Oil Trading Alert originally sent to subscribers on September 17, 2014, 10:19 AM.

Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

On Tuesday, crude oil moved higher after news that the OPEC could cut its production target for next year. Additionally, fresh fighting in Libya also supported the price. As a result, light crude gained 2.07% and broke above the key resistance line. Is it enough to trigger further rally?

Yesterday, OPEC Secretary-General Abdalla Salem el-Badri said that the group could cut its production target for next year (from 30 million barrels a day to 29.5 million barrels a day) at its meeting in November. This news in combination with Libya's National Oil Co. commentary that production at the country's largest oil field has been cut slightly after rockets fell near the refinery it supplies was very supportive for the commodity and triggered a rally above $95 per barrel. How high could light crude climb in the coming days? (charts courtesy of http://stockcharts.com).

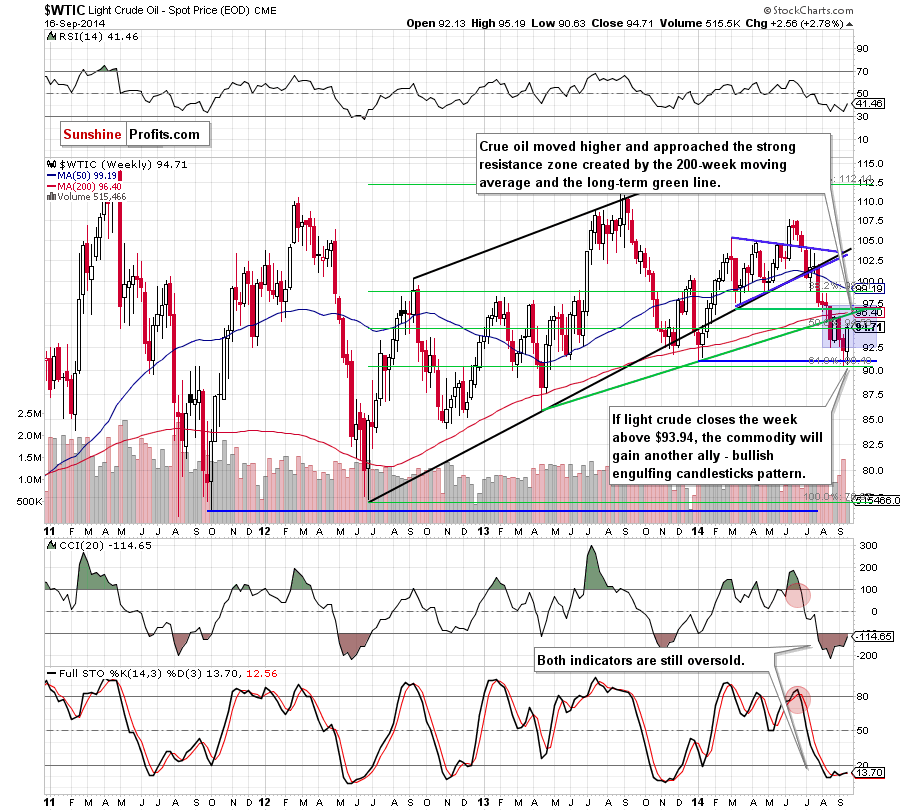

The situation in the medium term has improved as crude oil extended rally above the support zone (created by the long-term declining support line, the Jan low and the 61.8% Fibonacci retracement). Taking this positive fact into account, we believe that our last commentary is up-to-date:

(…) crude oil will rebound to at least the strong resistance zone created by the previously-broken 200-day moving average and the long-term support/resistance green line seen on the first chart.

Please note that the above-mentioned area is currently around $96.15-96.40.

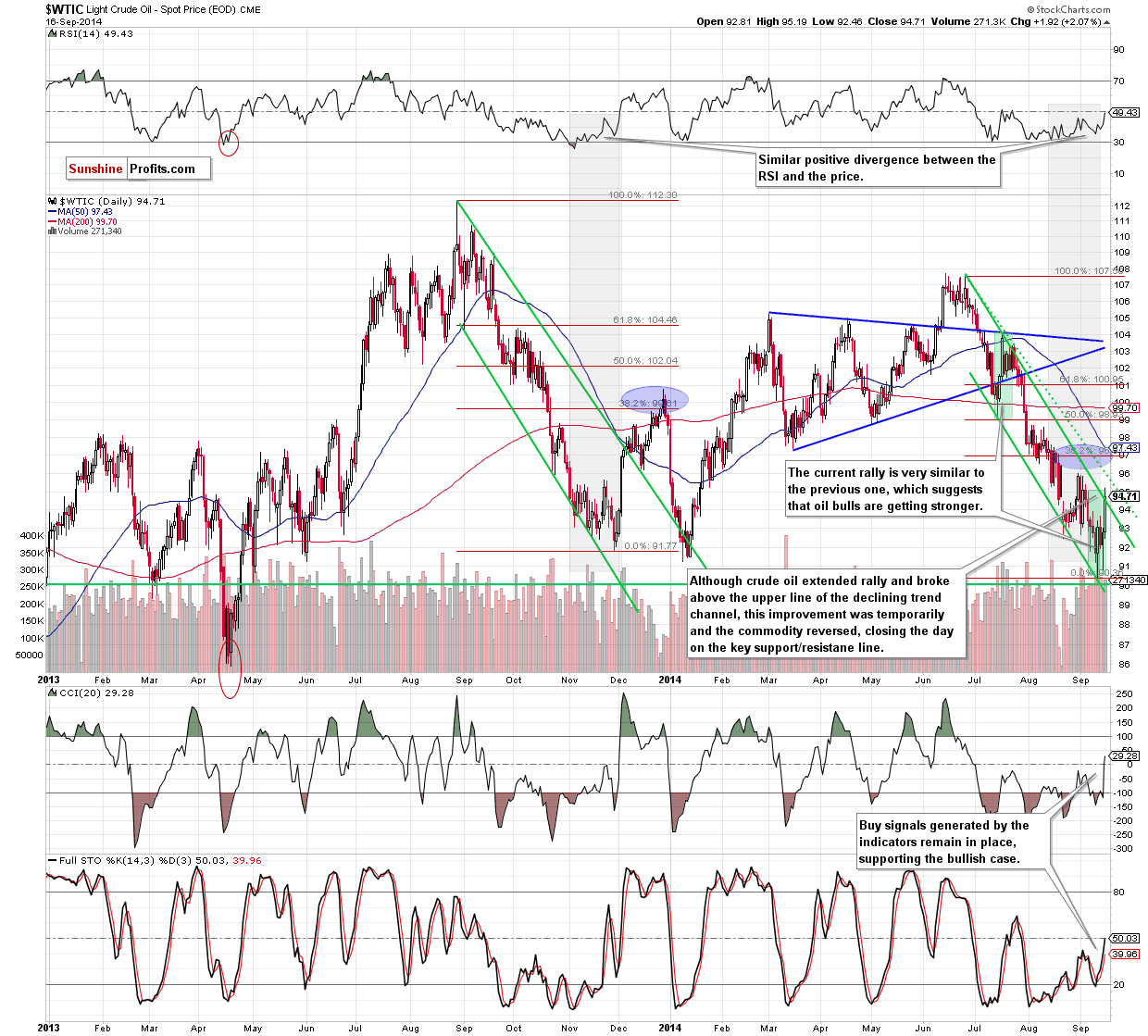

Once we know the medium-term picture, let’s check the daily chart.

In our Oil Trading Alert posted on Friday, we wrote the following:

(…) the current situation is similar to the one that we saw in November. (...) Taking this fact into account, we think that the next bigger move will be to the upside and crude oil could rally to the 38.2% Fibonacci retracement based on the entire Jun-Sep decline (around $97). Nevertheless, before we see a realization of this scenario oil bulls will have to push the commodity above the upper line of the declining trend channel (currently around $94.50).

Looking at the above chart, we see that oil bulls took their chance and pushed the commodity higher, which resulted in a rally to an intraday high of $95.19 and a breakout above the upper line of the declining trend channel. Despite this very positive signal, the commodity reversed and slipped to the previously-broken key support/resistance line. What’s next? Taking into account buy signals generated by the indicators and a breakout (not confirmed, but still), it seems to us that light crude will extend rally and reach our upside target in the near future. At this point, it’s worth noting that when we take a closer look at the daily chart, we see that the current rally is bigger than earlier one-day upswings and very similar to the one that we saw in July, which means that oil bulls are getting stronger. Nevertheless, we should keep in mind that such sharp rallies are usually corrected on the following day as day-traders take profits. Therefore, a short-lived and shallow pullback from here should not surprise us.

Summing up, the highlight of yesterday’s session was a breakout above the upper line of the declining trend channel. This is a strong bullish signal, which suggests further improvement. Therefore, we are still convinced that keeping long positions (which are already profitable) is justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts