Although yesterday’s data from the U.S. Department of Labor, the Commerce Department and the Federal Reserve Bank of Philadelphia disappointed market’s participants and pushed the greenback little lower, the USD Index rebounded and came back above 92.50 earlier today. What impact did this move have on major currency pairs? Did it change their outlooks?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: long (stop loss: 0.7940; initial upside target: 0.8320)

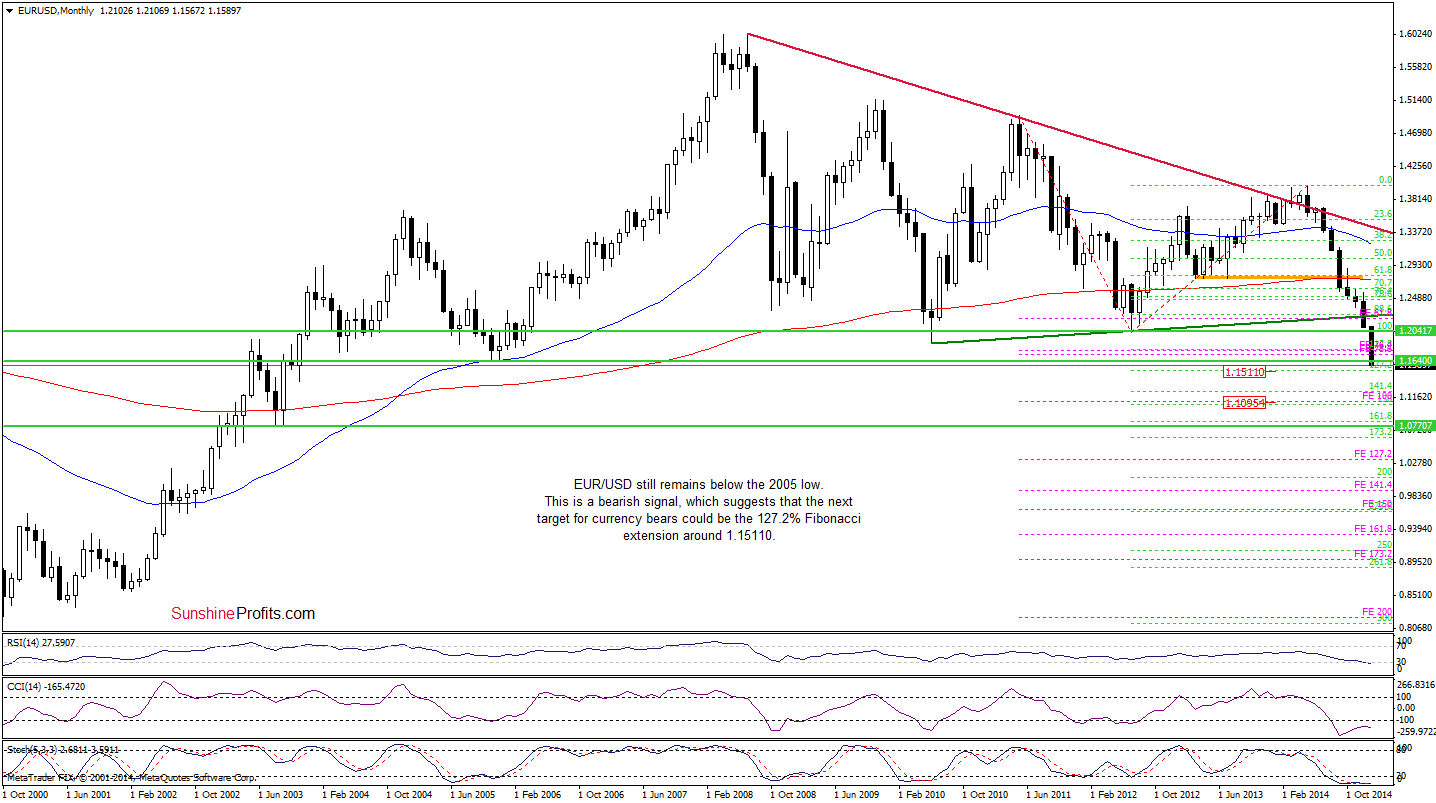

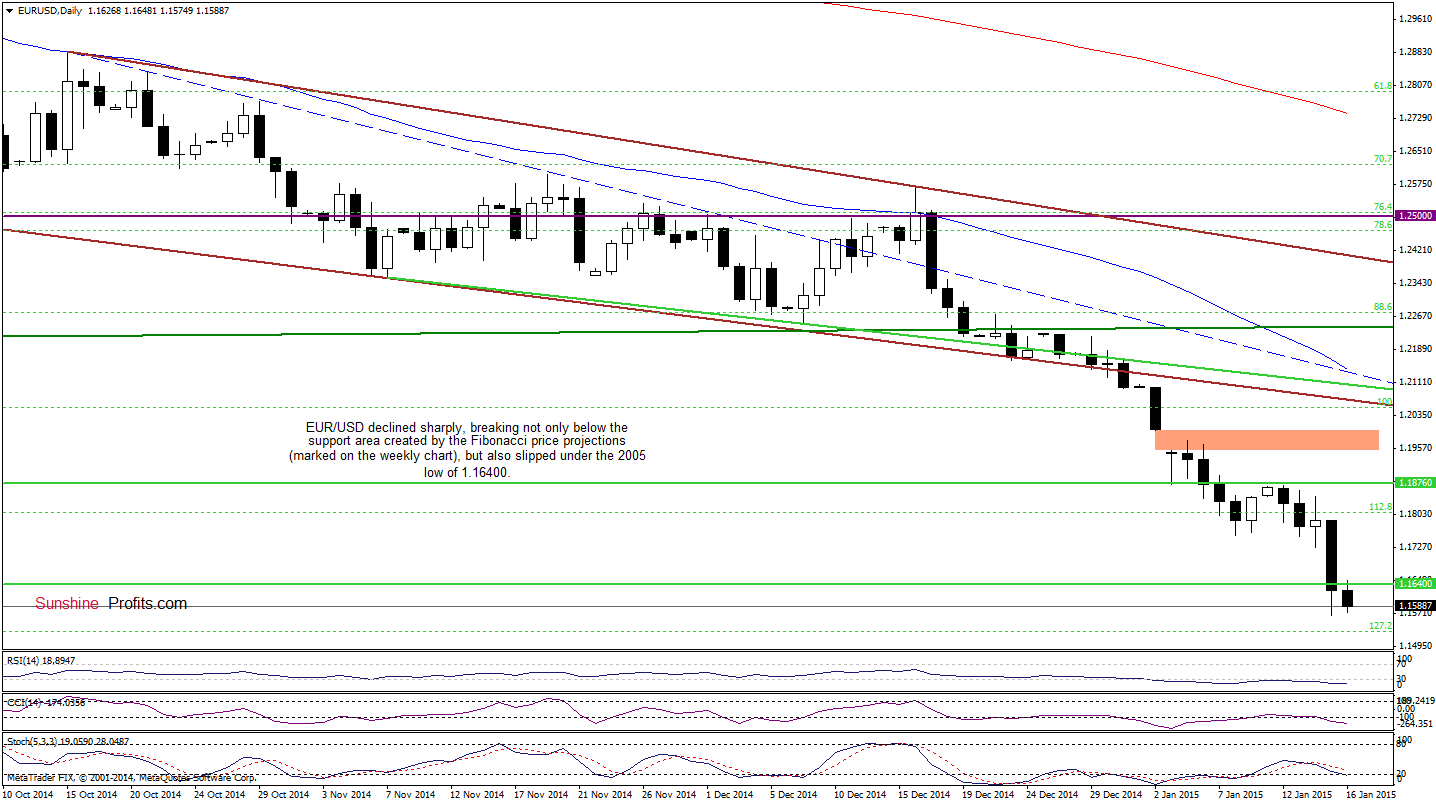

EUR/USD

Looking at the daily chart, we see that although EUR/USD rebounded slightly and invalidated the breakdown below the Nov 2005 low, currency bulls didn’t manage to hold gained levels. As a result, the exchange rate reversed and dropped below its key support/resistance line once again. Therefore, we believe that our last commentary is up-to-date:

(…) the next downside target would be around 1.15110, where the 127.2% Fibonacci extension (based on the 2012-2014 rally) is.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

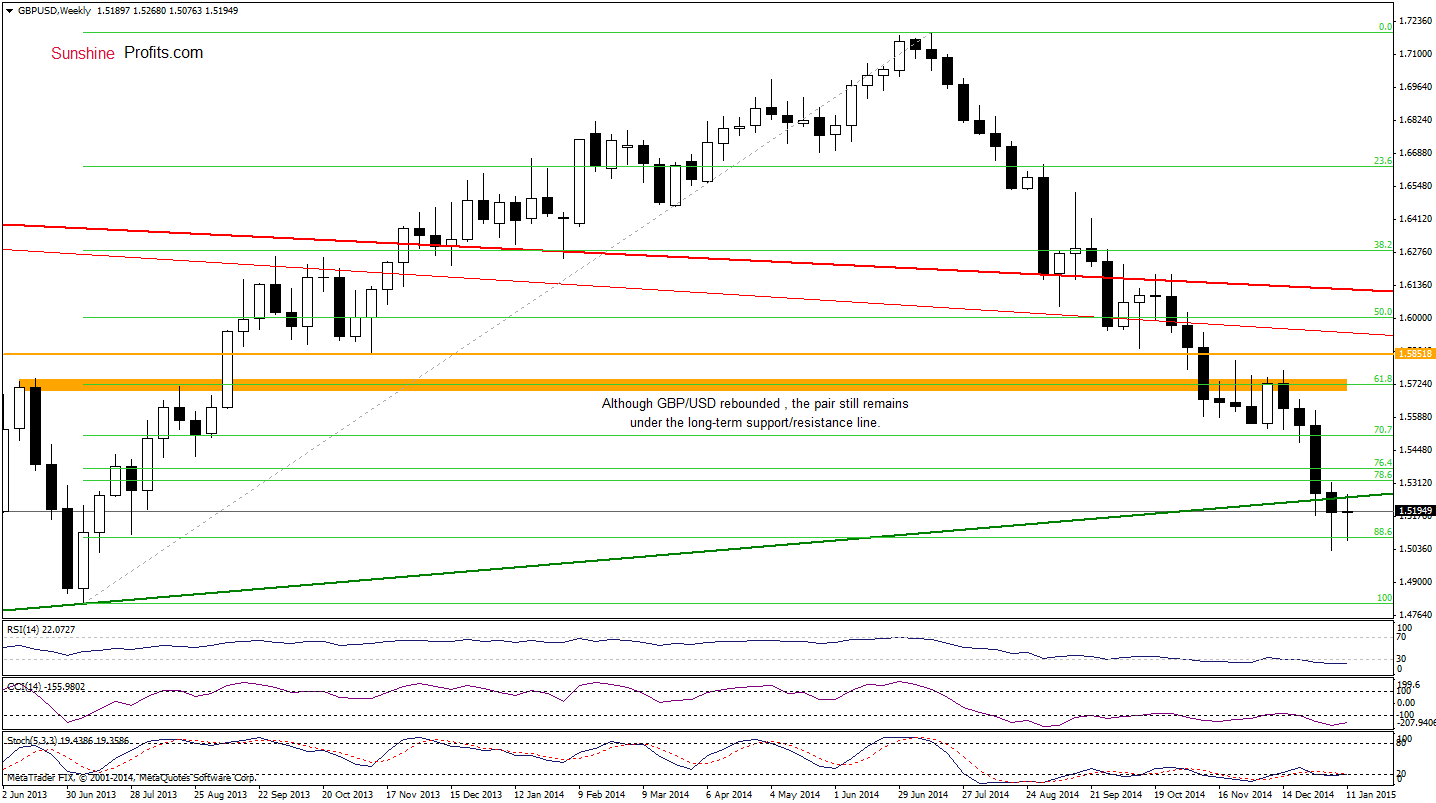

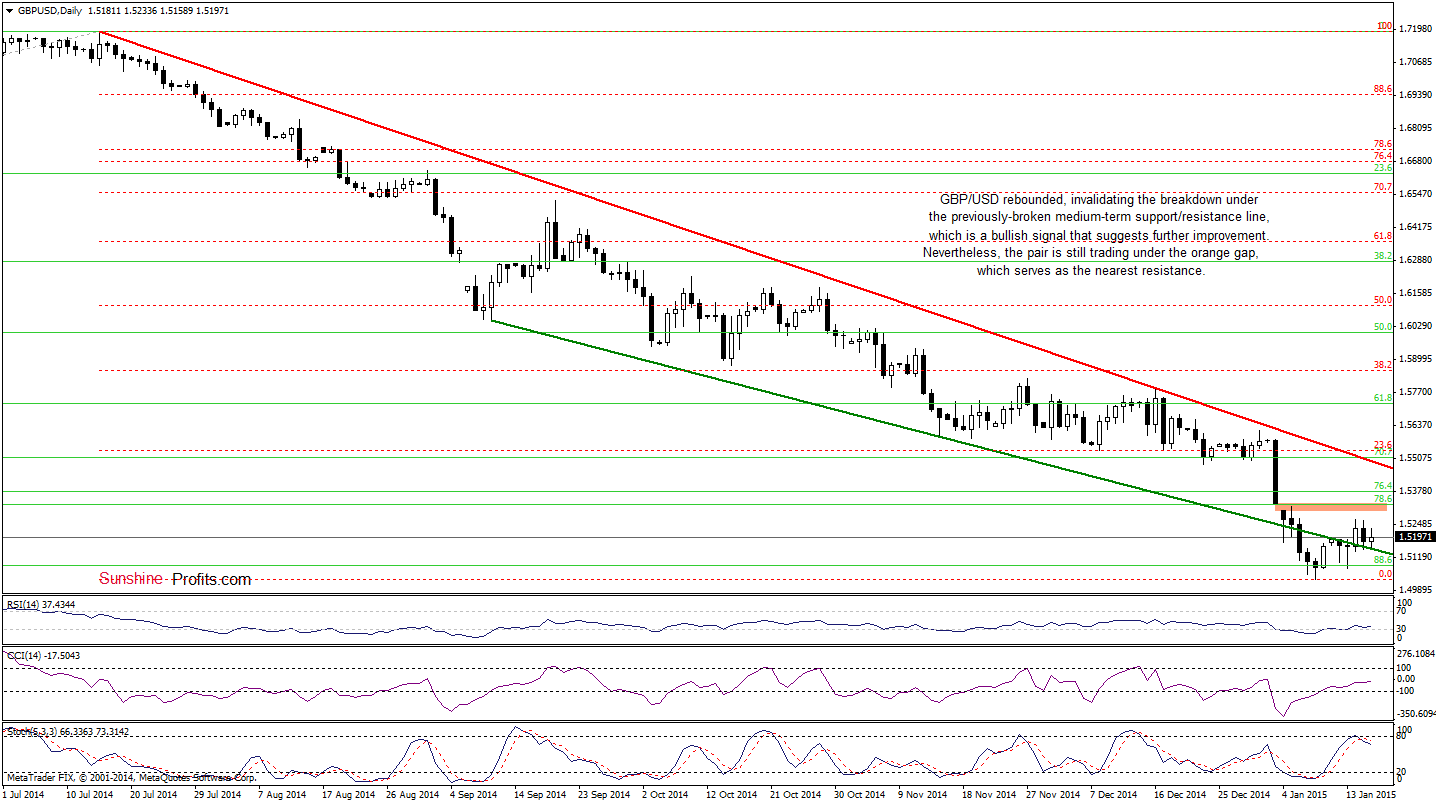

GBP/USD

From the daily perspective, we see that GBP/USD extended gains and invalidated the breakdown below the medium-term green support/resistance line earlier this week. This is a bullish signal, which suggest further improvement, however, we should keep in mind that the long-term resistance line (marked on the weekly chart) and the orange gap (seen on the daily chart) are still in play. This means that as long as there is no invalidation of the breakdown below them, further improvement and a sizable upward move is questionable. Nevertheless, if we see such price action, we’ll consider opening long positions. Until this time, waiting on the sidelines for a profitable opportunity is the best choice.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

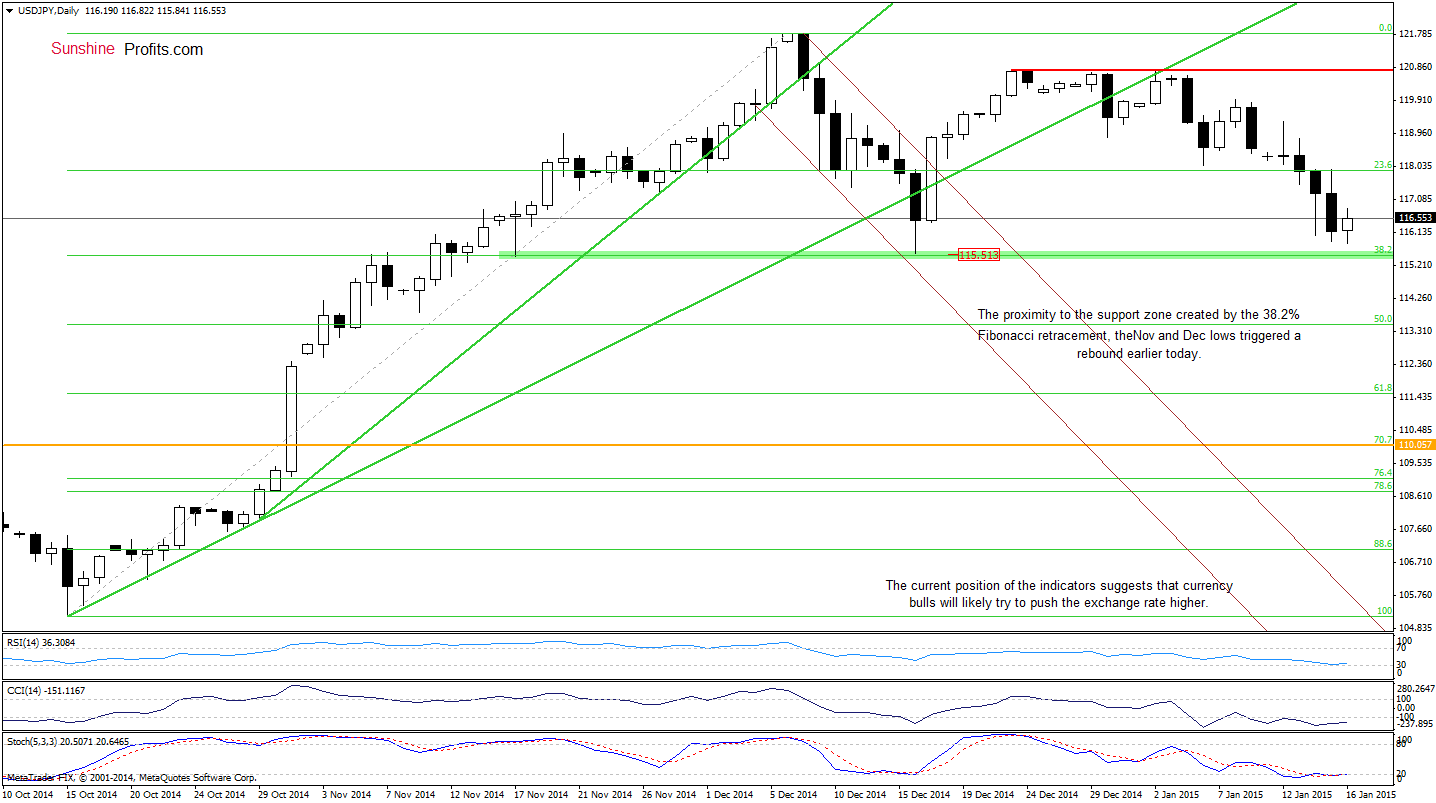

USD/JPY

From the medium-term perspective, we see that the 61.8% Fibonacci retracement triggered a correction. How did this move affected the short-term picture? Let’s examine the daily chart and find out.

Quoting our last commentary on this currency pair:

(…) we think that the pair will extend losses in the coming days and the initial downside target will be the 38.2% retracement at 115.51. (…) this area is supported by the Dec 16 low, which suggests that the pair could rebound from here later this week.

As you see on the daily chart, the exchange rate approached our downside target area, which triggered a rebound earlier today. Taking this fact into account, and combining it with the current position of the indicators (the Stochastic Oscillator generated a buy signal, while the CCI is close to doing it), it seems that currency bulls will try to push the exchange higher in the coming day(s). If this is the case, the initial upside target would be the previously-broken 23.6% Fibonacci retracement and yesterday’s high of 117.93.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

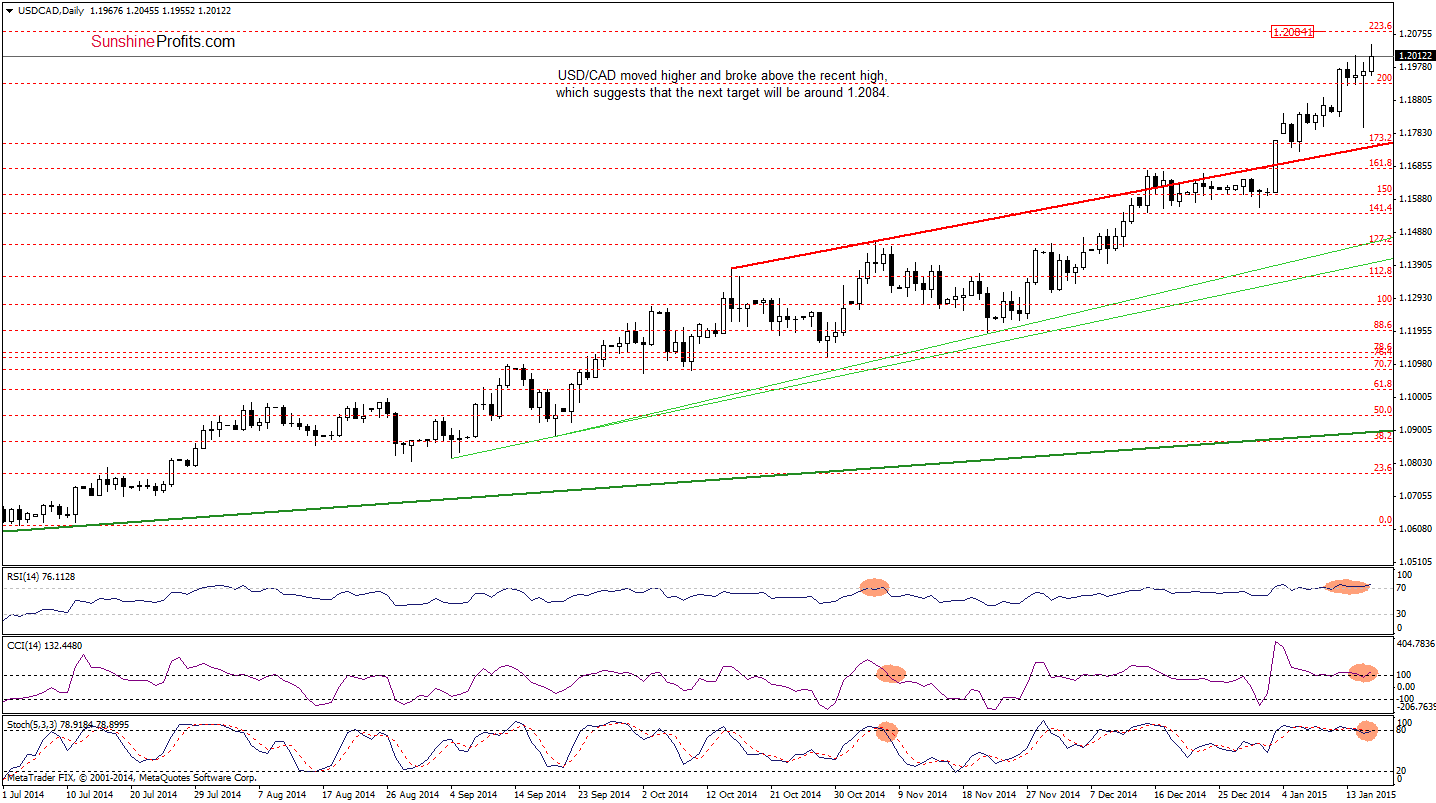

USD/CAD

Quoting our last commentary on this currency pair:

(...) we will likely see further improvement and an increase to the 70.7% Fibonacci retracement (around 1.1977) seen on the weekly chart.

From today’s point of view, we see that the situation developed in line with the above-mentioned scenario and USD/CAD reached our upside target. As you see on the daily chart, the exchange rate broke above the recent high earlier today, which suggests further improvement and an increase to around 1.2084, where the 223.6% Fibonacci extension is. However, taking into account a breakout above the 70.7% Fibonacci retracement, it seems that we could see a rally even to 1.2186-1.2265, where the orange resistance zone (marked on the weekly chart) is.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

Yesterday, we wrote the following:

(…) USD/CHF declined sharply, approaching the Mar 2014 lows, which serve as the nearest support. If this area is broken, it seems that the pair will test the strength of the previously-broken long-term red, declining support line (currently around 0.84144).

As you see on the monthly chart, the situation developed in tune with the above-mentioned scenario and USD/CHF reached our downside target. This solid support encouraged currency bulls to act, which resulted in a rebound earlier today. With this upward move, the pair invalidated a breakdown below the Mar 2014 lows and the 50% Fibonacci retracement, which is a positive signal. However, taking into account the fact that the pair is trading slightly above them and the recent huge volatility, it seems that a test of this support area in the coming day(s) should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

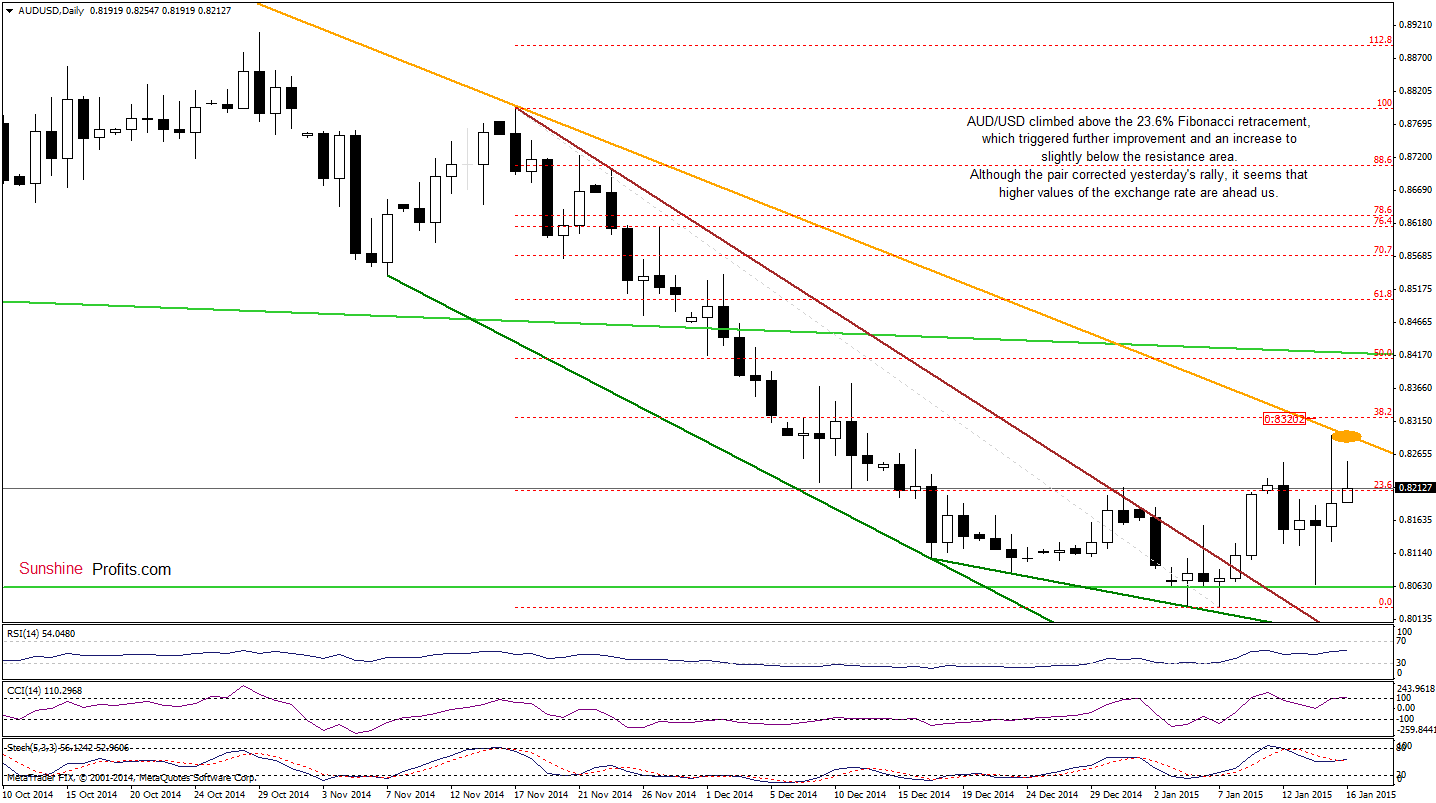

AUD/USD

Looking at the daily chart, we see that AUD/USD climbed above the 23.6% Fibonacci retracement, which triggered further improvement. With yesterday’s upswing the pair approached the orange declining resistance line, which resulted in a pullback. Despite this drop, an invalidation of the breakdown under the 2010 low and its positive effect is still in play, which suggests that higher values of the exchange rate are still ahead us.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.7940a and initial upside target at 0.8320. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

The markets in the US will be closed on Monday, Jan 19, 2015, so we will post our next Forex Trading Alert on Tuesday, Jan 20, however if something urgent happens, we will post in on Monday anyway.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts