Although AUD/USD hit a fresh 2015 low, the pair rebounded in the following hours supported by a weaker greenback. But did this upswing change anything in the short-term picture of the exchange rate?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

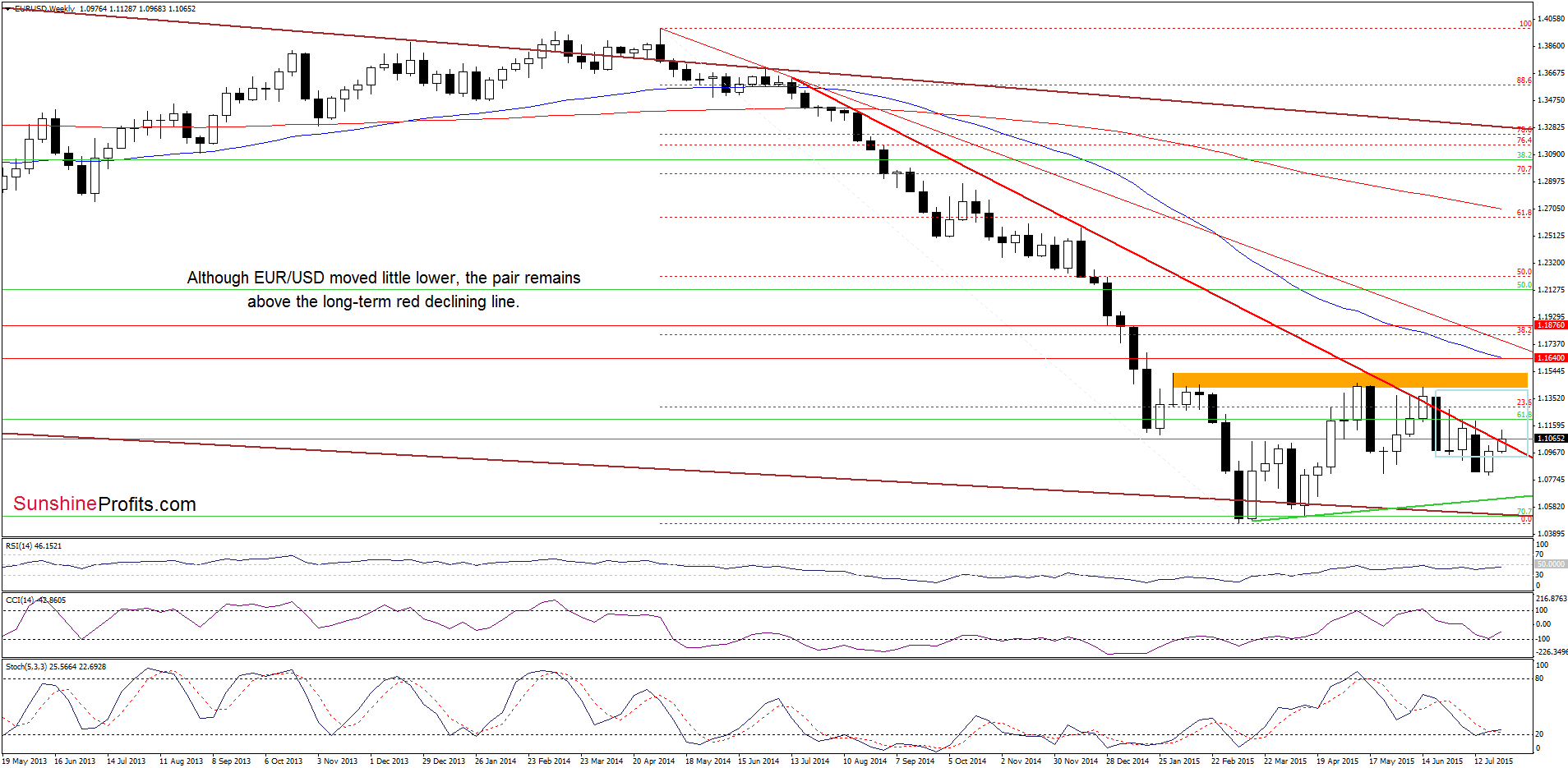

Looking at the weekly chart, we see that although EUR/USD moved little lower, the exchange rate remains slightly above the previously-broken long-term red declining resistance line. Nevertheless, when we take a closer look at the weekly chart, we’ll notice that there were several intra-week breakouts above this major resistance in the previous weeks, but none of them was successful. Therefore, in our opinion, the current breakout will be bullish only if we see a weekly close above this key support/resistance line.

What can we infer from the very short-term picture? Let’s examine the daily chart and find out.

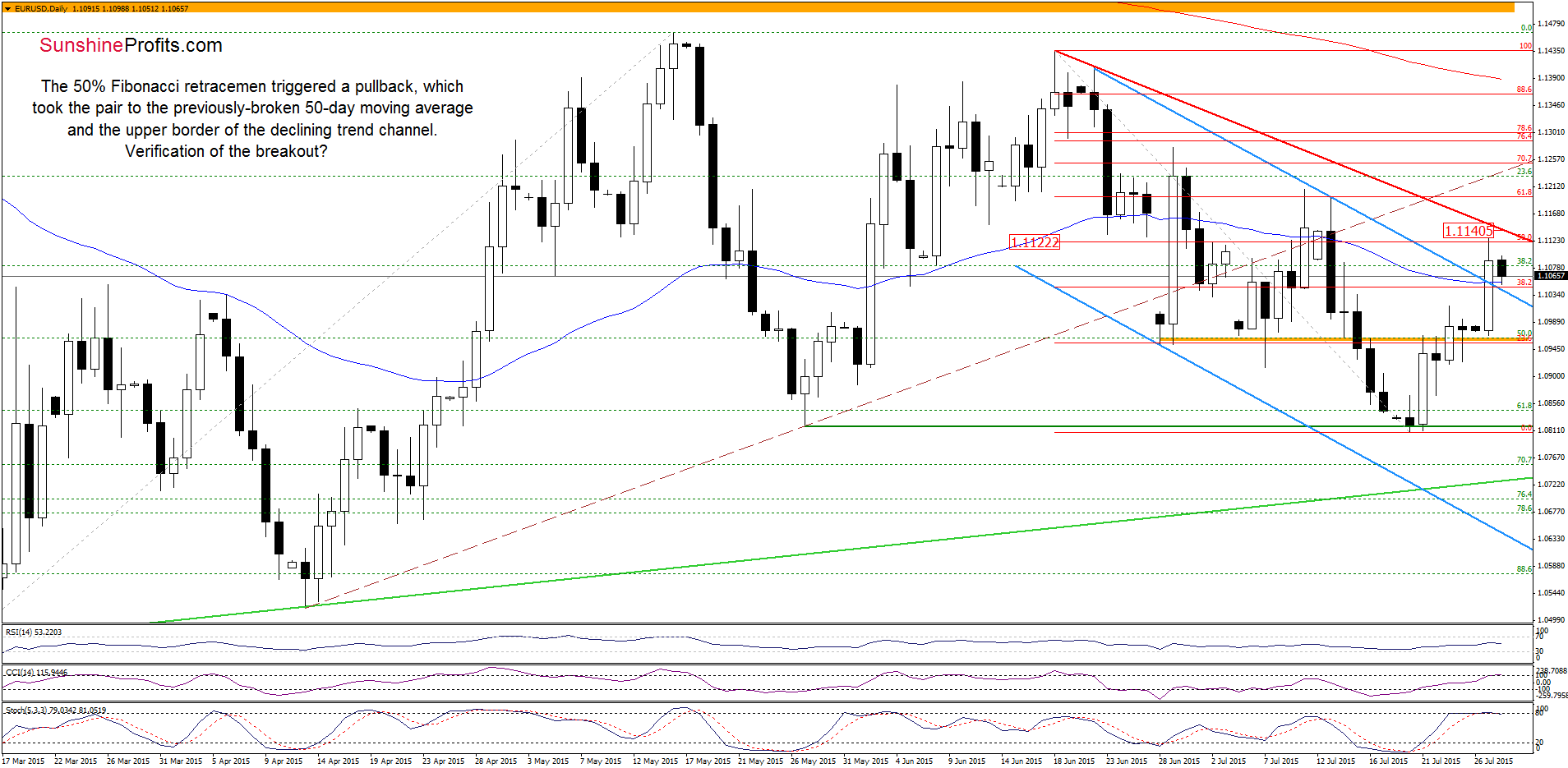

From this perspective, we see that the 50% Fibonacci retracement based on the entire Jun-Jul decline triggered a pullback, which took the exchange rate slightly below the previously-broken 50-day moving average and the upper border of the declining blue trend channel earlier today. Despite this move currency bulls managed to push the pair higher. Nevertheless, taking into account the current position of the indicators, it seems that another attempt to move lower might be just around the corner. Therefore, we think that today’s closing price will give us more valuable clues about future moves. Why? If we see a daily close below the blue support line, it would be a negative signal, which will likely trigger further deterioration. On the other hand, if EUR/USD rebounds from here, it would be a positive event, which will mean that today’s downswing is just a verification of yesterday’s breakdown. In this case, the exchange rate will likely test the red declining resistance line in the coming day(s).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

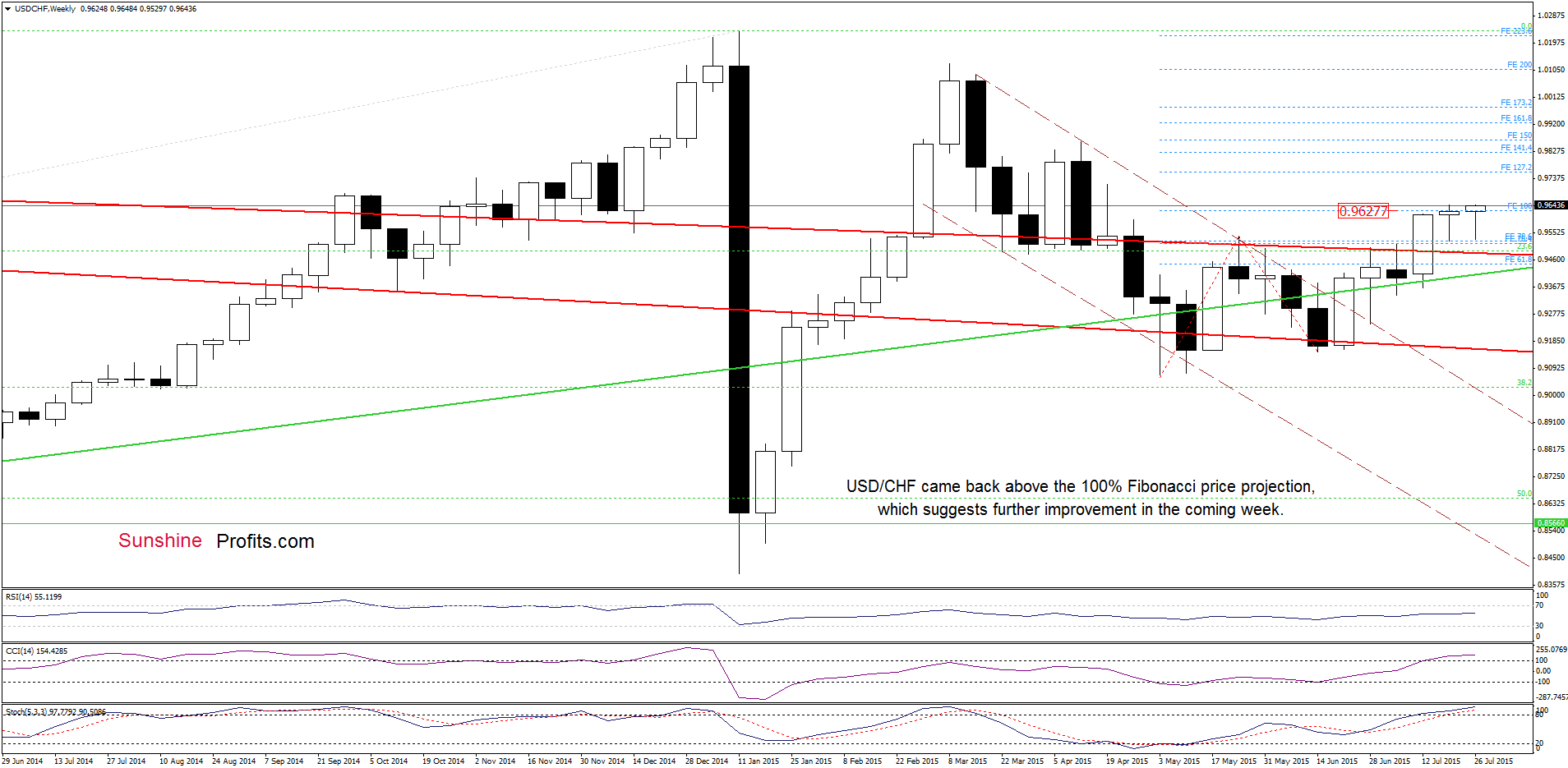

The situation in the medium term has improved as USD/CHF came back above the 100% Fibonacci price projection (marked with blue), invalidating earlier breakdown. This is a positive signal, which suggests further improvement.

Will the very short-term picture confirm this pro-growth scenario? Let’s examine the daily chart and find out.

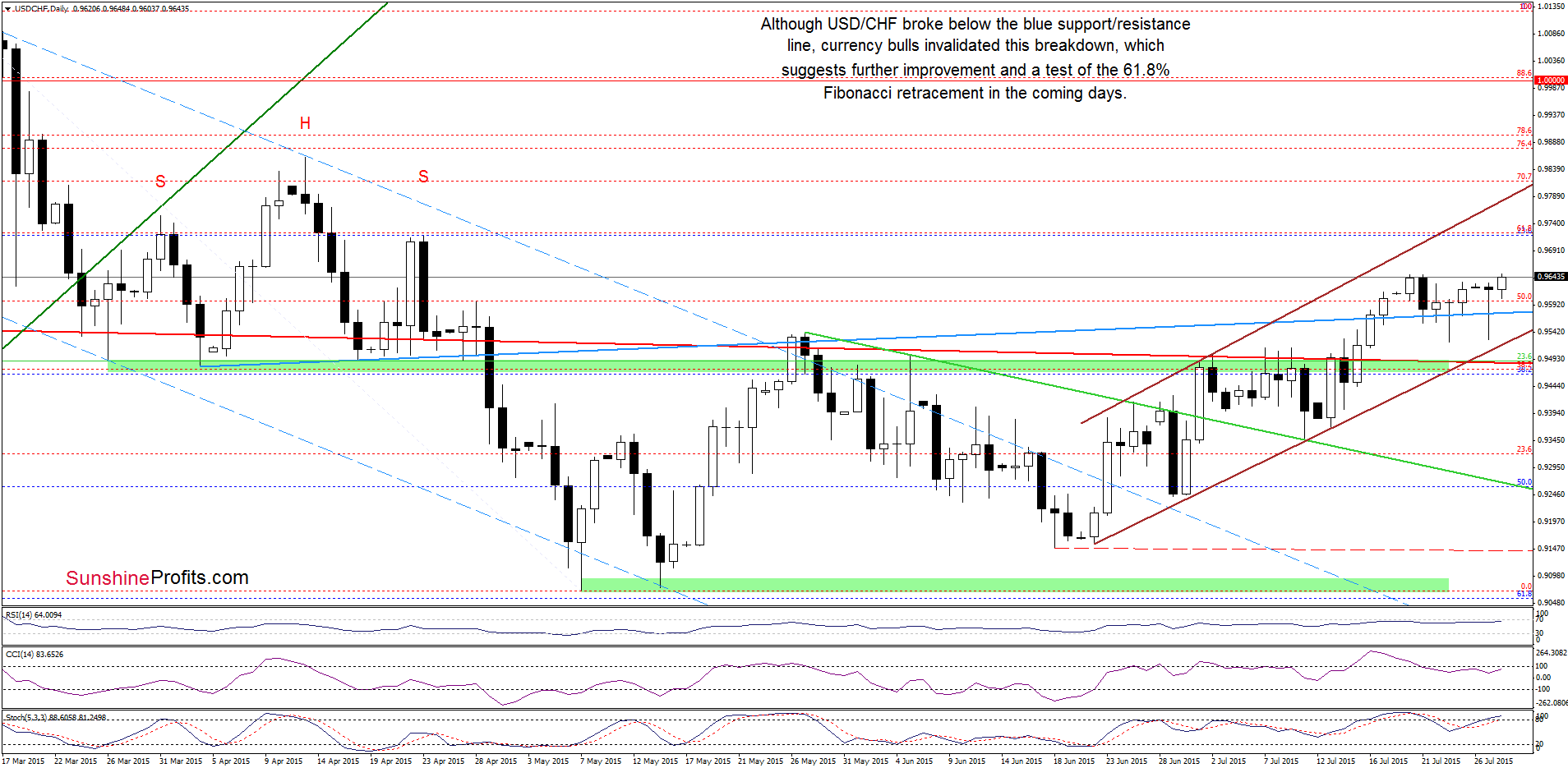

On the above chart, we see that currency bulls managed to stop their opponents and the pair rebounded, invalidating small breakdown under the blue line (similarly to hat e saw on Thursday). Additionally, USD/CHF closed yesterday’s session above this line, which encouraged currency bulls to act earlier today. As a result, USD/CHF broke above the Jul high, which suggests further improvement and a test of the 61.8% Fibonacci retracement in the coming days.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

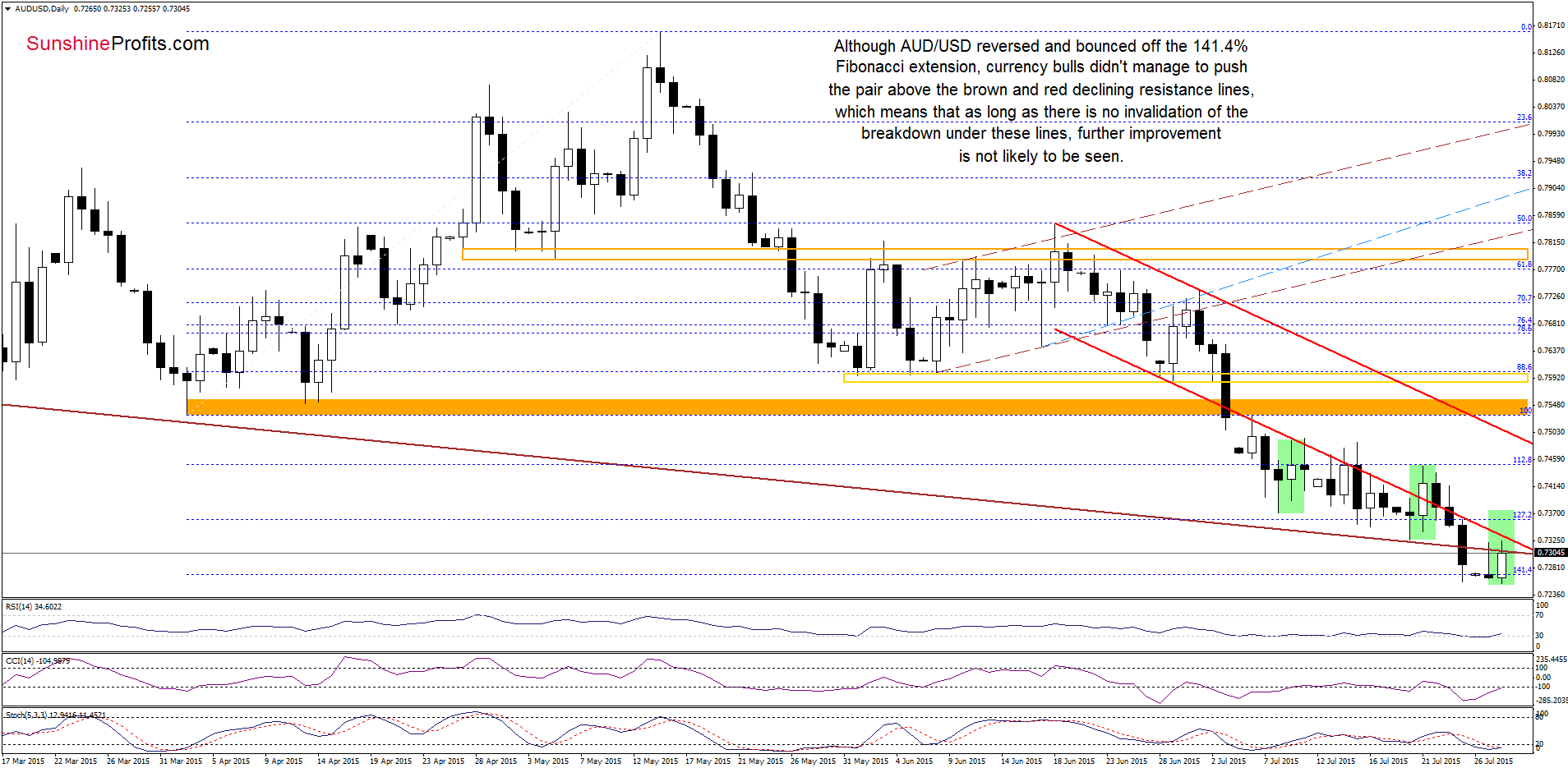

AUD/USD

Looking at the daily chart, we see that although AUD/USD reversed and bounced off the 141.4% Fibonacci extension earlier today, currency bulls didn’t manage to push the exchange rate above the previously-broken brown and red declining resistance lines. Additionally, the current rebound is much smaller than previous upswings (marked with green), which suggests that currency bulls may be not as strong as it seems at the first sight. Therefore, in our opinion, further improvement will be more likely and reliable only if we see an increase above these resistance lines and the upward move will be bigger than previous ones. Until this time, another downswing should not surprise us. Please note that if currency bears manage to push the exchange rate lower, we may see a decline even to (around 0.7097-0.7200, where the green support zone based on the 76.4% and 78.6% Fibonacci retracement levels (marked on the weekly chart) is.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to travel plans there will be no regular Forex Trading Alerts on Thursday and Friday. Thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts