Today, sterling extended losses from the previous session as yesterday’s Bank of England Governor testimony and better-than-expected consumer confidence and housing data still support the greenback. In this way, GBP/USD declined to its lowest level since June 18. Will it drop to 1.6900 in the near future?

In our opinion the following forex trading positions are justified - summary:

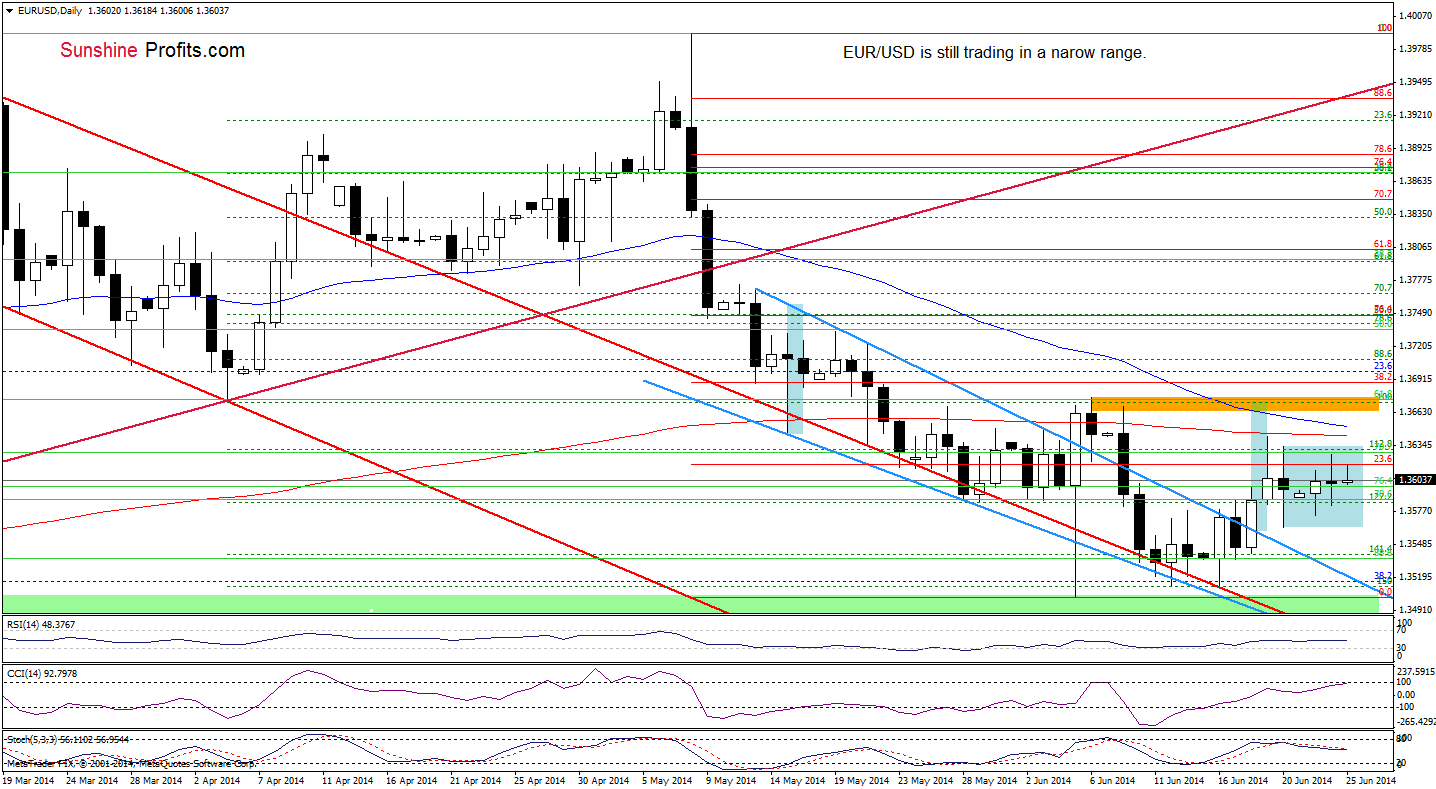

EUR/USD

The situation in the medium term hasn’t changed much as EUR/USD is still trading in the consolidation between the support zone (created by the 38.2% Fibonacci retracement and last week’s low) and the June high, which is slightly below the long-term declining line at the moment. Let’s take a closer look at the very short-term chart.

Looking at the above chart, we see that the situation in the very short-term remains unchanged as EUR/USD is still trading in a narrow range between Friday’s high and low. Therefore, what we wrote yesterday is up-to-date:

(…) slightly above the recent highs is the 200-day moving average, which successfully stopped further improvement on Thursday. Therefore, even if the exchange rate moves higher, it seems to us that history will repeat itself and we’ll see a pullback (especially when we factor in the proximity to the 50-day moving average and a sell signal generated by the Stochastic Oscillator). If this is the case, the initial downside target will be Friday’s low and if it is broken we’ll see another try to reach the upper line of the declining wedge.

Very short-term outlook: mixed

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

Yesterday, we wrote the following:

(…) the pair also dropped below the lower border of the consolidation (marked with blue), which suggests that we’ll see further deterioration (especially when we factor in sell signals generated by all indicators) in the coming days and the initial downside target will be around 1.6905, where the size of a pullback will correspond to the height of the consolidation. At this point, it’s worth noting that slightly below this level is the medium-term support line, which may pause the current correction.

From this perspective, we see that the exchange rate extended losses earlier today, which means that currency bears didn’t rest on their laurels and suggests that they will try to realize the above-mentioned scenario in the coming days. As you see on the above chart, the current position of the indicators will support them in this action in the near future.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

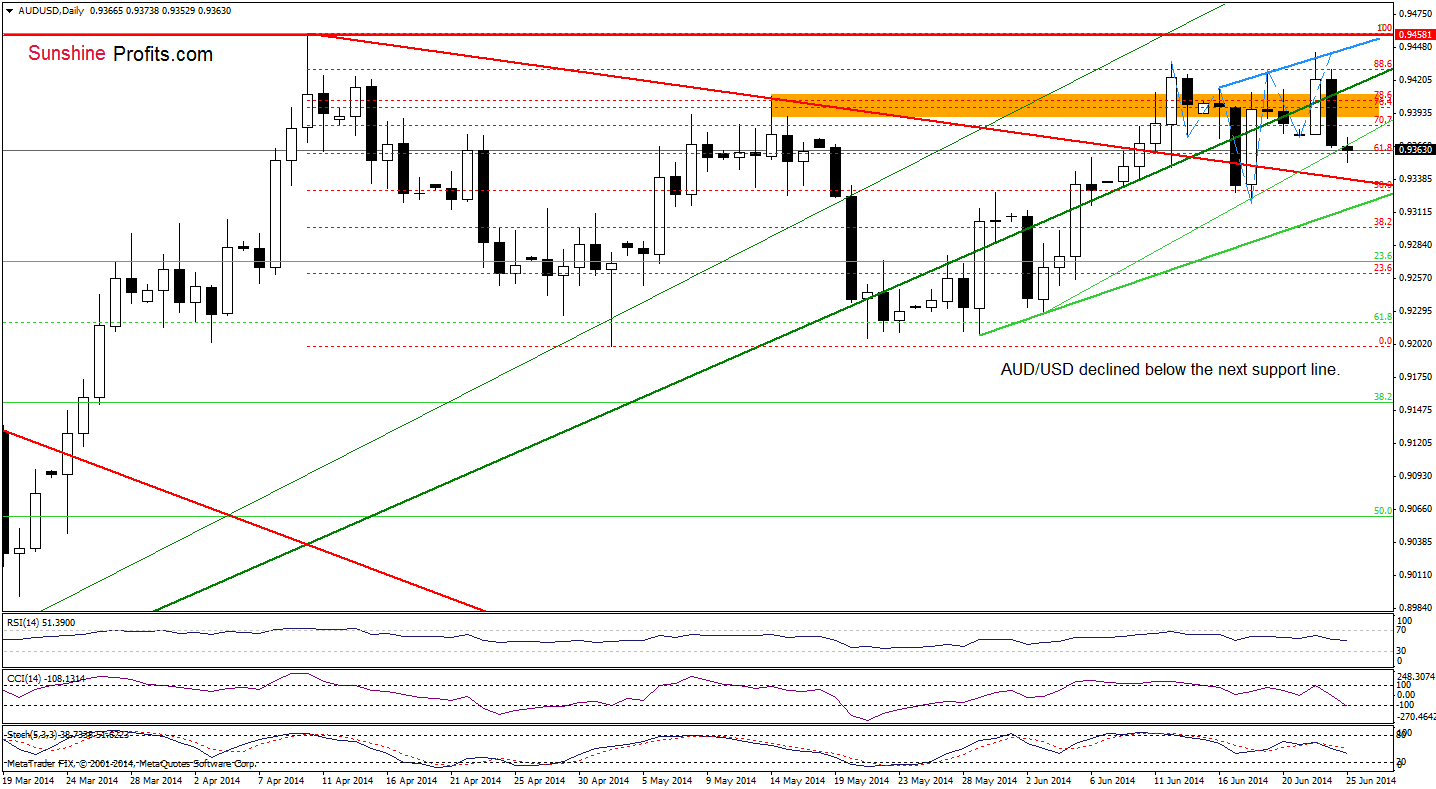

AUD/USD

The situation in the medium term hasn’t change much. Today, we’ll focus only on the very short-term changes.

Looking at the daily chart, we see that AUD/USD extended losses below the medium-term green support/resistance line and declined below the next support line (the short-term one based on the June 3 and June 18 lows). Therefore, we think that our last commentary on this currency pair is up-to-date also today:

(…) If currency bears manage to push the pair lower, (…) we’ll see further deterioration and a correction to around 0.9341, where the red declining support line is. If it is broken, the next downside target will be the June 18 low of 0.9319. Please note that the current position of the indicators supports the bearish scenario at the moment. Nevertheless, if the pair move higher from here, it seems to us that the combination of the resistance zone and the green support line will be strong enough to stop currency bulls.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts