Earlier today, the Department of Labor reported that the number of initial jobless claims in the week ending October 3 declined by 13,000, beating analysts’ expectations for a 2,000 drop. As a result, the USD Index came back above 95.50, which pushed EUR/USD sharply lower. Thanks to this move, the exchange rate invalidated earlier breakout. Will we see further deterioration in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (a stop-loss order at 1.1887; the downside target around 1.0938)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

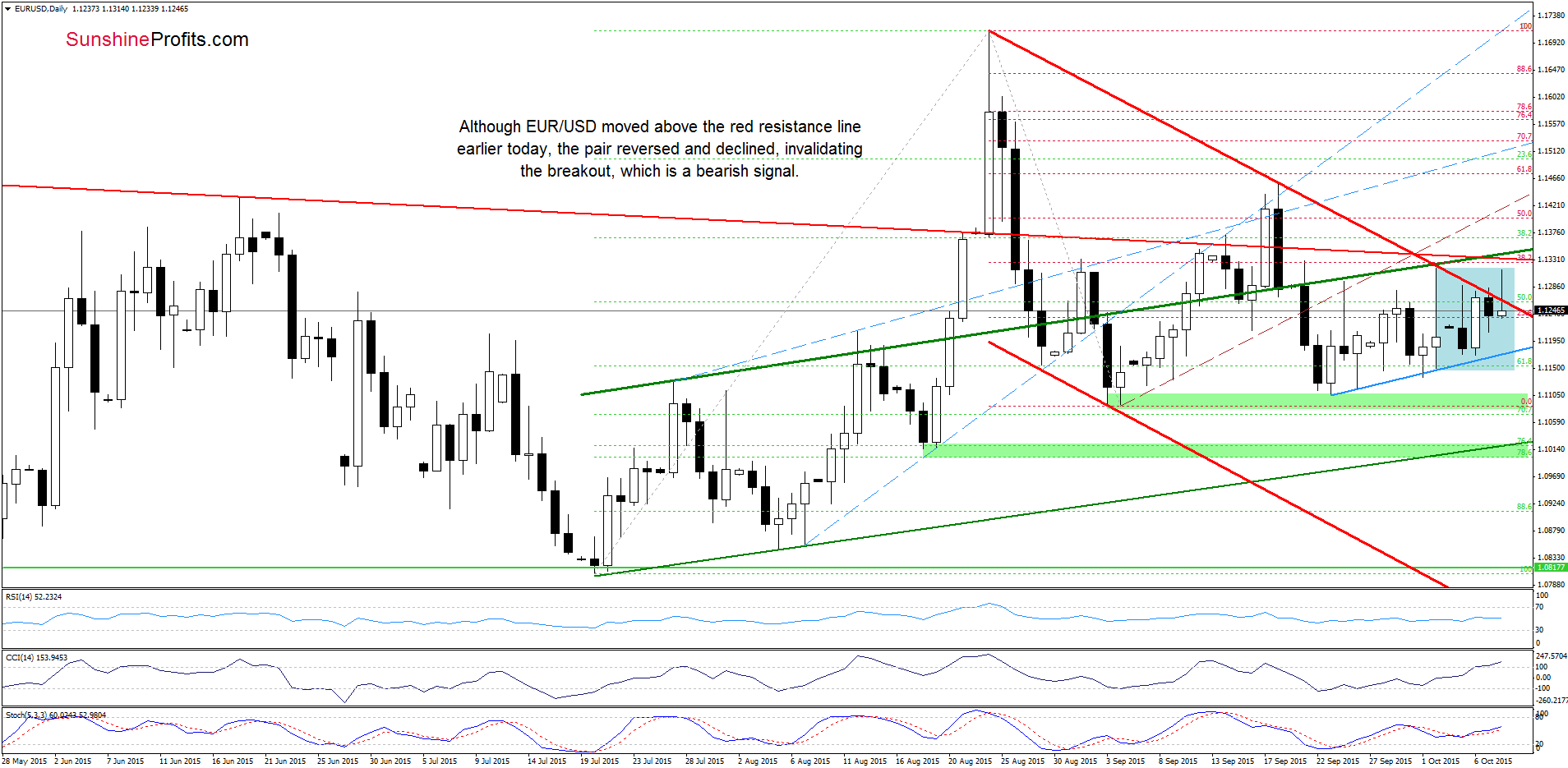

The overall situation in the medium term remains almost unchanged as EUR/USD is still trading under the long-term red declining resistance line and the orange resistance zone (reinforced by the bearish evening pattern), which together continue to keep gains in check. Today, we’ll focus on the very short-term changes.

On Tuesday, we wrote the following:

(…) as long as there is no successful breakout above the upper border of the red declining trend channel or a breakdown below the blue line, another sizable move is not likely to be seen and short-lived moves in both directions should not surprise us.

Earlier today, EUR/USD moved higher and broke above the upper border of the red declining trend channel. Despite this improvement, currency bulls didn’t manage to hold gained levels as the proximity to the resistance zone (created by the green and red resistance lines and the 38.2% Fibonacci retracement) encouraged their opponents to act. As a result, the exchange rate reversed and declined sharply, invalidating earlier breakout above the upper border of the formation. In our opinion, this is a negative signal, which suggests further deterioration (especially if EUR/USD closes today’s session under the above-mentioned red line). If this is the case, and the par moves lower from here, the initial downside target would be around 1.1172, where the blue support line is.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at 1.1887 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

The medium-term picture hasn’t changed much as the exchange rate is still trading in the consolidation under the blue resistance line. Will the daily chart give us more clues about future moves? Let’s check.

Quoting our Monday’s commentary:

(…) USD/JPY came back above the green line, invalidating earlier breakdown. Taking this fact into account and combining it with the current position of the indicators, we think that further improvement is just around the corner. If this is the case and the pair moves higher from here, the initial upside target would be around 120.67-120.92, where the brown resistance lines are.

Looking at the daily chart from today’s point of view, we see that currency bulls pushed the pair higher as we had expected. With this upswing USD/JPY approached our initial upside target, but the proximity to the resistance area triggered another test of the green support line earlier today. Taking this fact into account, we think that as long as there is no successful breakout above brown resistance lines or a breakdown below the green line, another sizable move is not likely to be seen and short-lived moves in both directions should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

Quoting our previous commentary on this currency pair:

(…) USD/CAD extended losses and slipped under the green support line yesterday. This is a negative signal, which suggests further deterioration. How low could the exchange rate go? (…) the recent downward move approached the pair to the previously-broken Mar 2009 high of 1.3062, which serves as the nearest support. Additionally, slightly below this level (around 1.3017) is also the lower border of the declining red trend channel, which could encourage currency bulls to act. (…) the daily CCI and Stochastic Oscillator are oversold, while the RSI approached the level of 30, which together suggests that reversal may be just around the corner.

As you see on the charts, the situation developed in line with the above scenario and USD/CAD rebounded slightly after a decline to the lower border of the declining red trend channel and the green support zone. Although the pair gave up some gains earlier today, the current position of the indicators (the Stochastic Oscillator generated a buy signal, while the CCI is very close to doing the same) suggests that further improvement in the coming days is more likely than not. If this is the case, and the pair increases from here, the initial upside target would be around 1.3194, where the previously-broken green support/resistance line is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts