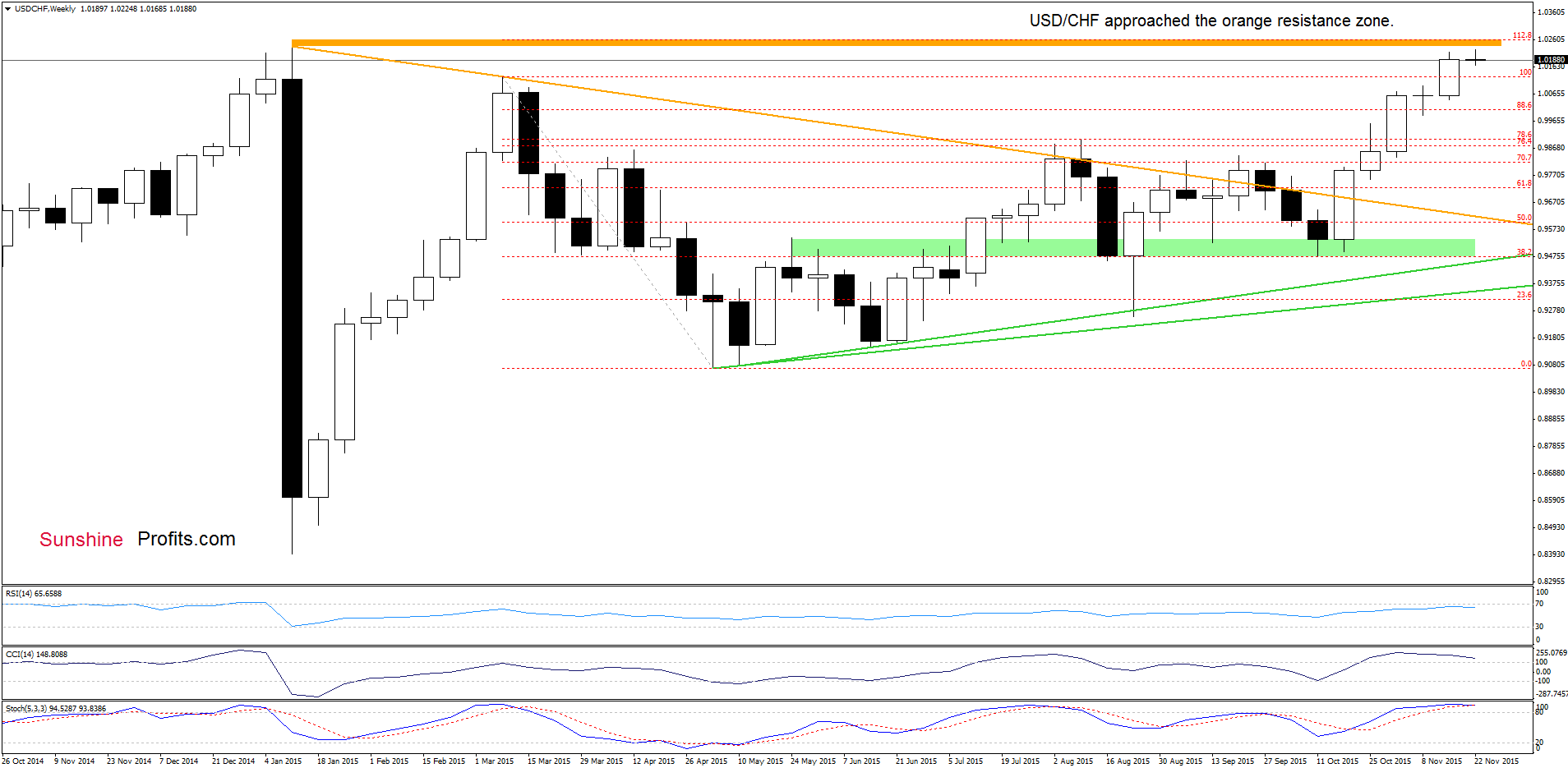

Although yesterday’s data showed that existing home sales dropped by 3.4% to 5.36 million units in Oct (missing analysts’ forecasts for a 2.3% fall), demand for the greenback continued to be supported by expectations that the Fed would raise interest rates next month. Thanks to these circumstances, USD/CHF hit a fresh Nov high and approached the Jan high. Will this resistance encourage currency bears to act in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

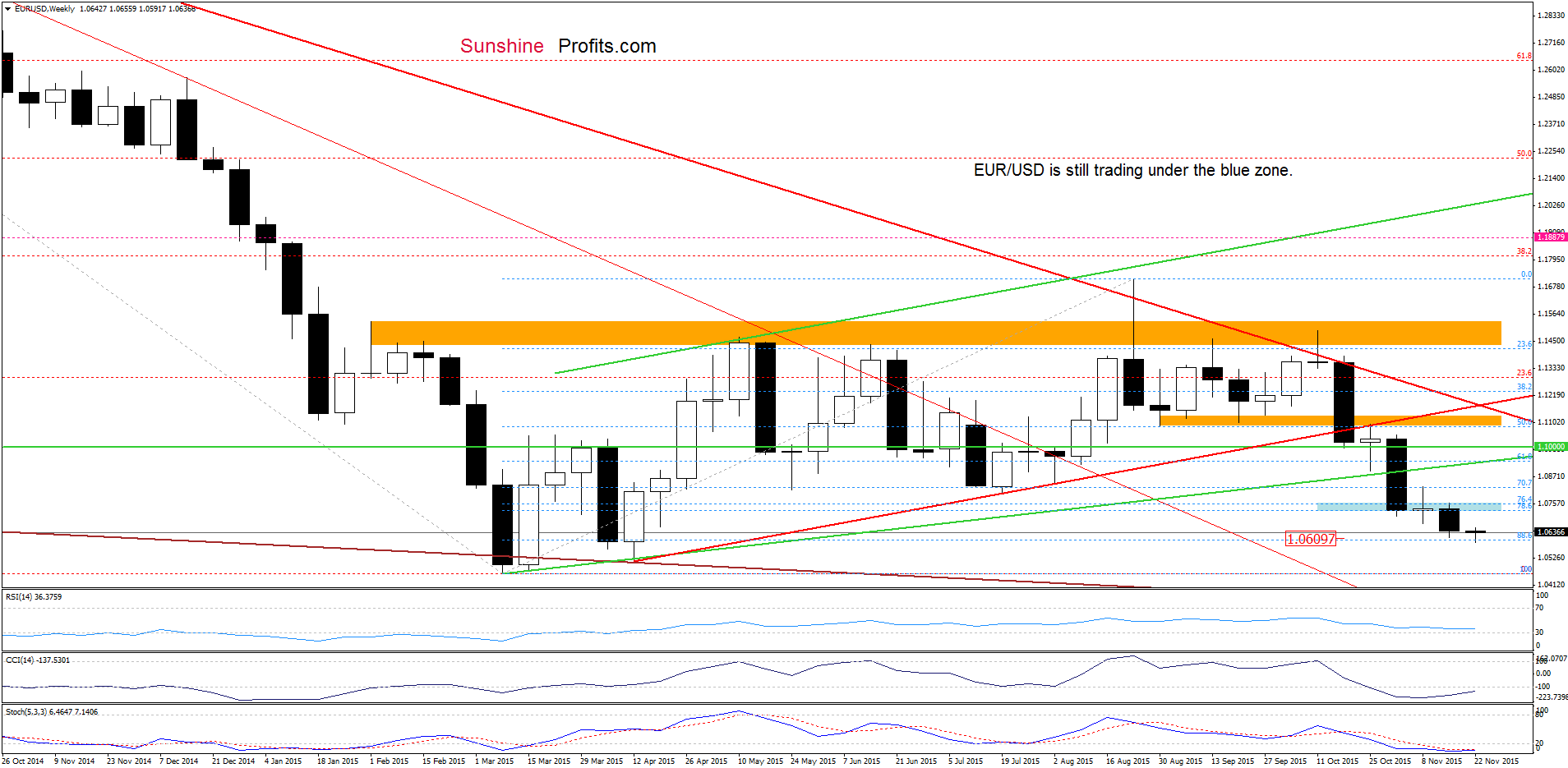

EUR/USD

The situation in the medium term remains almost unchanged as EUR/USD is trading between the 88.6% Fibonacci retracement and the blue resistance zone.

Will the daily chart give us more clues about future moves? Let’s check.

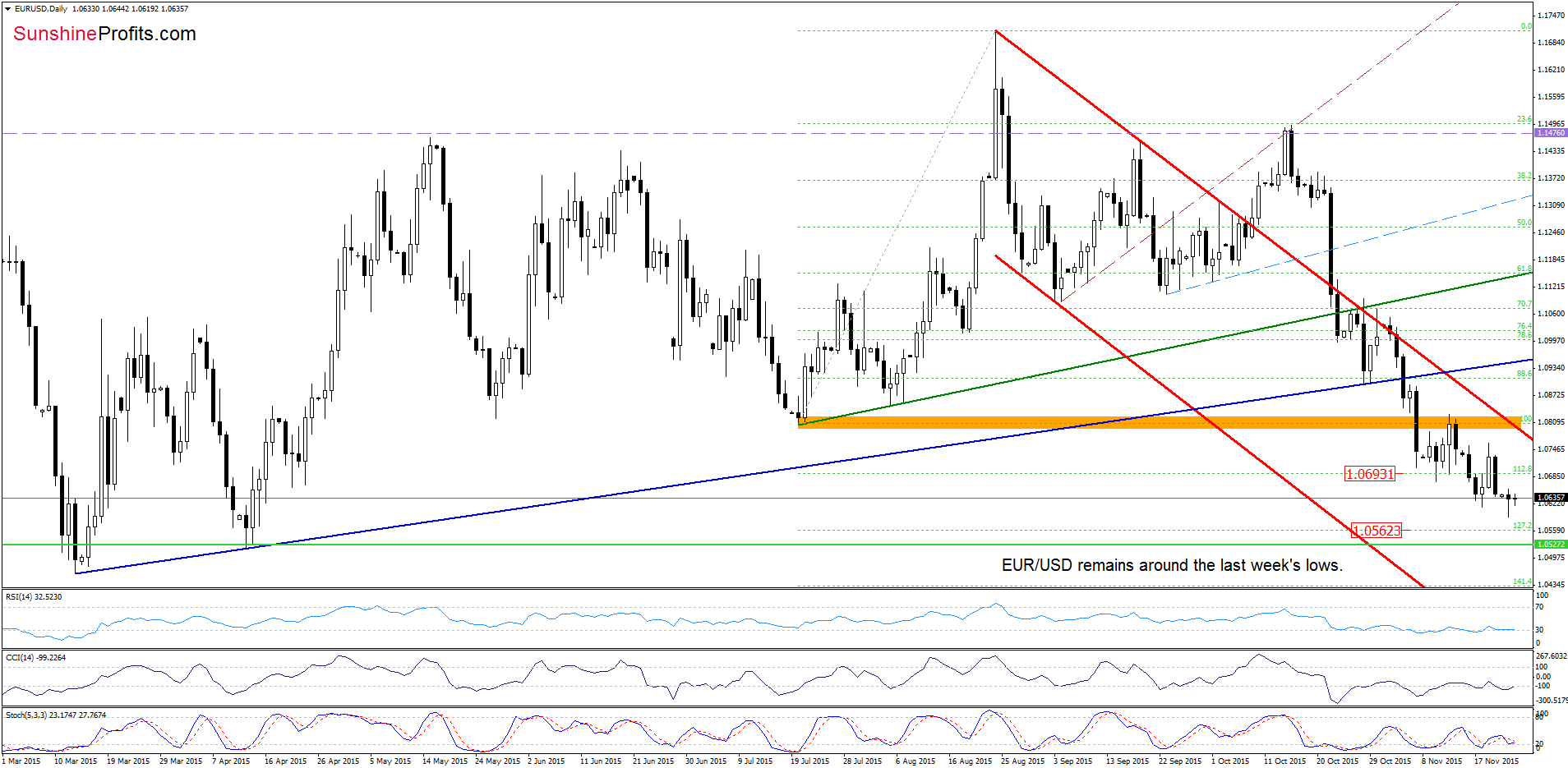

Looking at the daily chart, we see that EUR/USD is trading around the last week’s lows and well below the orange resistance zone and the upper border of the red declining trend channel, which suggests that another attempt to move lower is still likely. In this case, the next downside target would be around 1.0562, where the 127.2% Fibonacci extension (based on the Jul-Aug rally) is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are already profitable as we opened them when EUR/USD was around 1.1427) with a stop-loss order at 1.1476 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

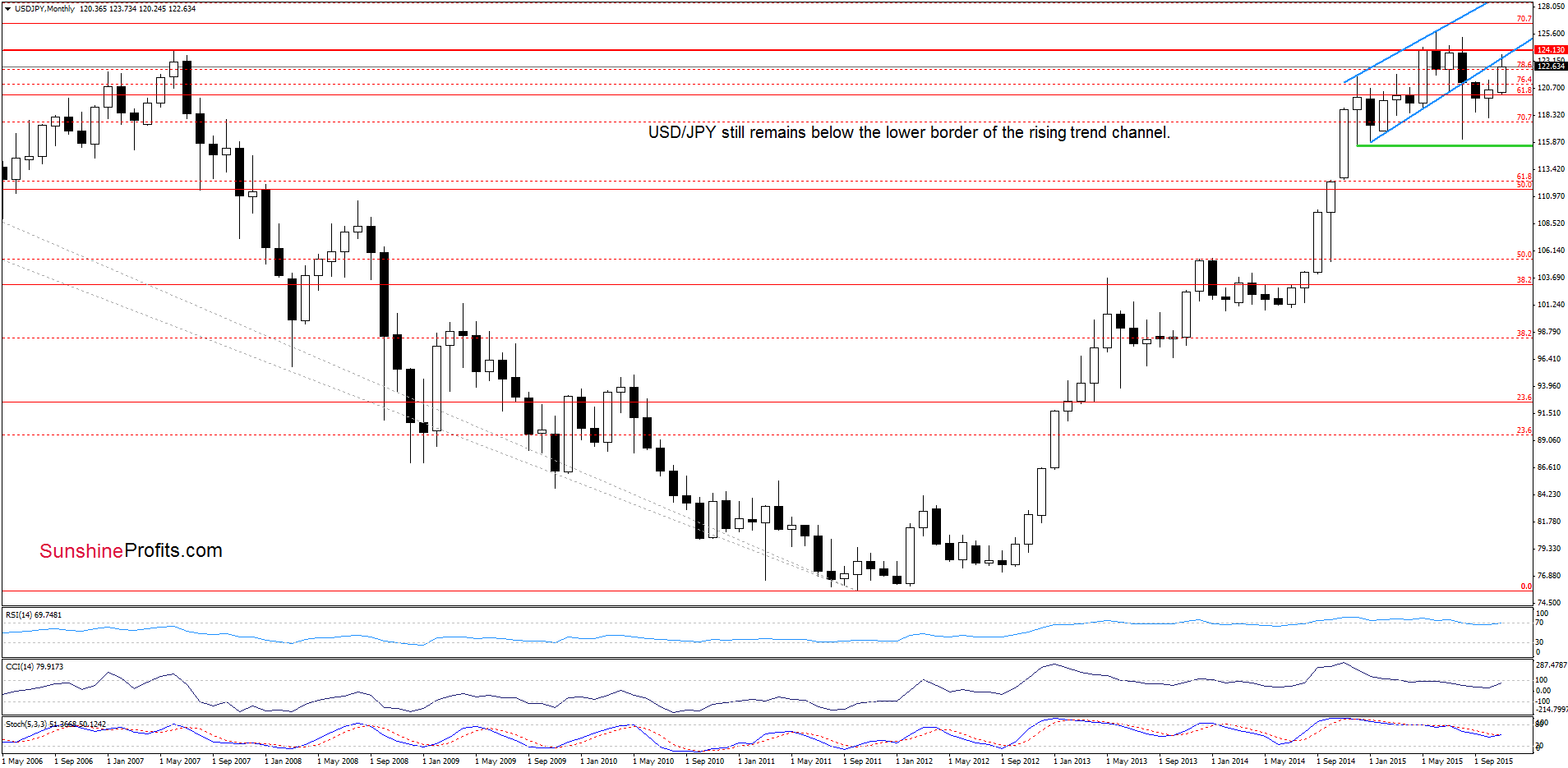

USD/JPY

On the above chart, we see that USD/JPY is still trading under the lower border of the blue rising trend channel, which means that as long as there is no comeback above this key resistance line a sizable upward move is not likely to be seen.

Having said that, let’s take a closer look at the very short-term chart. What can we infer from it?

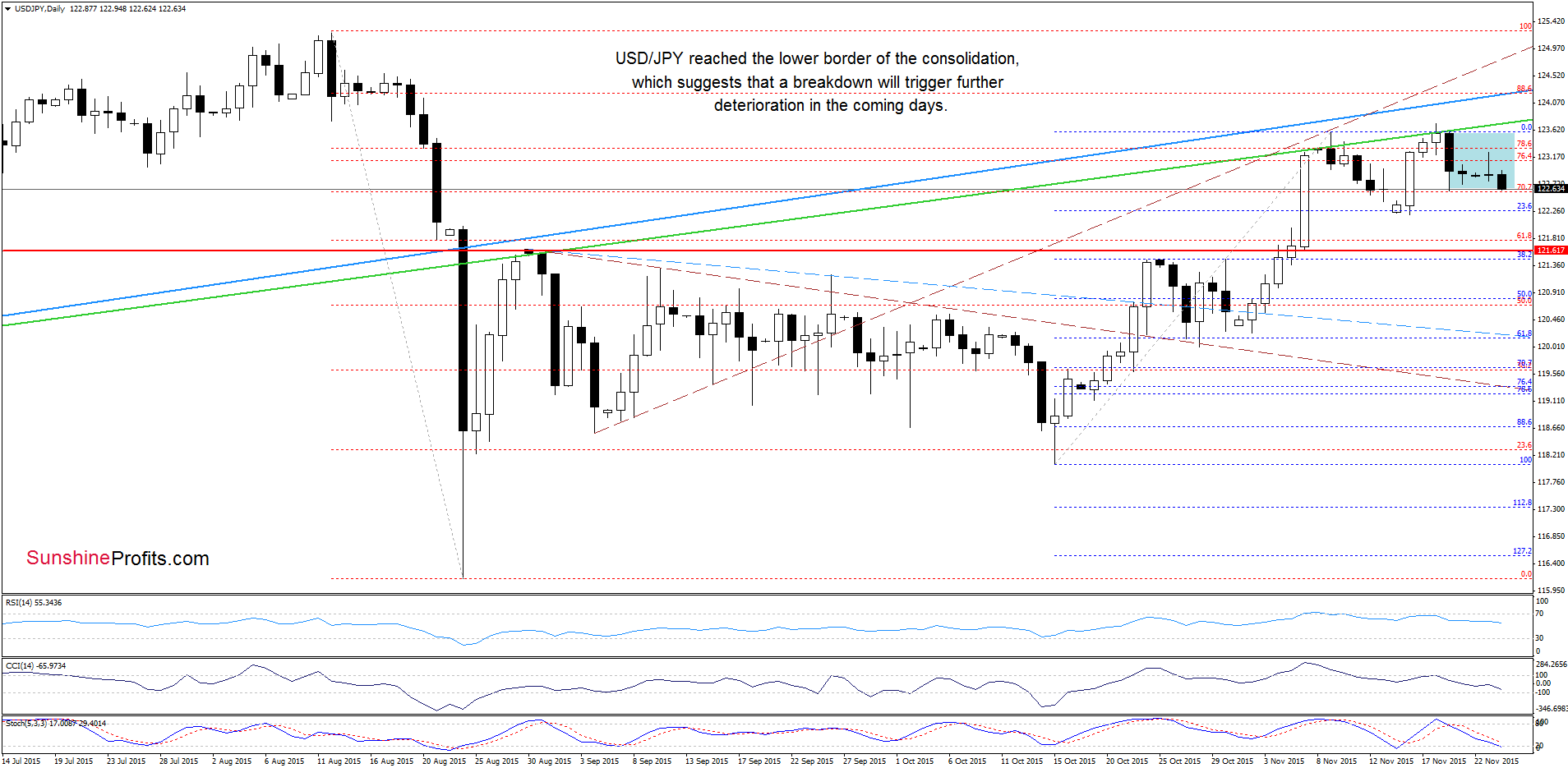

From today’s point of view we see that the very short-term picture hasn’t changed much since our last commentary was posted as USD/JPY is consolidating under the green resistance line. Earlier today, the pair reached the lower border of the formation, which in combination with sell signals generated by the indicators suggests further deterioration. Therefore, if the pair extends losses the initial downside target would be around 122.21, where the Nov 16 low is.

Please note that if this support is broken we may see a decline even to the red horizontal support line based on the Aug high of 121.64 (it is worth noting that in this area the size of the downward move will correspond to the height of the consolidation).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

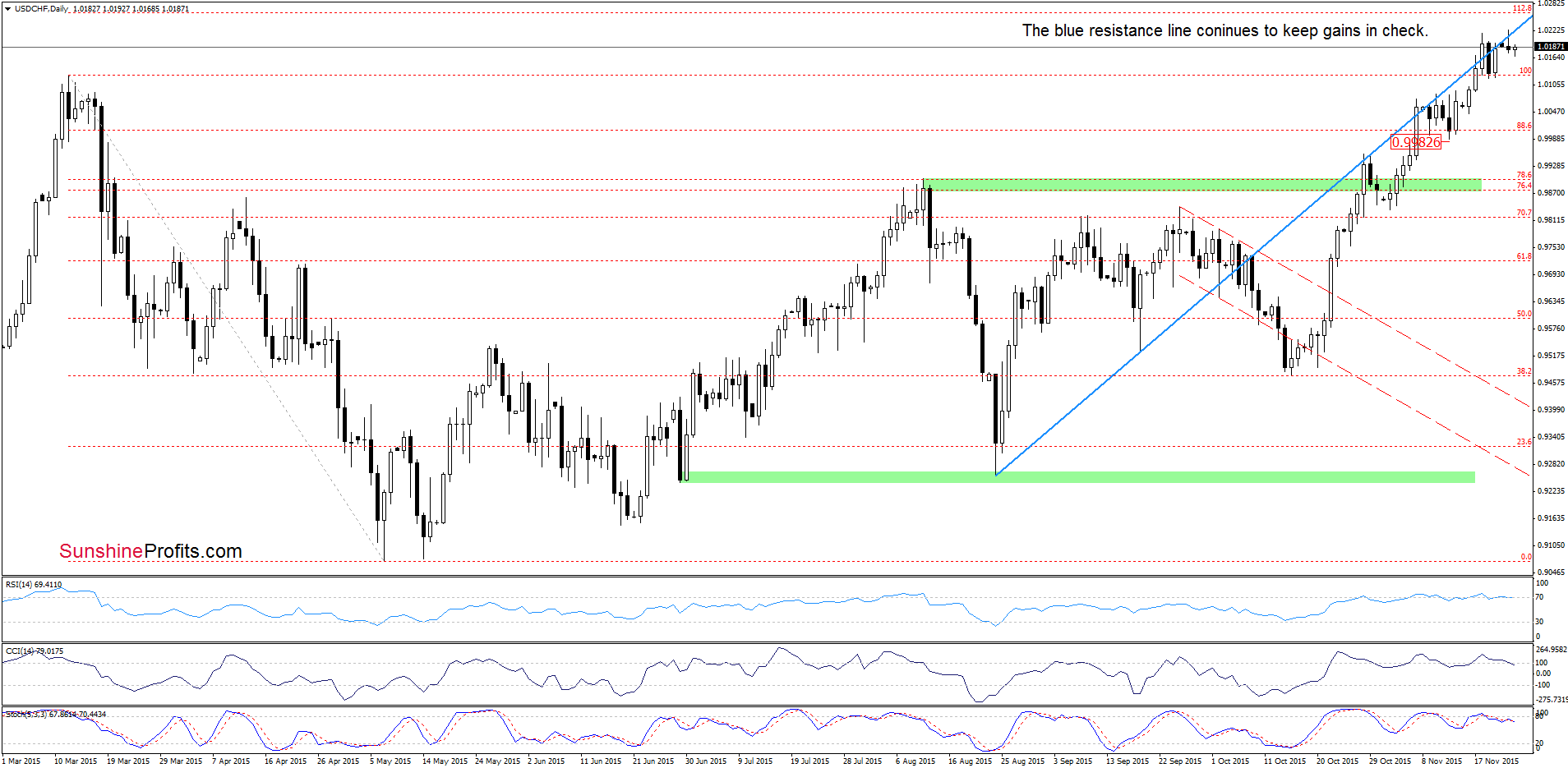

USD/CHF

Looking at the above charts we see that although USD/CHF moved higher once again and hit a fresh Nov high ysterday, the blue resistance line and the orange resistance zone continue to keep gains in check. Taking ths fact into account, and combning it with sell signals generated by the indicators, we think that reversal in the coming days should not surprise us. If this is the case, and the exchange rate declines from here, the initial downside target from our last commentary (around 0.9988, where the bottom of the previous pullback is) will be in play in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts