The U.S. dollar rebounded from a fresh 2014 low after stronger-than-expected data on U.S. retail sales and initial jobless claims. The Commerce Department reported that retail sales rose 0.3% in February (above expectations for an increase of 0.2%), while the Department of Labor showed in its report that initial claims for jobless benefits decreased by 9,000 (while analysts had expected an increase of 6,000) to a three month low of 315,000 last week. What impact did it have on major currency pairs? If you want to know our take on this question, we invite you to read our today's Forex Trading Alert.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: short (stop-loss order: 1.4008)

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: none

EUR/USD

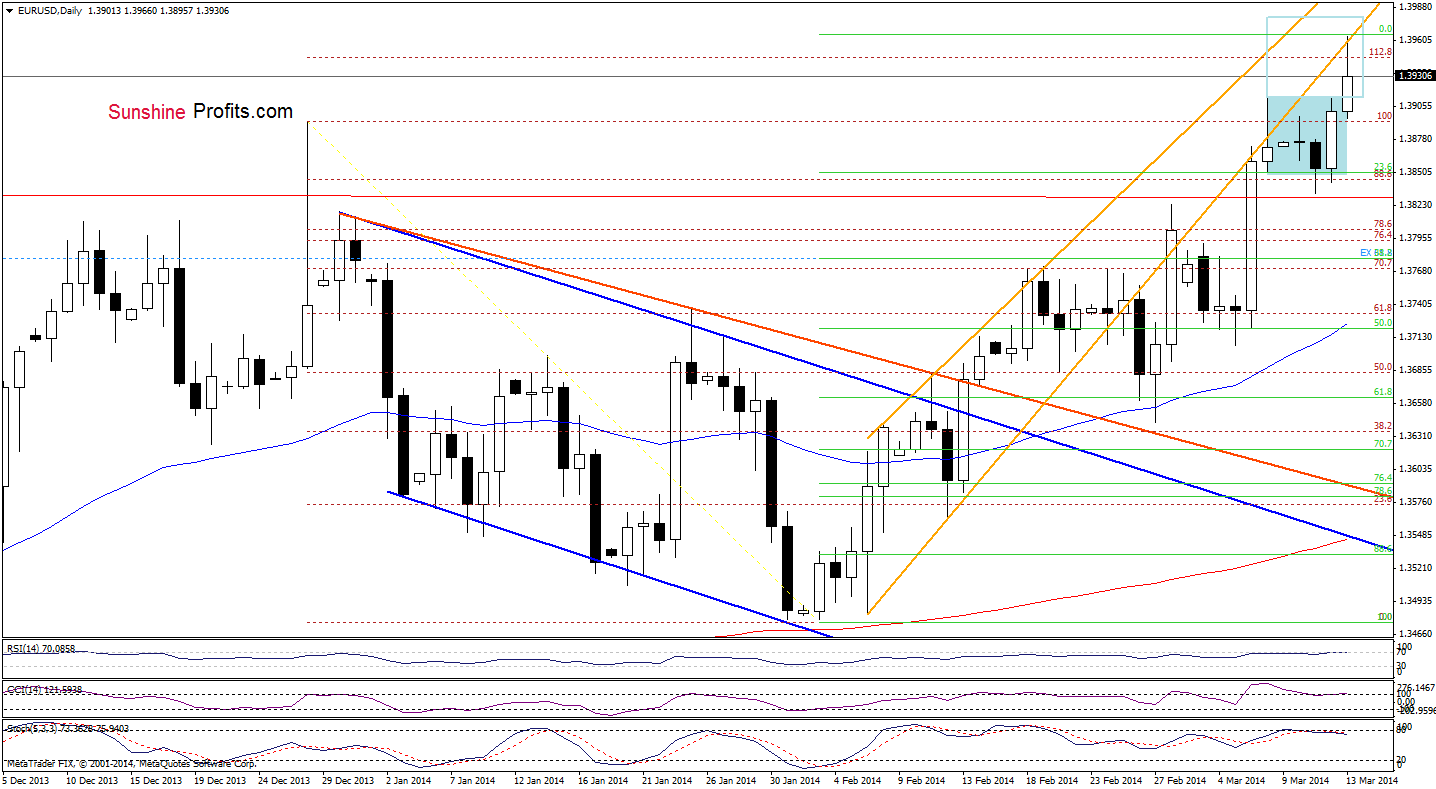

On the above chart, we see that EUR/USD broke above the upper line of a consolidation range and hit a fresh 2014 high earlier today. With this upswing, the pair reached its first upside target - the lower orange line. If this resistance (in combination with the 112.8% Fibonacci extension) encourages sellers to act, we may see a pullback to around yesterday’s low (in this area is also the 23.6% Fibonacci retracement based on the recent rally). This scenario is also reinforced by the current position of the indicators (although they didn’t help in the proper assessment of the situation in the recent days).

Before we summarize this currency pair, let’s take a look at the 4-hour chart.

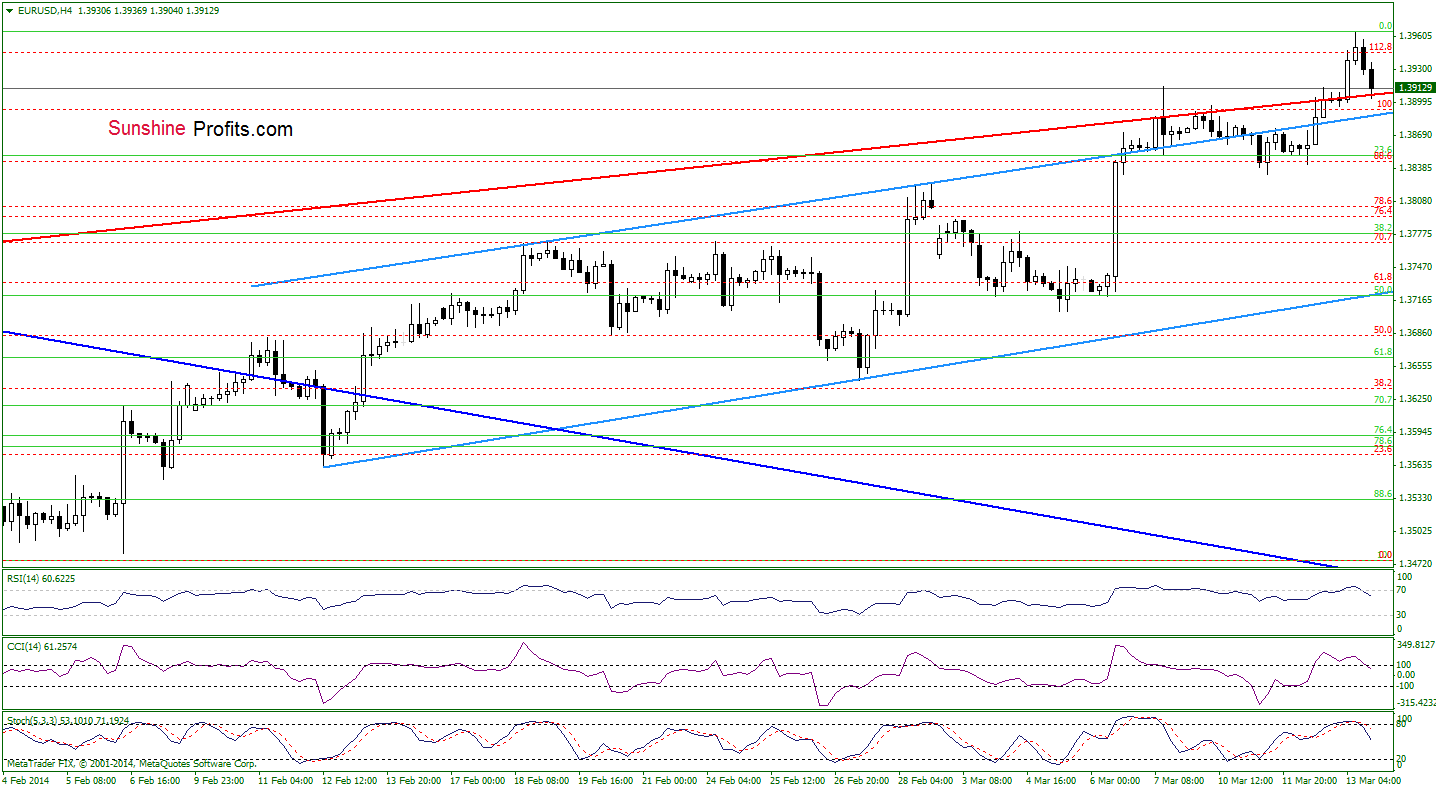

From this perspective, we see that EUR/USD reached the red support line. If it holds, we may see a corrective upswing to around today’s high. However, if it is broken, we will see a drop to the upper line of the rising trend channel in the very near future. If this support is broken, the next downside target for the sellers will be the 23.6% Fibonacci retracement. As you see on the above chart, all indicators generated sell signals, which suggests further deterioration.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, opening short positions at the following terms is a good idea: stop-loss order: 1.4008. We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above. The above is not an investment / trading advice and please note that trading (especially using leveraged instruments such as futures or on the forex market) involves risk.

GBP/USD

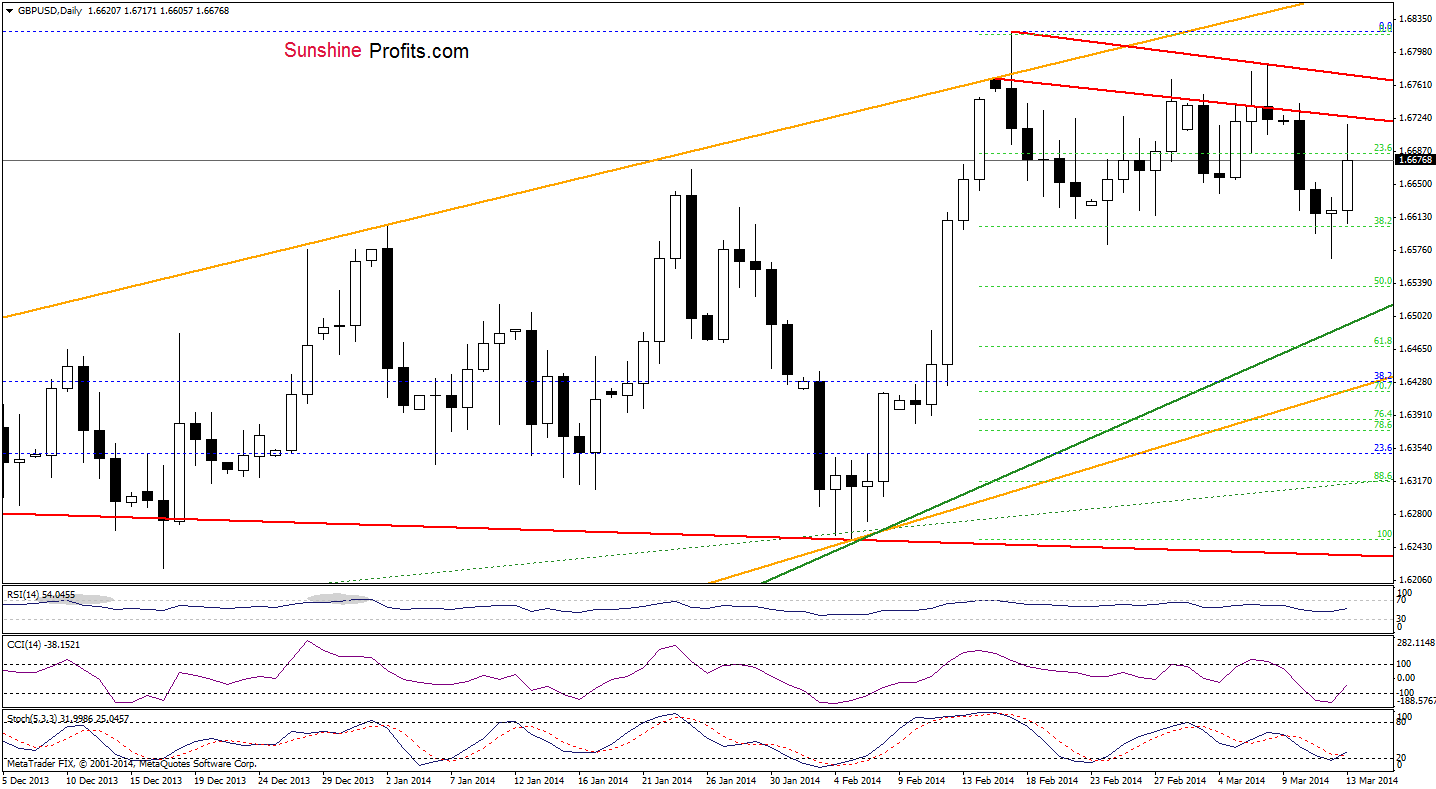

Looking at the above chart, we see that the 38.2% Fibonacci retracement level encouraged buyers to push the order button and triggered a corrective upswing earlier today. As you see on the daily chart, although GBP/USD rebounded sharply, the pair still remains below the declining line resistance lines (in terms of intraday highs and daily closing prices). If they holds, we may see a pullback to the nearest Fibonacci retracement in the near future. However, if they are broken, the exchange rate will likely climbs to the February high (or even to the upper orange line, which serves as the major resistance). The position of the indicators supports buyers at the moment.

Let’s take a look at the 4-hour chart.

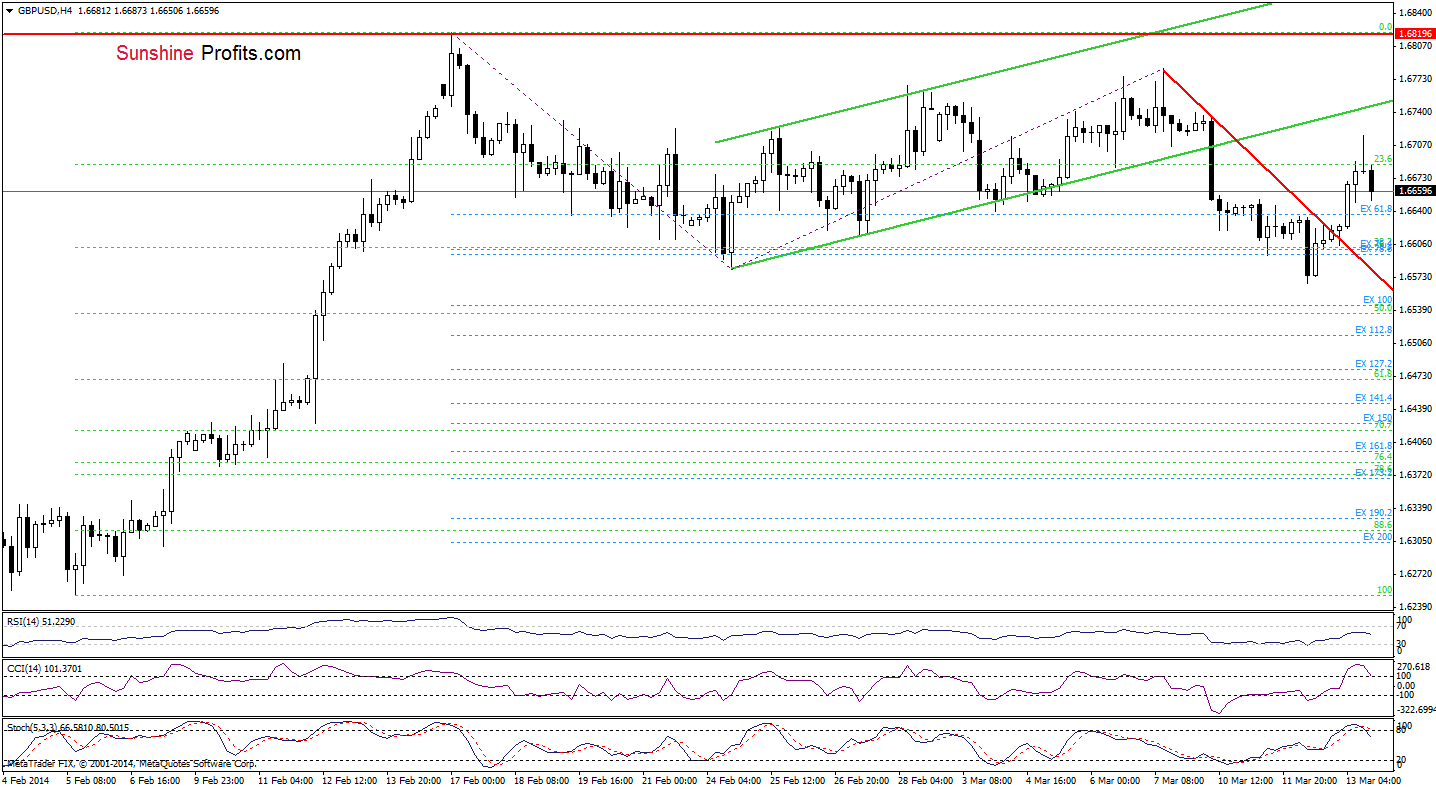

From this perspective, we see that despite today’s upward move, the pair remains below the lower border of the rising trend channel. The CCI and Stochastic Oscillator generated sell signals and when we take a closer look at the chart, we see a bearish candlestick pattern – an evening star, which suggests that we may see a pullback in the following hours. If this is the case, an initial downside target will be the previously-broken declining red line, which serves as support at the moment.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

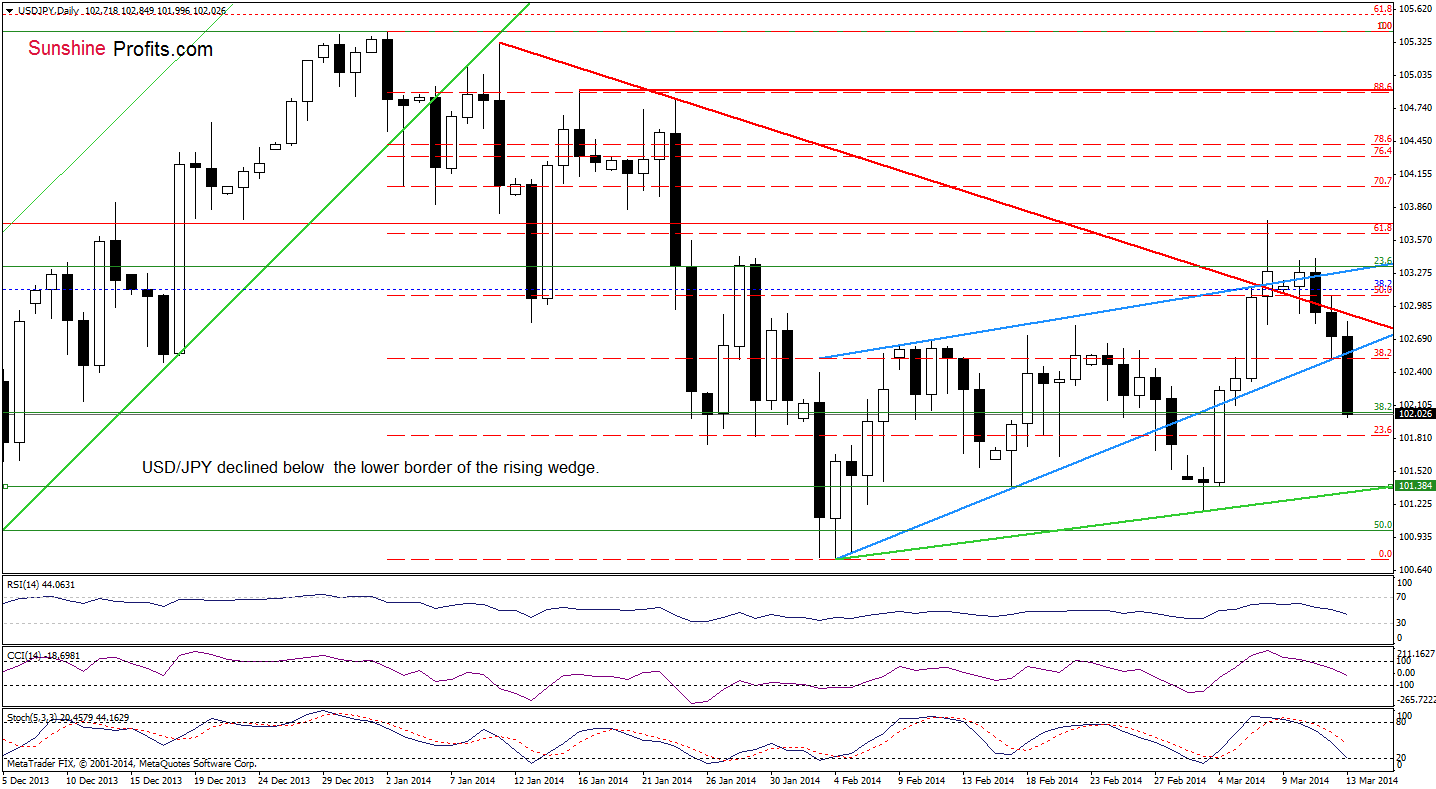

USD/JPY

Although USD/JPY rebounded after a small drop below the lower line of the rising wedge earlier today, the previously-broken declining resistance line (marked with red) successfully stopped further improvement. As you see on the above chart, the sellers successfully pushed the exchange rate below the very short-term support line, which suggests further deterioration – especially when we factor in sell signals generated by the indicators. In this case, we may see a drop even to around 101.38 (the March 4 low).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

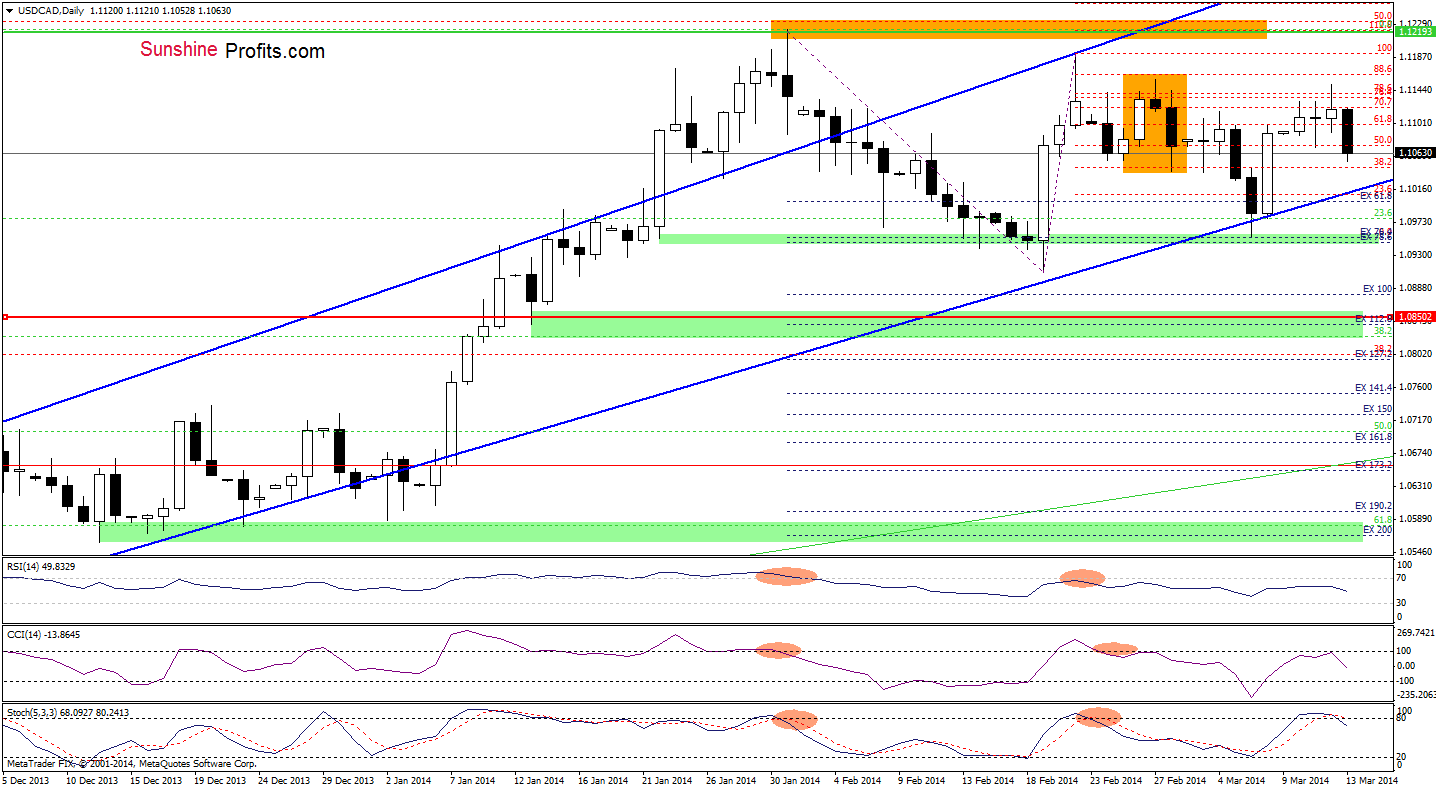

USD/CAD

Quoting our last Forex Trading Alert:

(…)USD/CAD (…)approached its next upside target – the Feb.27 high (…)this is also a top of a bearish candlestick pattern – an evening star (…) this formation helped push the exchange rate lower at the beginning of the month. Taking into account the proximity to this resistance level and combining it with the 78.6% Fibonacci retracement (reached earlier today), we may see a pullback in the near future – especially if the indicators generate sell signals.

Looking at the above chart, we see that the buyers didn’t manage to push USD/CAD higher, which resulted in a decline earlier today. Additionally, all indicators reversed and the CCI and Stochastic Oscillator generated sell signals, which suggests further deterioration. In this case, the first downside target will be the lower border of the rising trend channel (currently around 1.1009).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

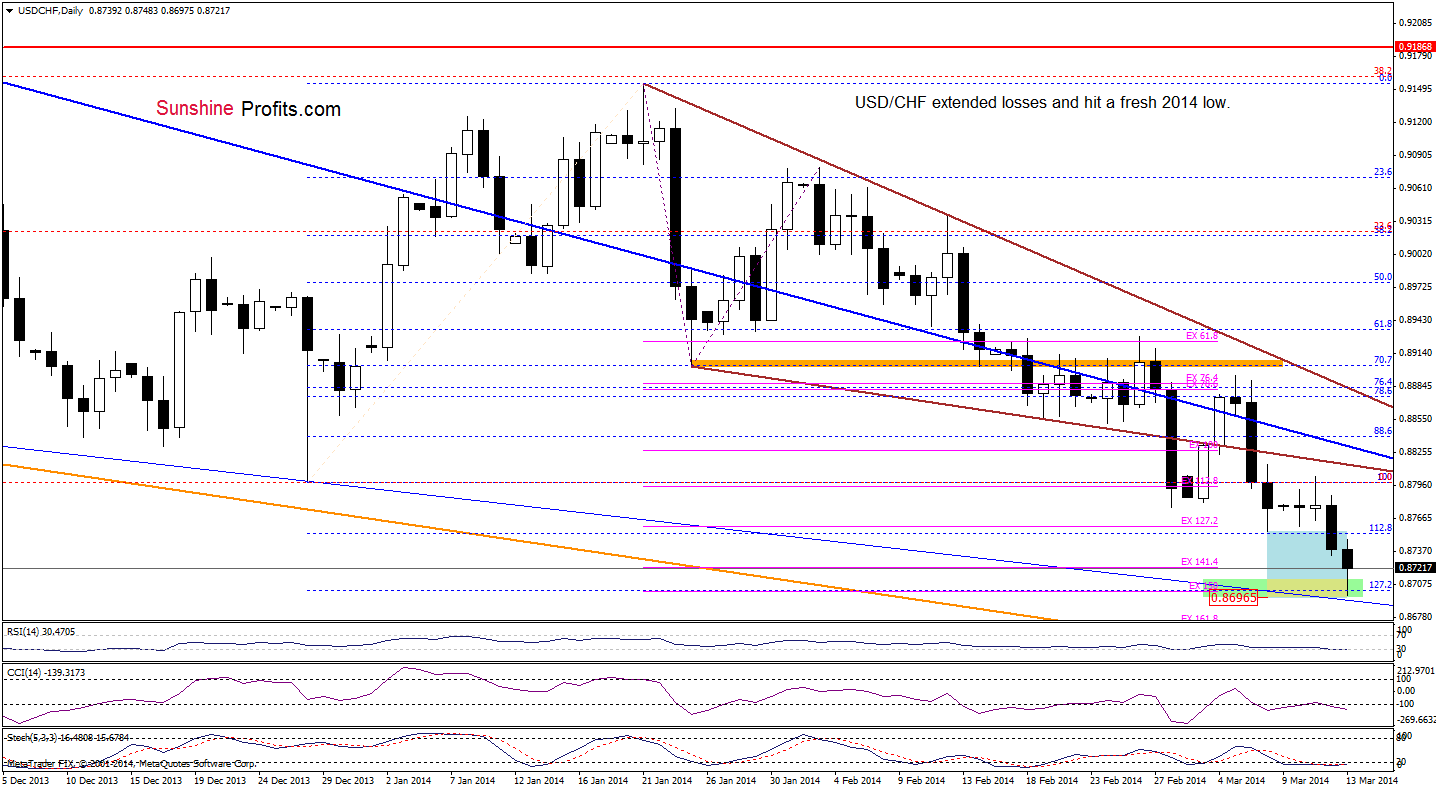

USD/CHF

Quoting our last Forex Trading Alert:

(…) USD/CHF broke below the lower border of the consolidation range. According to theory, such price action may trigger further declines and downside target (marked with a blue rectangle) would be around 0.86965. At this point it’s worth noting that this level is in the next support zone created by the 127.2% Fibonacci extension, the 150% Fibonacci projection and the medium-term thin blue support line.

Looking at the above chart, we see that the sellers realized their scenario and reached the support zone. If this area encourage buyers to act, we will likely see a corrective upswing in the coming day (or days). However, if it is broken, the next downside target will be around 0.8671, where the 161.8% Fibonacci projection is. The position of the indicators hasn’t changed much. Although there is a positive divergence between the CCI and the exchange rate, the Stochastic Oscillator is oversold and the RSI slipped to its lowest level since the beginning of the month, there are no buy signals at the moment.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion, the space for further declines seems limited, so opening short positions at the moment is not a good idea. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

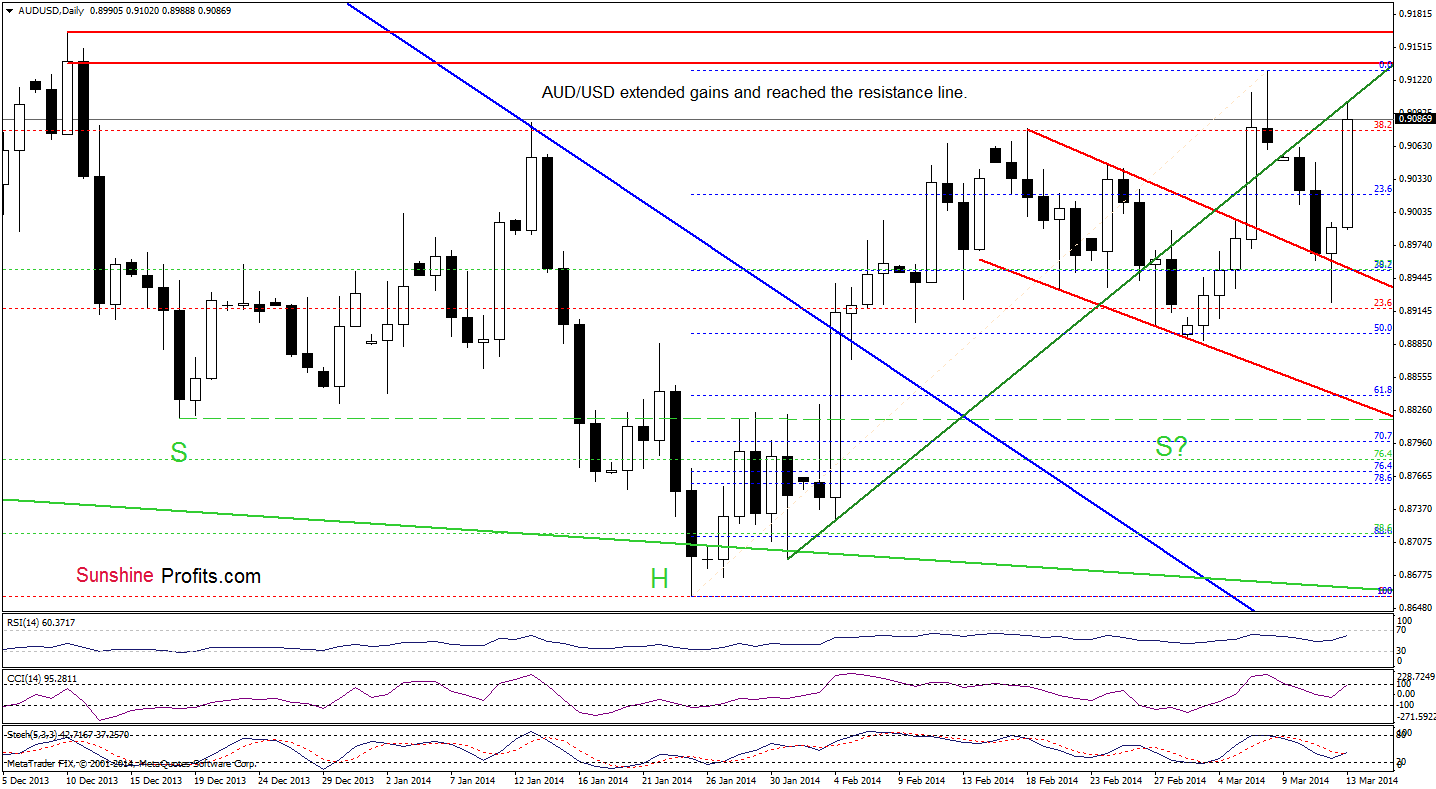

AUD/USD

Earlier today, AUD/USD extended gains and reached the green resistance line. If it holds, we will likely see a pullback to the upper line of the declining trend channel in the coming day (or days). However, if it is broken, the buyers will likely try to push exchange rate above the 2014 high. As a reminder, slightly above the March high is a resistance zone created by the Dec.10 high (in terms of an intraday high and daily closing prices).

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts