Oil Trading Alert originally sent to subscribers on March 18, 2015, 8:37 AM.

Trading position (short-term; our opinion): Short positions are justified from the risk/reward perspective.

On Tuesday, crude oil lost 3.11% as ongoing concerns over a supply glut weighed on investors’ sentiment. In this way, light crude hit a fresh 2015 low, but will we see a test of $40 in the coming days?

Yesterday, oil investors focused more on developments surrounding talks between Iran and world powers over Tehran's nuclear program after news that there were some signs of progress in discussions. Although it is unlikely that a possible deal over Iran's nuclear program will remove economic sanctions against Tehran and trigger a flood of Iranian oil into the global market, it was enough to weigh on investors’ sentiment and push the commodity to a fresh 2015 low of $42.41.

Additionally, after the market’s close, the American Petroleum Institute reported that domestic crude oil inventories increased by 10.5 million barrels in the week ended March 13, compared to expectations for a gain of 3.8 million. This is very bearish news for the commodity – especially when we factor in Friday’s report from Baker Hughes, which showed another drop in the number of rigs drilling for oil in the U.S. (at this point, it’s worth noting that the number of working U.S. oil rigs is 46% lower than in October). Therefore, if today’s data from the EIA confirms the build in inventories, the commodity will decline once again and the probability of a test of $40 will increase significantly. On the other hand, if today’s report is better than expectations, we’ll likely see a short-term rebound in the coming days. Which scenario is more likely at the moment? Let’s examine charts and find out what are they saying about future moves (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

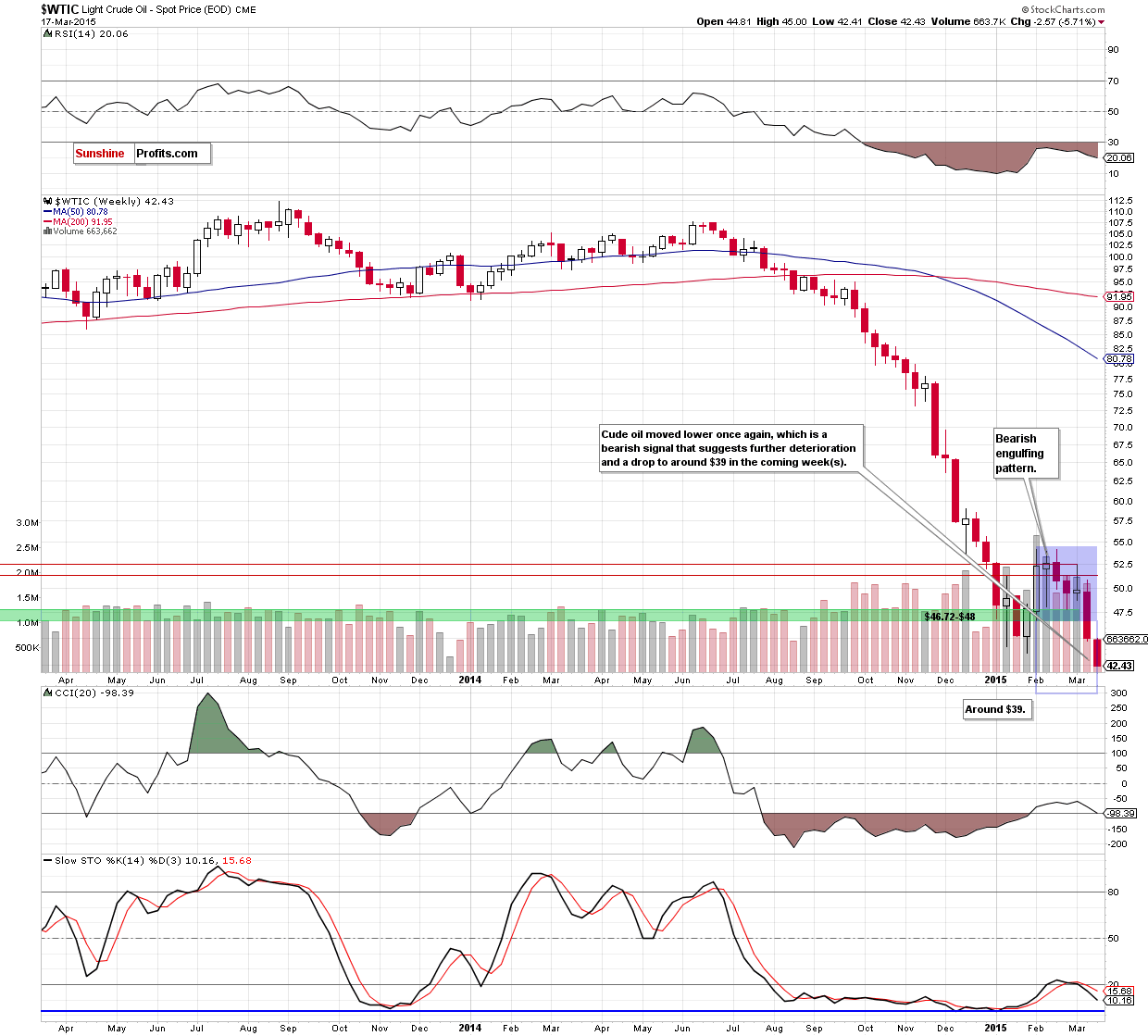

(…) oil bears (…) managed to (…) hit (…) a fresh 2015 low. What’s next? Taking the above into account, and combining it with the breakdown under the lower border of the consolidation (marked with blue) and a sell signal generated by the Stochastic Oscillator, we think that lower values of light crude are still ahead us.

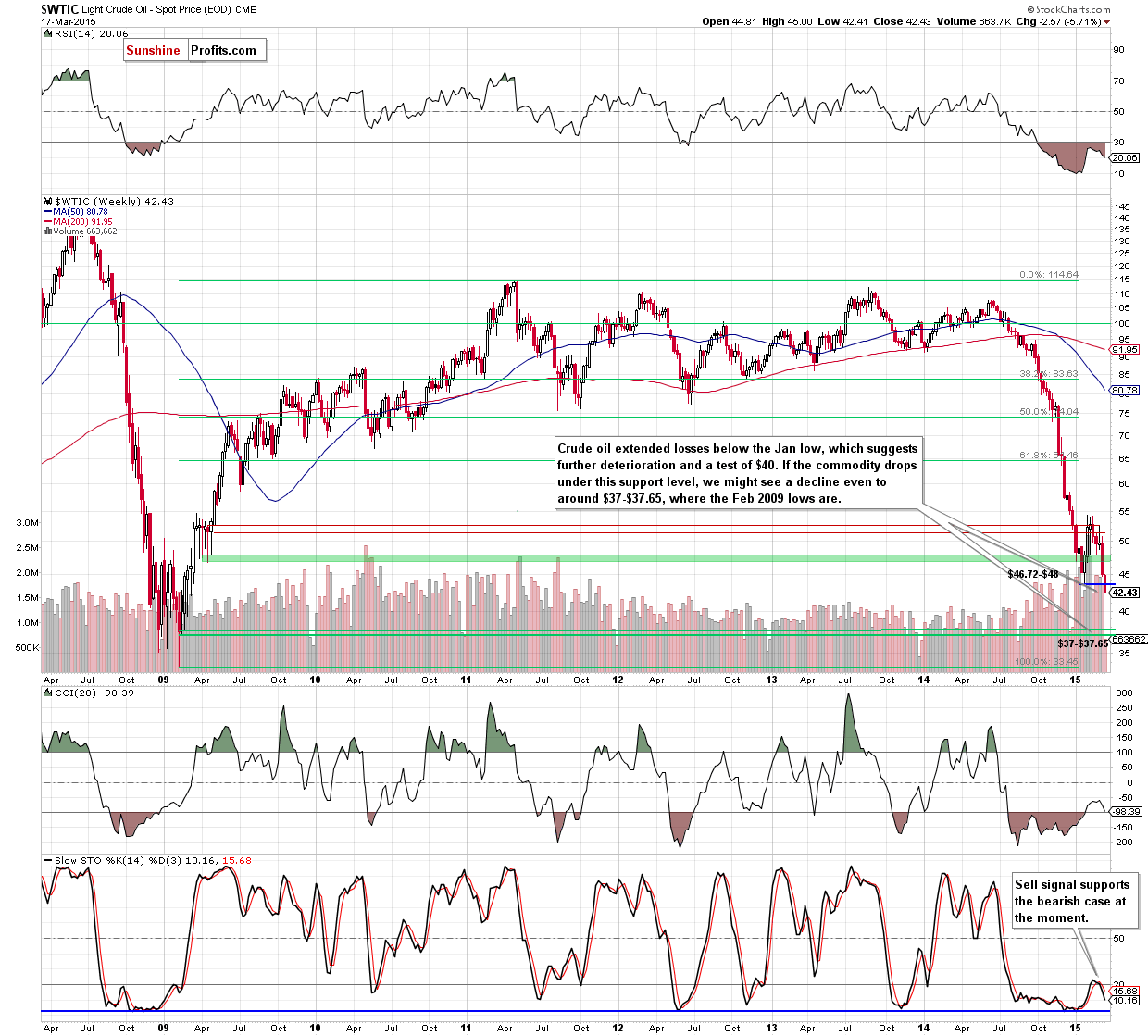

As you see on the weekly chart, the situation developed in line with the above-mentioned scenario and crude oil extended losses below the Jan low. Therefore, our downside targets from the last commentary are still up-to-date:

(…) How low could the commodity go? (…) it seems that we could see a fresh 2015 low around $39, where the size of the downward move will correspond to the height of the formation (…) if oil bulls won’t be able to hold this level, the next target for the commodity would be around $37-$37.65(…) where the Feb 2009 lows are (please note that this zone is also reinforced by the 161.8% Fibonacci extension based on the Jan-Feb upward move).

Summing up,crude oil extended losses below the Jan low and hit a fresh 2015 low of $42.41, which suggests further deterioration and a drop to at least $40 in the coming day(s).

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Short positions with a stop loss order at $46.10 are justified from the risk/reward perspective. We will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts