Earlier today, the Labor Department reported that the initial jobless claims in the week ending November 8 increased by 12,000, missing analysts expectations for a 4,000 rise. Although these disappointing numbers pushed the greenback lower against major currencies, USD/JPY still remains in a consolidation. Is this a sign of strength?

In our opinion, the following forex trading positions are justified - summary:

EUR/USD

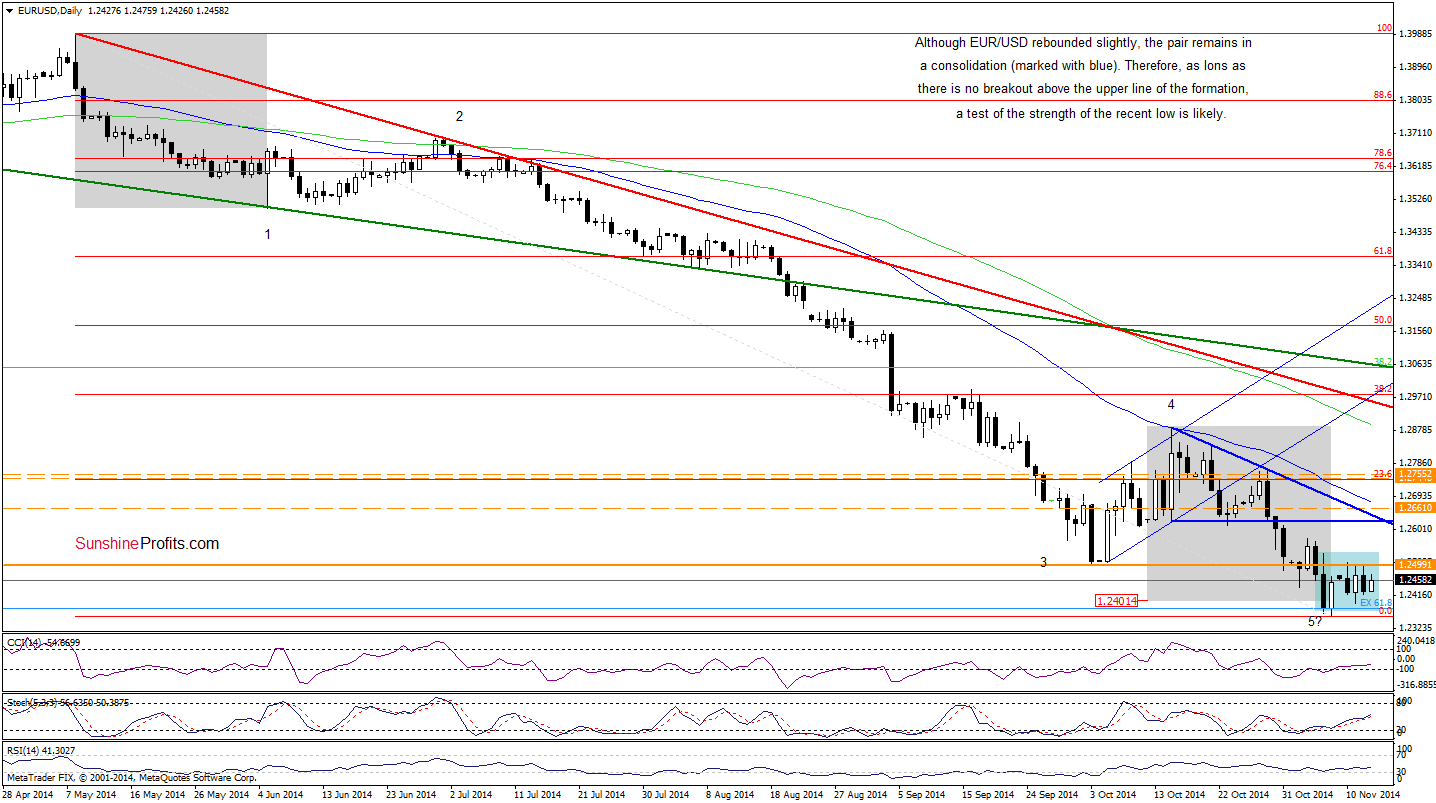

The medium-term picture of EUR/USD hasn’t changed much as the exchange rate is still trading around the 127.2% Fibonacci extension. Will the daily chart show us where will the pair head next?

From this perspective, we see that although EUR/USD rebounded slightly earlier today, the pair is still trading in the consolidation (marked with blue) under the key resistance level of 1.2500. Taking this fact into account, we think that as long as there is no breakout above the upper line of the formation (and an invalidation of the breakdown below 1.2500), another upward move is not likely to be seen and a test of the strength of Tuesday’s low of 1.2394 is likely.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Quoting our last commentary on this currency pair:

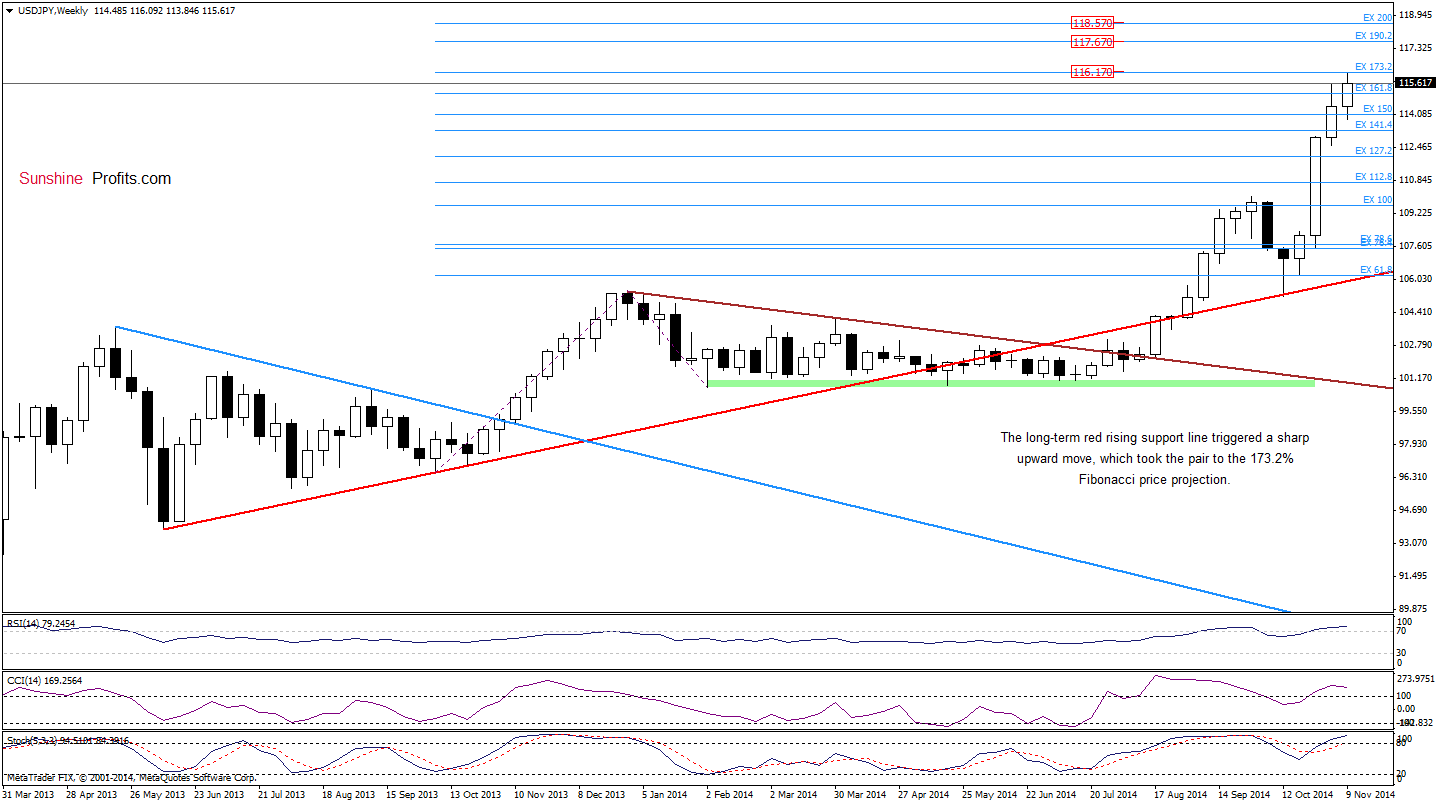

(…) Although the exchange rate gave up some gains, the pair is still trading near the fresh multi-year high, which suggests that further improvement is likely. If this is the case, the next target for currency bulls would be the 173.2% Fibonacci price projection at 116 (…)

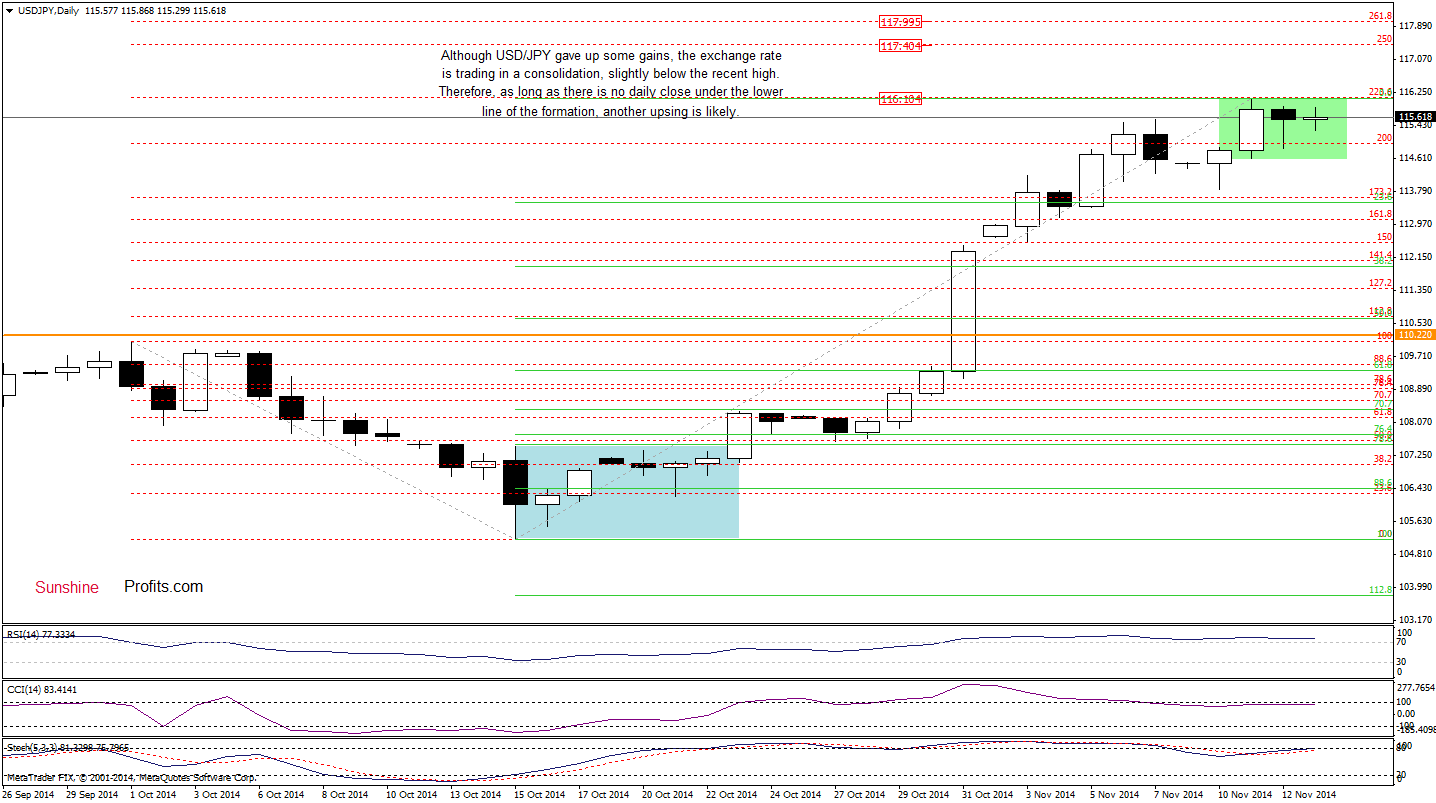

Looking at the daily chart, we see that after short-lived consolidation USD/JPY increased as we expected. In this way, the pair hit a fresh multi-year high and reached our upside target on Wednesday. What’s next? Taking into account the fact that the exchange rate is consolidating once again we could see another upswing in the coming days. In this case, the initial upside target would be the 250% Fibonacci extension at 117.40 or even the solid resistance zone (marked on the monthly chart) around 117.60-118.57. Nevertheless, we should keep in mind that there are negative divergences between the CCI, Stochastic Oscillator and the exchange rate, while the monthly RSI climbed to its highest level since Dec 2013, which suggests that a pause is just around the corner.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bullish

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

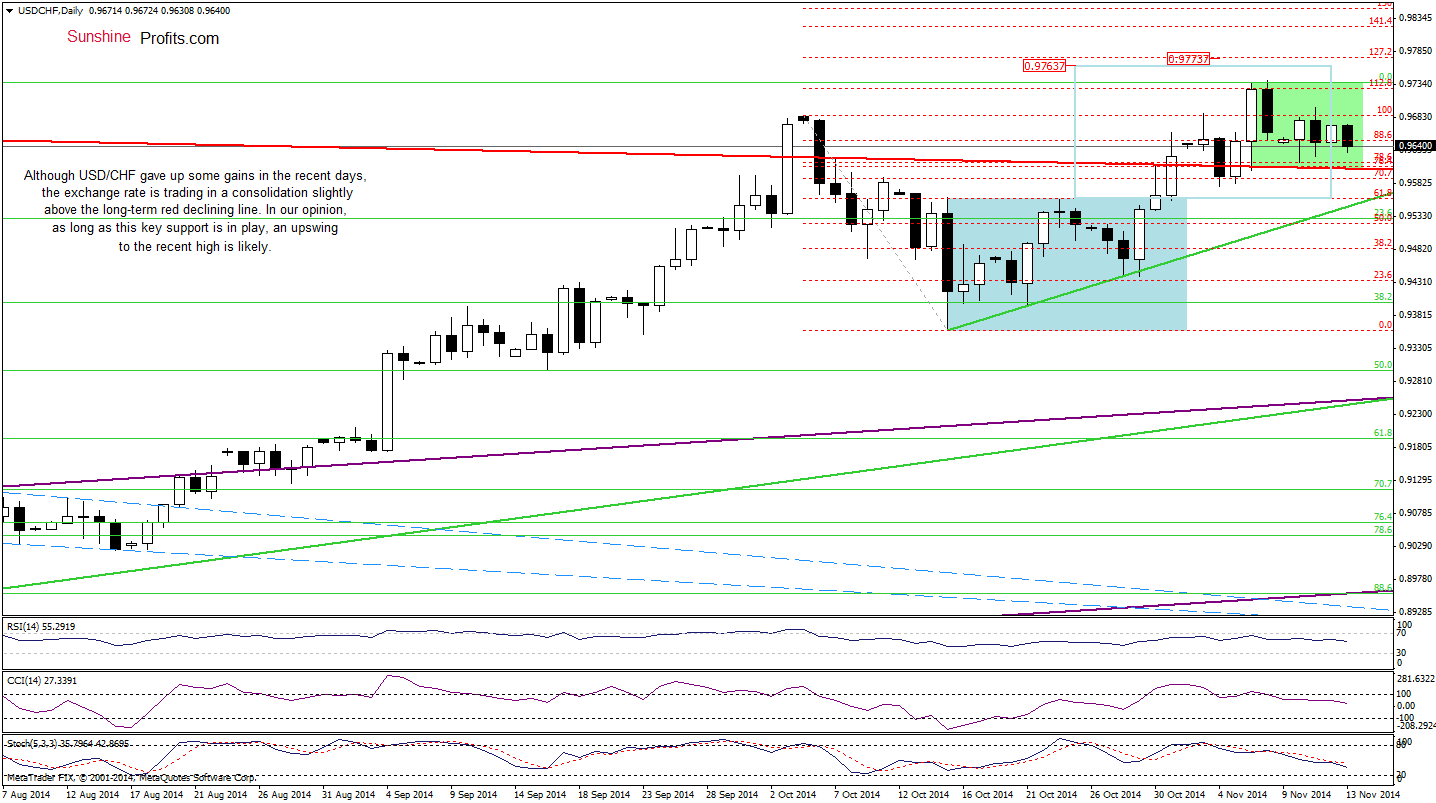

The situation in the medium term remains almost unchanged as USD/CHF is trading in a narrow range between the long-term support line and the 88.6% Fibonacci retracement (based on the entire May 2013-Mar 2014 decline), which serves as the nearest resistance.

Having say that, let’s take a closer look at the daily chart.

As you see on the above chart, although USD/CHF moved little lower in the recent days, the exchange rate is trading in a consolidation (marked with green) slightly above the long-term red declining line. In our opinion, as long as this key support is in play, an upswing to the recent high is likely. At this point, it’s worth noting that if the pair climbs higher, the next target for currency bulls would be around 0.9773, where the 127.2% Fibonacci extension is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts