Visit our archives for more gold & silver articles.

Fish are jumping and the cotton is high. Yes, it's summertime and the living is (quantitatively) easy. At least that's how it looks from the Federal Open Market Committee minutes for the July/August meeting that revealed support among some of the members for a new round of quantitative easing.With the release of the minutes Wednesday, gold went up and the U.S. dollar took a dive. The Fed members see three pitfalls for the economy-- the sovereign debt crisis in Europe, a global economic slowdown led by China and other BRICs, and the fiscal cliff, which could result in substantial fiscal contraction. (Fed Chairman Ben Bernanke has repeatedly asked Congress to solve the problem, but with a Presidential election coming in November it is difficult to see how Republicans and Democrats will reach an agreement.)

Gold investors combed through the text of the FOMC's latest minutes to find a nugget that will make the value of their nuggets go up. What they found was a single sentence towards the end of the meetings that went like this:

Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery.

This sets the stage for further monetary easing possibly at the Fed's Jackson Hole, Wyoming meeting slated for the end of this month.

Waiting for other hints from the FED, let's now turn to the technical part of today's essay with the analysis of the mining stocks (charts courtesy by http://stockcharts.com.).

In the Toronto Stock Exchange Venture Index (which is a proxy for the junior miners as so many of them are included in it), we see a rally but it is quite small especially when compared to the recent several-week-long rally in the general stock market. It is likely just a correction after a breakdown below the recent huge head-and-shoulders pattern, so the implications are bearish for all precious metals mining stocks, not only for juniors.

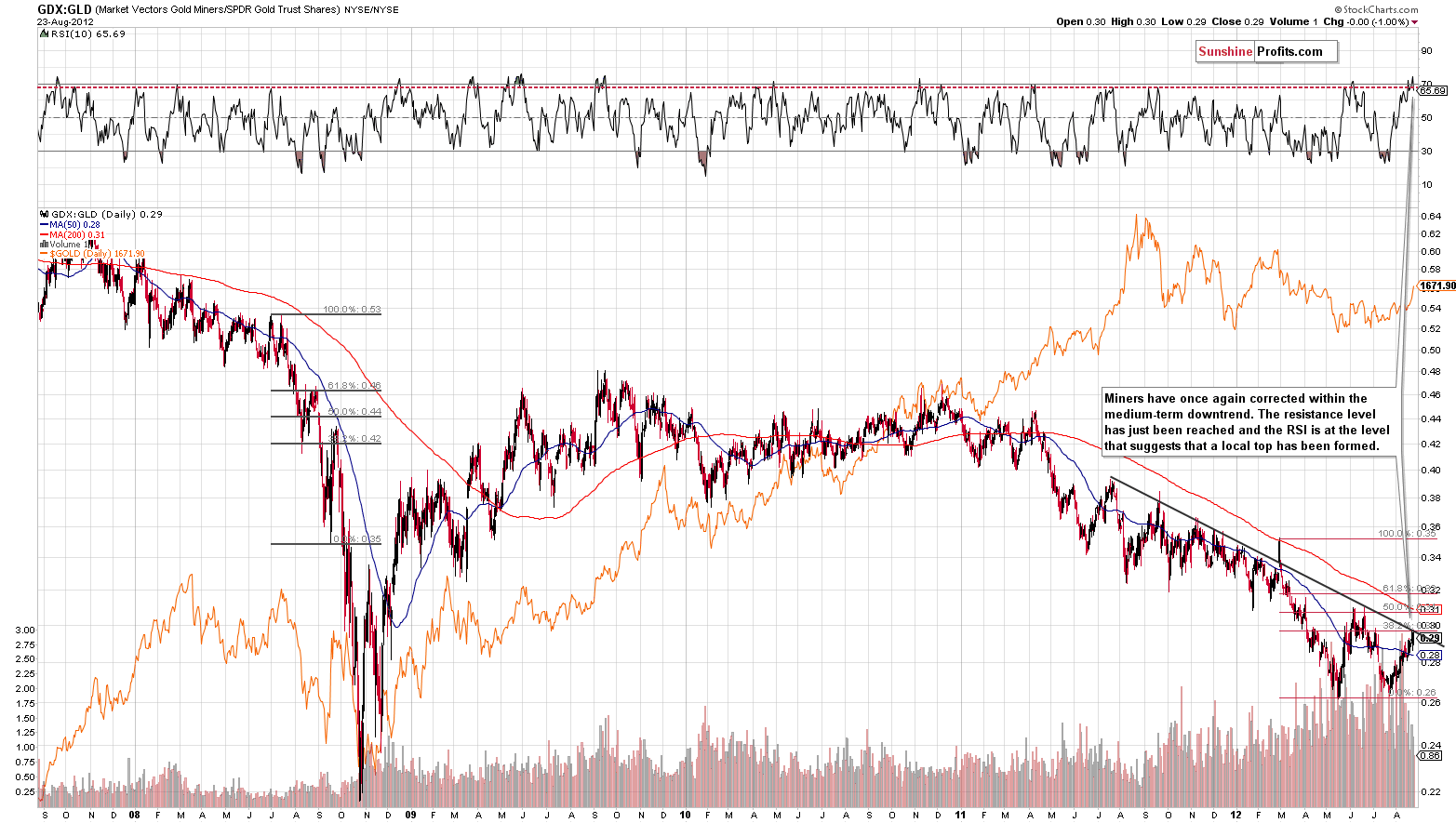

Let's now move on to a very interesting chart that gauges the performance of mining stocks relative to gold. It can shed light on which group of assets (miners or the underlying metals) will perform better in the next couple of weeks.

In the miners to gold ratio chart (if you are reading this essay on sunshineprofits.com, you may click the above chart to enlarge), the medium-term trend is down and the recent rally here does not change the overall outlook. A short-term overbought status has actually been created, a situation not seen since previous local tops and the final top of 2011 which followed a big rally. The implications are bearish, the trend is likely to reverse, and the miners are likely to underperform the underlying metals in the coming weeks.

Summing up, the situation is less favorable for the precious metals mining stocks than it is for the underlying metals.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

If we had to choose one word for the current situation on the precious metals market, it would be "critical". Gold rallied in the past week, and so did silver and the rest of the precious metals sector. Still, mining stocks didn't move higher on Thursday and Tuesday when metals moved higher and the miners-to-gold ratio reached a key resistance line. Will this be enough to keep the metals' rally in check?

In order to make sure that we analyzed the situation from all important perspectives, today's Premium Update includes more charts than usually (over 20). Among other issues, we covered silver viewed from the non-USD perspective and the GDX:SPY ratio.

The supplementary analysis of the currency indices and general stock market help to put the above into perspective, especially that this week it is accompanied by 2 Correlation Matrixes. As always, we provide you with our direct suggestions for speculative and long-term investment capital along with the probability that the next price swing will indeed materialize as predicted.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.