Earlier today, the USD Index extended gains and hit a fresh eight month high of 100.13. What impact did this increase have on the euro, British pound and Canadian dollar?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

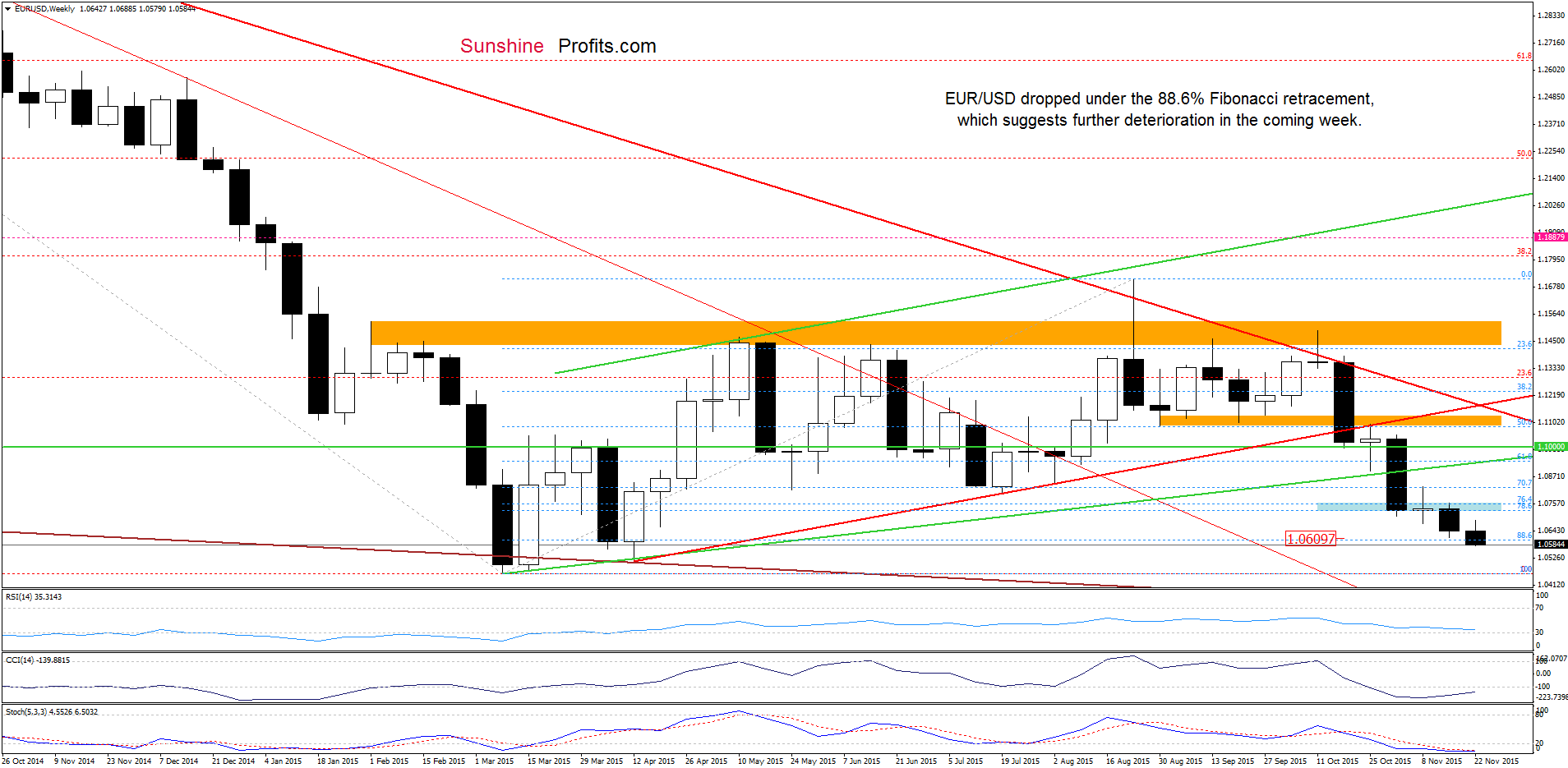

EUR/USD

The first thing that catches the eye on the weekly chart is a breakdown under the 88.6% Fibonacci retracement, which is a negative signal that suggests further deterioration.

How low could the exchange rate go in the coming days? Let’s examine he daily chart and find out.

From this perspective, we see that EUR/USD extended losses and dropped under this week’s low, which suggests further deterioration and a drop to our downside target from yesterday’s alert:

(…) the next downside target would be around 1.0562, where the 127.2% Fibonacci extension (based on the Jul-Aug rally) is.

Please note that if this support is broken, we’ll see test of the lower border of the blue declining trend channel in the coming days (currently around 1.0545).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are very profitable as we opened half of them when EUR/USD was around 1.1427 and half when the pair was trading around 1.1000) with a stop-loss order at 1.1476 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

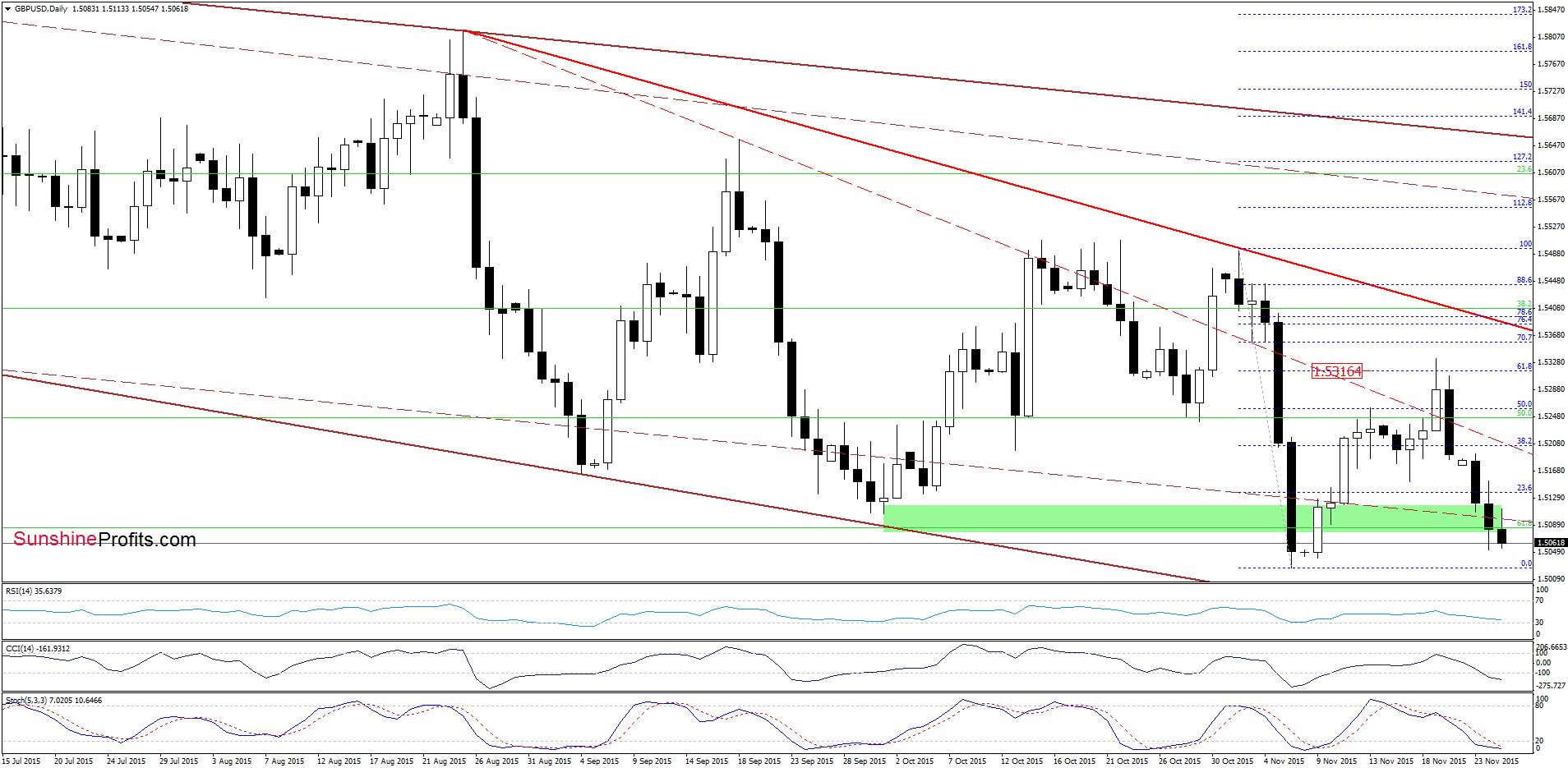

GBP/USD

On Monday, we wrote the following:

(…) GBP/USD broke below the last week’s low and approached the green support zone. Although the pair could rebound from here, the current position of the indicators (sell signals remain in place, supporting currency bears) suggests further deterioration and a test of the Nov lows in the coming week.

Looking at the daily chart, we see that the situation developed in line with the above scenario and the exchange rate broke below the green zone, which means that our downside target from previous commentary will be in play in the coming days.

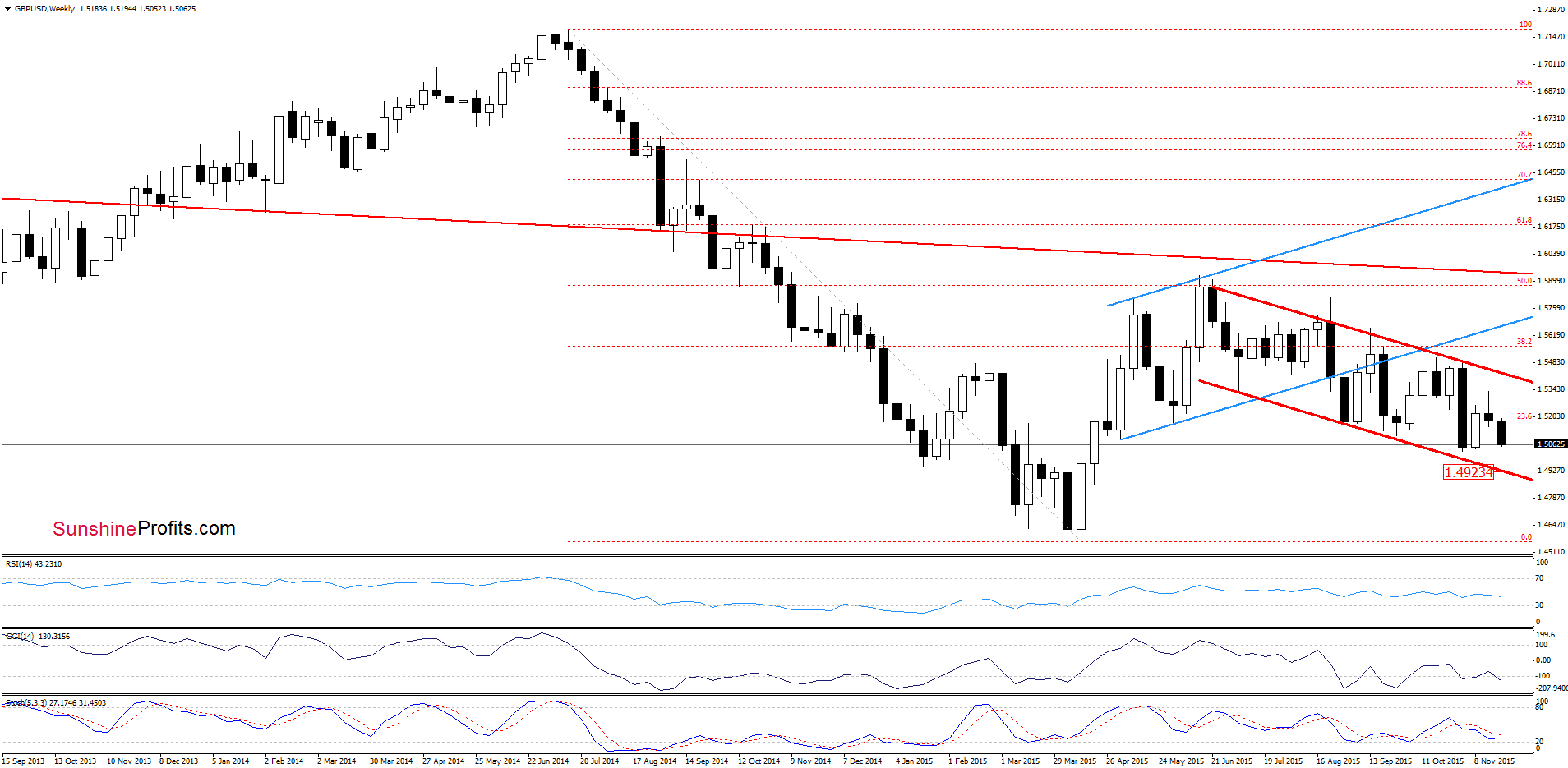

What could happen if it is broken? Let’s take a closer look at the weekly chart.

From this perspective we see that if the pair extends losses, we may see a decline even to around 1.4923, where the lower border of the red declining trend channel is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

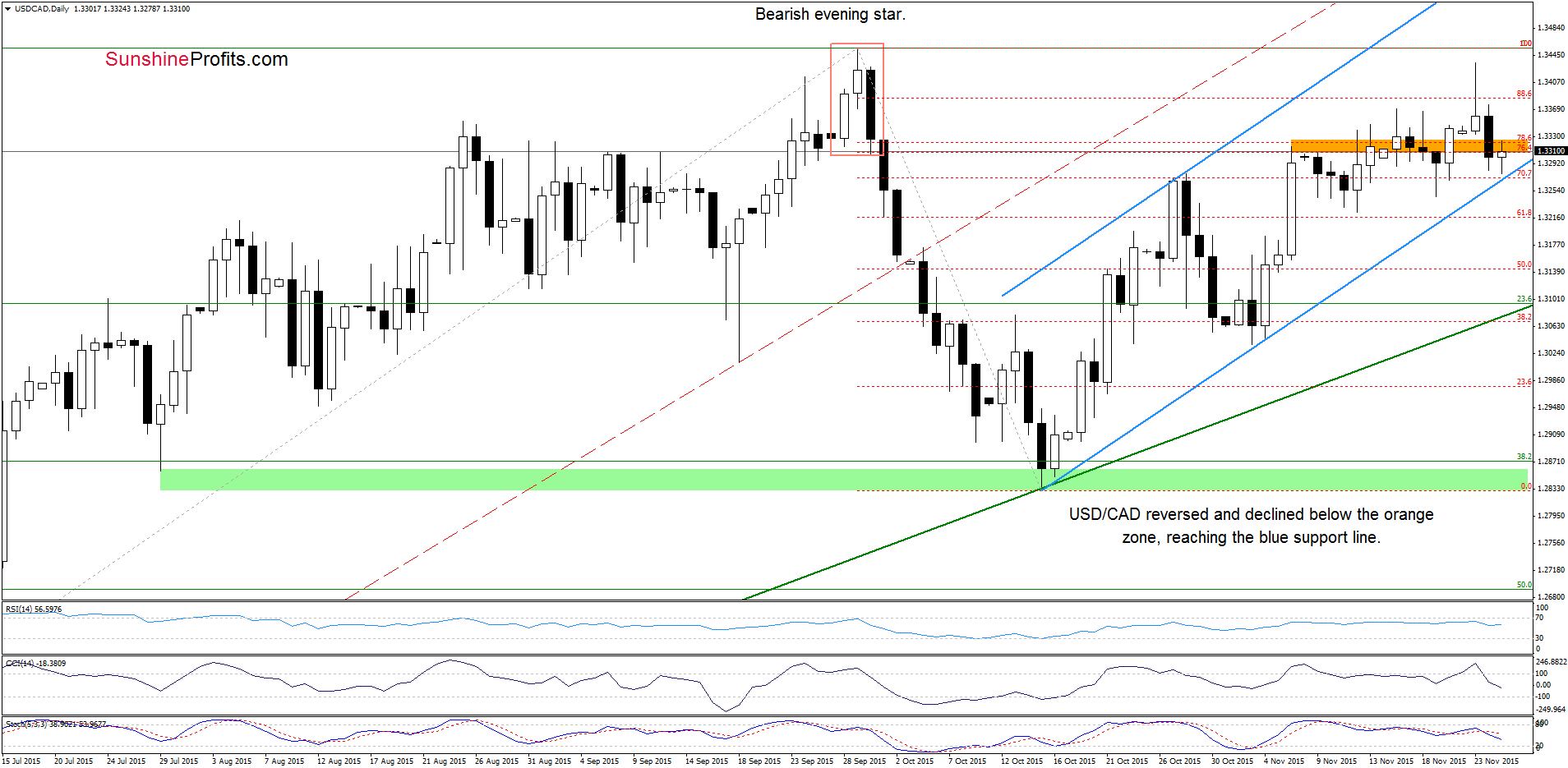

USD/CAD

Although the medium-term picture has improved, the proximity to the 61.8% Fibonacci retracement and the previous high encouraged currency bears to act, which resulted in a pullback.

How did this drop affect the very short-term picture? Let’s check.

On the daily chart, we see that USD/CAD reversed and declined below the orange zone, reaching the blue line (the lower border of the rising trend channel). If this important support withstands the selling pressure, we’ll see a rebound from here and another attempt to climb above the orange zone. At this point it is worth noting that sell signals generated by the indicators suggests a bearish scenario and further deterioration. Nevertheless in our opinion as long as there is no breakdown below the lower border of the rising trend channel a sizable downward move is not likely to be seen and another attempt to move higher should not surprise us.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Forex Trading Alert tomorrow and on Friday, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts