Visit our archives for more gold & silver articles.

People put too much store in central bankers and hang on their every word as if they are prophets with a direct line to the divine. It seems that no one does this more than gold investors. In the past gold has shown itself to be super sensitive to monetary policy announcements and investors hope that any indication of further easing would give gold a joy ride.

We have had enough evidence that central bankers are no super heroes able to leap tall buildings at a single bound and save the economy. There are plenty who contend that if the Fed had not stimulated the economy with zero percent interest rates, two rounds of quantitative easing and the so called “operation twist”, the economic fiasco would have been much worse and the recession much deeper, perhaps even a depression. They go even further and say that the Fed has not done enough, and if only it had printed more money, we would be out of the woods by now.

The Austrian economists, on the other hand, counter that there is no free lunch and the tab will be paid later. The short-term pain of a deep recession would have been more salutary to the economy and would have eventually built a more robust sustainable recovery, they say. They argue that the Fed’s actions simply delay, or numb the pain. So far, even with all the quantitative easing, we have not seen much of a recovery as the employment report released on Friday confirms. In the best case scenario the U.S. economy is stagnant. At the worst case scenario it is going down the hill. That the economy is a mess is the one thing that Barack Obama and his Republican challenger, Mitt Romney, agree on.

We believe that interest rates cannot stay low forever. The Fed's interest rate was bought down from 5.25% in August 2007 to 0.25% in December 2008. When interest rates finally rise, the prophets of doom and gloom will have plenty to rant about.

Just what did QE do for gold? One could argue—plenty. On November 24th, 2008, which is the day that QE1 was announced, the price of gold was $819.50. It rose to $1,113.30 by March 31st 2010, which is when QE1 ended. This was a hefty increase of $293.80. The price of gold rose from $1,337.60 on November 3rd 2010, the day QE2 was announced, to $1,502.50 on June 30th 2011, which is when QE2 ended. This was a sizeable increase of $164.90, but smaller than in the first round. Does the smaller increase in the second round suggest that investors are becoming less sensitive to such measures by the Fed? Has gold lost its “safe haven” status and become a “risk on” asset?

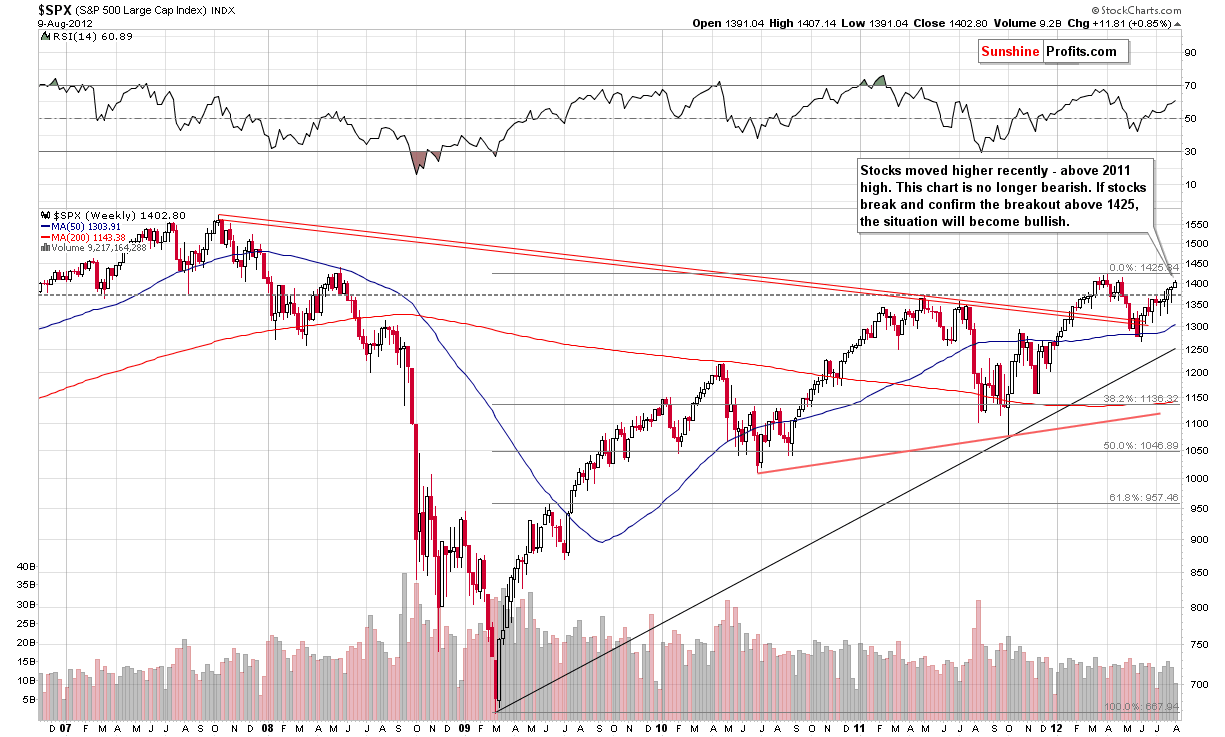

Without any clear signs of the next round of QE, we will search the stock market for clues regarding gold and silver. We will start with the S&P 500 Index long-term chart (charts courtesy by http://stockcharts.com.)

In the chart (if you are reading this essay on sunshineprofits.com, you may click the above chart to enlarge), we see that stocks have rallied recently and approached but not yet moved above the level of the previous 2012 high. It seems that once the S&P moves above the $1,425 level and verifies this move, the picture will be bullish here once again. For now, we continue to view the outlook as mixed with a resistance line around 1.5% above Thursday’s closing price level and RSI levels neither overbought nor oversold at this time.

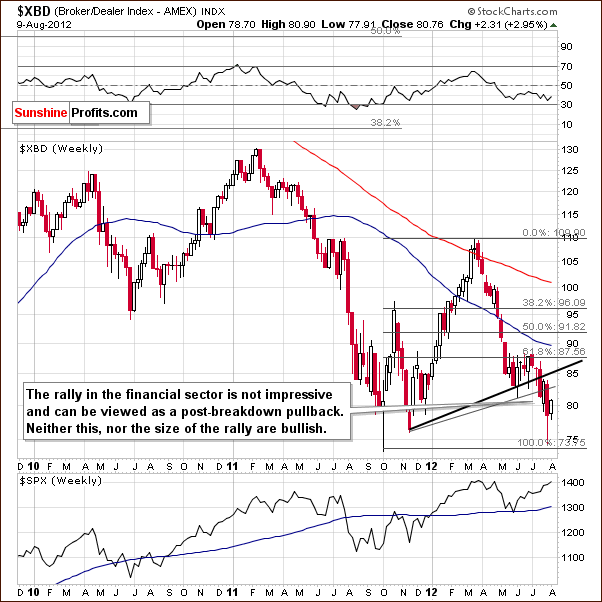

Let us now move on to the financial sector.

In the Broker Dealer Index chart (a proxy for the financial sector), we saw a bit of a rally for the financials last week, but their underperformance over the past five months remains clearly evident. The small rally seen last week does little to atone for the declines seen in two-thirds of the weeks since the mid to late-March high. In short, there is really no good signal for the stock indices in general here.

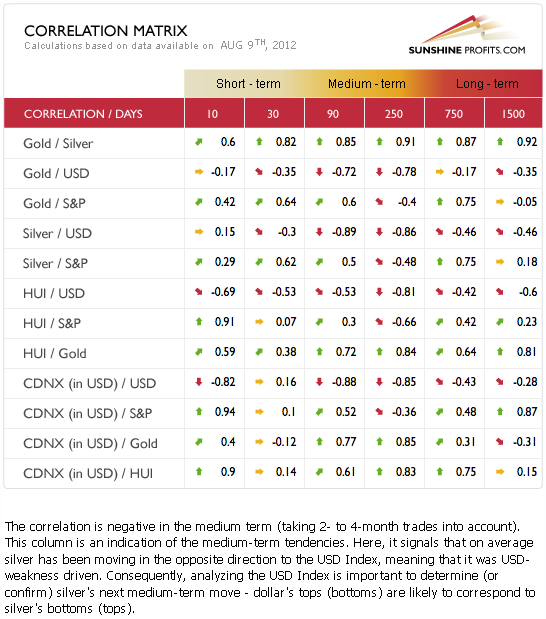

To better see what possible effects could higher stock prices have on the precious metals market, should a rally in the S&P 500 emerge, let’s take a look at our own tool intended for measuring intermarket correlations.

The Correlation Matrix is a tool which we have developed to analyze the impact of the currency markets and the general stock market upon the precious metals sector.

Both gold and silver are positively correlated with the S&P 500 Index in the short and early medium term. Hence the possible rally in the stock market could help these two metals reach higher prices in this time horizon.

Yet one cannot forget that the currency markets are strongly and negatively correlated with precious metals at this time. If the medium-term rally in the USD Index continues, the downward pressure on precious metals prices will remain in place as well. Note that the metals’ reaction may be delayed by a day or a few of them in response to strong moves in the USD Index, because the nature of the relationship is medium-term, not a short-term one.

Summing up, the overall picture for stocks is best described as mixed or unclear at this time. A short-term rally has been seen recently but an important resistance line is in place and the strength of the rally will be determined when this previous 2012 high price level is tested. It simply seems best to wait and see before commenting further here. Should such a rally in the stock market emerge, gold and silver could benefit from it in the short and medium term, as suggested by the Correlation Matrix. For now, this bullish factor is not in place. One should still bear in mind that such a scenario would be thwarted by a strong rally in the USD, as the correlation between these two metals and the dollar is still strong.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

Gold declined today and the mining stocks generally failed to move lower. We dediced to let our subscribers know our thoughts about this phenomenon via Market Alert. If you'd like to read it, please sign up.