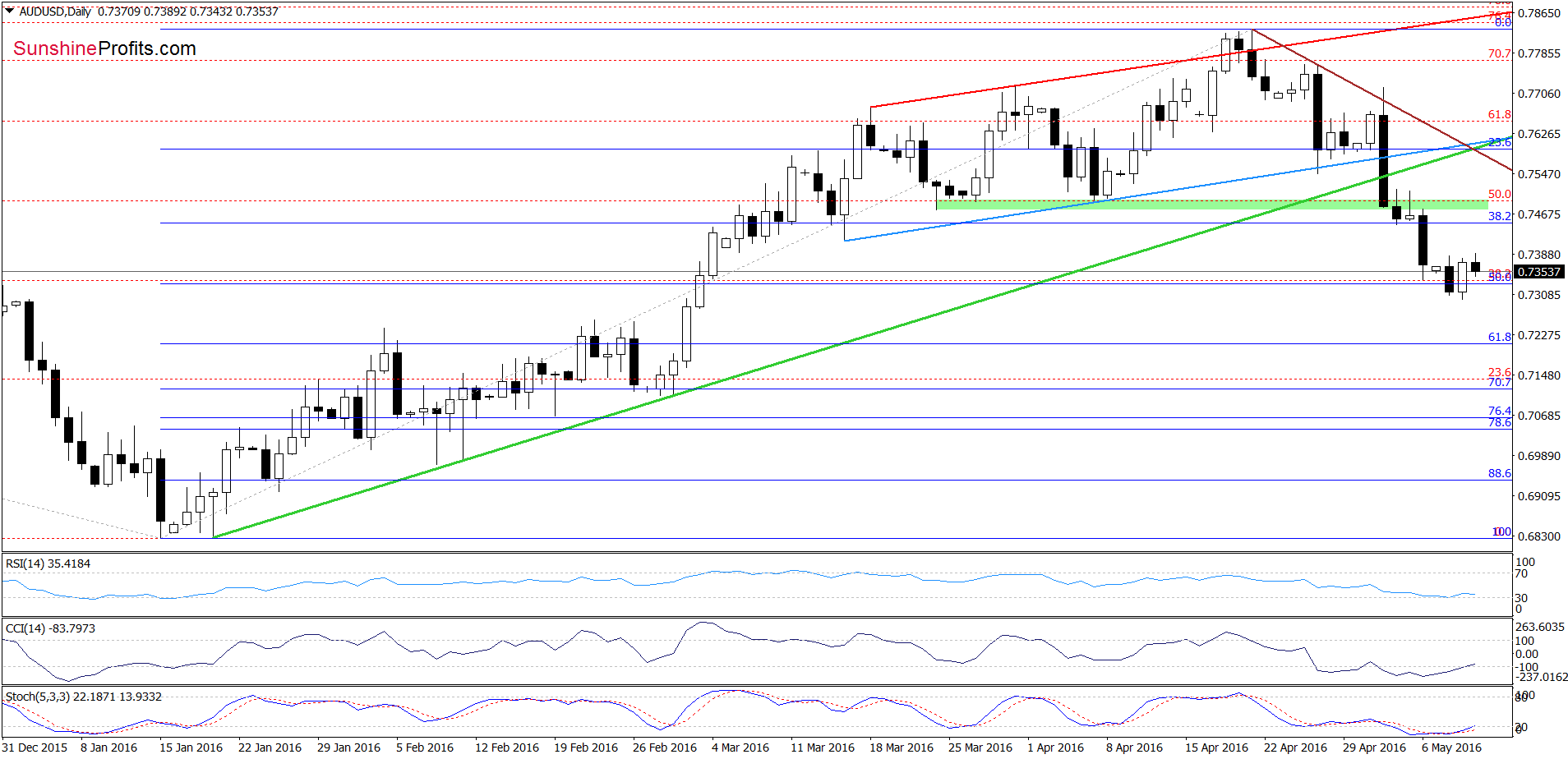

The situation in the medium-term hasn’t changed much as AUD/USD remains under the previously-broken upper border of the rising purple trend channel. Today, we’ll focus on the very short-term changes.

On Monday, we wrote:

(…) the pair dropped to the 50% Fibonacci retracement, which in combination with the current position of the indicators suggests that we may see a reversal in the coming day(s) – especially if the CCI and Stochastic Oscillator generate buy signals.

As you see on the daily chart, we see that currency bulls pushed the pair higher as we had expected. With yesterday’s upswing the exchange rate invalidated earlier small breakdown under 50% Fibonacci retracement, which in combination with buy signals generated by the indicators suggest further improvement in the coming days. If this is the case and the pair rebound from current levels, we’ll likely see a test of the previously-broken green zone, which serves now as resistance.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case, we will refer to these levels as levels of exit orders. Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts