Oil Trading Alert originally sent to subscribers on September 15, 2014, 9:37 AM.

Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective.Initial price target: $96.

On Friday, crude oil lost 1% as a stronger greenback in combination with ongoing worries that global supply is plentiful weighed on the price. Because of these circumstances, light crude reversed and erased some of Thursday’s gains. Did this move change anything in the short-term perspective?

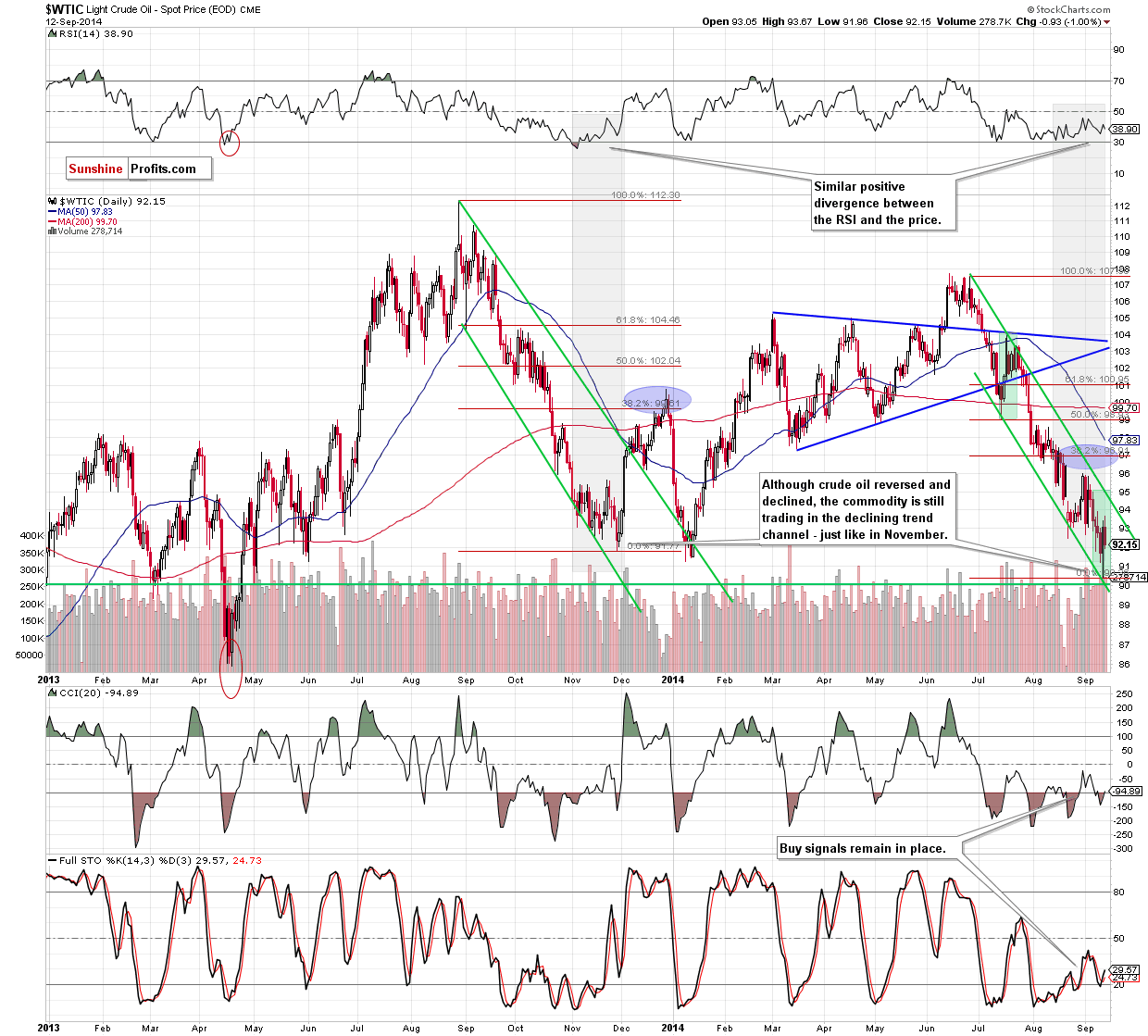

On Friday, official data showed that U.S. retail sales rose 0.6% last month, while core retail sales (without automobiles) increased by 0.3% in August, both in line with market expectations. Additionally, the Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to a 14-month high of 84.6 this month from 82.5 in August, beating analysts’ expectations for an increase to 83.3 in September. These bullish numbers supported the greenback, which made oil less attractive in dollar-denominated exchanges, especially among investors holding other currencies. As a result, light crude gave up some gains and slipped below $93 once again. Is it as bearish sign as it looks at the first glance? Let’s check the chart below and find out (charts courtesy of http://stockcharts.com).

Despite Friday’s drop, the situation in the medium term hasn’t changed much as crude oil remains above a solid support zone created by the long-term declining support line and the 61.8% Fibonacci retracement. Today, we’ll focus on the very short-term changes.

From this perspective, we see that although crude oil reversed and dropped below $93 once again, the commodity is still trading in the declining trend channel, well above the recent and May 2013 lows. Taking this fact into account, and combining it with the medium-term support levels, we think that even if crude oil moves lower from here, oil bulls do not give up so easily and will fight for this area in the coming day (or days). Therefore, what we wrote in our last commentary is still up-to-date:

(…) the current situation is similar to the one that we saw in November. Back then, the above-mentioned positive divergence between the RSI and the price in combination with the lower border of the declining trend channel encouraged oil bulls to act and resulted in a sharp increase in the following days. Taking this fact into account, we think that the next bigger move will be to the upside and crude oil could rally to the 38.2% Fibonacci retracement based on the entire Jun-Sep decline (around $97). Nevertheless, before we see a realization of this scenario oil bulls will have to push the commodity above the upper line of the declining trend channel (currently around $94.50).

Summing up, although crude oil erased around 50% of Thursday’s rally, the overall situation hasn’t changed much as the commodity still remains above the very strong support zone (created by the long-term declining support line, the 61.8% Fibonacci retracement level based on the Jun 2012-Aug 2013 rally, the lower border of the declining trend channel and the May 2013 low). Therefore, we are convinced that as long as there is no breakdown below it, another sizable downward move is not likely to be seen and long positions are justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): Long with a stop-loss order at $89. Initial price target: $96. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts