Oil Trading Alert originally sent to subscribers on November 19, 2014, 9:34 AM.

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective.

On Tuesday, crude oil lost 1.67% as ongoing speculation the Organization of the Petroleum Exporting Countries will not cut output continued to weigh on the price. As a result, the commodity extended losses and approached the key support line. Will light crude finally rebound from here?

In the recent weeks, market watchers have become increasingly doubtful that OPEC will cut production to reduce a global glut of oil and support the price of the commodity at its Nov. 27 meeting. Although Goldman Sachs said in a note that it expects the cartel to cut production by about 700,000 barrels a day, it didn’t change investors’ sentiment and the above-mentioned key fundamental factor continued to weigh also yesterday. In this environment, light crude extended losses, hitting an intraday low of $74.12. Will we see further deterioration? (charts courtesy of http://stockcharts.com).

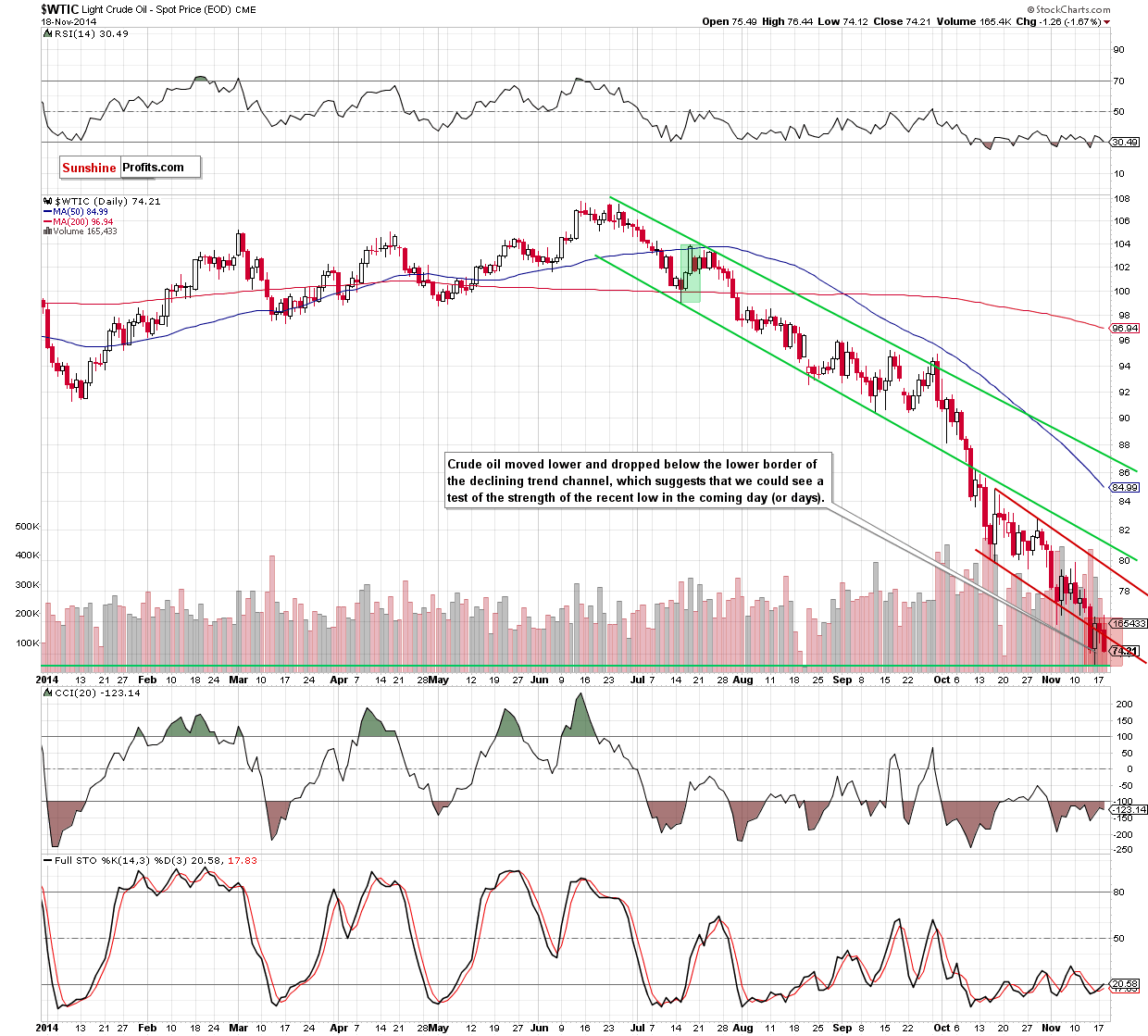

From the very short-term perspective, we see that crude oil extended losses and dropped below the lower border of the declining trend channel. This time, oil bulls didn’t manage to invalidate the breakdown and the commodity closed the day under this support line, which is a bearish signal that suggests further deterioration. Nevertheless, we should keep in mind that even if the commodity tests the strength of the recent low in the coming day, the space for further declines seems limited as the 50% Fibonacci retracement still holds. If the proximity to this key support encourage oil investors to push the buy button, we could see a corrective upswing and the initial upside target would be the barrier of $80 and the previous lows.

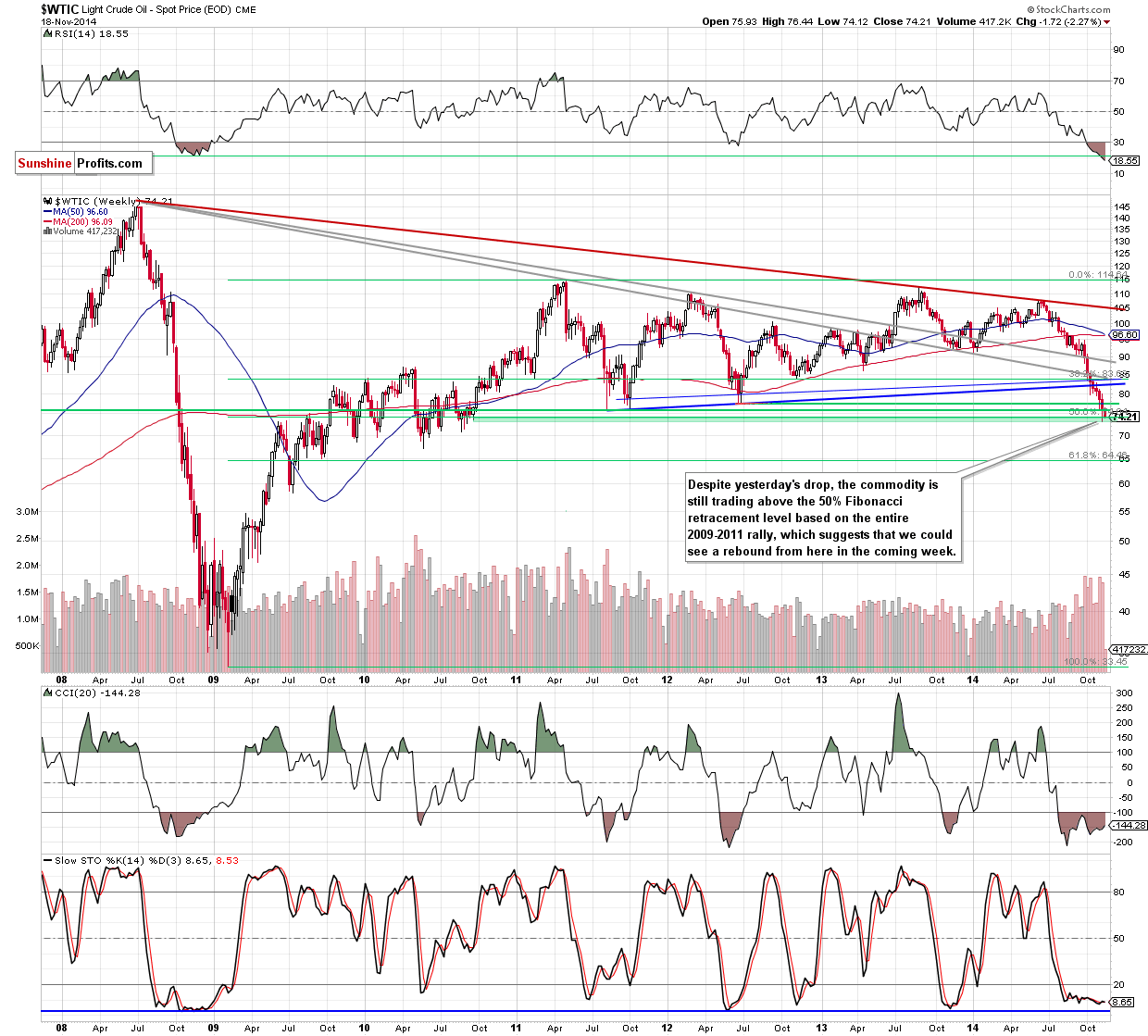

Summing up, although crude oil extended losses, the commodity remains above the 50% Fibonacci retracement. This suggests that we still could see a rebound from here in the coming week even if crude oil re-test the strength of this key support level.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): Long positions with a stop-loss at $72.78 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts