Earlier today, the Institute for Supply Management showed that its index of purchasing managers declined to 56.6, missing analysts expectations for a drop to 58.5 in September. As a result, the greenback gave up some gains and USD/JPY slipped below the recent highs. Will an invalidation of the breakout encourage currency bears to act?

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: long (stop-loss order: 1.2527; initial price target: 1.3188)

- GBP/USD: none

- USD/JPY: short (stop-loss order: 110.73; initial price target: 105.20)

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

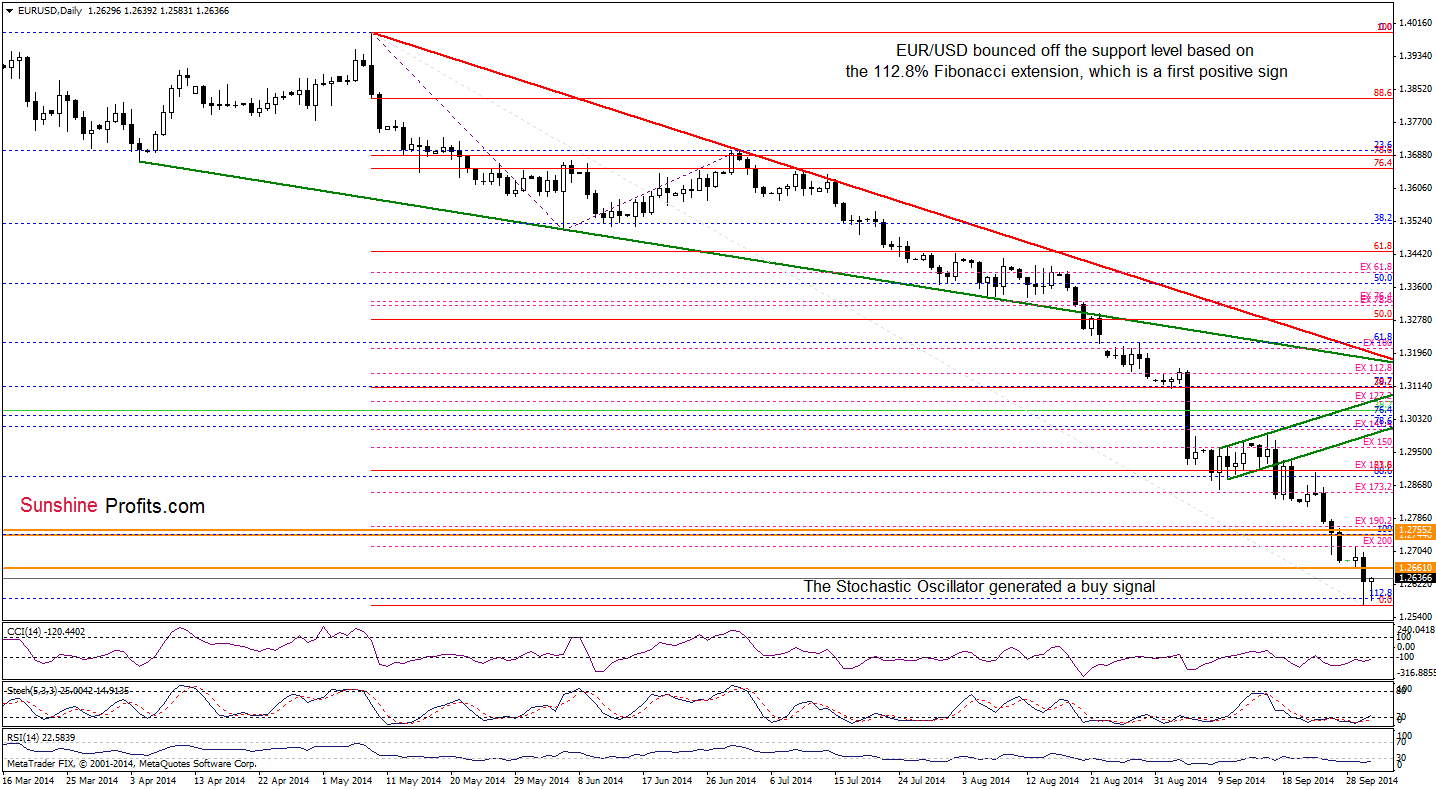

EUR/USD

The situation in the medium-term hasn’t changed much as EUR/USD is still trading near yesterday’s multi-month low. Today, we’ll focus on the very short-term changes.

Looking at the above chart, we see that EUR/USD rebounded slightly, moving away from the 112.8% Fibonacci extension. Additionally, the Stochastic Oscillator generated a buy signal, which suggests that an upward move is just around the corner. Taking these facts into account, we believe that our last commentary is up-to-date:

(…) If this area encourages currency bulls to act, we’ll see a rebound from here and the initial upside target will be the Apr and Jul 2013 lows – especially if the indicators generate buy signals. Please note that they are not only oversold, but there are clearly visible positive divergences between them and the exchange rate (…)

Very short-term outlook: bullish

Short-term outlook:mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Long positions with a stop-loss order at 1.2527 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

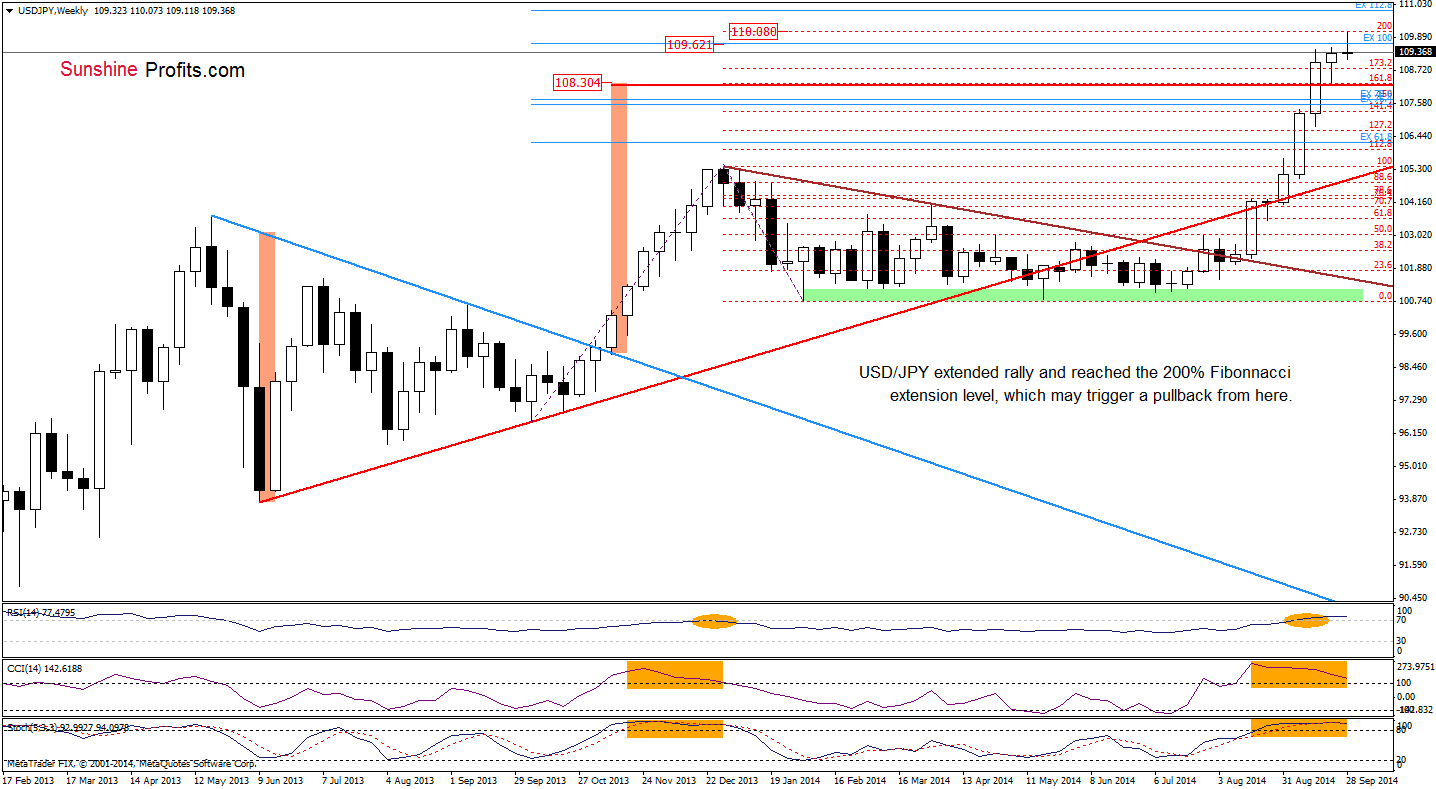

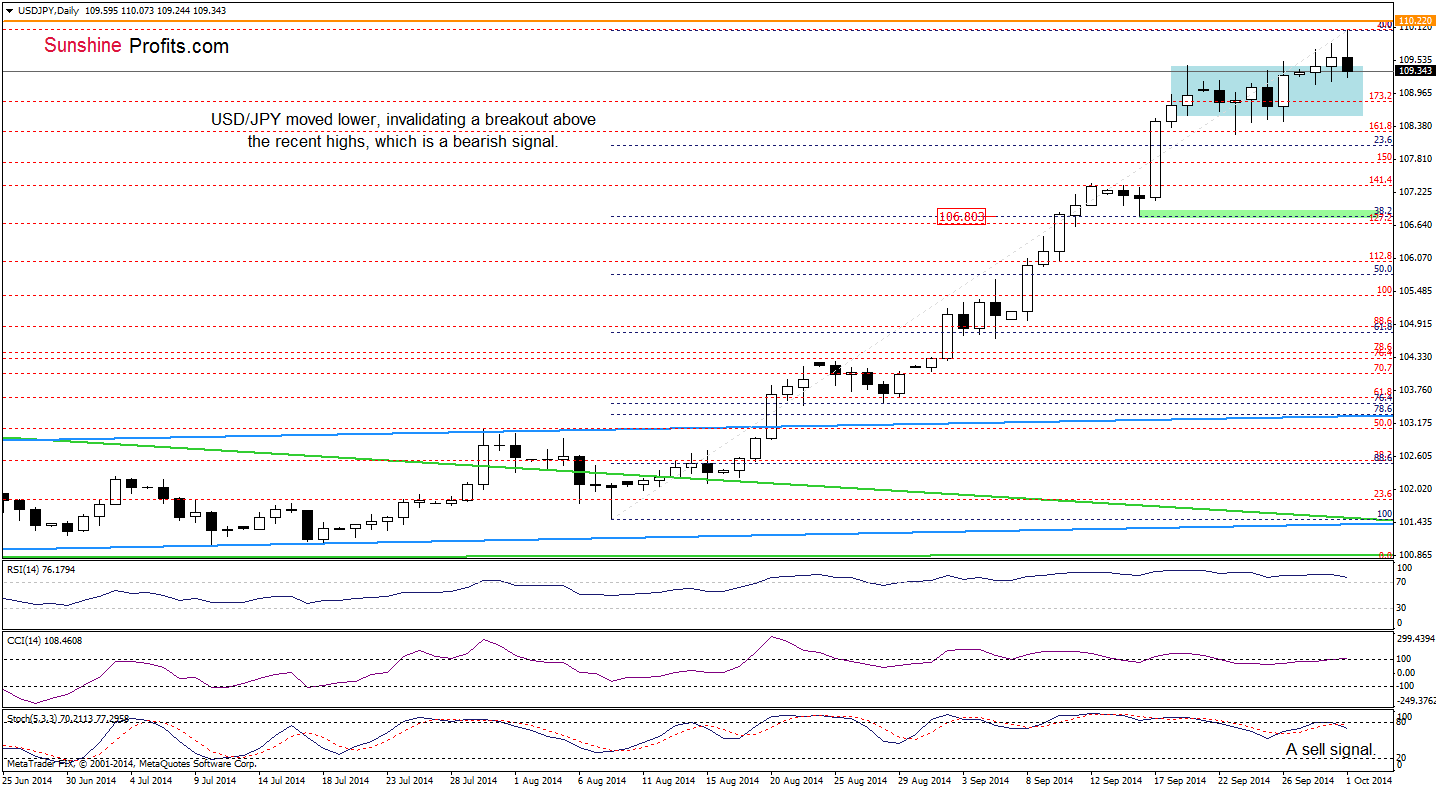

USD/JPY

On the above charts, we see that although USD/JPY extended rally earlier today, the 200% Fibonacci extension stopped further improvement, triggering a corrective downswing. With this move, the pair slipped below the 100% Fibonacci price projection and the recent highs, invalidating earlier brakout. Taking this fact into account, and combining it with the current position of the indicators (not only daily, but also weekly), we still believe that the next move will be to the downside. In this case, the initial target for currency bears will be around 106.80, where the 38.2% Fibonacci retracement based on the Aug-Sep rally is.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): Short positions with a stop-loss order at 110.23 are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

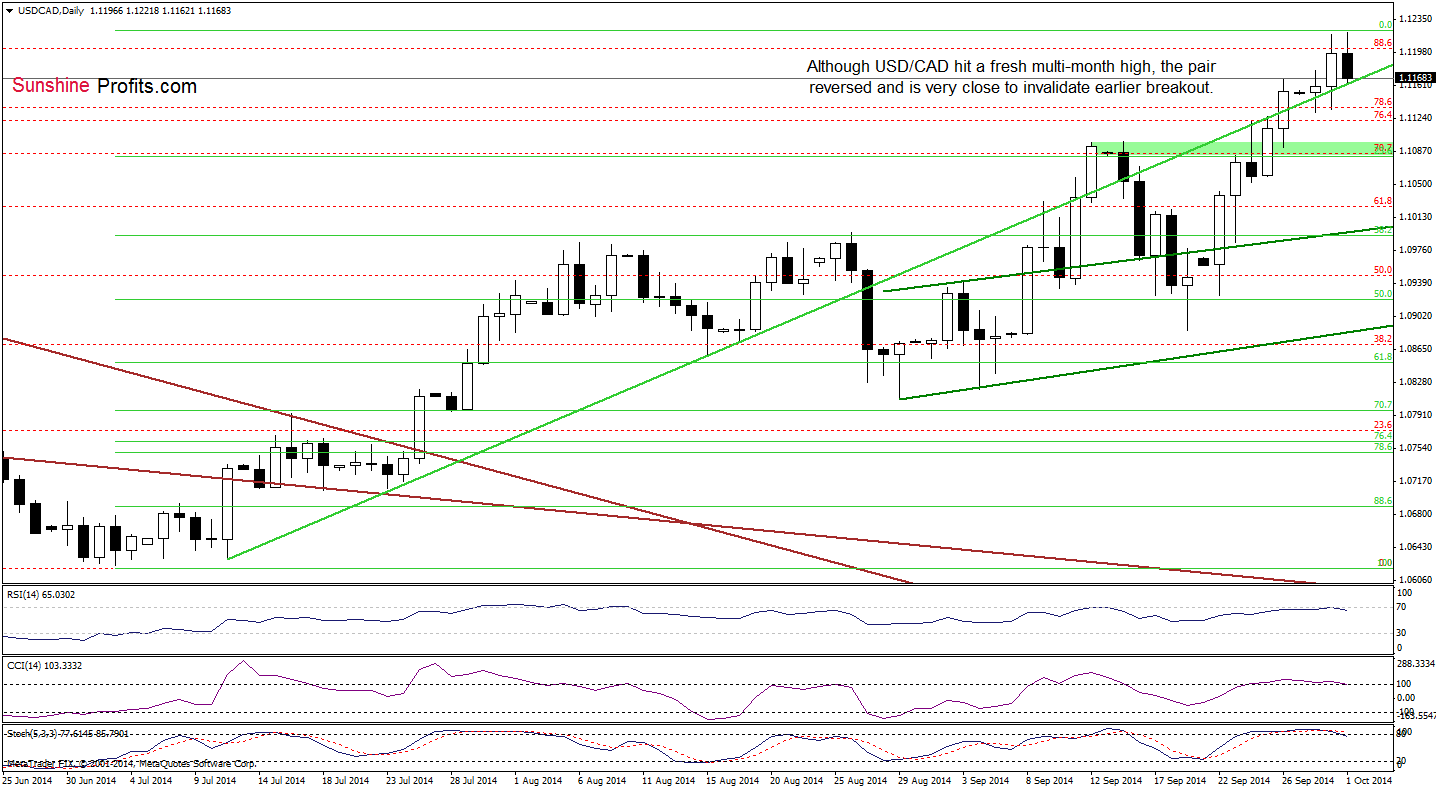

USD/CAD

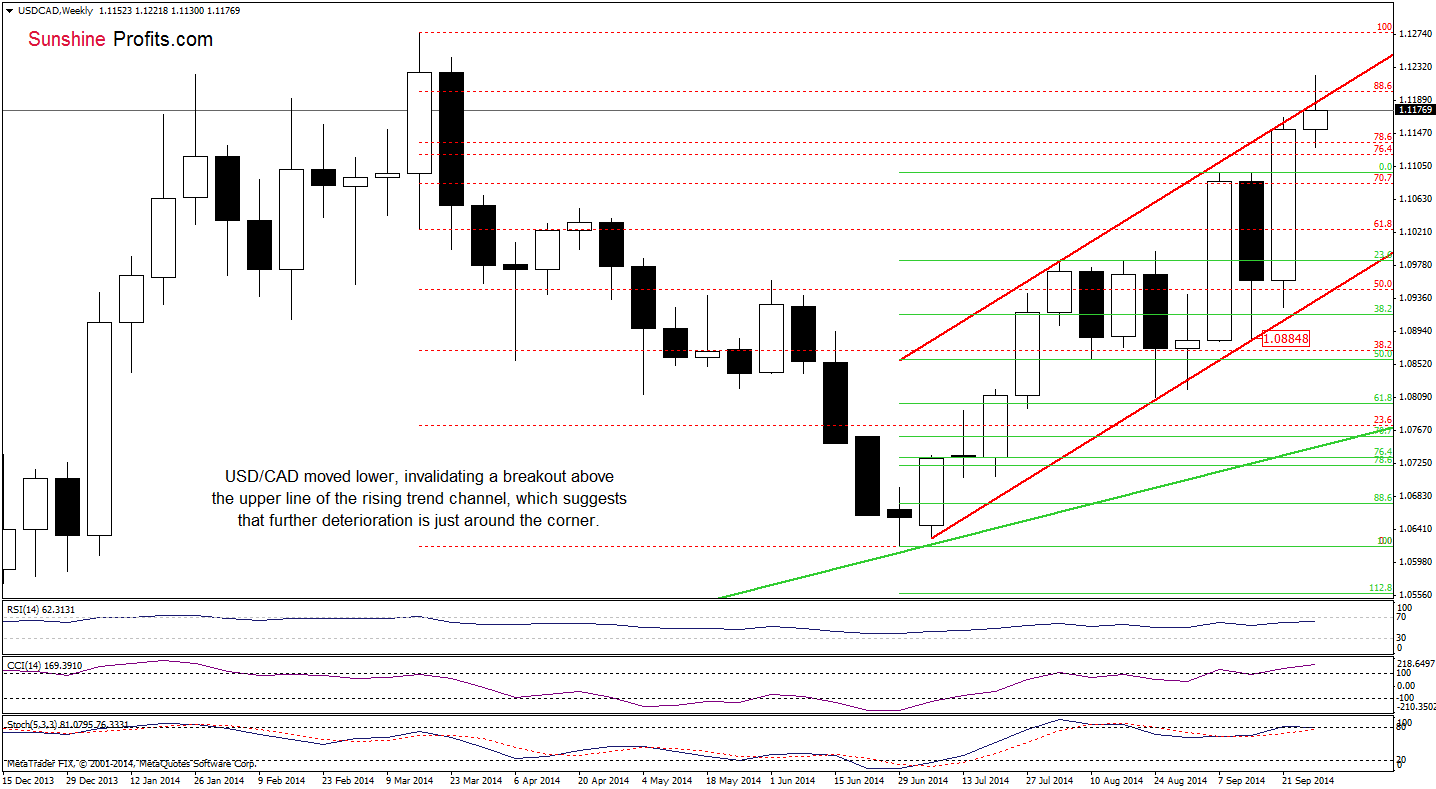

As you see on the daily chart, although USD/CAD moved higher, hitting a fresh multi-month high earlier today, the exchange rate gave up some gains and approached the previously-broken green support line. Will we see further deterioration? Let’s examine the weekly chart and look for clues about future moves.

The first thing that catches the eye on the above chart is an invalidation of the breakout above the key resistance line – the upper border of the rising trend channel. Although the week is not over yet, this is a negative signal, which suggests that we may see further deterioration in the coming days. Taking this fact into account, and combining it with the very short-term picture (which shows that the pair is close to invalidate the breakout above the green support/resistance line, while the RSI and Stochastic Oscillator generated sell signals), it seems to us that the next bigger move will be to the downside. If this is the case, the initial downside target will be around 1.1097, where the mid-Sep high is. Please note that in this area is also the 23.6% Fibonacci retracement (based on the entire Jul-Oct rally (marked on the daily chart).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed with bearish bias

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts