Earlier today, the U.S. dollar was little changed against major currencies as market participants are awaiting Federal Reserve Chairman Janet Yellen's testimony on the bank’s semiannual monetary policy report on Tuesday. What is the current outlook for major currency pairs? We invite you to read our today's Forex Trading Alert.

In our opinion the following forex trading positions are justified - summary:

- EUR/USD: none

- GBP/USD: none

- USD/JPY: none

- USD/CAD: none

- USD/CHF: none

- AUD/USD: long (stop-loss order: 0.8728 and an upside target: 0.9069)

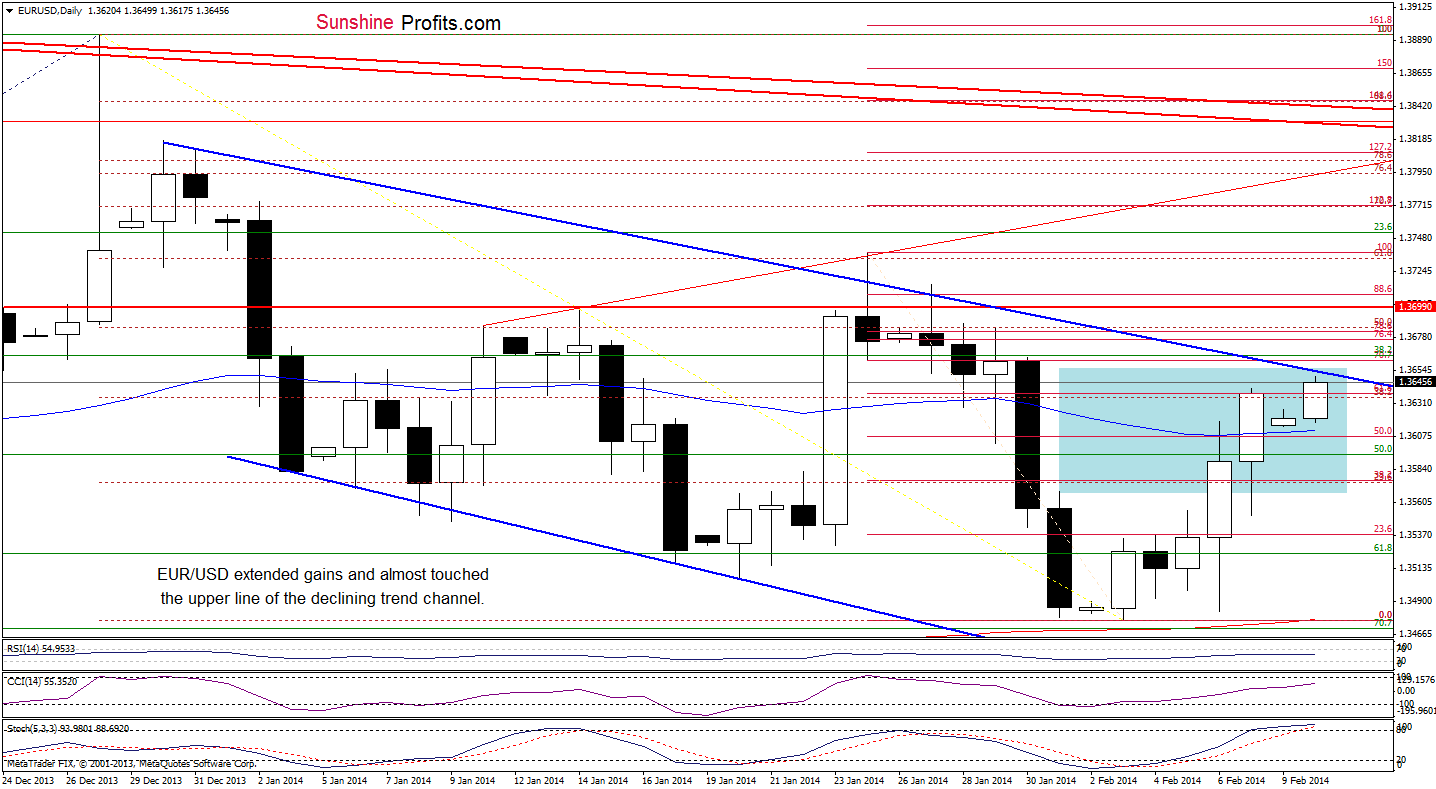

EUR/USD

As you see on the above chart, the pair extended gains and almost touched the upper line of the declining trend channel (and also its upside target at 1.3660). At this point, we should consider two scenarios. If the proximity to this strong resistance encourages the sellers to act, we will likely see a pullback in the coming day (or days) and the first support will be the 50-day moving average. However, if this resistance line is broken, we may see further improvement and the initial upside target would be around 1.3676-1.3682, where the 76.4% and 78.6% Fibonacci retracement levels are.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

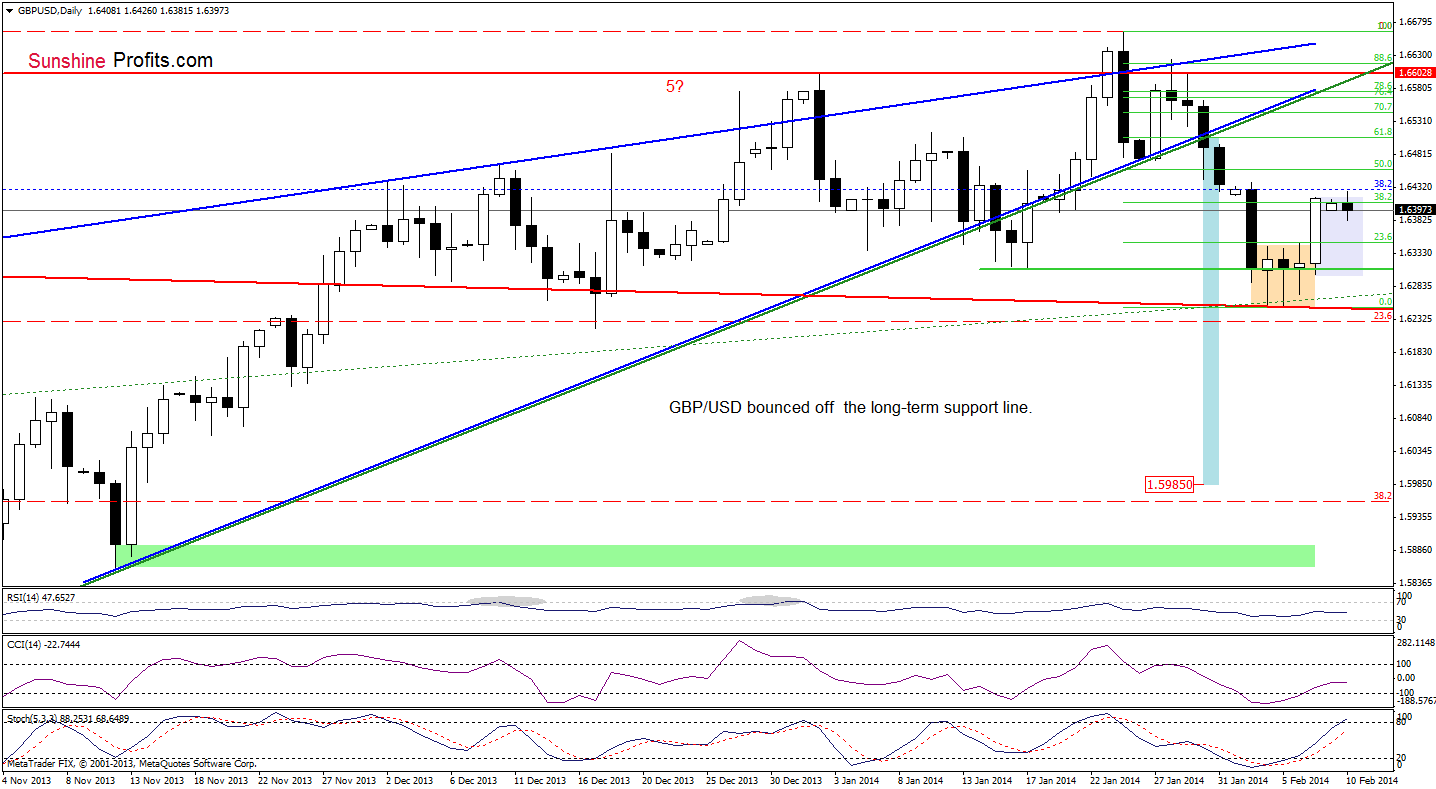

GBP/USD

As you see on the above chart, the situation hasn’t changed much as GBP/USD remains around Friday’s high (slightly above the 38.2% Fibonacci retracement level based on the recent decline). Please note that buy signals generated by the CCI and Stochastic Oscillator remain in place and suggest that further improvement is likely to be seen. The nearest resistance level is created by Feb.3 at the moment. If it is broken, the next upside target will be the 50% Fibonacci retracement (slightly below the Jan.27 low). Nevertheless, if the 38.2% Fibonacci retracement encourages sellers to act, we may see a pullback to around 1.6347, where the previously-broken upper line of the consolidation range is.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

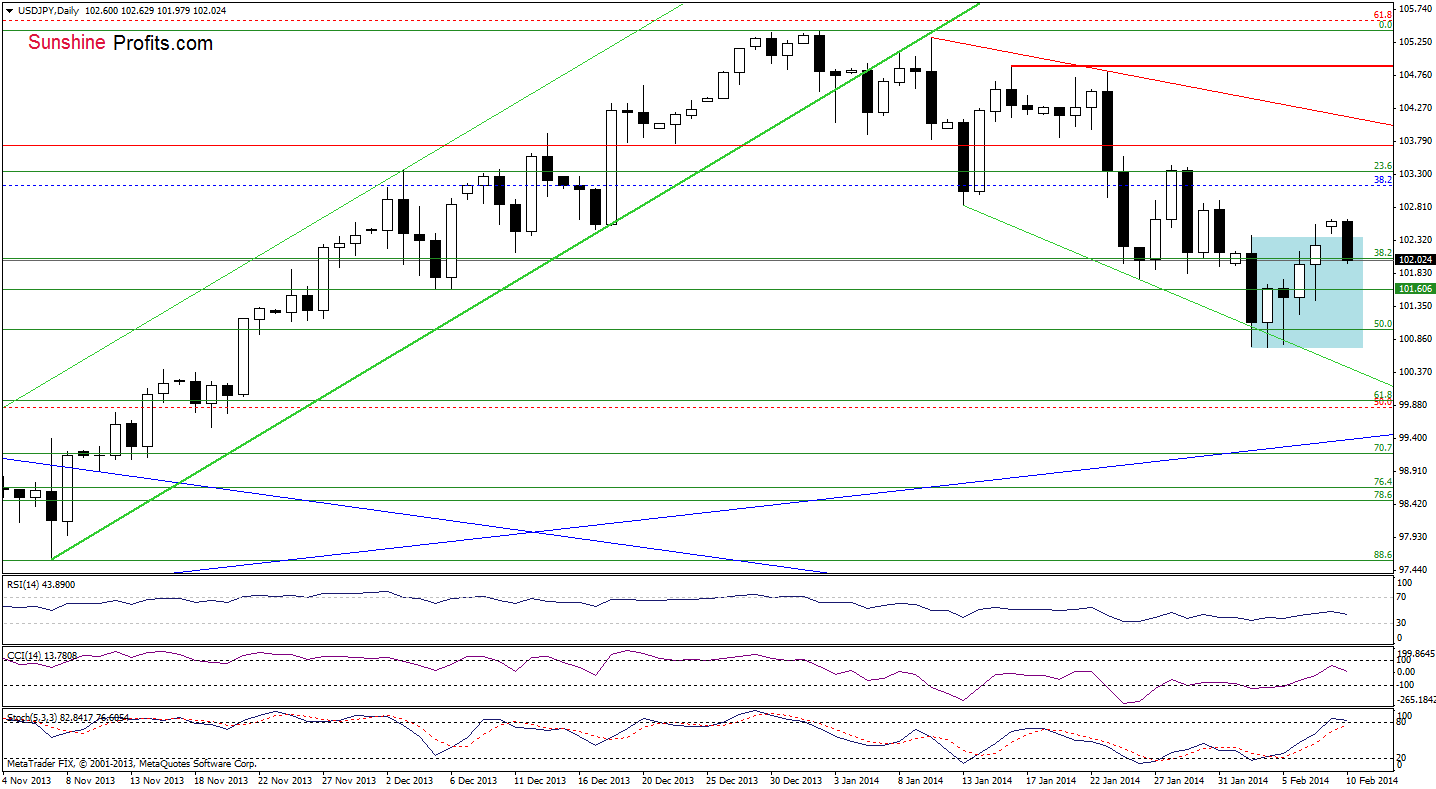

USD/JPY

On the above chart, we see that the situation has deteriorated as USD/JPY invalidated a breakout above the upper line of the consolidation range earlier today. Additionally, the CCI and Stochastic Oscillator declined, which suggests that we may see another attempt to move lower. If this is the case, the first downside target will be around 101.43 where Friday low is.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

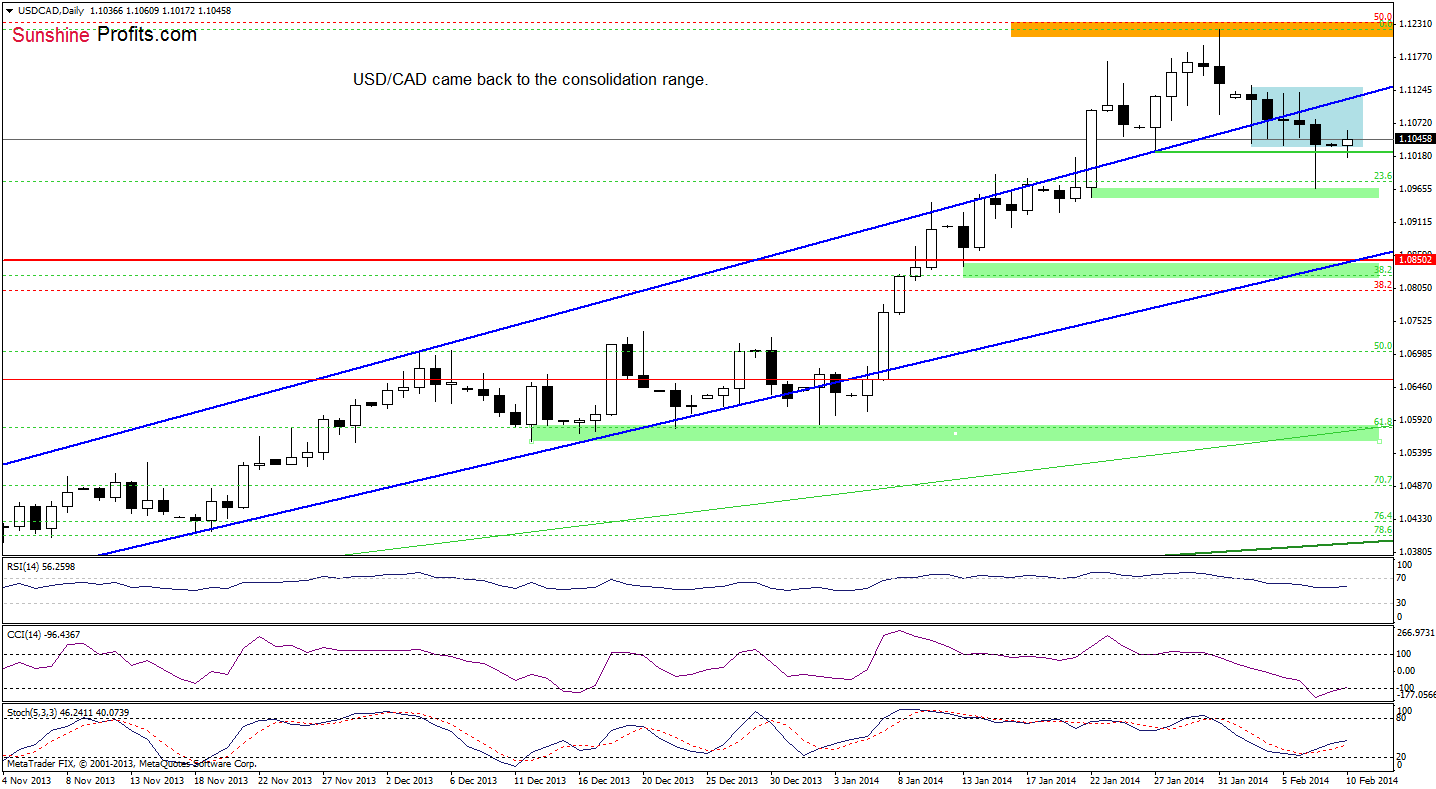

USD/CAD

Looking at the above chart, we see that the situation hasn’t changed much as USD/CAD came back to the consolidation range. If the buyers do not give up, we may see further improvement – especially when we take into account buy signals generated by the CCI and Stochastic Oscillator. If this is the case, the first upside target will be the previously-broken upper line of the rising trend channel. Nevertheless, if they fail (and the pair doesn’t come back above this resistance line), we may see another attempt to move lower. Please note that if the exchange rate drops below the Jan.22 low, it will likely trigger a decline to 1.0904 (the Jan. 16 low) or even to a strong support zone created by the 38.2% Fibonacci retracement level (based on the entire Sept.-Jan. rally), the lower border of the trend channel, the Jan. 13 low and the 2010 high.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: bullish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

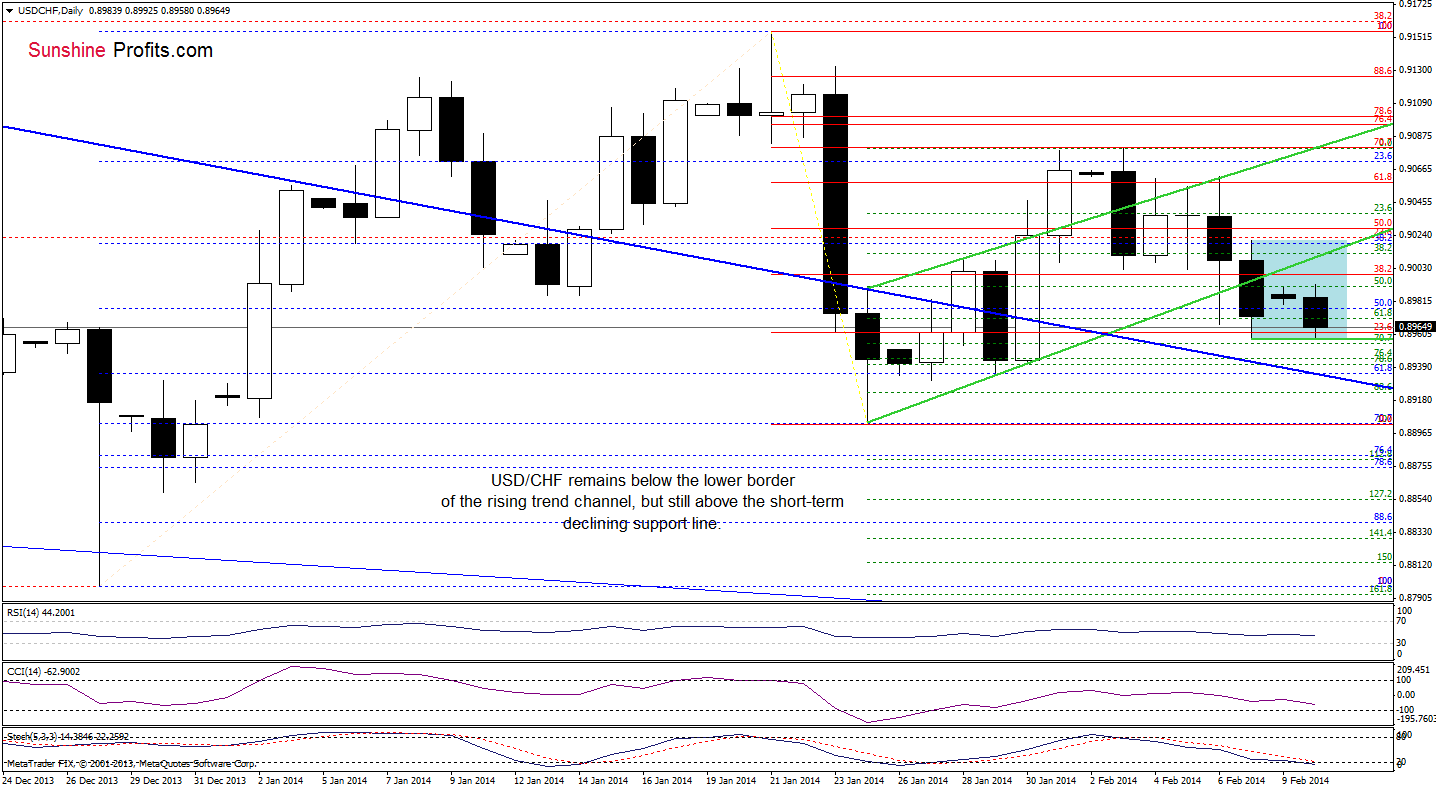

USD/CHF

As you see on the above chart, USD/CHF still remains below the lower line of the trend channel. Earlier today, the pair declined once again and reached Friday’s low. If the buyers manage to hold this support level and the exchange rate climbs above today’s intraday high, we may see a post double bottom rally. In this case, the first upside target will be the previously-broken lower line of the trend channel. However, if USD/CHF declines below Friday’s low, we will likely see further deterioration and the downside target will be the short-term declining support line (marked with blue).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

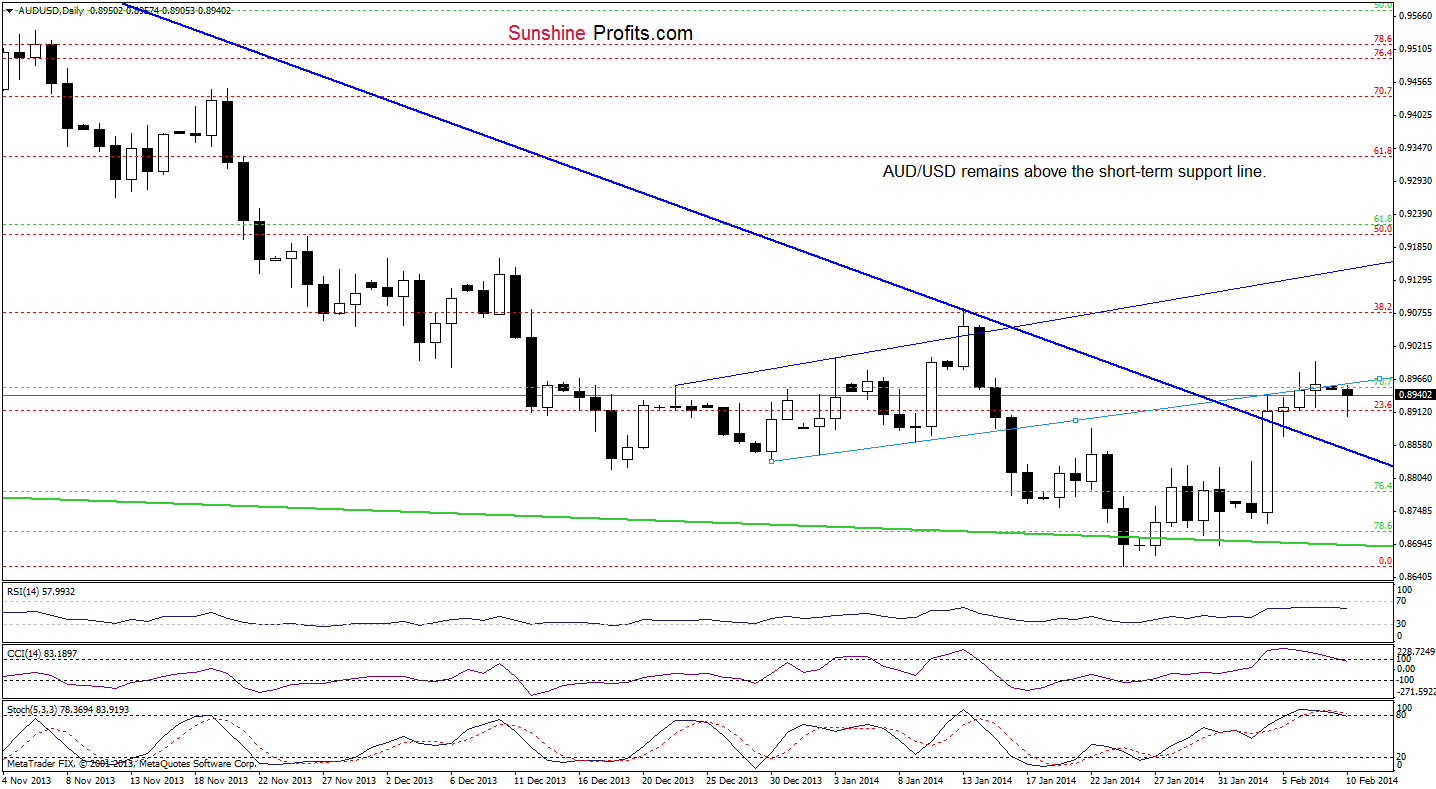

AUD/USD

As you see on the above chart, AUD/USD declined below the very short-term support line, which is not a positive signal. However, the pair still remains above the short-term blue rising line, which serves as support at the moment. Please note that the CCI and Stochastic Oscillator are overbought, which suggests that a pullback is just around the corner. Nevertheless, as long as the exchange rate remains above the short-term blue rising line, the space for declines seems limited.

Very short-term outlook: mixed

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bearish

Trading position (short-term): long (stop-loss order: 0.8728 and an upside target: 0.9069). We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above. The above is not an investment / trading advice and please note that trading (especially using leveraged instruments such as futures or on the Forex market) involves risk.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts