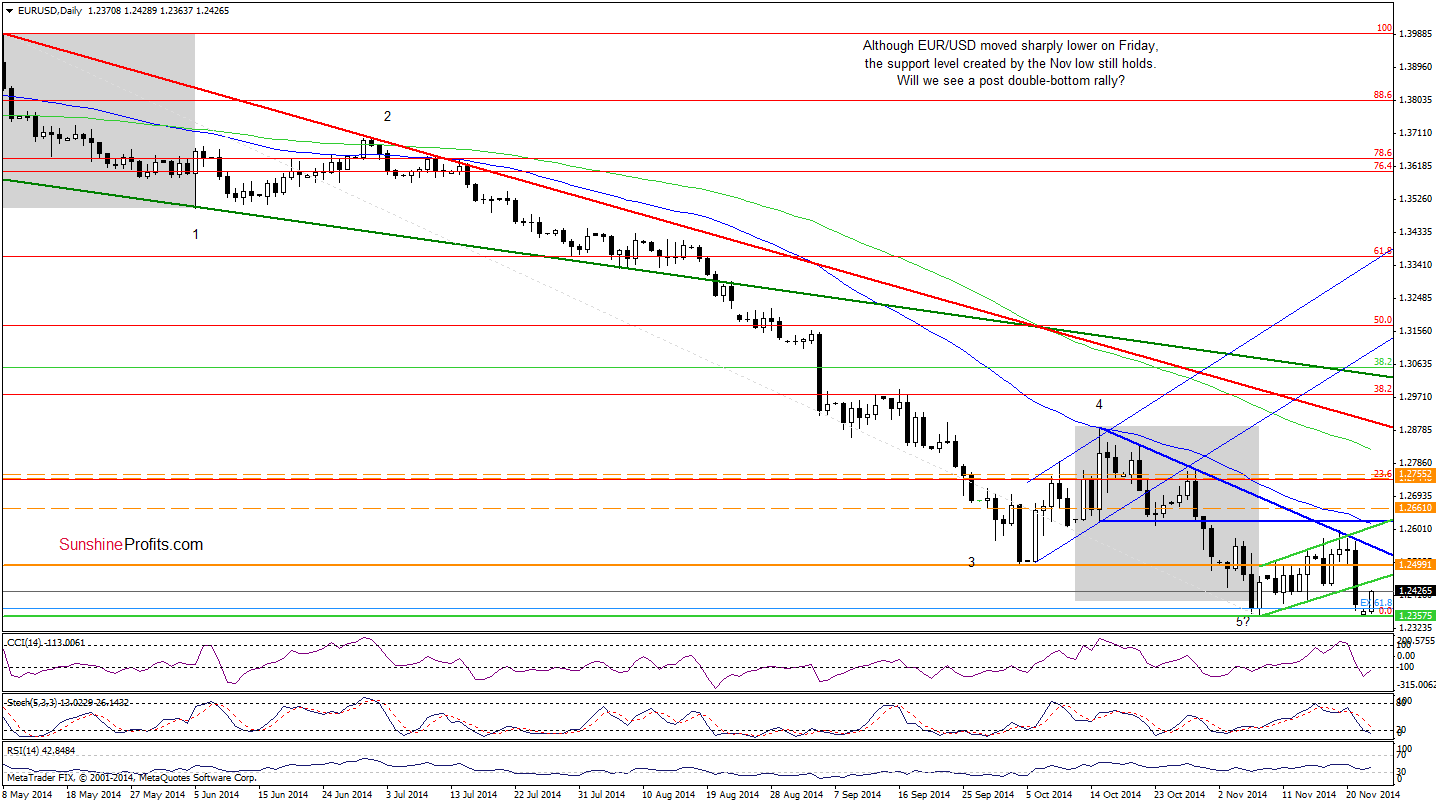

Earlier today, Germany’s Ifo business climate index rose to 104.7, beating economists‘ expctations for a decline to 103.0. This month’s increase supported the common currency and EUR/USD bounced off the previous lows. Will we see a post double-bottom rally in the coming days?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: short (stop-loss: 1.5763; initial price target: 1.5307)

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

The medium-term picture has improved slightly as EUR/USD bounced off the Nov and last week’s low. Today we’ll focus on the very short-term changes.

On Friday, we wrote that currency bears pushed the pair below the lower border of the rising trend channel, which suggested a test of the strength of the Nov low of 1.2357. Looking at the above chart, we see that the situation developed as we expected and EUR/USD almost touched the Nov low earlier today. As you see on the daily chart, this solid support withstood the selling pressure, which resulted in a rebound in the following hours. This is a positive signal, which suggests that we could see a post double-bottom rally in the coming days (especially when we factor in the current position of the indicators). In our opinion, this scenario will be even more likely if the exchange rate invalidates the breakdown below the previously-broken lower line of the trend channel (currently around 1.2457). If this is the case, the next upside target would be the barrier of 1.2500 and the blue declining resistance line (around 1.2550), which stopped the rally in the previous week. Nevertheless, we should keep in mind that as long as the pair remains under its first resistance line, another attempt to move lower can’t be ruled out.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

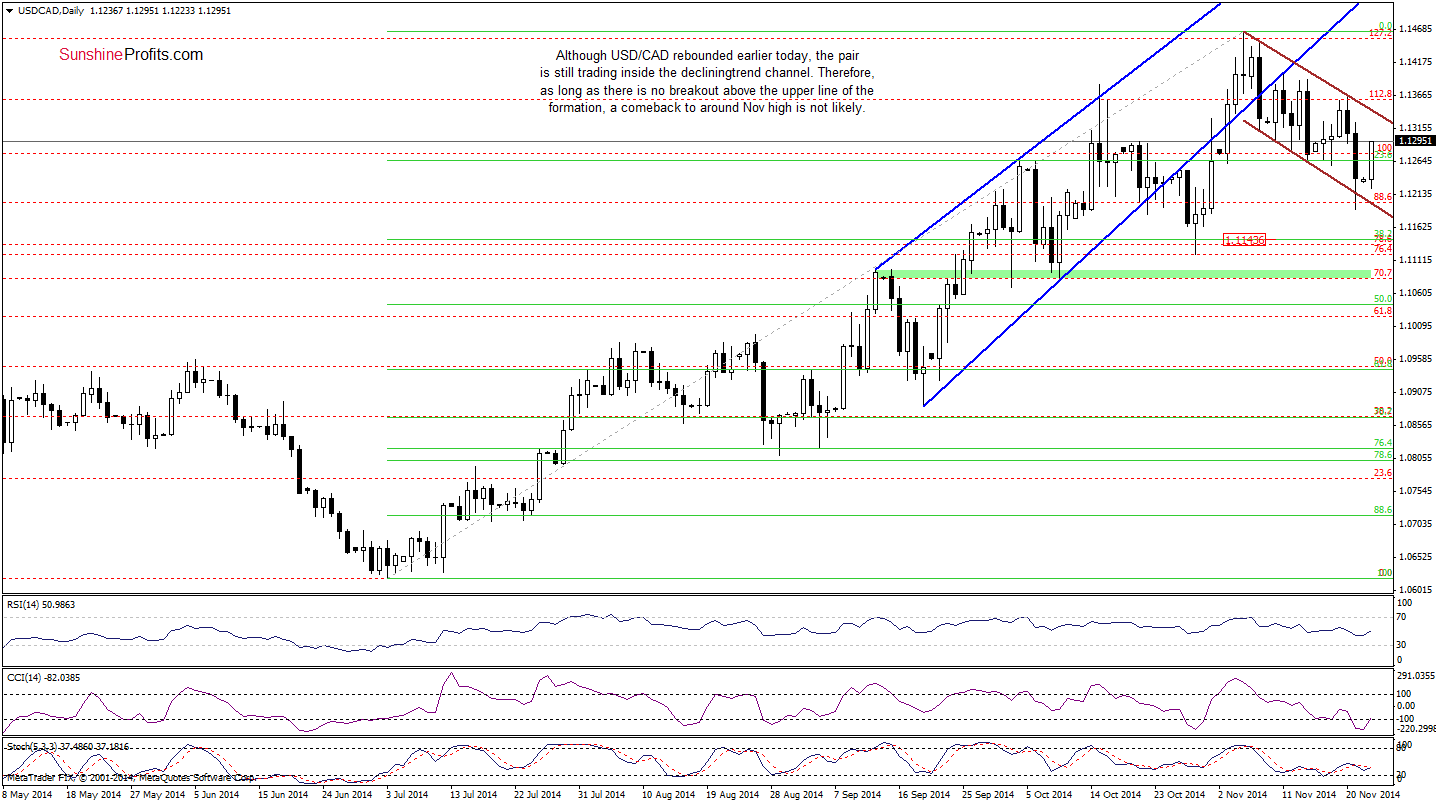

USD/CAD

The medium-term outlook remains unchanged as the strong resistance zone created by the upper line of the rising trend channel and the 127.2% Fibonacci extension still holds.

Has anything changed in the very short-term picture? Let’s check.

From this perspective, we see that although USD/CAD declined sharply on Friday, the lower border of the declining trend channel stopped further deterioration. As a result, the exchange rate reversed and invalidated the breakdown below this support line, which triggered a rally earlier today. Despite this improvement, the pair is still trading inside the trend channel, which means that as long as there is no breakout above the upper line of the formation, the space for further gains seems limited. However, taking into account the current position of the indicators, it seems that currency bulls will try to break above the resistance line in the coming days. If they succeed, we will likely see an increase to around the Nov high.

Please note that while other currencies are relatively weak compared to the USD (especially the Japanese yen), the Canadian dollar is holding up relatively well. Other currency exchange rates are either near their November extremes, but the USD/CAD is visibly far from it. Consequently, when we decide to short the USD, the USD/CAD pair will be first or one of the first pairs that we will consider using.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed with bearish bias

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

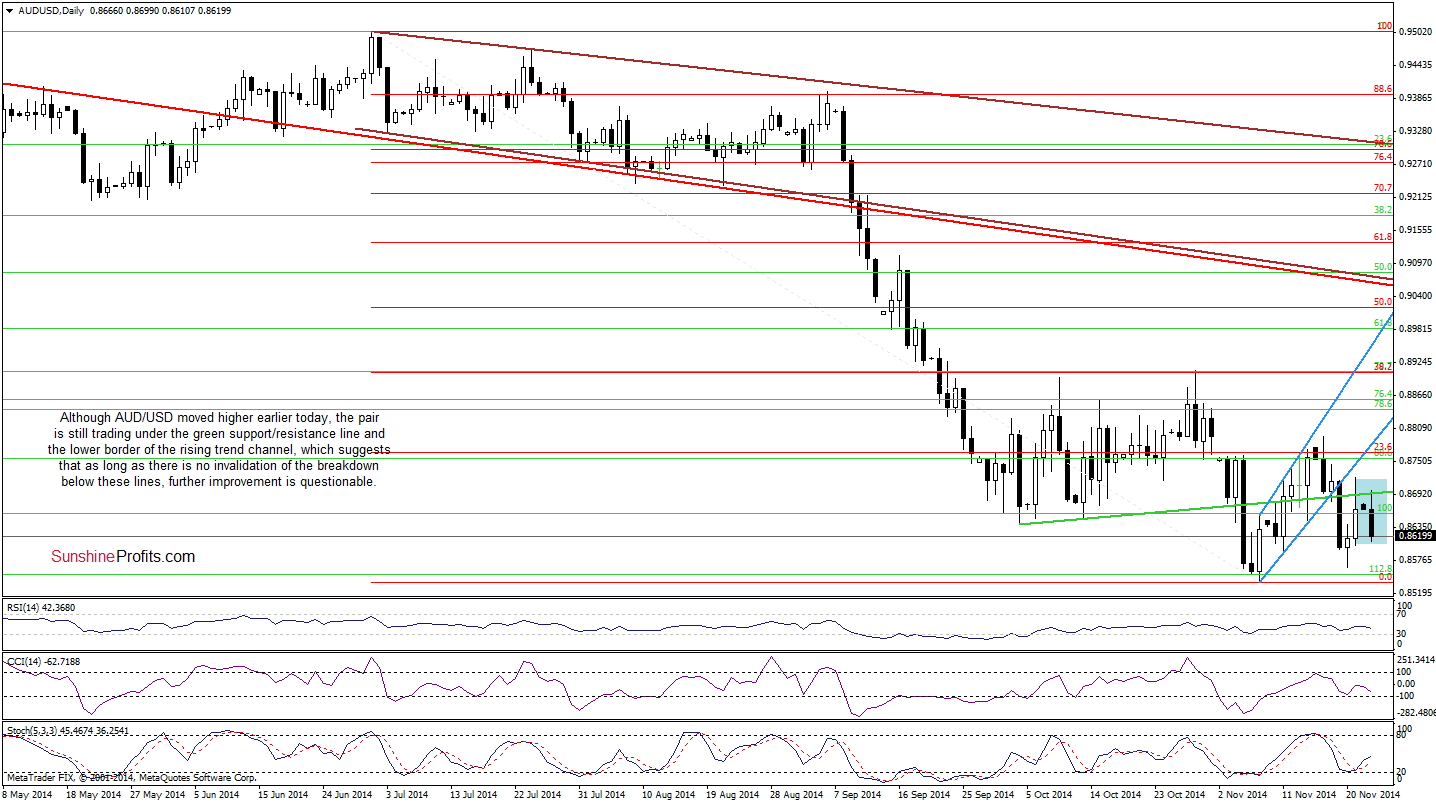

AUD/USD

Looking at the daily chart, we see that although currency bulls tried to push AUD/USD above the previously-broken green support/resistance line earlier today, they failed once again (similarly to what we saw on Friday). This bearish signal triggered a pullback, which approached the pair to the Friday’s low. At this point, it’s worth noting that the recent days have formed a consolidation, which means that if the exchange rate drops below the lower line of the formation (0.8604), we’ll see a test of the strength of the last week’s low of 0.8565 or even the Nov low in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, the markets in the U.S. will be closed on Thursday and we expect the trading activities to be limited on Friday as well. Consequently, we there will be no Forex Trading Alerts on Thursday and Friday. The alerts will be posted until Wednesday and will then be posted normally beginning on Monday, Dec 1.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts