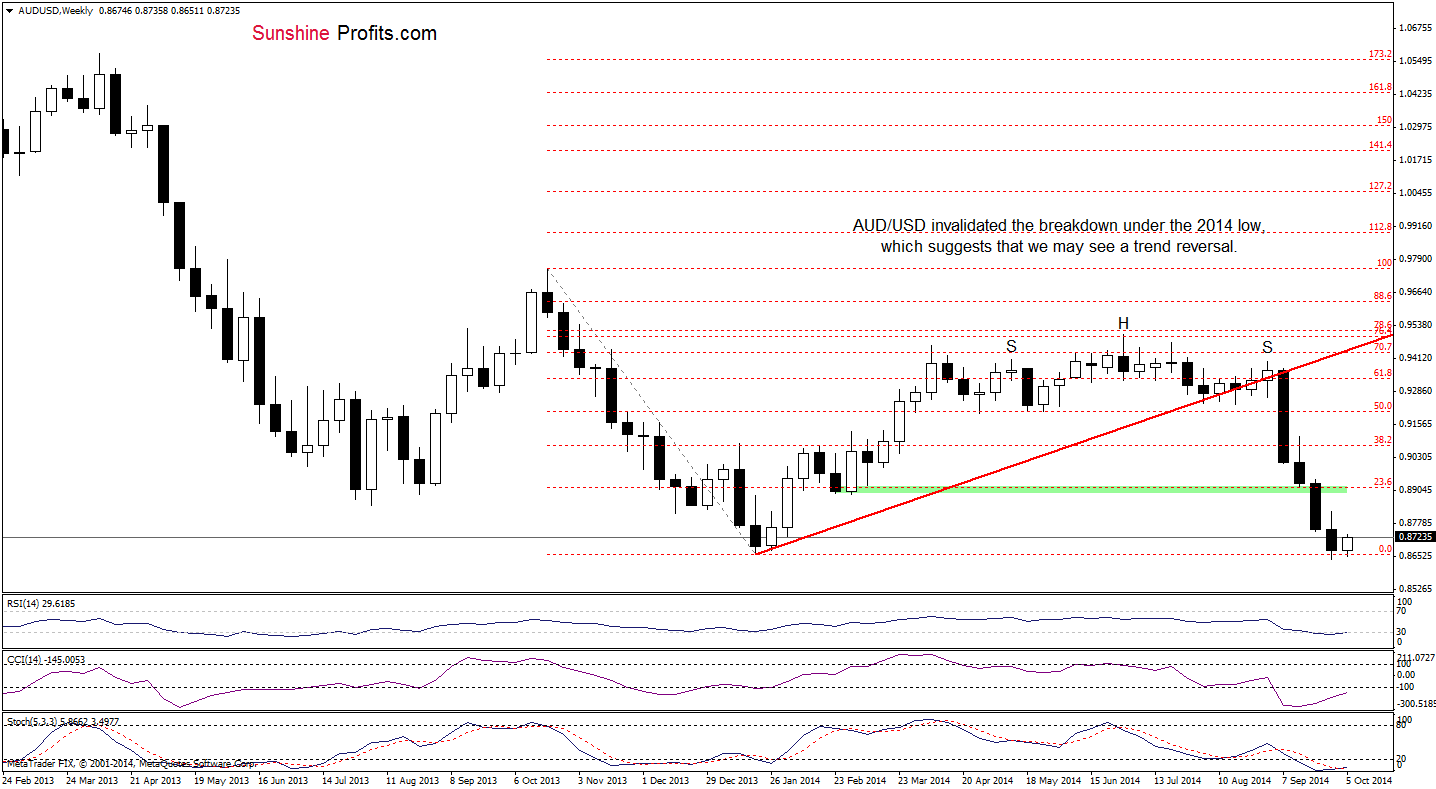

On Friday, the Labor Department showed that the U.S. economy added 248,000 jobs in September, beating forecasts for a 215,000 growth. Additionally, the unemployment rate dropped to its lowest level since July 2008 (to 5.9%). As a result, the USD Index rallied to a fresh multi-month high of 86.87, which pushed AUD/USD below the Jan low. Despite this deterioration, positive Australian data, which showed that job advertisements rose 0.9% last month, triggered a corrective upswing earlier today. Will an invalidation of the breakdown be sufficiently strong factor to initiate a rally?

- EUR/USD: none

- GBP/USD: none

- USD/JPY: short (stop-loss order: 110.73; initial price target: 105.20)

- USD/CAD: none

- USD/CHF: short (stop-loss order: 0.9711; initial price target: 0.9332)

- AUD/USD: long (stop-loss order: 0.8587; initial price target: 0.8943)

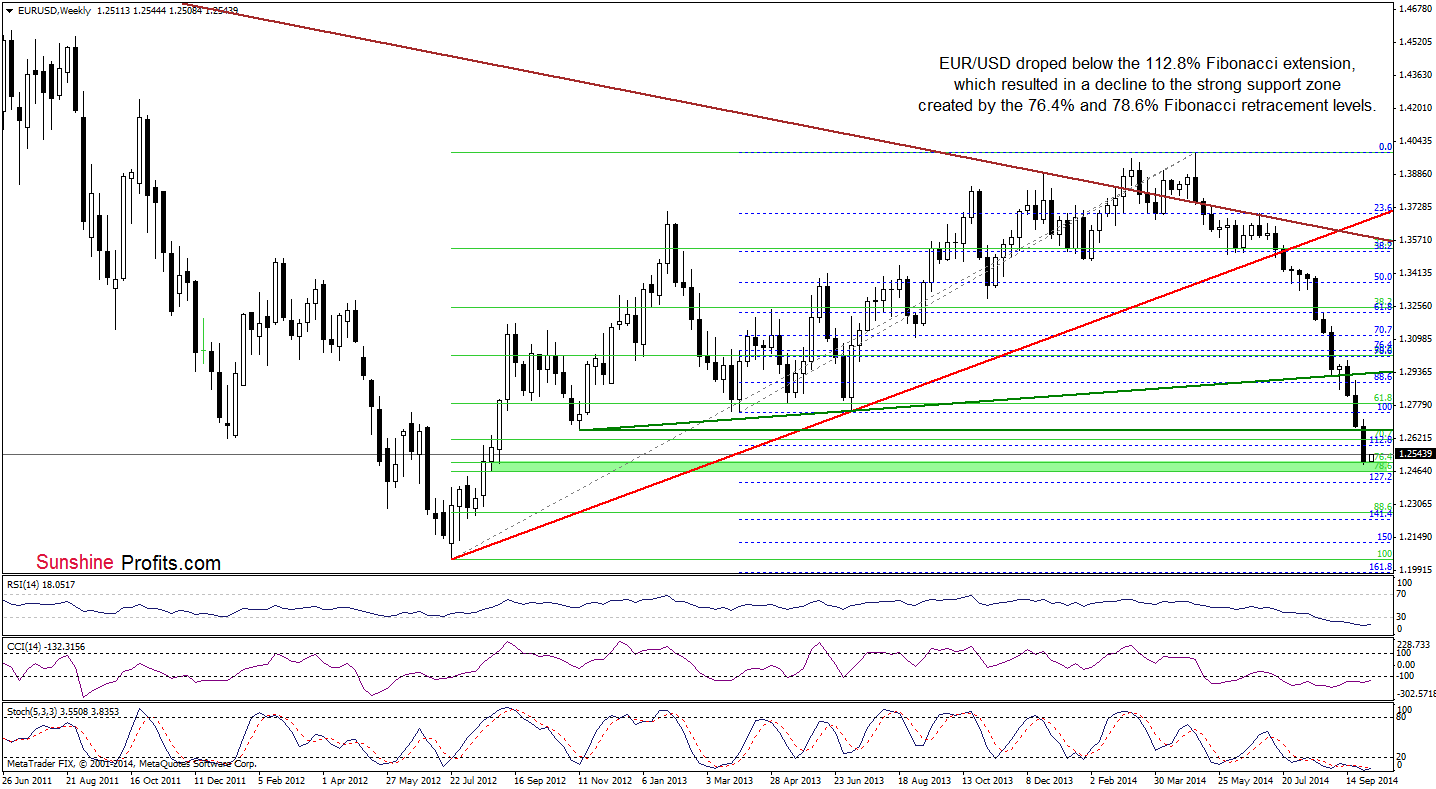

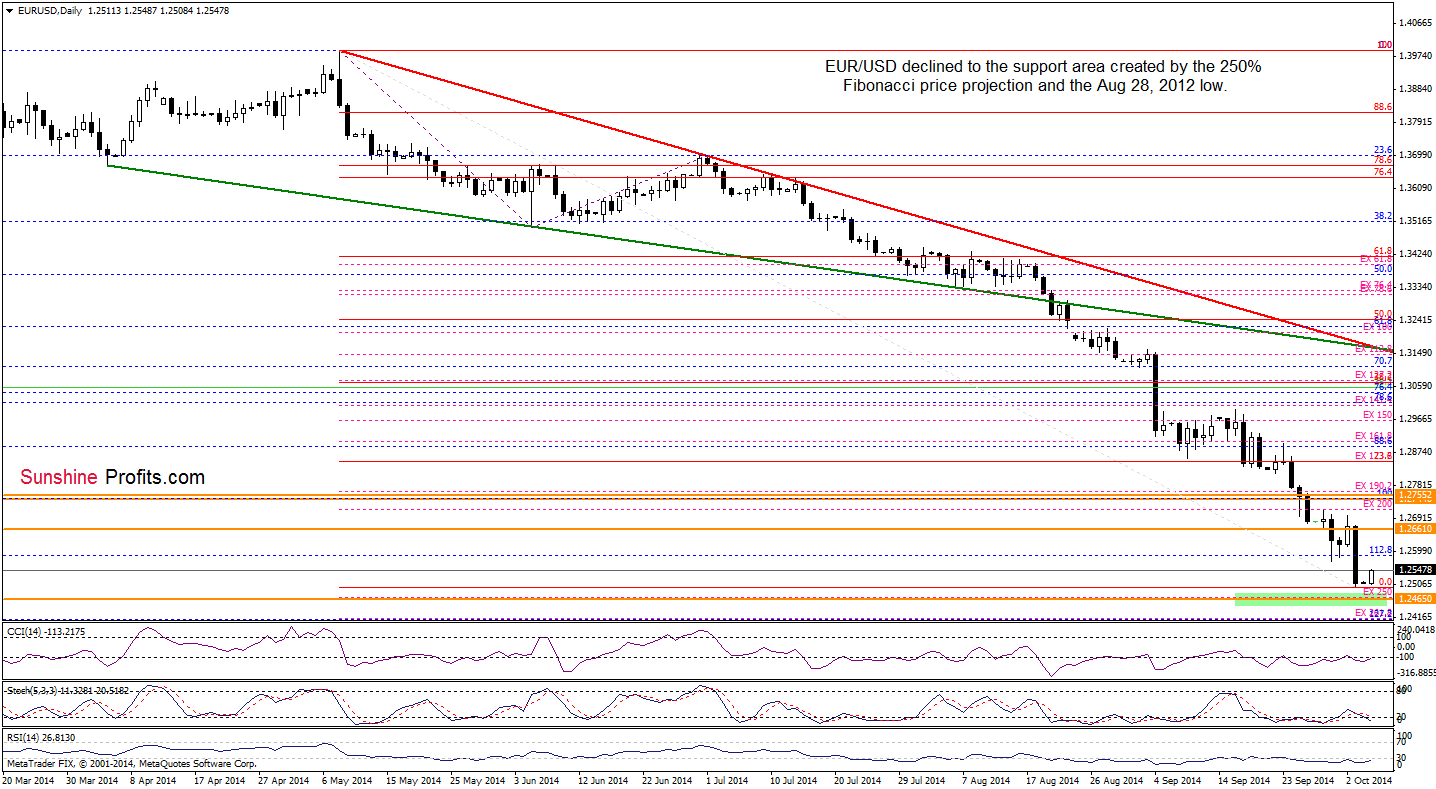

EUR/USD

Looking at the above charts, we see that EUR/USD dropped below the 112.8% Fibonacci extension, which triggered further deterioration and resulted in a fresh multi-month low of 1.2500. With this downswing, the pair reached not only another psychological barrier, but also a solid support zone created by the Aug 28, 2012 low, the 250% Fibonacci price projection, and the 76.4% and 78.6% Fibonacci retracement levels based on the entire Jul 2012-May 2014 rally. Many times in the past, these two important Fibonacci retracement levels were strong enough to pause or even stop further declines. Taking this fact into account, and combining it with the current position of the indicators, we think that a trend reversal is just around the corner. Nevertheless, as long as there are no additional bullish factors (like buy signals generated by the indicators or an invalidation of the breakdown below the Nov 2012 low) that could trigger a rally, staying at the sidelines and waiting for a profitable opportunity is the best choice at the moment. We are positioned to profit from USD’s corrective downswing in case of other currency pairs, so it seems that being out here (until we see an additional bullish confirmation) doesn’t change that much.

Very short-term outlook: bullish

Short-term outlook:mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

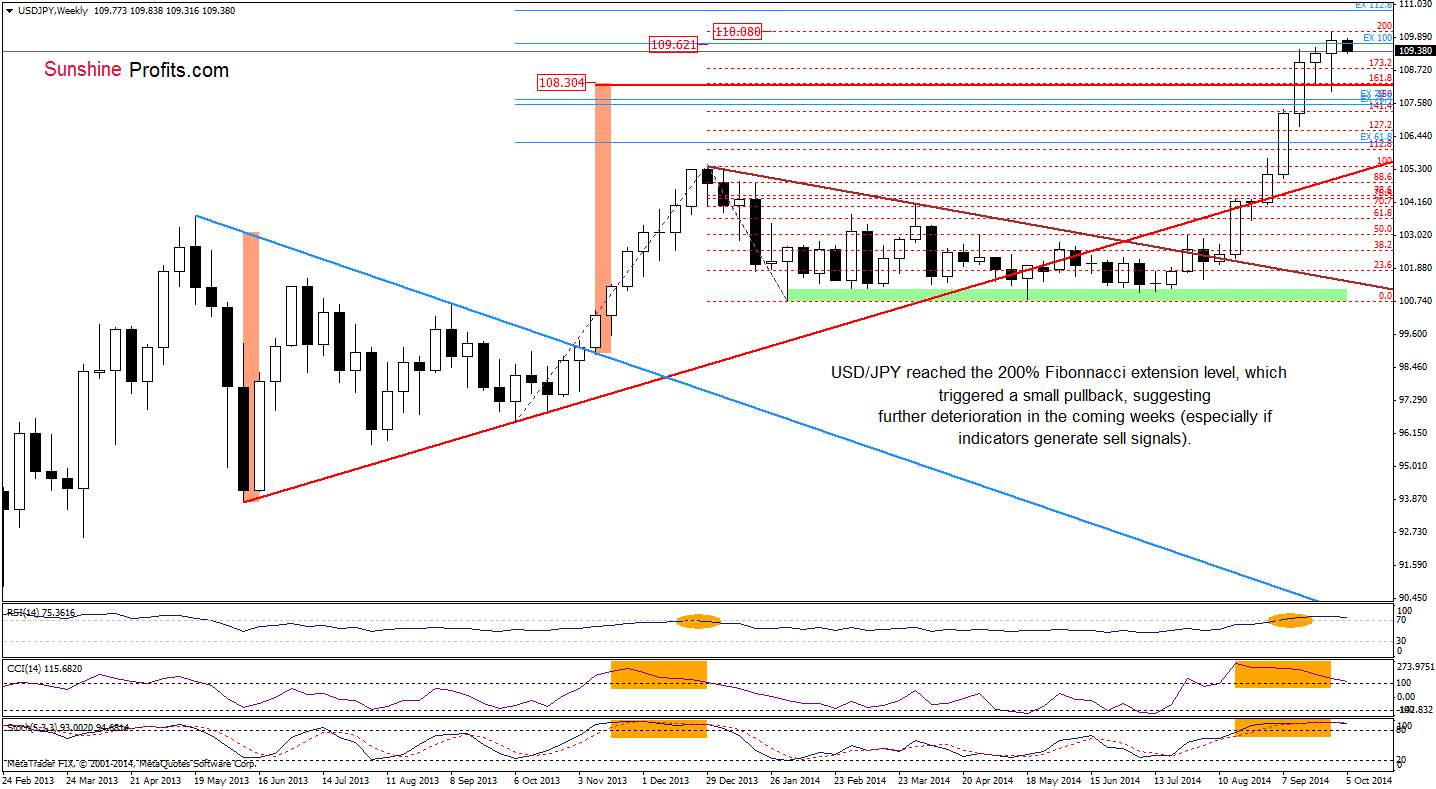

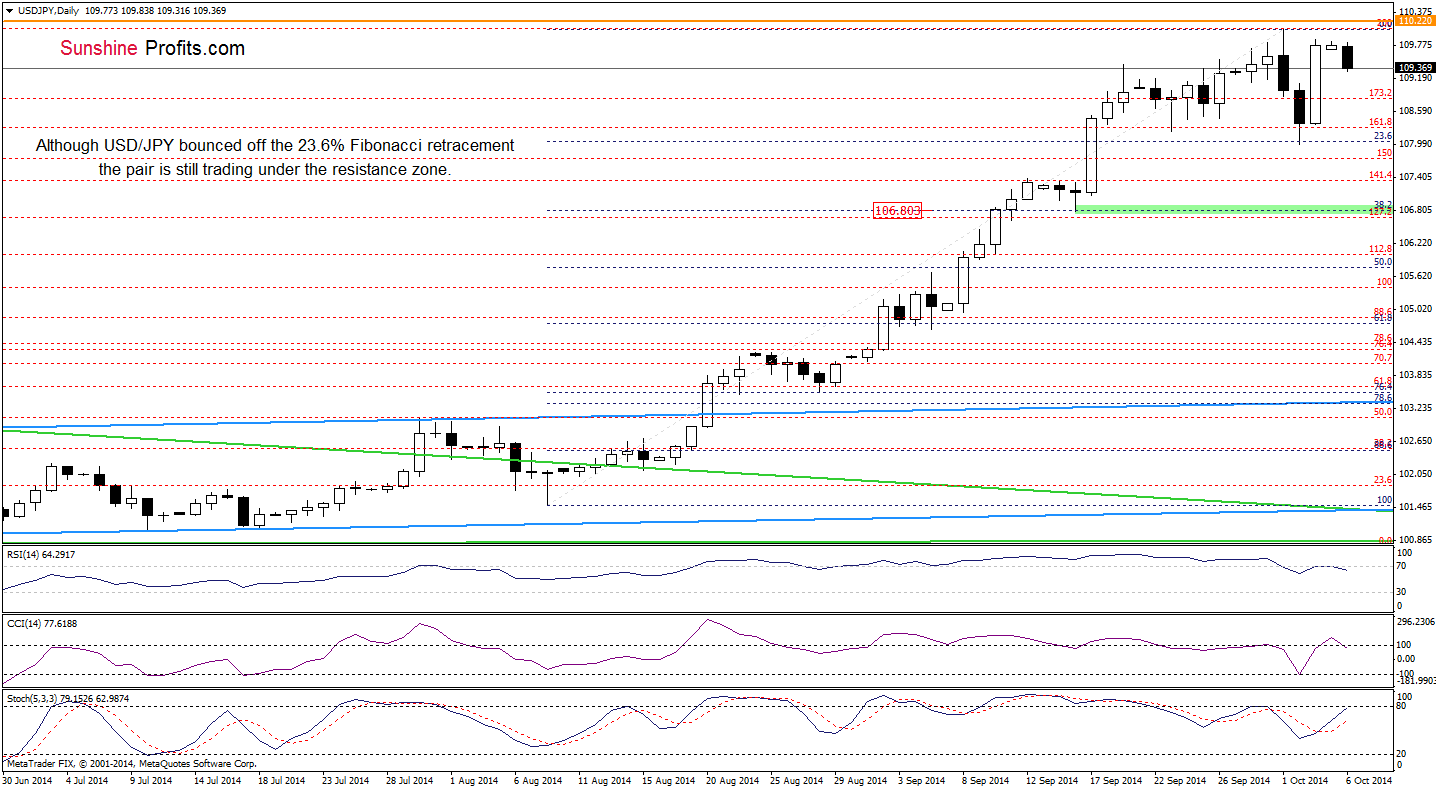

USD/JPY

As you see on the above charts, although USD/JPY bounced off the 23.6% Fibonacci retracement based on the Aug-Sep rally and approached the recent high, the pair is still trading under the resistance zone created by the recent high and the 200% Fibonacci extension and 100% Fibonacci price projection. Therefore, we maintain our assumption from the previous commentary that the next bigger move will be to the downside. Please note that this scenario is currently reinforced by sell signals generated by the daily RSI and CCI (a correction will accelerate, if the weekly indicators also generate sell signals). In our opinion, the initial downside target will be the support area created by the Thursday’s low and the 23.6% Fibonacci retracement. If it is broken, the next target for currency bears will be around 106.80, where the 38.2% Fibonacci retracement and the bottom of the correction that we saw in mid-Sep is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.23 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

The first thing that catches the eye on the above chart, is an invalidation of the breakdown below the 2014 low. As you know from our previous Forex Trading Alerts, this is a strong bullish signal, which usually triggers further improvement. Taking this fact into account, and combining it with buy signals generated by the daily RSI and CCI, we think that the next move will be to the upside and the initial target for currency bulls would be around 0.8929, where the 38.2% Fibonacci retracement based on the recent declines is. Please note that although the size of the upswing is not significant at the moment, we believe that a rally will accelerate if the weekly indicators also generate buy signals.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Long positions with a stop-loss order at 0.8587 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts