This essay is based on the Premium Update posted October 4th, 2009. Visit our archives for more gold articles.

In my previous essay, I commented i.a. on the situation in the U.S. Dollar. I wrote the following:

There are several factors that make me think that we may move a little higher - above 77 but not higher than the 78 level. The declining trend line (thick blue line) provides a solid resistance right now, and it has not been reached yet. Moreover, the breakdown below December 2009 low has not been verified yet, and a brief move higher from here would verify it.

This is precisely what we have seen this week - USD moved slightly higher, yet gold and silver managed to close this week a little higher as well. This type of action during consolidations (rising despite fairly negative influence from other markets) signals strength of the precious metals.

Speaking of consolidations, let's turn to the gold chart (charts courtesy of http://stockcharts.com) and see what it did this week, to estimate what is likely to take place next.

Gold

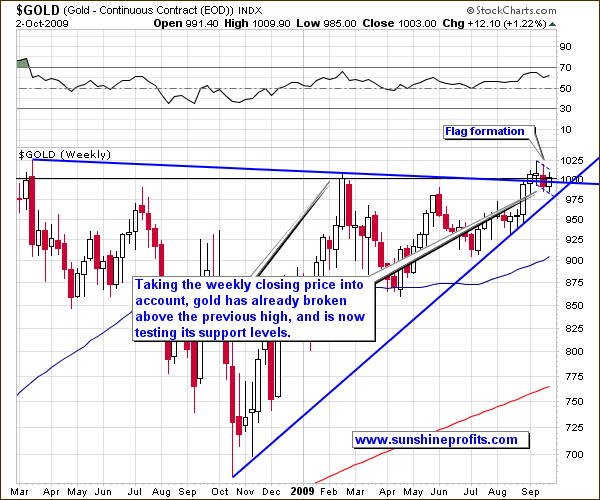

The yellow metal is currently hovering at the $1,000 level. Since this is such important number from a long-term point of view, I believe a weekly chart would be particularly useful to analyze the situation:

Once we take a look at gold from this perspective, it becomes noticeable that in terms of weekly closes gold has already broken above the previous highs, and is now verifying this breakout. So far it has been successful, as the price closed below the $1,000 level only last week, but bounced higher this week.

Moreover, on this chart you can see the flag formation marked with thin, dashed lines. This pattern suggests continuation of the previous trend, and that the following rally will be at least as large as the preceding move. This would imply gold above $1,050 - high enough to convince many people that $1,000 has been taken out for good.

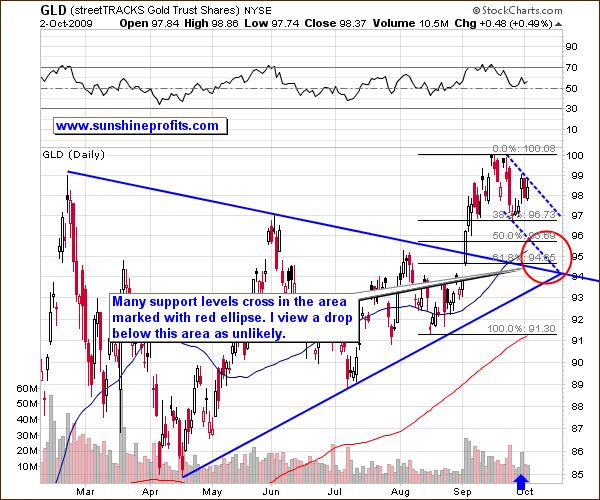

From a short-term point of view, it seems that the price of gold may correct a bit before a big rally materializes. As always, the Fibonacci retracement levels provide us with valuable support areas, which are strengthened by several other support lines. Most of the support levels cross at the area marked with red ellipse, so it is very likely to stop the decline.

This would more or less correspond to the ABC correction pattern, which is often seen in the metals market - a move lower would be the C part. Taking the long-term charts into account, it seems that the upper part of the ellipse, and the 50% Fibonacci retracement level (at 95.69 in the GLD ETF) are most likely to stop the decline, as they also correspond to the rising long-term support line (visible on the weekly chart.)

Gold Stocks

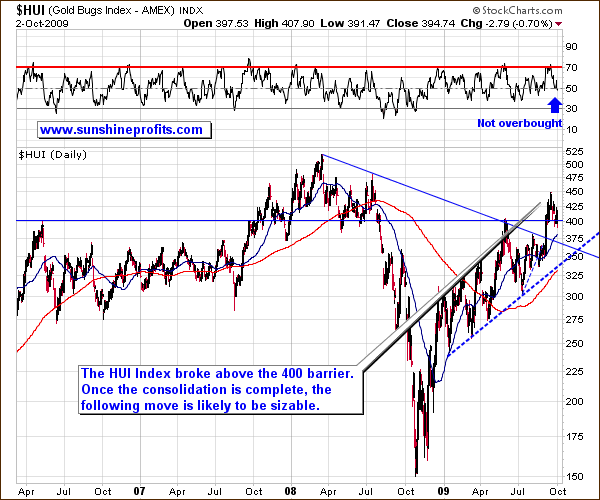

Moving on to the mining stocks, it appears that the breakout above the critical $400 level has been verified by several days when HUI closed above it. Since that was the case, we don't need to worry too much about Friday's close below $394.74, slightly lower than $400. Whether or not we will see HUI even lower on a short-term basis is based on the action in other markets. Since I mentioned earlier that a move higher is likely to follow after another small drop in gold and silver, it suggests a similar action in the mining equities. Let's take a look at the short-term chart for more details.

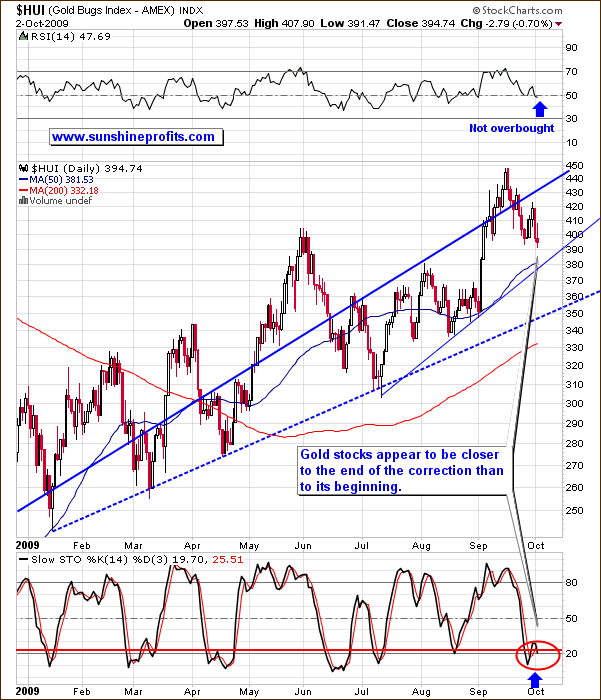

Short-term chart suggests that a downswing is close to being completed, as HUI Index is relatively close to the rising support line (currently at the $380 level). This would correspond also to the zigzag (ABC) pattern. As mentioned in the past, precious metals tend to correct in a zigzag fashion, and this time we could see another example of this tendency, meaning that the bottom is rather near, as the A, B and about half of the C part are behind us.

The Stochastic Indicator provides us with additional signal, as it was just below levels that meant temporarily oversold condition in the past, and it appears to move into this area once again. This type of behavior characterized local bottoms in the past so we may infer that one will emerge soon.

Not every important mechanism is directly visible on the above charts featured above, so let's turn to our indicators for more clues.

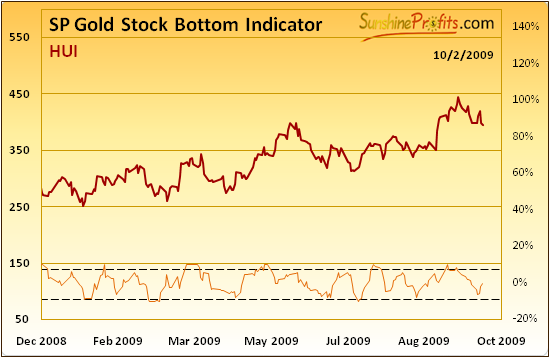

The SP Gold Stock Bottom Indicator recently moved near the lower dashed line. Generally, touching, or breaking through it means a buy signal. This did not take place yet, but please note that in the past bottoms materialized also when the orange line was just about to generate a buy signal, but finally didn't do so. In other words, when this indicator goes very near the dashed line, the probability that the bottom is in increases significantly.

Again, it was usually the initial downswing that took this indicator to the 'buy' level, so it does not invalidate the above analysis - another small move down is not out of the question. Should it take this indicator below the dashed line, it would signals another favorable entry point.

Summary

The precious metals have been correcting the previous rapid rally that took gold over $1,000, but the question here is if the bottom is already in. Based on the above analysis, it seems that PMs are likely to move a little lower before resuming their main direction - up. Should the USD Index move lower sharply, we are likely to see gold and silver soar. Another critical signal comes from the analysis of the general stock market, but I will leave this part of the analysis to my Subscribers.

To make sure that you get immediate access to my thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Save time and money, by using our Premium Service! It saves you a great deal of time, as a large part of the analysis will be done for you. You pull the final strings, but you get a Premium version of our Updates, Alerts, Charts and Tools, which are bound to shorten the time that you need to make your investment- and speculation-related decisions. Saving time means saving money, and additionally - how much did you save by not selling at the beginning of September (recall that you received a free alert from me, in which I recommended holding your positions at that time) and by selling two weeks ago? Join our savvy Subscribers today and take advantage of the full version of the exclusive, premium commentary.

Thank you for reading. Have a great and profitable week!

P. Radomski

--

The general stock market broke below its support level, while USD Index stopped at its multi-month resistance line. Given such mixed signals, precious metals wait for a decisive move from either of the abovementioned markets. What's next for gold and silver? Which market are they more likely to follow? Is gold likely to rise in all currencies? This week I deal with the above questions and comment on many other important developments in the precious metals market.

Other topics covered this week include: buying gold with borrowed dollars, comments on our exclusive indicators, and ranking of the top gold-, and silver juniors. One of them - Silver Quest Resources Ltd. (SQI.V) - that I added to the list last month has more than doubled since that time.