Oil Trading Alert originally sent to subscribers on August 29, 2014, 6:34 AM.

Trading position (short-term; our opinion): In our opinion no positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 0.97% as escalating tensions in eastern Ukraine and upbeat U.S. data weighed on the price. In this way, light crude broke above the upper line of the consolidation range. What’s next for the commodity?

Yesterday, Ukraine accused Russia of invading the country as more than 1,000 Russian troops were fighting alongside pro-Russian separatists in eastern Ukraine. This news boosted the price of crude oil prices fueling fears that the conflict may disrupt crude exports out of Russia.

Upbeat U.S. data gave crude oil support as well. The Commerce Department showed that the U.S. gross domestic product grew at a revised annualized rate of 4.2% in the second quarter of this year, beating expectations for a downward revision to 3.9%.

Additionally, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending Aug. 22 declined by 1,000 to 298,000, while analysts had expected a 1,000 rise. On top of that, a separate report showed that U.S. pending home sales increased by 3.3% last month, beating expectations for a 0.5% rise.

These better-than-expected numbers confirmed Federal Reserve Chair Janet Yellen's comments at Jackson Hole that the U.S. economy is recovering and fueled hopes that the world's largest economy will consume more fuel and energy. What impact did these numbers have on the technical picture of crude oil? Let’s check (charts courtesy of http://stockcharts.com.)

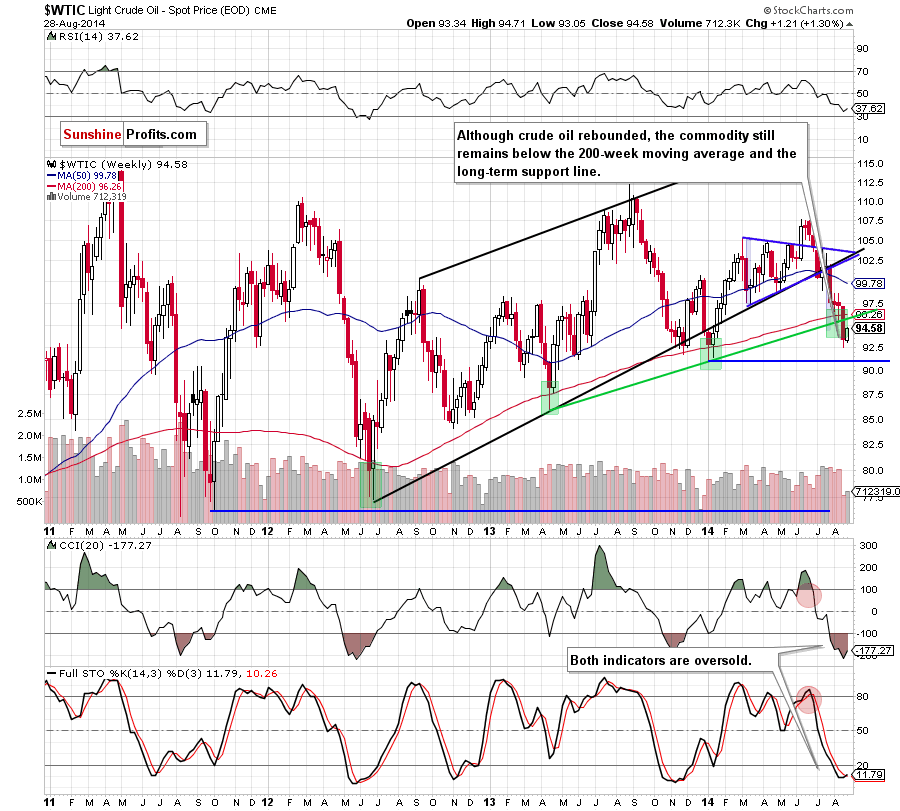

The situation in the medium term has improved slightly as crude oil extended gains and moved away from the multi-month low. Despite this growth, the commodity still remains below the previously-broken 200-week moving average and the rising, long-term support line, which together serve as the nearest resistance zone (around $95.70-$96.26). Therefore, as long as there is no invalidation of the breakdown, the medium-term outlook remains bearish. Nevertheless, we should keep in mind that the current position of the indicators suggests that a trend reversal is just around the corner.

Having say that, let’s take a closer look at the very short-term changes.

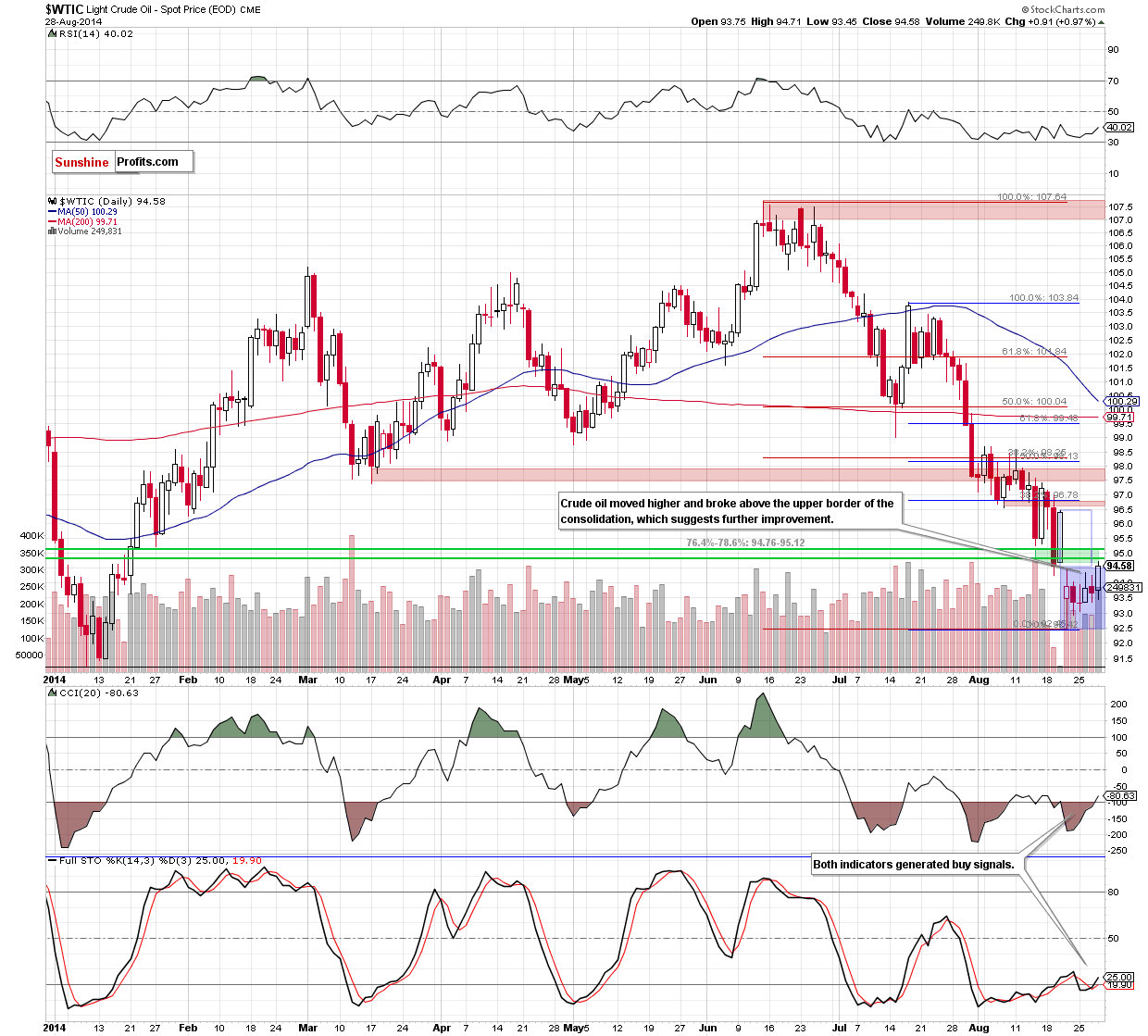

From this perspective, we see that crude oil broke above the upper line of the consolidation, which is a bullish signal. Additionally, the CCI and Stochastic Oscillator generated buy signals, which supports further improvement. Taking these facts into account, we think that our last commentary is up-to-date:

(…) if oil bulls manage to push the price above the upper line of the formation, we’ll see an attempt to invalidate the breakdown below the green area. If they succeed, the initial upside target will be around $96.50, where the size of the upswing will correspond to the height of the consolidation (it’s worth noting that slightly above this level is the 38.2% Fibonacci retracement based on the Jul-Aug decline, which may pause further improvement).

Summing up, the most important event of yesterday’s session was a breakout above the upper line of the consolidation, which suggests further improvement (especially when we factor in buy signals generated by the indicators). Nevertheless, we should keep in mind that the commodity still remains below two key resistance levels, which could stop the rally. Therefore, we think that as long as there is no invalidation of the breakdown, opening long positions is not justified from the risk/reward perspective.

Very short-term outlook: mixed bullish bias

Short-term outlook: mixed

MT outlook: bearish

LT outlook: bullish

Trading position (short-term): No positions are justified from the risk/reward perspective at the moment, but we will keep you informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts