The recent drops in the U.S. dollar pushed the USD/CHF under the medium-term support line. This negative signal triggered further deterioration earlier today. How low could the exchange rate go in the coming days?

In our opinion the following forex trading positions are justified - summary:

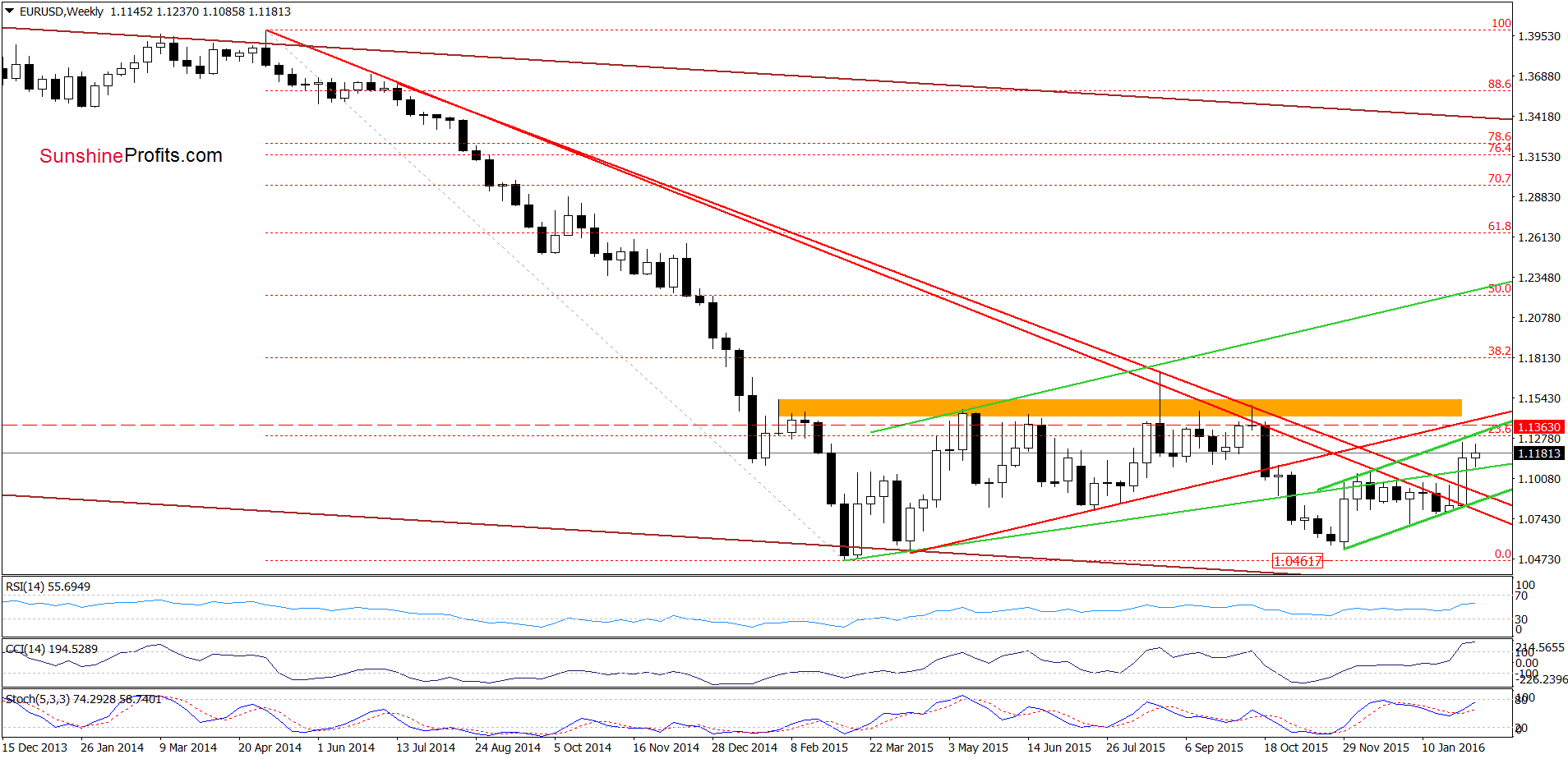

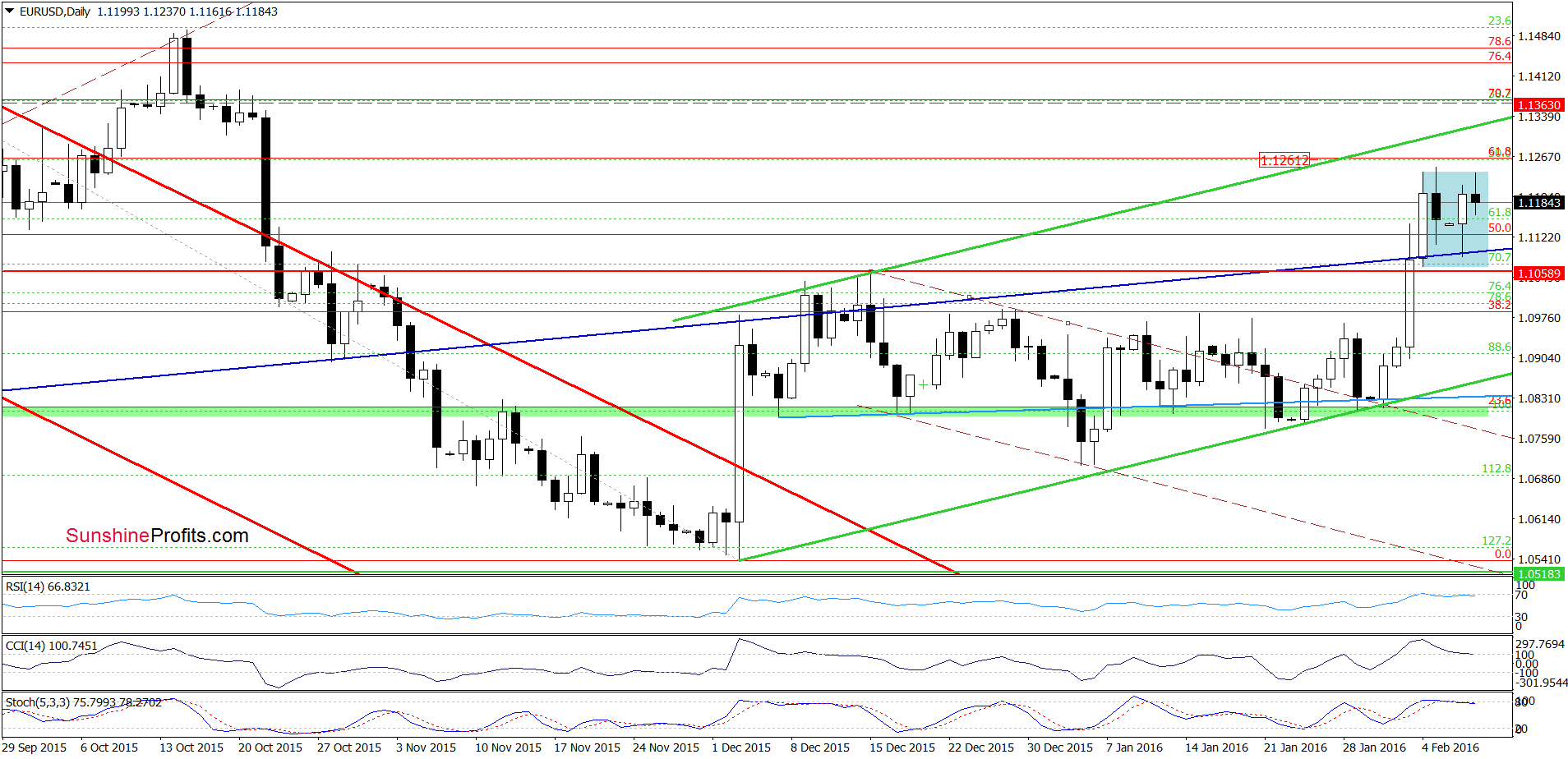

EUR/USD

Yesterday we wrote the following:

(…) the pair remains above the barrier of 1.1000, mid-Dec highs and the long-term green line based on Mar and Apr lows, which suggests that the pullback could be just a verification of earlier breakouts. Therefore, as long as there is no invalidation of the breakout above these levels, another attempt to move higher can’t be ruled out.

Looking at the charts, we see that the situation developed in line with the above scenario and EUR/USD bounced off the above-mentioned levels yesterday. Despite this improvement, the upper border of the blue consolidation stopped currency bulls earlier today, triggering a pullback. This means that as long as there is no breakout above this resistance further rally is questionable. However, if currency bulls manage to push the pair above Friday’s high, we’ll see a test of the upper border of the green rising trend channel in the following days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

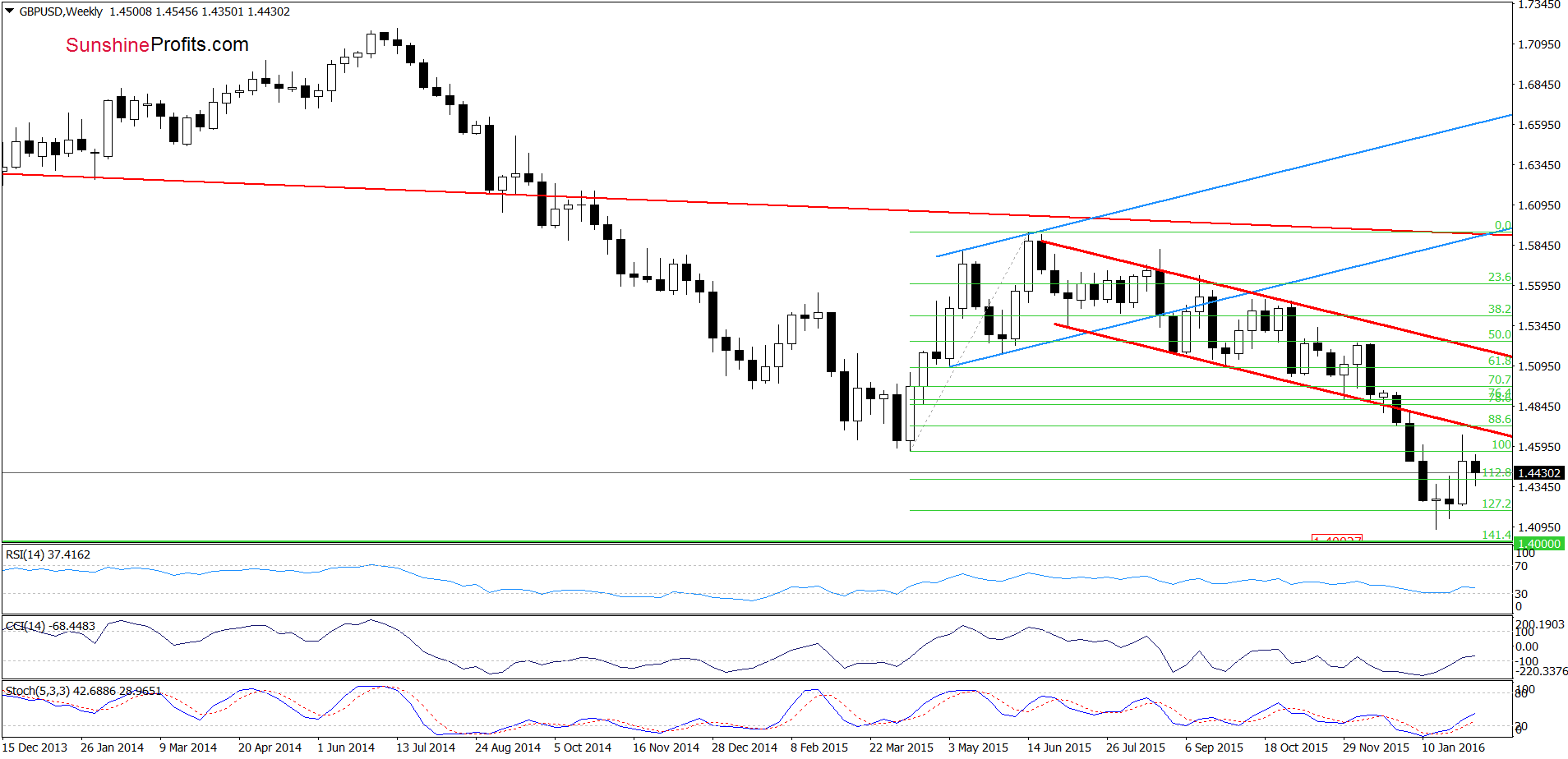

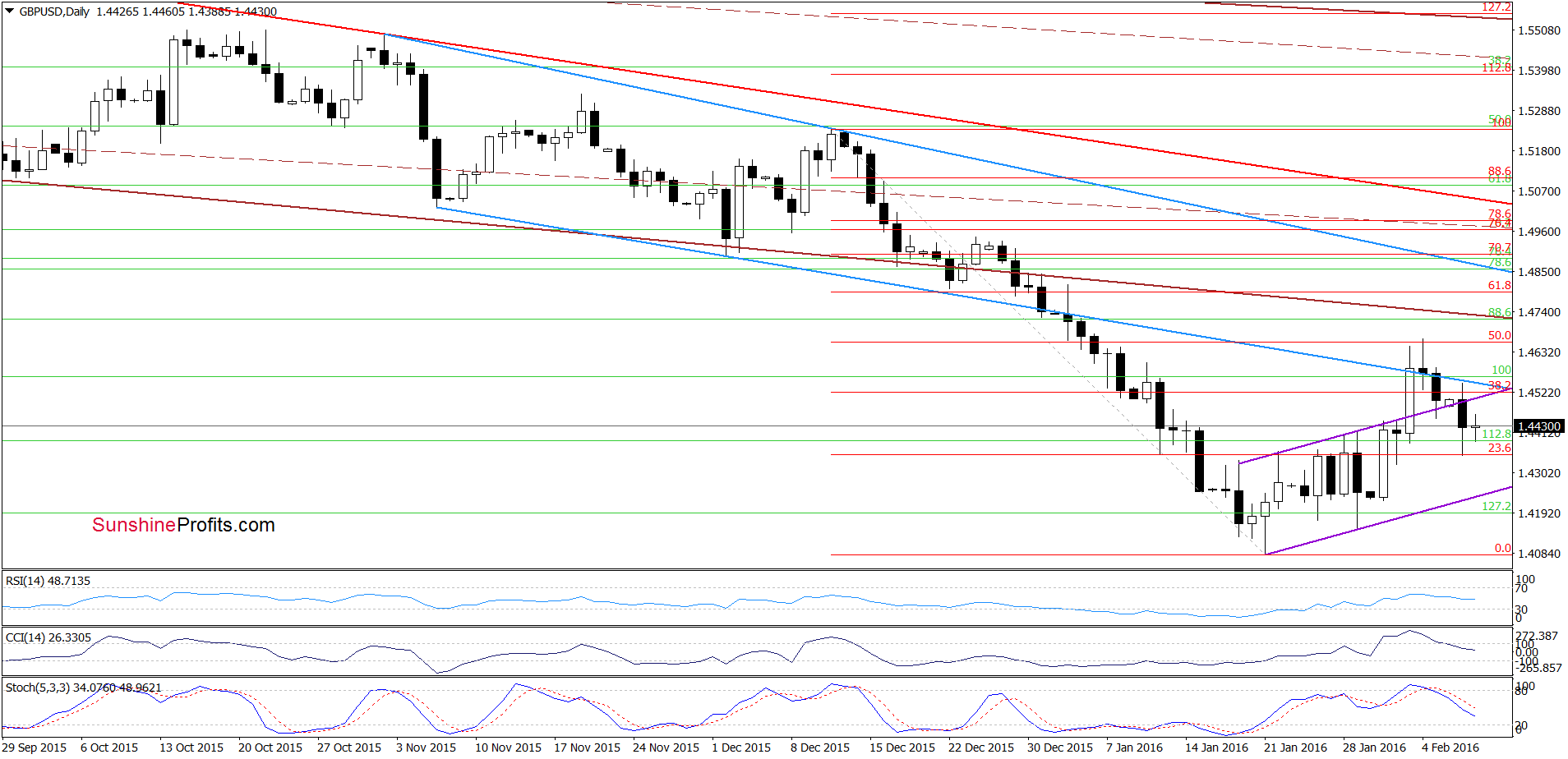

GBP/USD

On the daily chart, we see that the 50% Fibonacci retracement level stopped currency bulls and triggered a pullback. With this move, GBP/USD invalidated an increase above the blue resistance line, which resulted in further deterioration and a comeback below the previously-broken upper border of the very short-term rising trend channel. This invalidation of the breakout in combination with sell signals generated by the indicators doesn’t bode well for GBP/USD and suggests lower values of the exchange rate in the coming days. In our opinion, if the pair declines from here, the initial downside target would be the lower border of the triangle. If it is broken, the exchange rate will test the recent lows.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

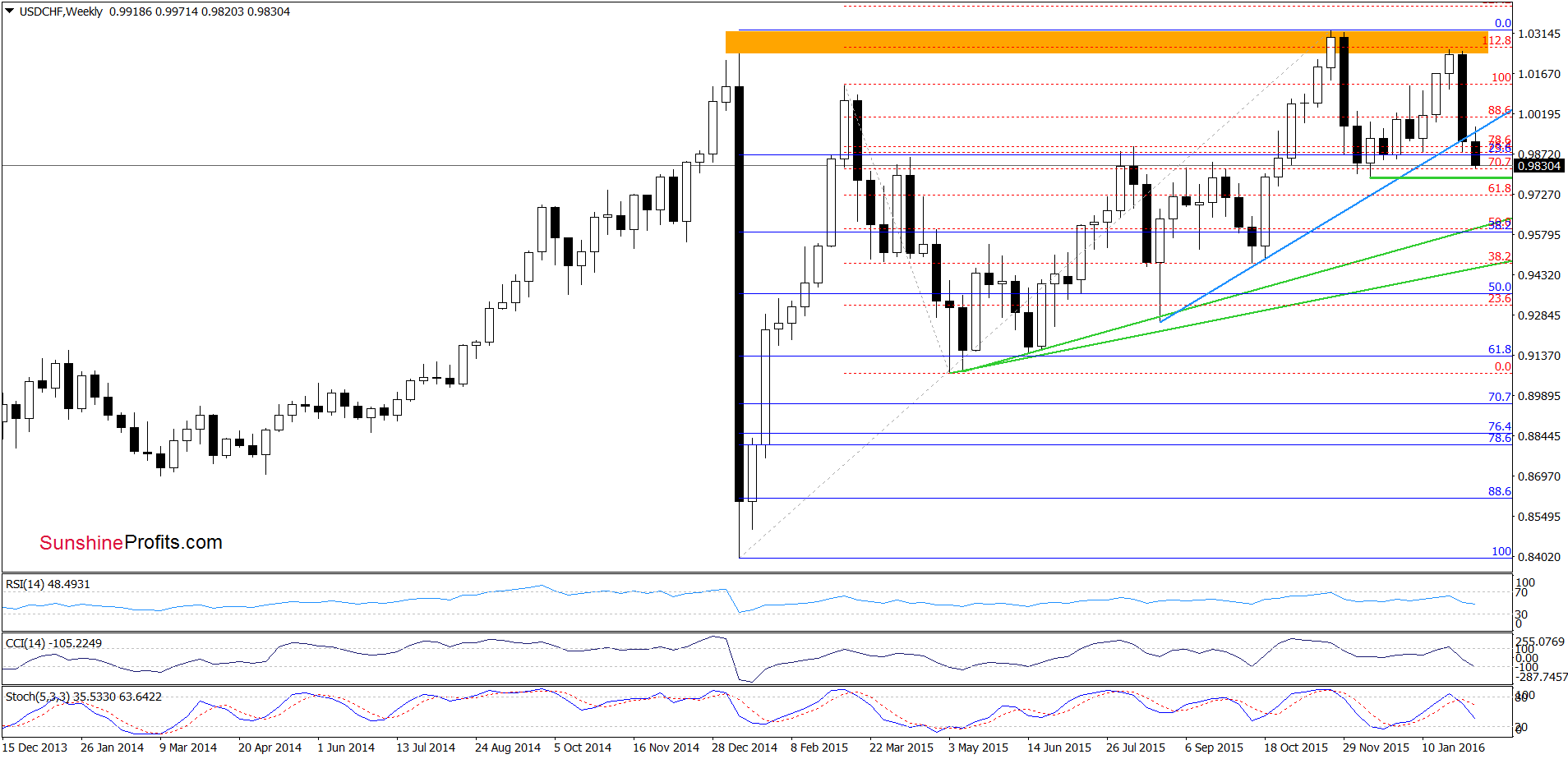

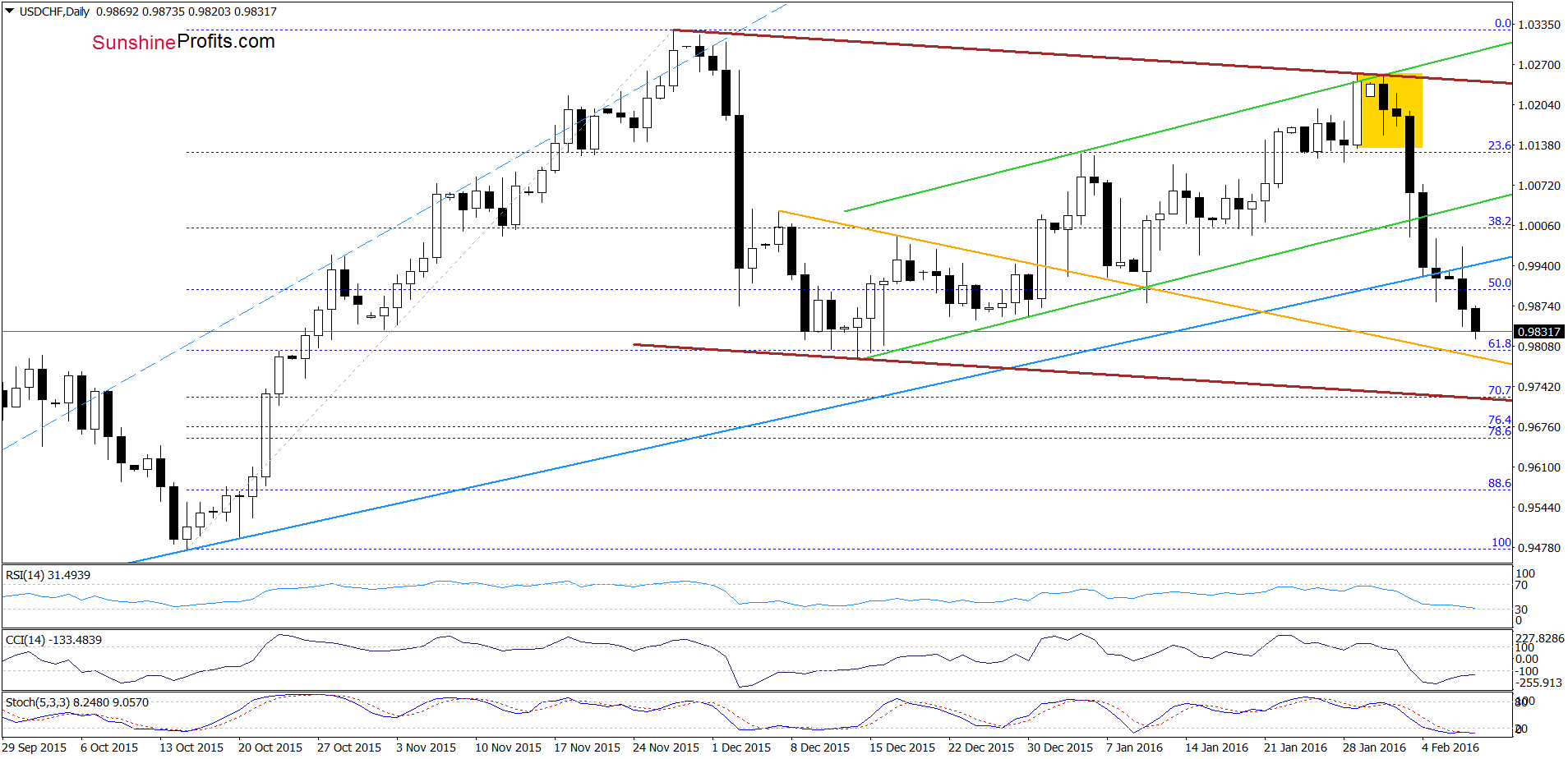

USD/CHF

The first thing that catches the eye on the above charts is a breakdown under the medium-term blue support line. This is a negative signal, which suggests further deterioration and a drop to the green support line (marked on the weekly chart) based on the mid-Dec low of 0.9785 (the bottom of the previous bigger pullback). If it is broken, the next downside target for currency bears would be the lower border of the brown declining trend channel marked on the daily hart (currently around 0.9720).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts