Yesterday we wrote about the slowing pace of the U.S. economic growth. We argued that GDP might rise in the next quarters, but that the strong pace of consumer spending as in the fourth quarter would probably not be repeated. The very recent data released by the Commerce Department confirm our skepticism. Why? Because consumer spending actually fell 0.3 percent in December (month-on-month), compared to a 0.5 percent increase in November. Wall Street was expecting a gain around 0.4 percent.

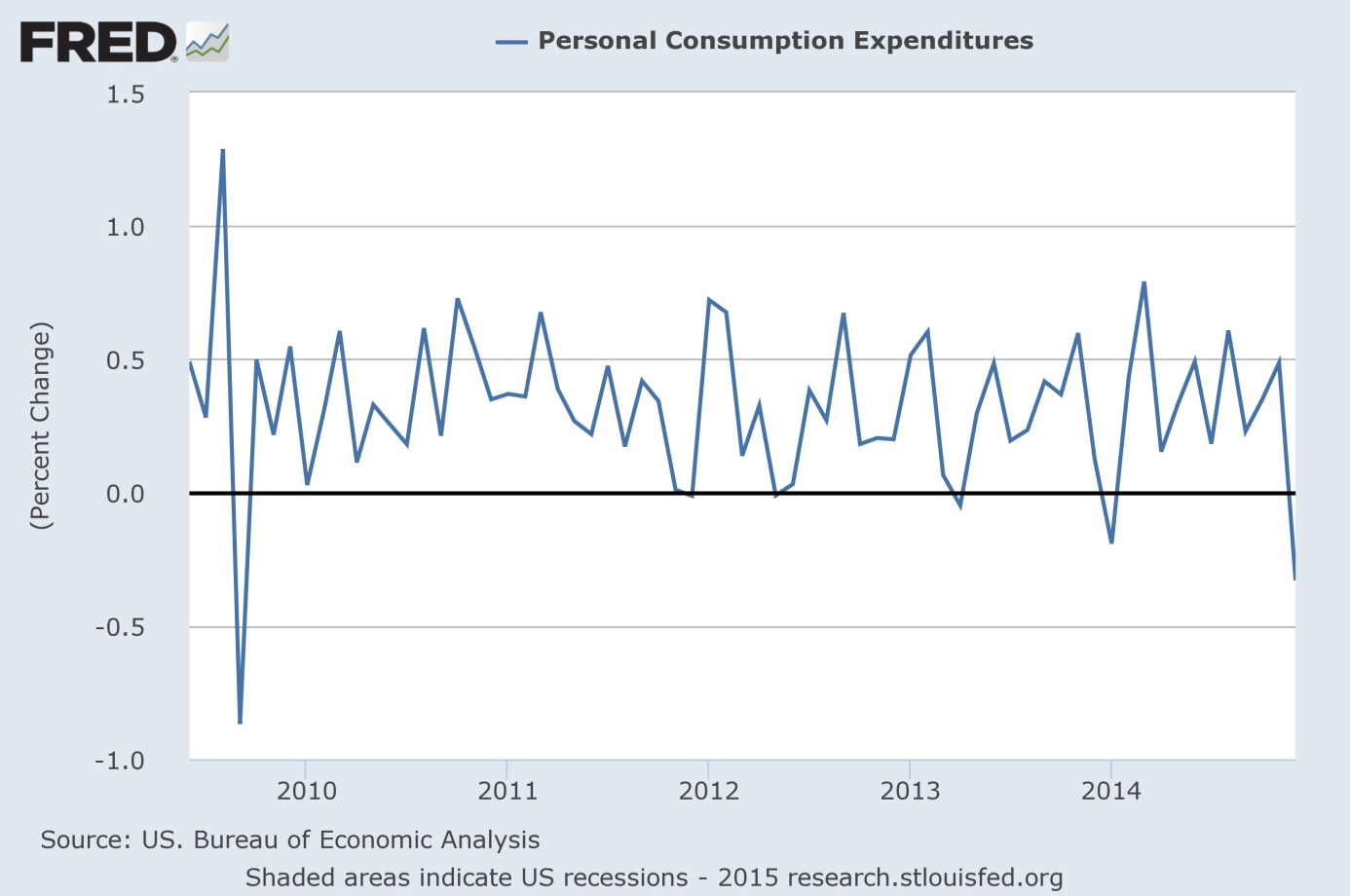

What is more, as you can see in the Figure 1, in December U.S. consumer spending recorded its biggest decline since late 2009. And remember that December is usually the busiest month of the shopping season.

Figure 1: U.S. personal consumption expenditures from 2009 to 2014 (monthly percent change)

What caused the drop in consumer spending? As we pointed out yesterday, the level of car sales from the end of the year is not sustainable and it actually began to decline in December. Sales of automobiles and parts dealers fell 0.7 percent (change from previous month), despite the drop in oil prices. However, the biggest decline was observed at gas stations. Sales of gasoline fell 6.5 percent in December. It is striking. Cheaper oil should boost sales. Some economists believe that seasonal fluctuations could be responsible for the weak spending. However, even if volatile purchases of automobiles and gasoline are excluded, retail sales fell 0.3 percent.

What does it mean? On the one hand, consumers could use much of the extra income from cheap gasoline to pay down debt and boost savings, which is good for the economy (although not necessarily for GDP). On the other hand, it may be an indication of slower economic activity, despite the low oil prices. When the economy is boosting, we expect a rise, not a fall, in purchased trucks and gasoline. Especially if the oil prices are falling. Especially in December, the busiest month of the shopping season.

Summing up, the recent data on personal expenditures may indicate an economic slowdown. As we wrote in January’s Market Overview “lower oil prices can be a signal that entrepreneurs are contracting their operations and thus demanding less oil.” The recent data confirm our thesis that U.S. economy may be experiencing a slowdown, despite the Fed’s opinion about “strong” growth, and the long-term outlook for gold remains bullish. We have already pointed out weak investment spending. Today we can add that, according to yesterday’s data, the Institute for Supply Management’s manufacturing index slowed to a reading of 53.5% in January from 55.1% in December, to mark the worst performance in a year. As yesterday, this is good news for gold investors for the following years.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Gold Trading Alerts

Gold Market Overview

This articles is exclusive to Sunshine Profits; please do not copy it (you are free to link to it, though).

Back