Not much happened on the currency markets yesterday (and early today) and comments that we made regarding the individual currency pairs yesterday remain up-to-date. Therefore, in today’s alert we would like to focus on something else – the key currency index – the USD Index.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order at 1.1476; initial downside target around 1.0462)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

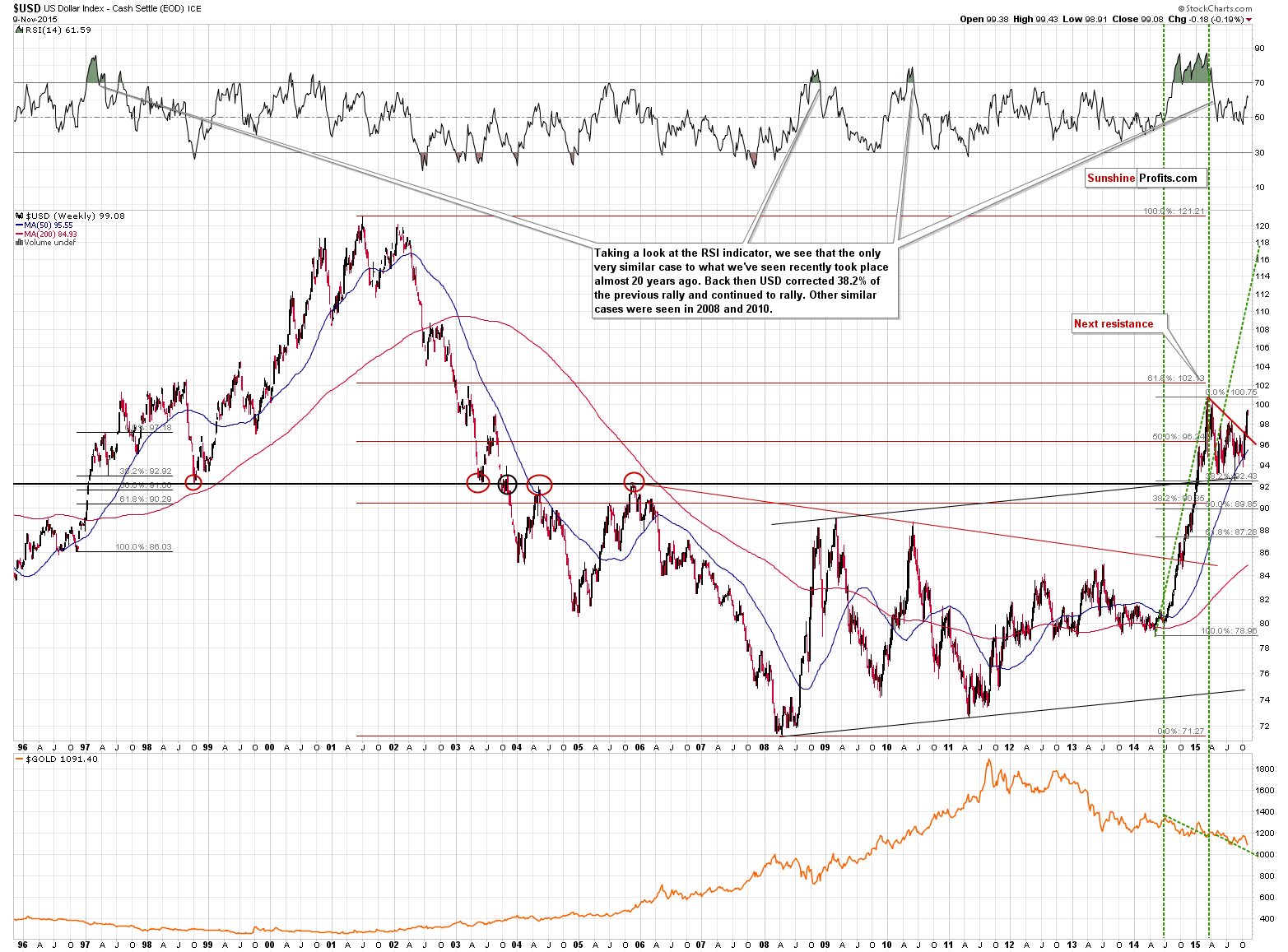

Let’s start with the long-term chart (charts courtesy of http://stockcharts.com):

The most important thing that we can say about the above chart is that it suggests that the next major upswing has just begun. From mid-2014 to early 2015 we saw a powerful rally that took the USD Index from below 80 to above 100. The USD Index was consolidating since that time. The critical thing is that it broke above the declining red resistance line, which suggests that the corrective decline is already over (we saw a few moves back to the 92 level which proved to be strong support at this time). The final confirmation will come when we see a breakout above the previous 2015 high – and we are likely to see one.

How high can the USD Index go? Much higher, because the rally following corrective patterns is likely to be similar to the one that preceded it. That’s what we marked with green lines on the above chart. The long-term upside target is at about 118 – yes, it’s much higher and may seem extreme, but the same kind of rally was already seen about a year ago.

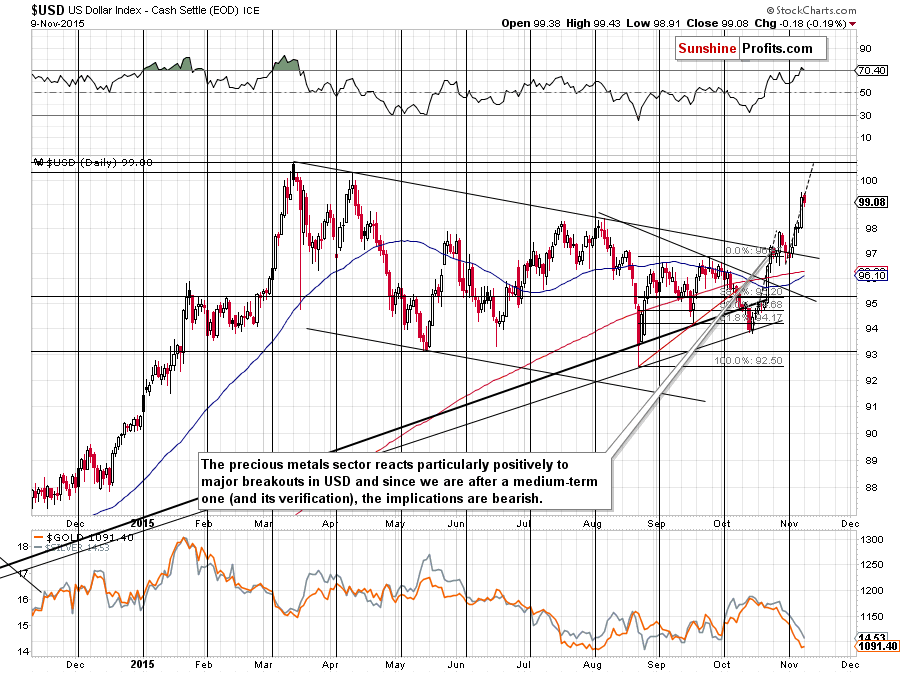

On a short-term basis, we see that the next strong resistance is indeed at the previous 2015 high. The USD Index may pause there, but it doesn’t seem that the rally will end there. Let’s keep in mind that the largest component of the USD Index is the EUR/USD rate and there are good fundamental reasons for this pair to decline (thus fueling rally in the index). The interest rates in the US are said to go up while at the same time the QE2 in the Eurozone is just around the corner.

Technically, the next strong resistance is at about 100 anyway, so based on the recent correction and the previous rally, we are likely to see a move to this level.

Summing up, the outlook for the USD Index is bullish for the short- and medium term even though we could see a bigger pause when the index moves to the 100 level or so. The above bodes very well for our short position in the EUR/USD pair – it seems that the profits from this trade will become even bigger in the coming days.

On an administrative note, there will be no regular Oil Trading Alert tomorrow, but if the situation changes dramatically, we will send you a quick note with our latest analysis and thoughts on that matter.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts