Oil Trading Alert originally sent to subscribers on April 14, 2014, 8:17 AM.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

On Friday, crude oil hit a fresh five-week high as better-than-expected U.S. macroeconomic data weighted on the price. Despite this improvement, light crude gave up the gains and reversed as day before. Is the recent rally in crude oil running out of steam?

On Friday, the price of light crude was boosted after data showed that U.S. producer prices rose 0.5% in March, beating expectations for a 0.1% increase (it was the largest increase in nine months). Additionally, core producer price inflation (without volatile food, energy and trade items) rose 0.6% in March, above expectations for a 0.2% rise. On top of that, the preliminary Thomson Reuters/University of Michigan April consumer sentiment index rose to 82.6 in April (its highest level since July), beating expectations for a 81.0 reading.

These stronger-than-expected data fueled expectations that the U.S. economy will continue to recover and will demand more fuel and energy. In reaction to this, as mentioned earlier, light crude extended gains and hit a fresh five-week high of $104.44.

Despite these positive circumstances, crude oil gave up the gains and reversed in the following hours after the International Energy Agency reduced its forecast for oil-demand growth by 100,000 barrels to 1.3 million barrels per day, based on lower estimates for Russian demand.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

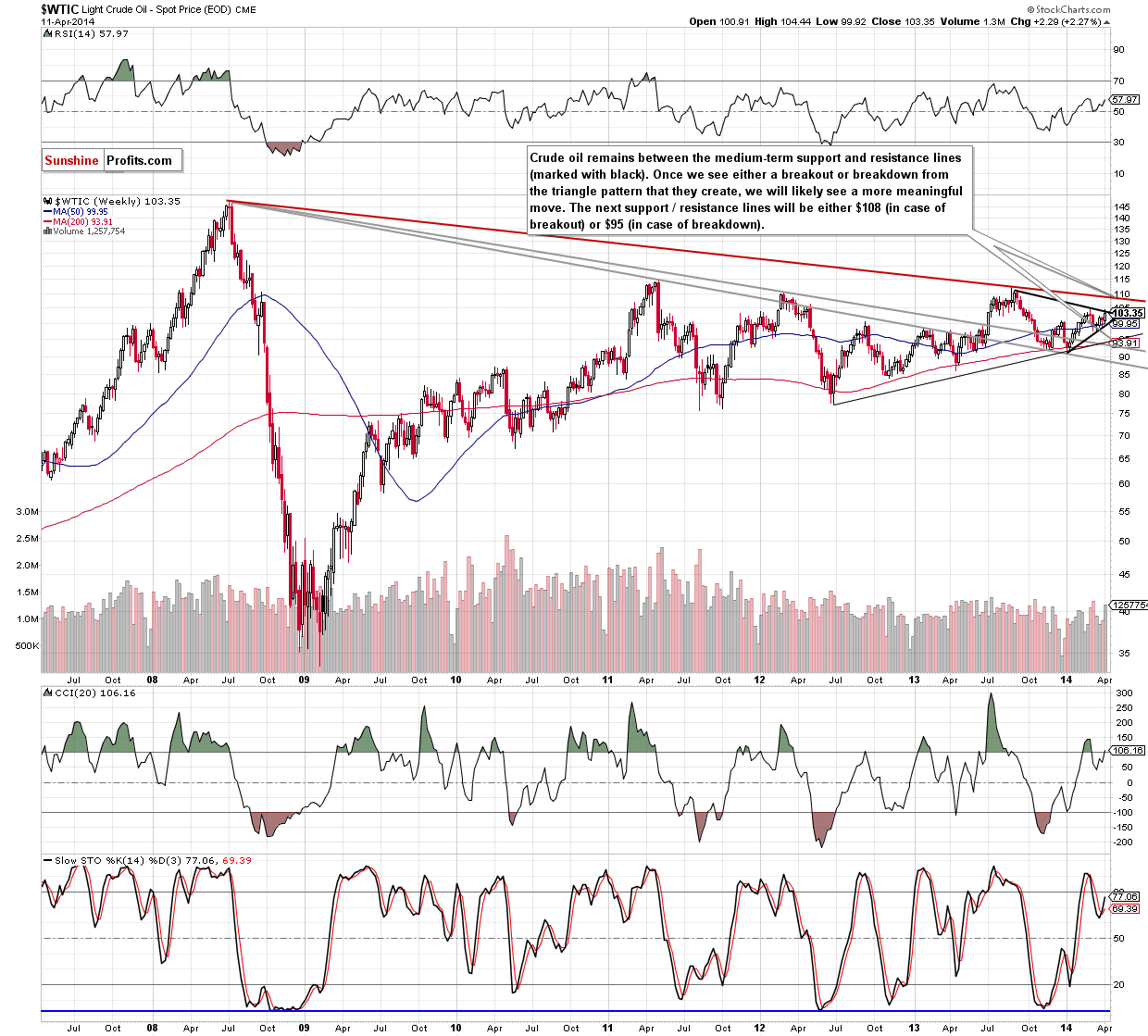

Looking at the weekly chart, we see that although there was an attempt to break above the black resistance line (the upper line of a triangle), the overall situation hasn’t changed much. Therefore, what we wrote in our last Oil Trading Alert is still-up-date.

(…) crude oil reached the resistance line based on the September and March highs, which is also the upper line of a triangle. Taking this fact into account, we should consider two scenarios. On one hand, if oil bulls do not give up and successfully push the price of light crude above this important line, we will likely see an increase to around $108, where the long-term resistance line (marked with red) is. However, if they fail, we may see a pullback to the previously-broken 50-week moving average (currently at $99.95). Please note that this area is supported by the medium-term support line (based on the January and March lows), which is also the lower border of the black triangle. Looking at the current position of the indicators, we see that they still support buyers as buy signals remain in place.

To see the current situation in crude oil more clearly, let’s zoom in on our picture and move on to the daily chart.

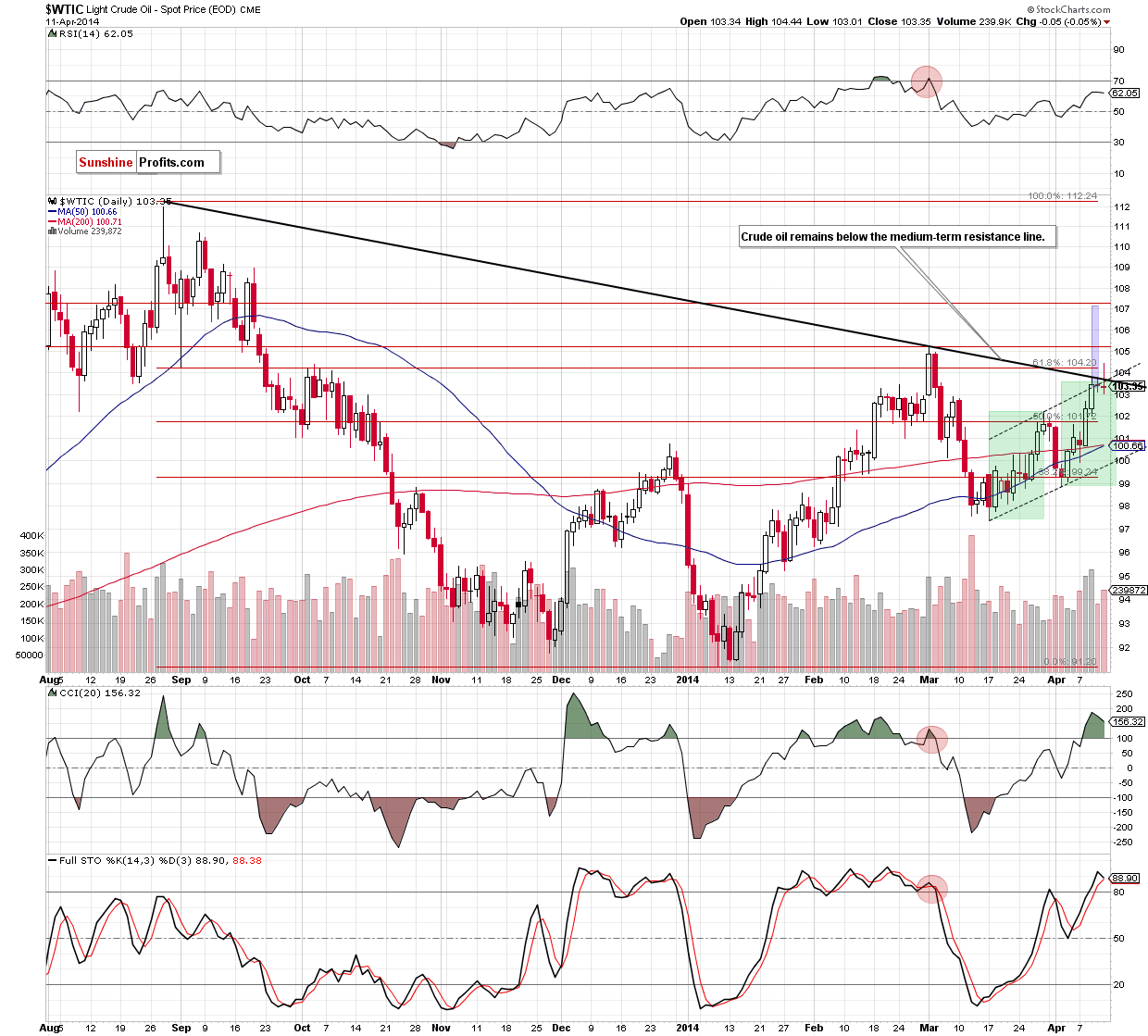

From this perspective, we see that crude oil extended gains after the market open, hitting a fresh five-week high. With this upswing light crude broke above the medium-term resistance line, which is also the upper line of a triangle marked on the weekly chart. As it turned out in the following hours, this improvement was only temporarily and oil bulls do not managed to hold gained levels, which resulted in a decline. As you see on the above chart, the pullback took light crude not only below the black resistance line, but also under the upper line of the rising trend channel (marked with black dashed lines). In this way, the breakout that we saw on Wednesday was invalidated, which is a bearish signal. Additionally, Friday’s downswing materialized on rising volume (compared to the previous day), while the CCI and Stochastic Oscillator are overbought. Connecting the dots, if the buyers do not break succesfully above the medium-term resistance, we will likely see another attempt to move lower in the coming day (or days).

Summing up, the situation has deteriorated slightly as crude oil declined below the upper line of the rising trend channel and the medium-term resistance, which suggests that further deterioration should not surprise us.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective. We plan to open the speculative positions once we see either a breakout or breakdown on the long-term chart. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts