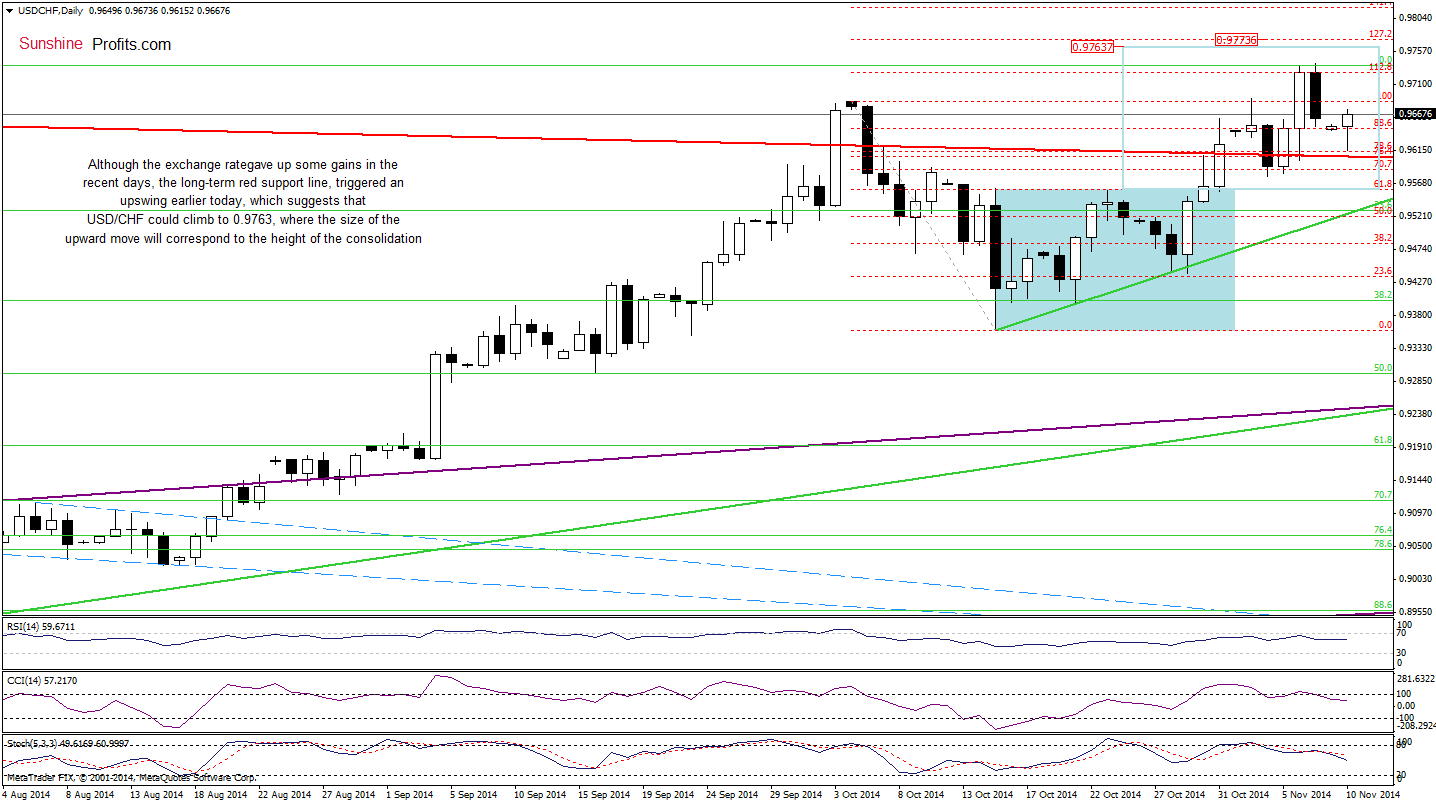

Although data showed that the U.S. economy added less jobs in Oct than expected, the U.S. unemployment rate dropped to a fresh six-year low of 5.8%. Earlier today, investors digested that slack in the labor market is diminishing and the numbers weren't weak enough to hold back the Federal Reserve from hiking interest rates in 2015. As a result, the greenback rebounded, which triggered an upswing in the USD/CHF pair. Will we see a fresh 2014 high?

In our opinion, the following forex trading positions are justified - summary:

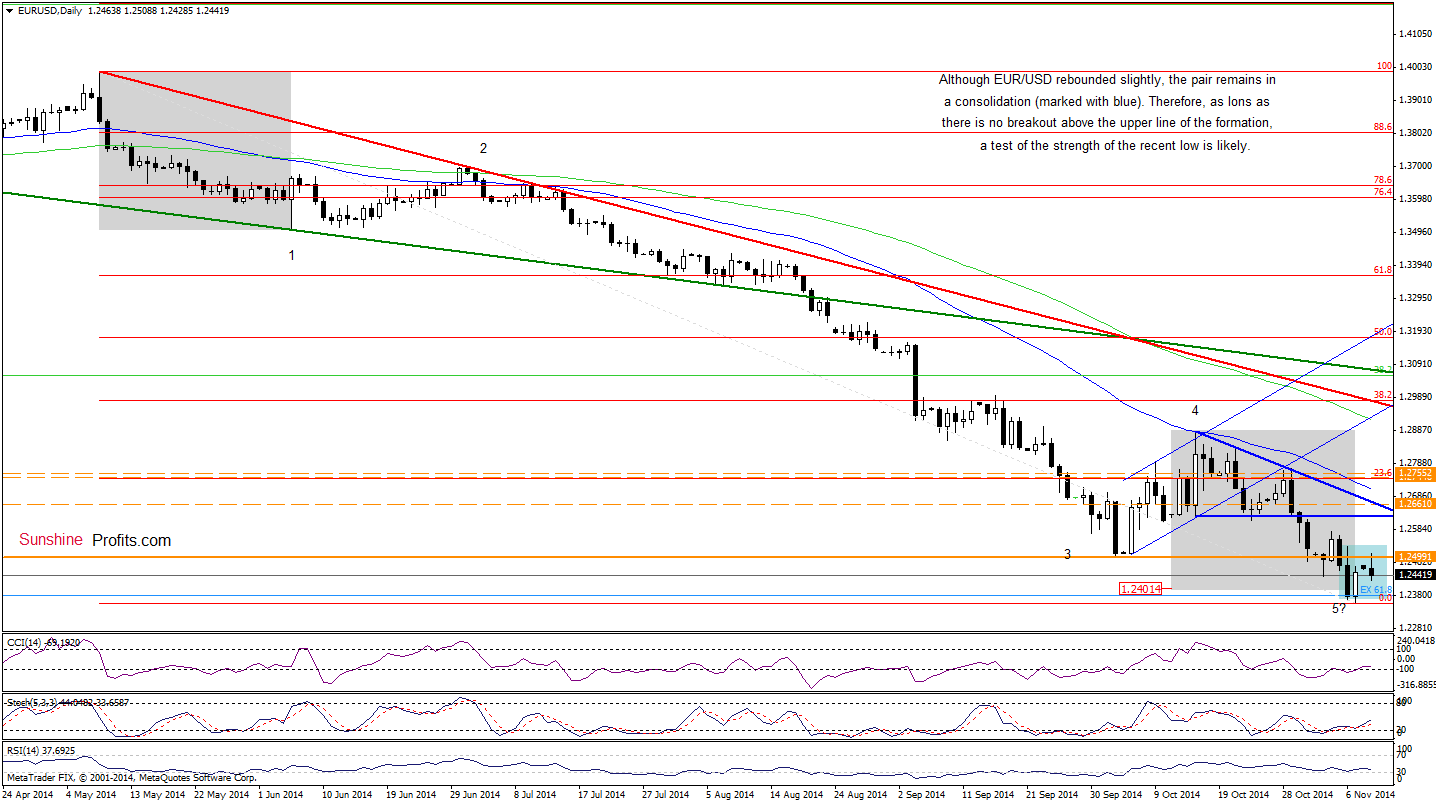

EUR/USD

The situation in the medium term hasn’t changed much as EUR/USD is still trading around the 127.2% Fibonacci extension. Can we infer something more from the very short-term picture? Let’s find out.

On Friday, we wrote the following:

(…) Although EUR/USD slipped below the barrier of 1.2400, this breakdown was invalidated almost immediately, which is a positive signal. Additionally, the recent downward move is similar to wave 1, which suggests that EUR/USD could rebound from here in the coming days. (…) Nevertheless, we should keep in mind that as long as the pair remains under the previous lows, another test of the support area can’t be ruled out.

Looking at the above chart, we see that currency bulls pushed the exchange rate higher as we expected. Despite this improvement, the resistance created by the previous lows stopped further rally earlier today. Taking this fact into account, it seems that the pair will erase the recent upward move and we’ll see a test of the support area around 1.2400 in the coming days. Please note that EUR/USD remains in a consolidation (marked with blue), which means that as long as there is no breakout above the upper line of the formation (and an invalidation of the breakdown below 1.2500), another upward move is not likely to be seen.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

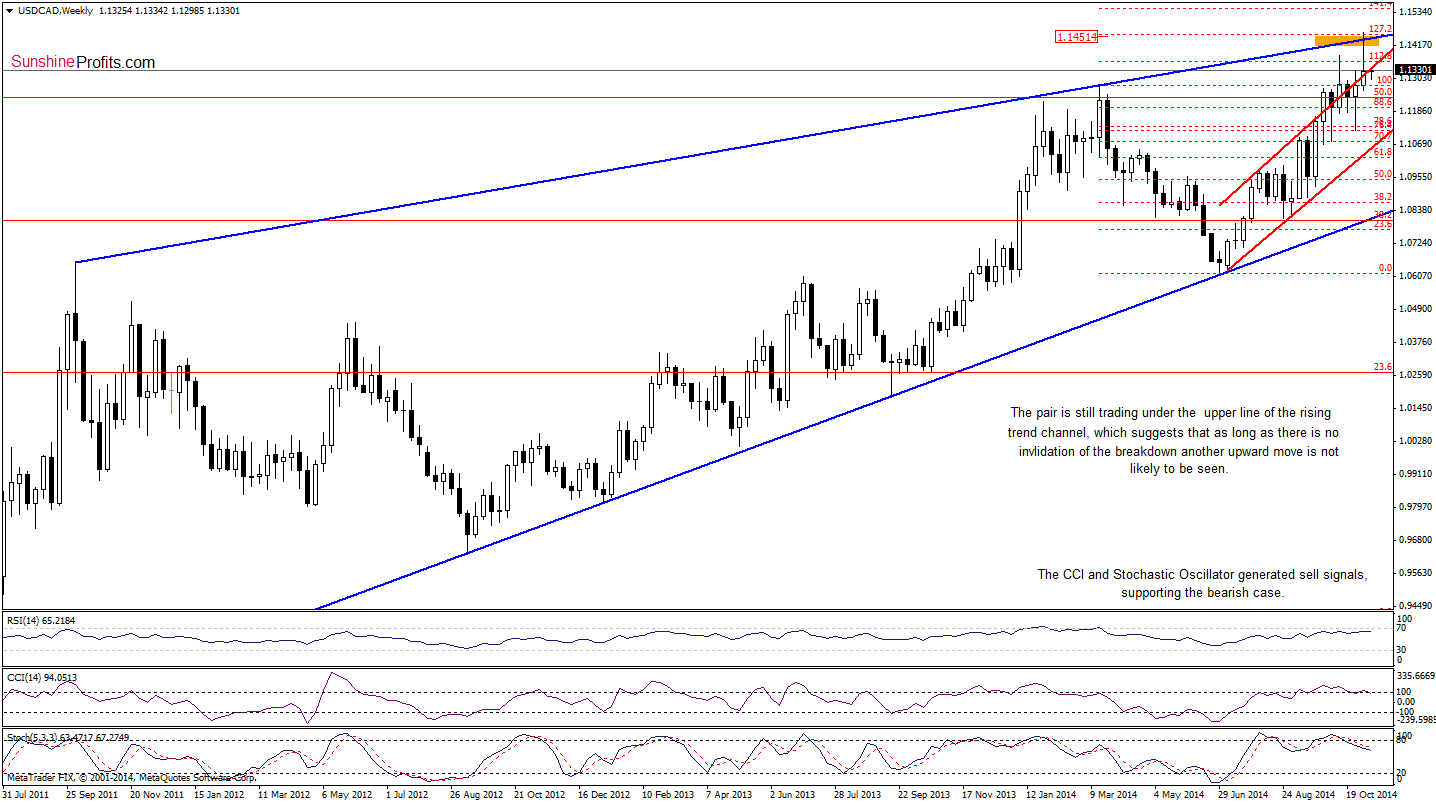

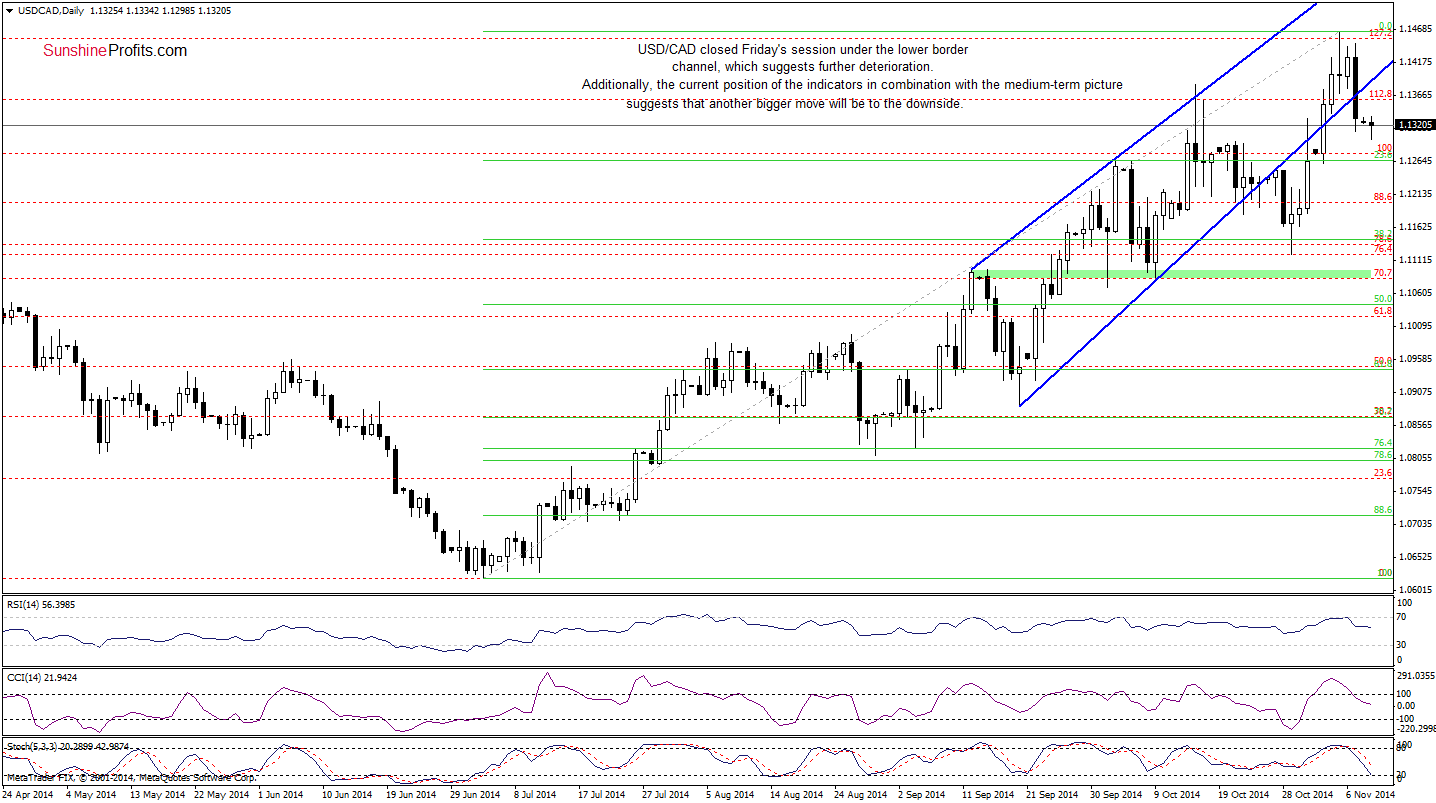

USD/CAD

In our last commentary on this currency pair, we wrote the following:

(…) it seems to us that the strong resistance zone will encourage currency bears to act in the near future and we’ll see a daily close below this support line. In this case, the initial downside target would be around 1.1142, where the 38.2% Fibonacci retracement (based on the entire Jul-Nov rally) is.

As you see on the above charts, the sitution developed in line with the above-mentioned scenario and USD/CAD closed Friday’session under the lower border of the rising trend channel (marked on the daily chart). This bearish signal triggered further deterioration earlier today, which suggests that our downside target (the 38.2% Fibonacci retracement) will be in play in the coming days. Please note that the current position of the indicators supports the bearish case at the moment.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CHF

Although USD/CHF moved lower in the recent days, the long-term red support line withstood the selling pressure and stopped further deterioration. As a result, the exchange rate reversed and rebounded earlier today. Taking this fact into account, we believe that our last commentary on this currency pair is up-to-date:

(…) it seems that as long as the long-term support/resistance line is in play, another upswing is likely. In our opinion, we could see an increase to around 0.9763, where the size of the upward move will correspond to the height of the consolidation.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, there will be no regular Forex Trading Alert on Tuesday - we will post the next one on Wednesday, Nov 12. Thank you for understanding.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts