Earlier today, the U.K. Office for National Statistics showed that the rate of consumer price inflation increased by 0.5% in March, beating analysts’ predictions. Additionally, month-over-month, consumer prices increases by 0.4% in the previous month also beating forecasts. Thanks to these numbers, GBP/USD extended gains, invalidating earlier breakdown under the support line. What does it mean for the exchange rate?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1512; initial downside target at 1.0572)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

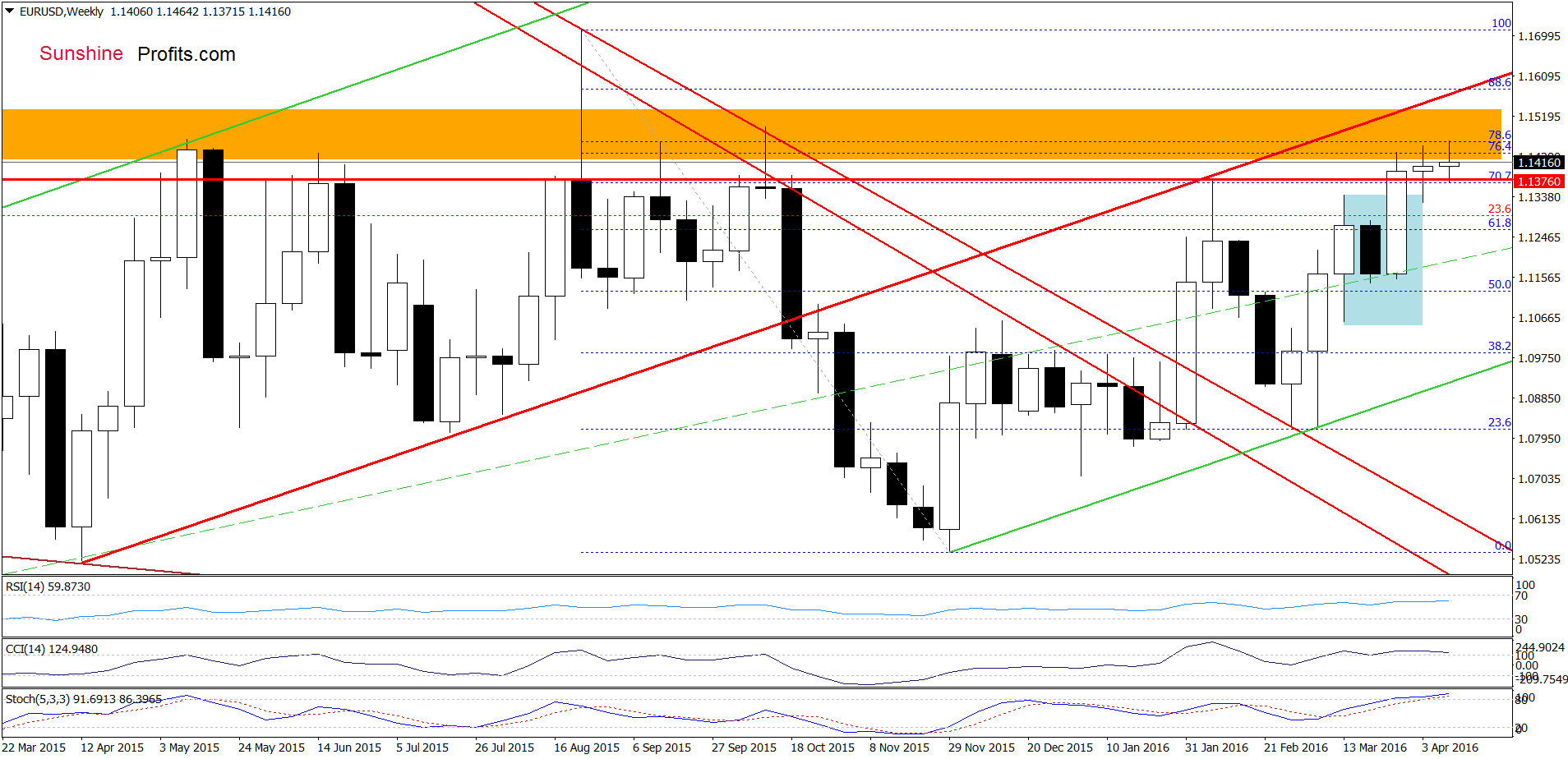

Looking at the weekly chart, we see that although EUR/USD moved little higher, the pair remains under the key orange resistance zone. Therefore, in our opinion, as long as there won’t be a breakout above it and the red rising resistance line (based on the Apr and Jul 2015 lows), further improvement is not likely to be seen.

Having said the above, let’s focus on the very short-term picture.

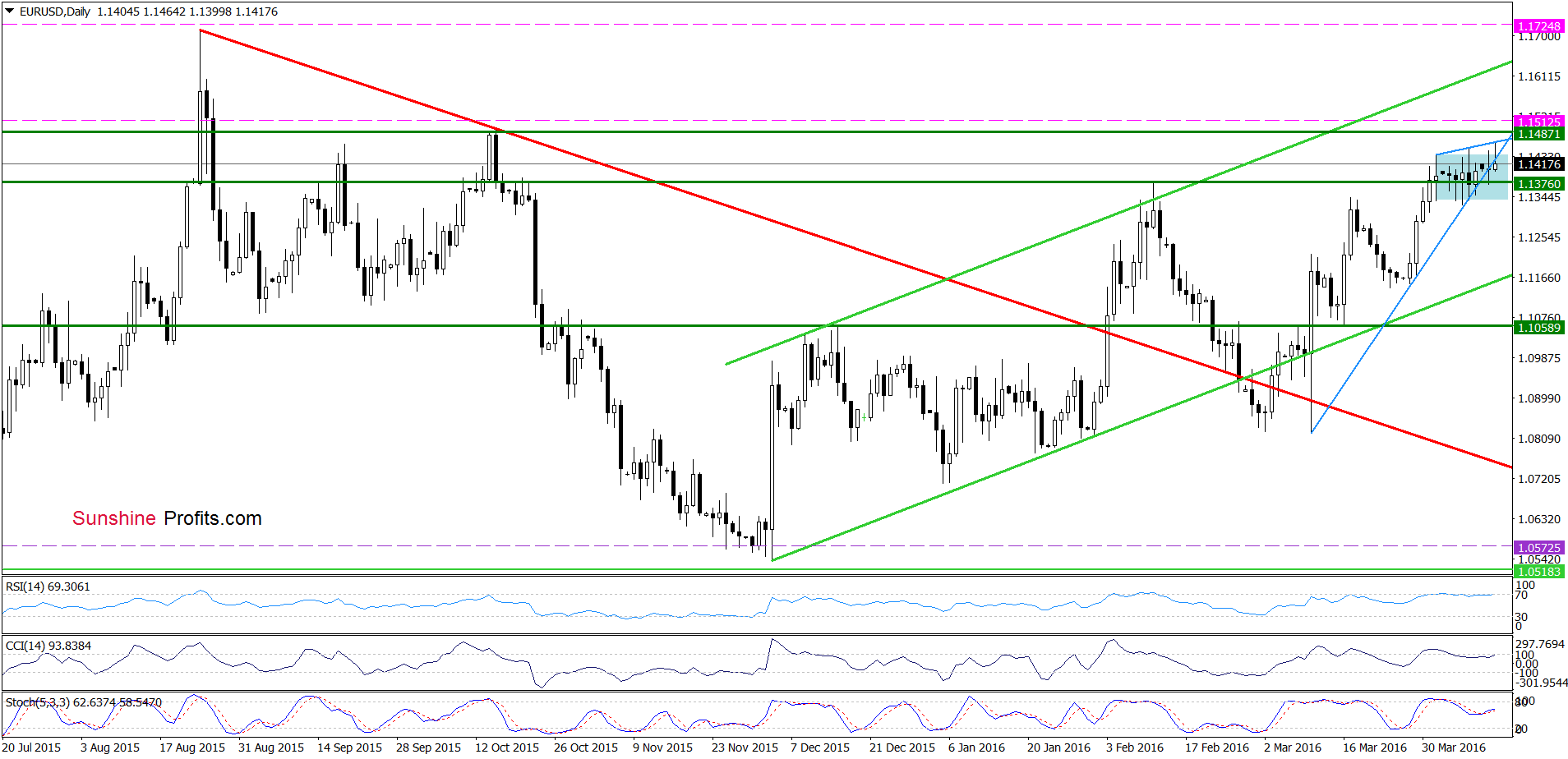

On the daily chart, we see that although EUR/USD moved higher earlier today and climbed above the upper line of the blue consolidation, this improvement was temporary as the blue resistance line (based on the previous highs) in combination with the proximity to the Oct high encouraged currency bears to act. As a result, the pair pulled back under the blue rising support line, which suggests further deterioration. Nevertheless, such price action would be more likely if the exchange rate closes today’s session below it.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1512 and the initial downside target at 1.0572) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

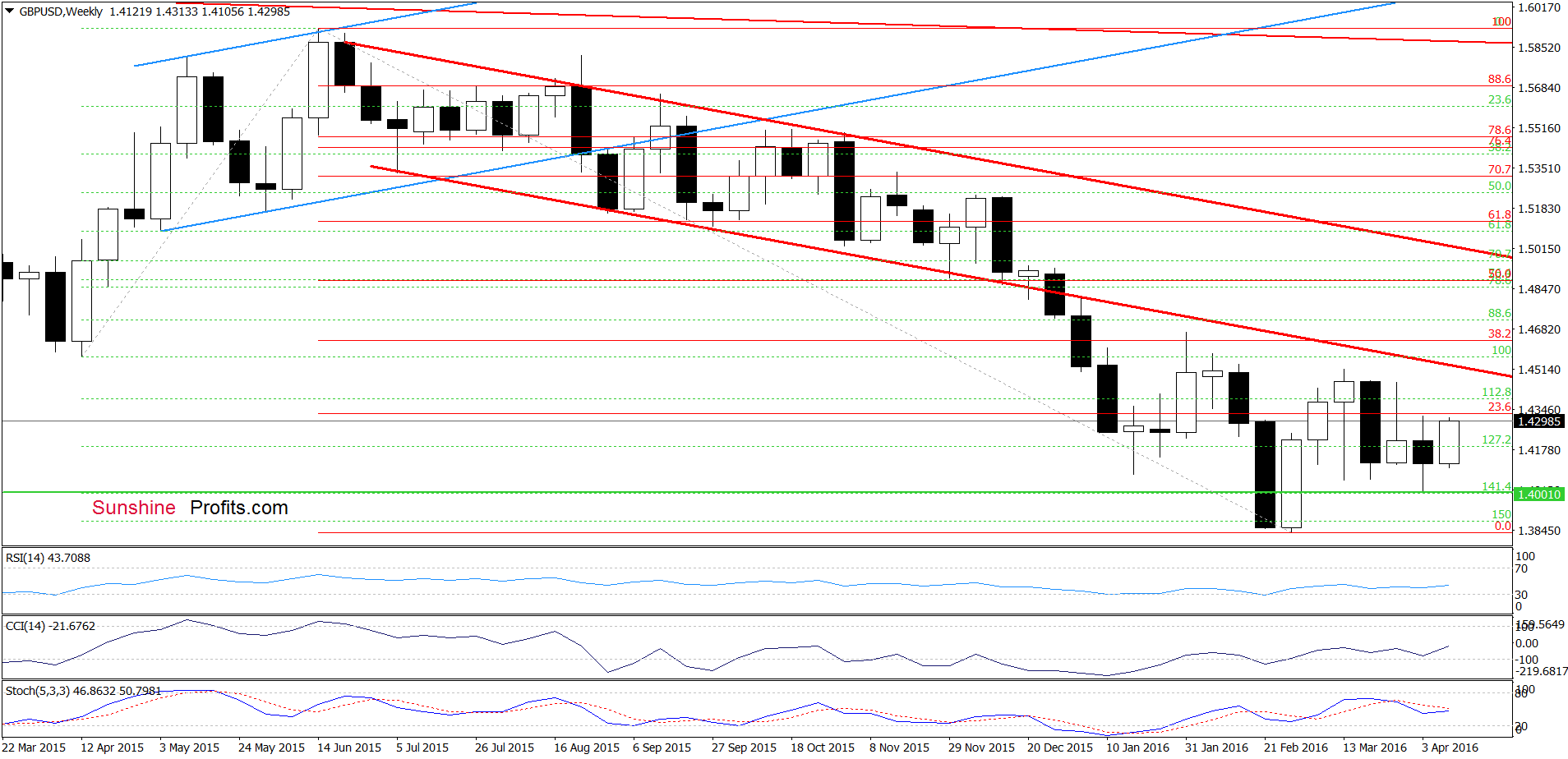

GBP/USD

Looking at the daily chart, we see that GBP/USD moved higher once again and closed the day above the green dashed resistance line, invalidating earlier breakdown. This means that what we wrote yesterday is up-to-date also today:

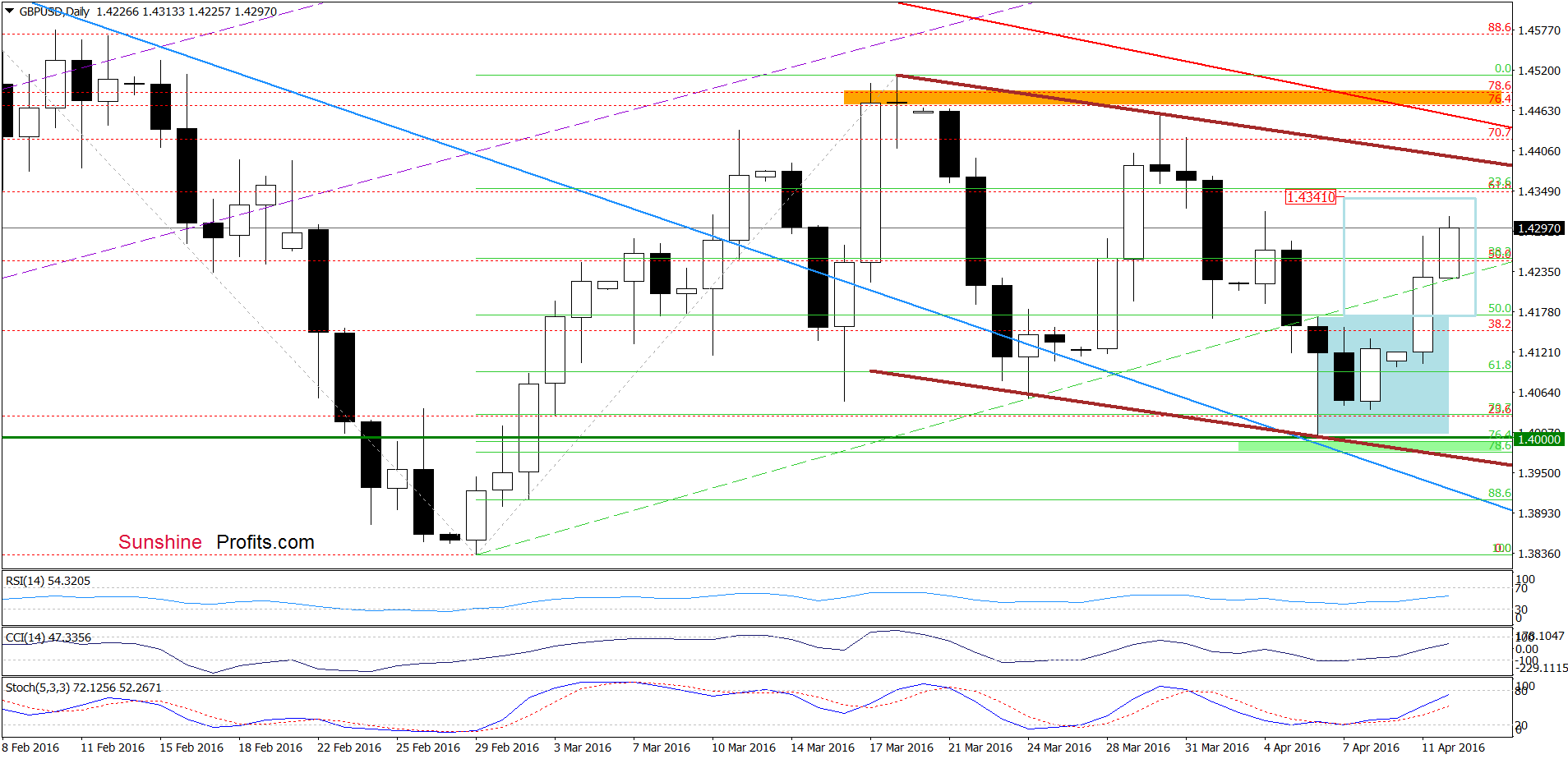

(…) the exchange rate extended gains and climbed above the upper border of the blue consolidation, which is a bullish signal that suggests further improvement (especially when we factor in buy signals generated by the CCI and Stochastic Oscillator). How high could the pair go in the coming days? Taking into account the breakout above the upper line of the formation, it seems that GBP/USD could increase to around 1.4341, where the size of the move will correspond to the height of the consolidation.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

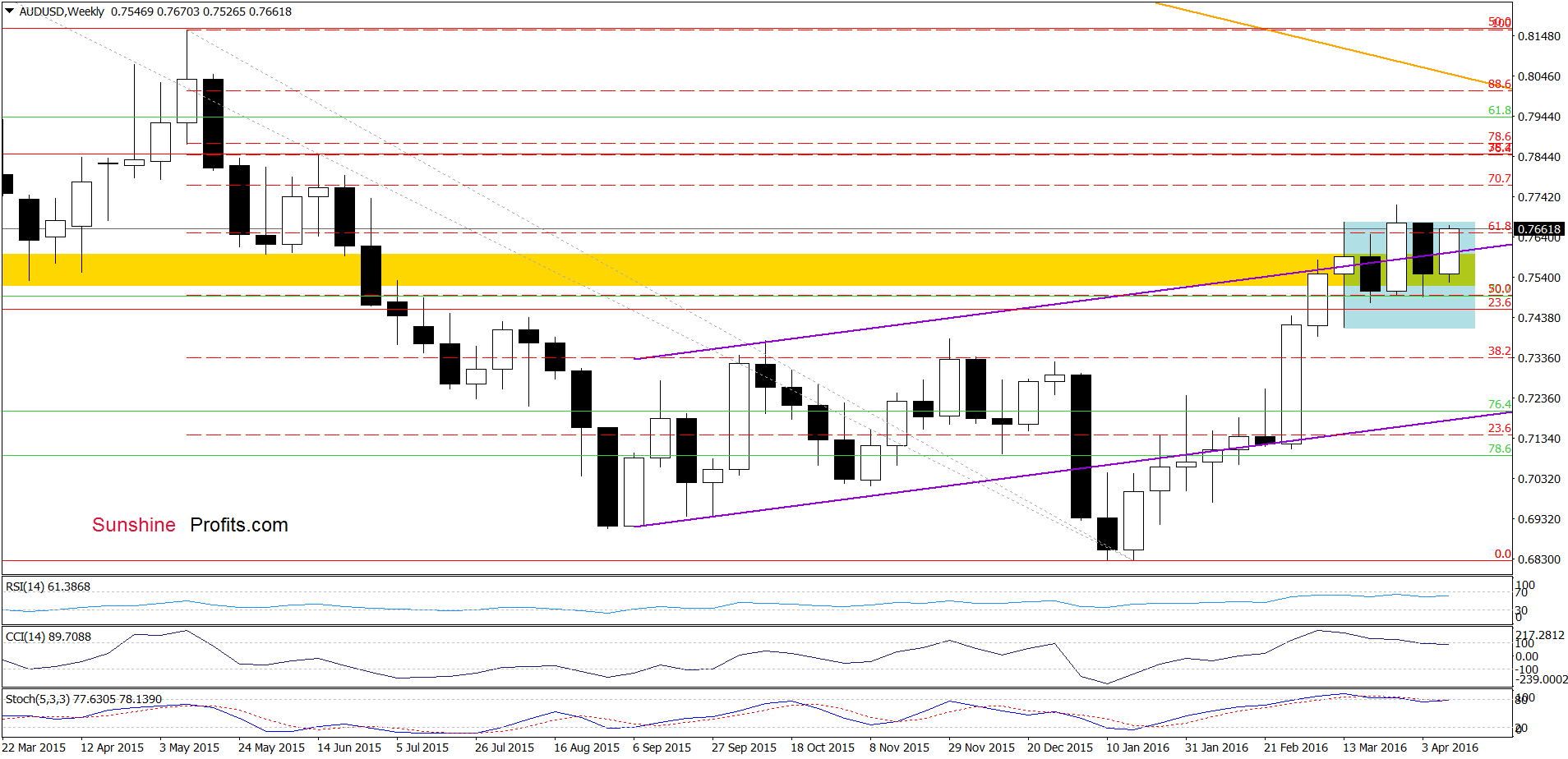

The first thing that catches the eye on the medium-term chart is an invalidation of the breakdown under the upper border of the purple rising trend channel, which is a positive signal that suggests a test of the March high or even an increase to the 70.7% Fibonacci retracement (based on the May-Jan downward move) around 0.7769.

Will the very short-term picture confirm this pro-growth scenario? Let’s check.

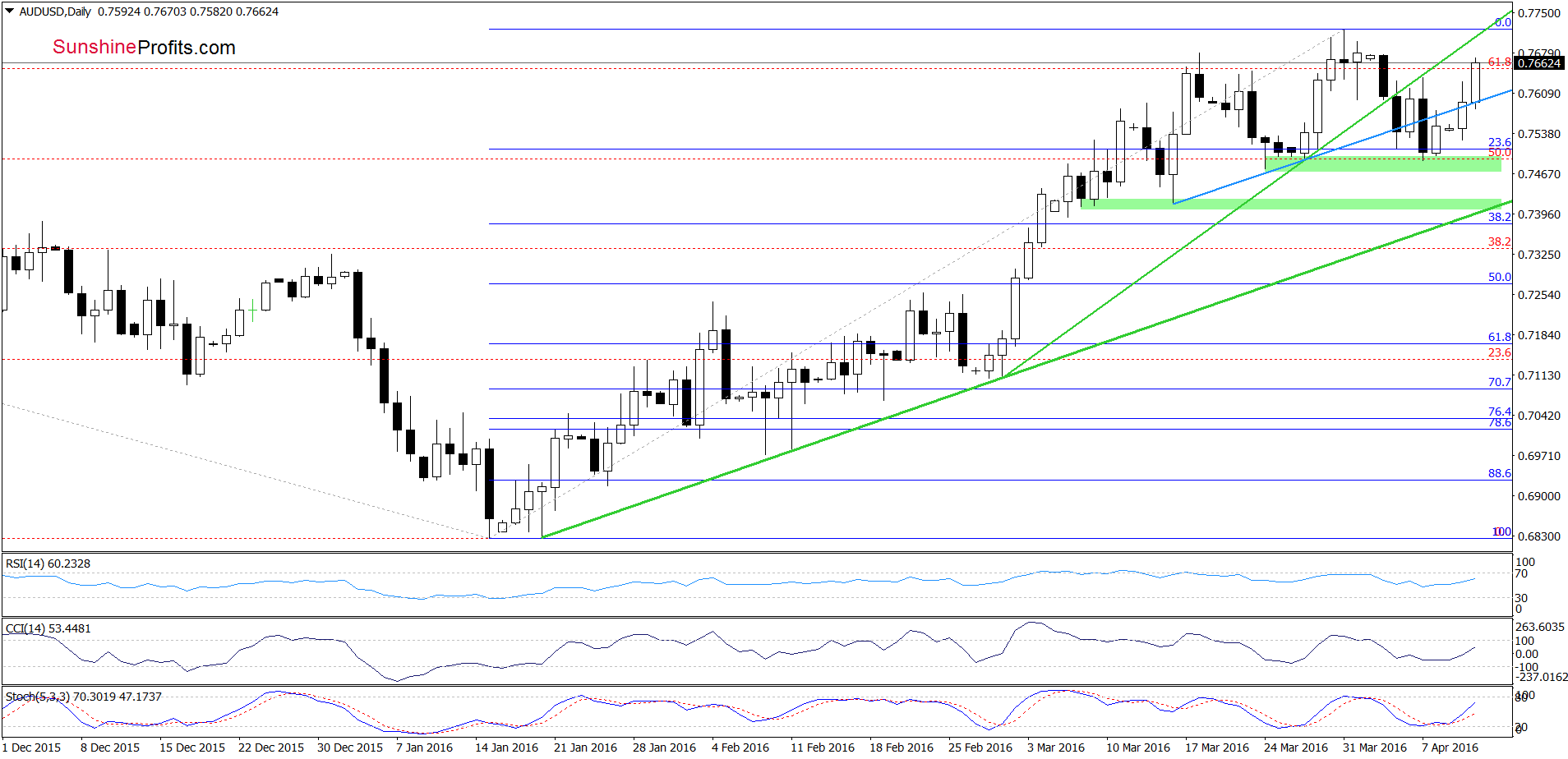

From this perspective, we see that AUD/USD extended gains and increased above the blue resistance line, which is a positive signal. Additionally, the Stochastic Oscillator generated a buy signal, which suggests further improvement and a test of the March high.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts