Oil Trading Alert originally sent to subscribers on November 3, 2014, 10:05 AM.

Trading position (short-term; our opinion): No positions.

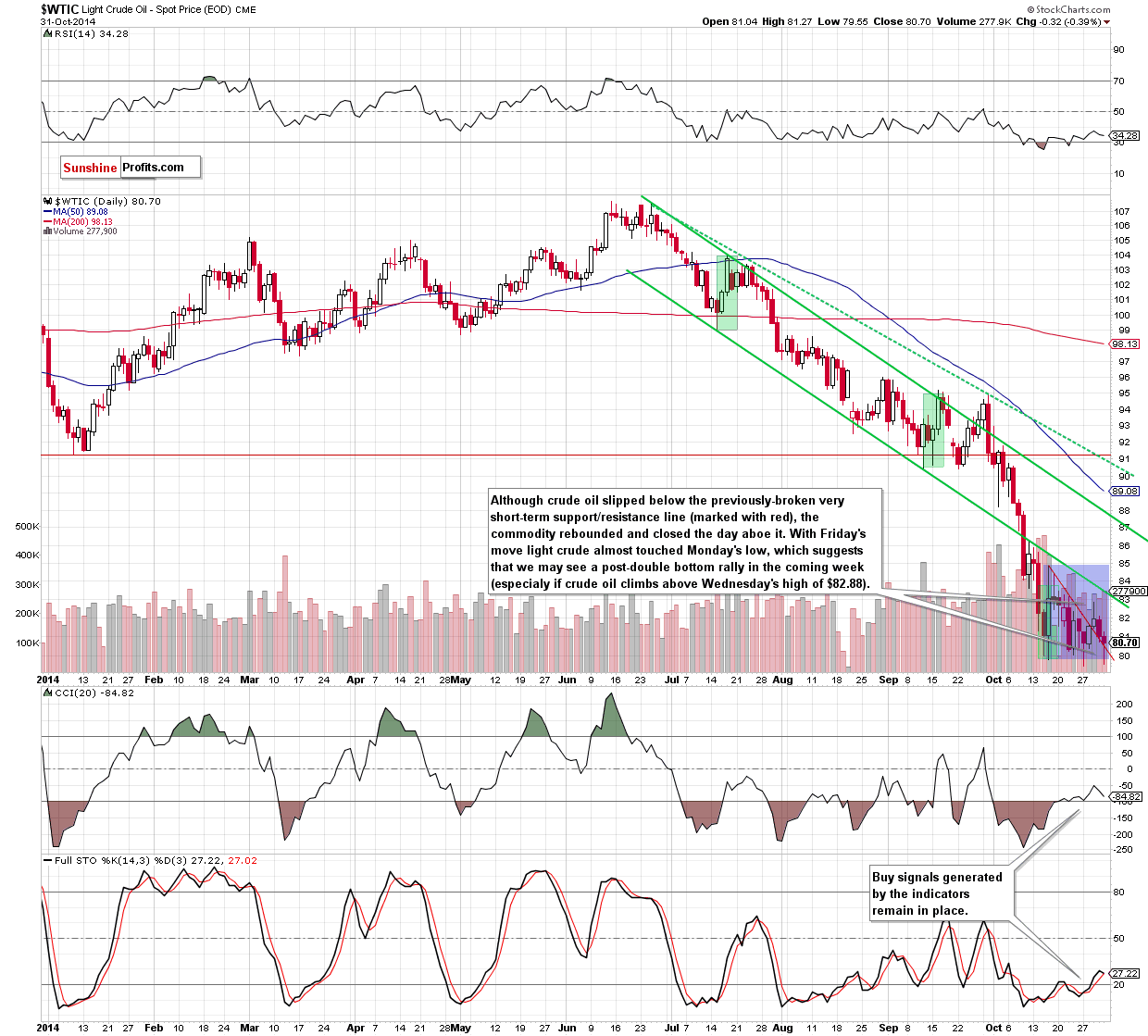

On Friday, crude oil lost 0.39% as stronger U.S. dollar weighed on the price. Although the price slipped below the very short-term support and the key level of $80 once again, the commodity rebounded in the following hours. Does it mean that investor sentiment is improving and we could see a bigger upward move in the near future?

On Friday, official data showed that personal spending fell 0.2% in the previous month, disappointing expectations for a 0.1% rise, while U.S. personal income rose 0.2% in September, missing forecast of 0.3% gain. However, data released later in the day, overshadowed these numbers. As a reminder, the Chicago purchasing managers' index rose to a three-and-a-half year high of 66.2 in October from 60.5 in September, beating expectations for a 60.0 reading. Additionally, the Thomson Reuters/University of Michigan final consumer sentiment index climbed to a seven-year high of 86.9 in October, while analysts had expected the index to remain unchanged. In response to this solid data, the U.S. dollar moved higher, making crude oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies. As a result, the commodity slipped below the key level of $80 once again, but then invalidated the breakdown. Will we see further improvement? (charts courtesy of http://stockcharts.com).

The situation in the medium term hasn’t changed much as crude oil is still trading between the key level of $80 and the previously-broken blue resistance line (based on the Aug 2011 and Jun 2012 lows. Did Friday’s price action change the very short-term picture? Let’s take a closer look at the daily chart and find out.

Quoting our last Oil Trading Alert:

(…) it seems to us that that the medium-term picture in combination with stronger greenback (please note that earlier today, the USD Index extended gains and climbed above 87, hitting a fresh multi-month high) will push the commodity lower later in the day. If this is the case, and light crude invalidates the breakout above the very short-term declining red line, it would be a bearish signal, which will trigger further deterioration and a drop to the key support level of $80 or even to the recent low of $79.44.

On Friday, the price of light crude moved lower as we expected. With this drop, the commodity slipped below $80 once again and approached the Oct low, hitting an intraday low of $79.55. As you see, this support level encouraged oil bulls to act, which resulted in a rebounded in the following hours. Thanks to this move, crude oil closed the day above the very short-term support/resistance red line, which is a positive sign and suggests that we could see further improvement in the coming days. In our opinion, the probability of a bigger upward move will increase after a breakout above $82.88. Why this level is important? When you take a closer look at the daily chart, you will see that in this area is the first resistance zone created by the last Wednesday’s high and the lower border of the declining trend channel. Therefore, if crude oil climbs above it, we could see a post-double bottom rally and an increase to at least $84.30, where the first of the long-term grey resistance lines is.

Summing up, although crude oil slipped below $80, this solid psychological barrier withstood the selling pressure once again. As a result, the commodity rebounded, invalidating earlier breakdown – similarly to what we saw earlier in October. In both previous cases, an invalidation of the breakdown under $80 triggered corrective upswings. Therefore, we think that crude oil will rebound from here in the coming day (or even days). Nevertheless, as long as there is no breakout above the first resistance zone, staying on the sidelines and waiting for the confirmation that the final bottom is in is the best choice at the moment.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts