Oil Trading Alert originally sent to subscribers on March 9, 2015, 10:32 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil moved little higher supported by worries over supply disruptions in Libya and Iraq. Despite this improvement, the commodity reversed and declined sharply as a stronger U.S. dollar weighed on the price. Thanks to these circumstances, light crude lost 2.33% and closed the day below support levels. Where the commodity head next?

On Friday, crude oil increased after the market’s open as the current situation in Libya and Iraq supported the price. As a reminder, in Iraq Islamic State militants have set fire to oilfields, while in Libya, worsening security conditions have led to the closure of 11 oilfields. These circumstances fueled worries over supply disruptions from the region and pushed crude oil to an intraday high of $51.22. Despite this improvement, the commodity reversed and declined sharply after the Bureau of Labor Statistics showed that the economy added 295,000 jobs in the previous month, beating analysts’ expectations for a 55,000gain. These bullish numbers supported the U.S. dollar, making light crude less attractive or buyers holding other currencies. As a result, crude oil declined to an intraday low of $48.88. How did this drop affect the very short-term outlook? (charts courtesy of http://stockcharts.com).

On Friday, we wrote the following:

(…) although crude oil extended gains and climbed to the 76.4% retracement level, this resistance withstood the buying pressure, which resulted in a pullback. With this downswing, light crude invalidated earlier breakout above the 78.6% Fibonacci retracement, which is a negative signal that suggests further deterioration.

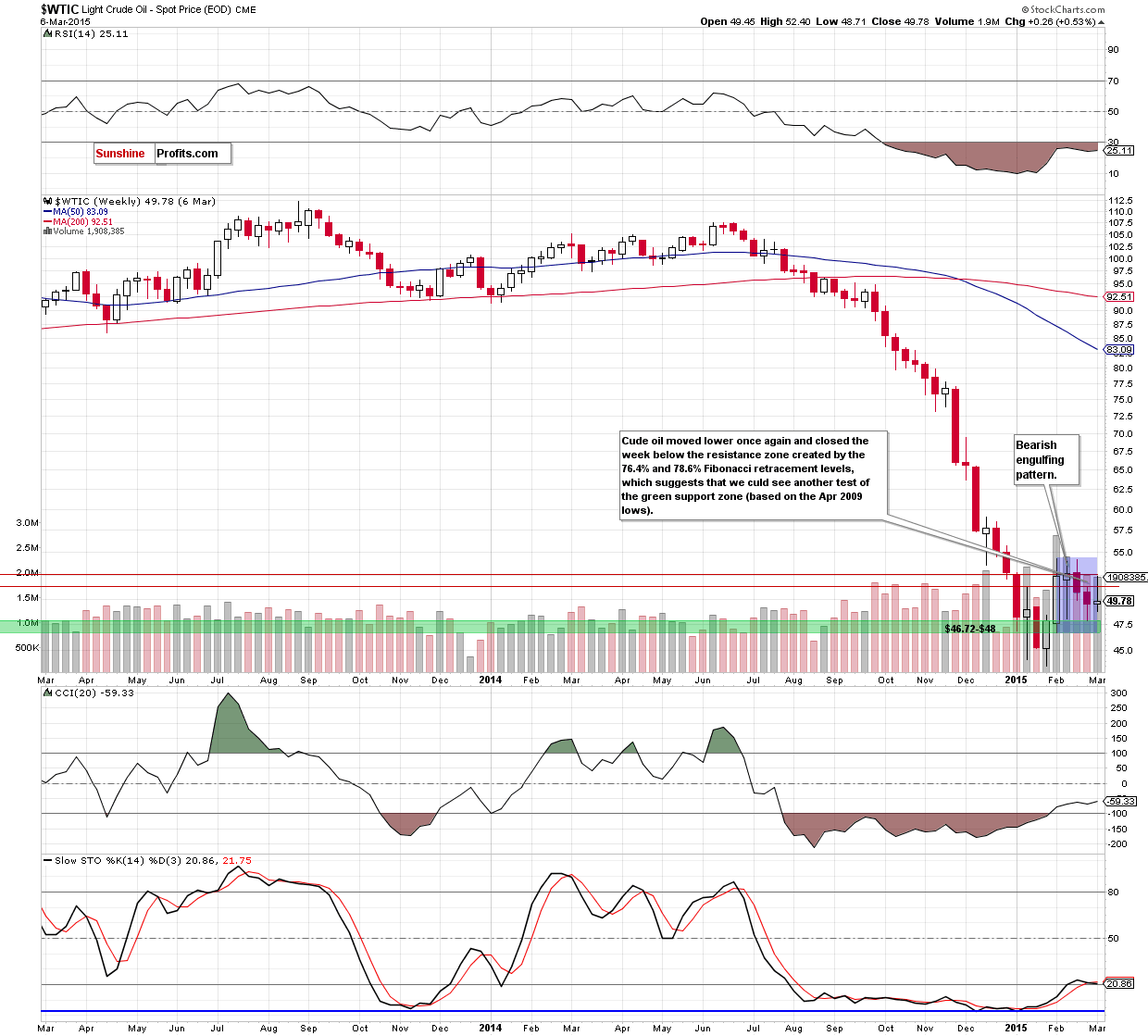

Looking at the weekly chart, we see that the situation developed n line with the above-mentioned scenario and crude oil moved lower once again. As a result, the commodity closed the previous week under the resistance zone created by the 76.4% and 78.6% Fibonacci retracement levels, which suggests that we could see another test of the green support zone (based on the Apr 2009 lows) in the coming week – similarly to what we saw at the end of the previous month.

How did this drop affect the very short-term picture? Let’s check.

In our previous Oil Trading Alert, we wrote the following:

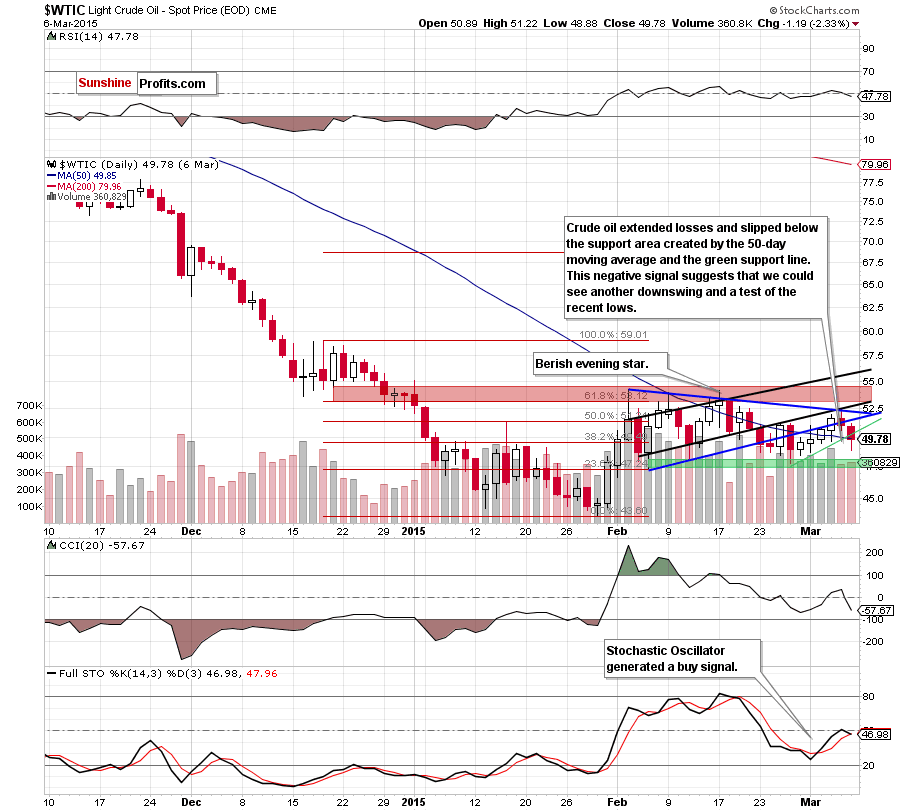

(…) the combination of the black resistance line and the upper border of the triangle stopped further improvement and encouraged oil bears to act. As a result, light crude reversed and dropped below the lower line of the formation. This is a negative signal, which suggests that lower values of crude oil are just round the corner. If this is the case, the initial downside target would be around $50, where the very short-term green support line (based on the recent lows) and the previously-broken 50-day moving average are.

As you see on the daily chart, oil bears not only took the commodity to our downside target, but also managed to close the day below them. Despte this deterioration, light crude rebouded slightly, ereasing some losses, which suggests that we’ll see an attempt to come back above these lines in the coming day. Nevertheless, we should keep in mind that even if we see such price action, the strong resistance area created by the borders of the blue triangle still will be in play. Therefore, in our opinion, as long as there is no comeback above these lines (and the black resistance line) further improvement is not likely to be seen. Additionally, if this zone withstands the buying pressure, crude oil will test of the green support zone (created by the Feb 5 and Feb 11 lows) around $47.36-$48.05 once again in the coming days.

Summing up,crude oil extended losses and slipped below the green support line and the 50-day moving average, but then ereased some losses; this suggests that an attempt to come back above these lines is likely. If this is the case, the initial upside target would be around $51.67-$52.30, where the borders of the blue triangle are.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts