Oil Trading Alert originally sent to subscribers on March 26, 2014, 6:18 AM.

Trading position (short-term; our opinion): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95.

On Tuesday, crude oil lost 0.21% on continued concerns over a slowdown in China and weakness in the U.S. housing sector. Because of these circumstances, light crude erased earlier gains and declined below the psychological barrier of $100 per barrel once again.

Weaker than expected Chinese manufacturing data released over the weekend continued to affect negatively the price of light crude on Tuesday. As a reminder, China’s HSBC Flash Purchasing Managers Index fell to an eight-month low of 48.1 in March from a final reading of 48.5 in February, which fuelled concerns over slowing growth in the world’s second largest oil consumer.

Yesterday, the Conference Board showed that its index of consumer confidence climbed to 82.3 in March (the highest level since January 2008). Despite this positive data , crude oil extended losses after the Commerce Department reported that new home sales fell by 3.3% in February to the weakest level since last September, suggesting continued weakness in the housing sector.

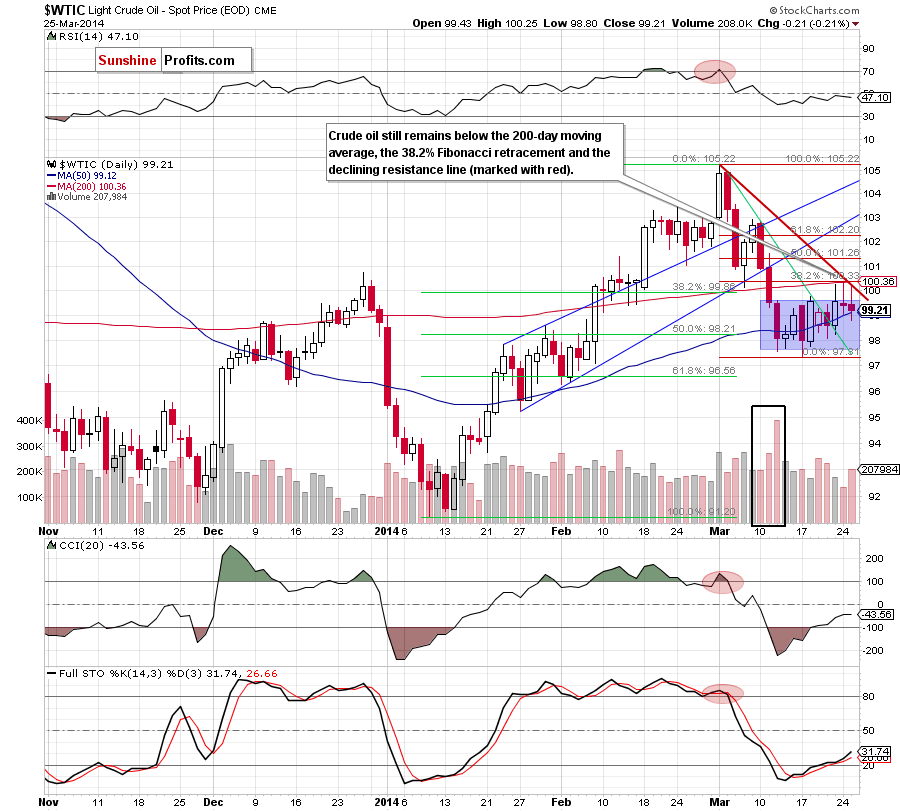

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

On the above chart we see that there was another attempt to break above $100, but a strong resistance zone created by the 200-day moving average and the 38.2% Fibonacci retracement successfully stopped further improvement and encouraged oil bears to act (just like in the two previous days). In this way, light crude reversed and declined to the consolidation range (marked with a blue rectangle) once again. Taking into account a price action that we noticed in the previous days, we can conclude that as long as crude oil remains below the resistance zone, a bigger upward move is not likely to be seen. As a reminder, the resistance area is also reinforced by the red declining resistance line (currently around $100).

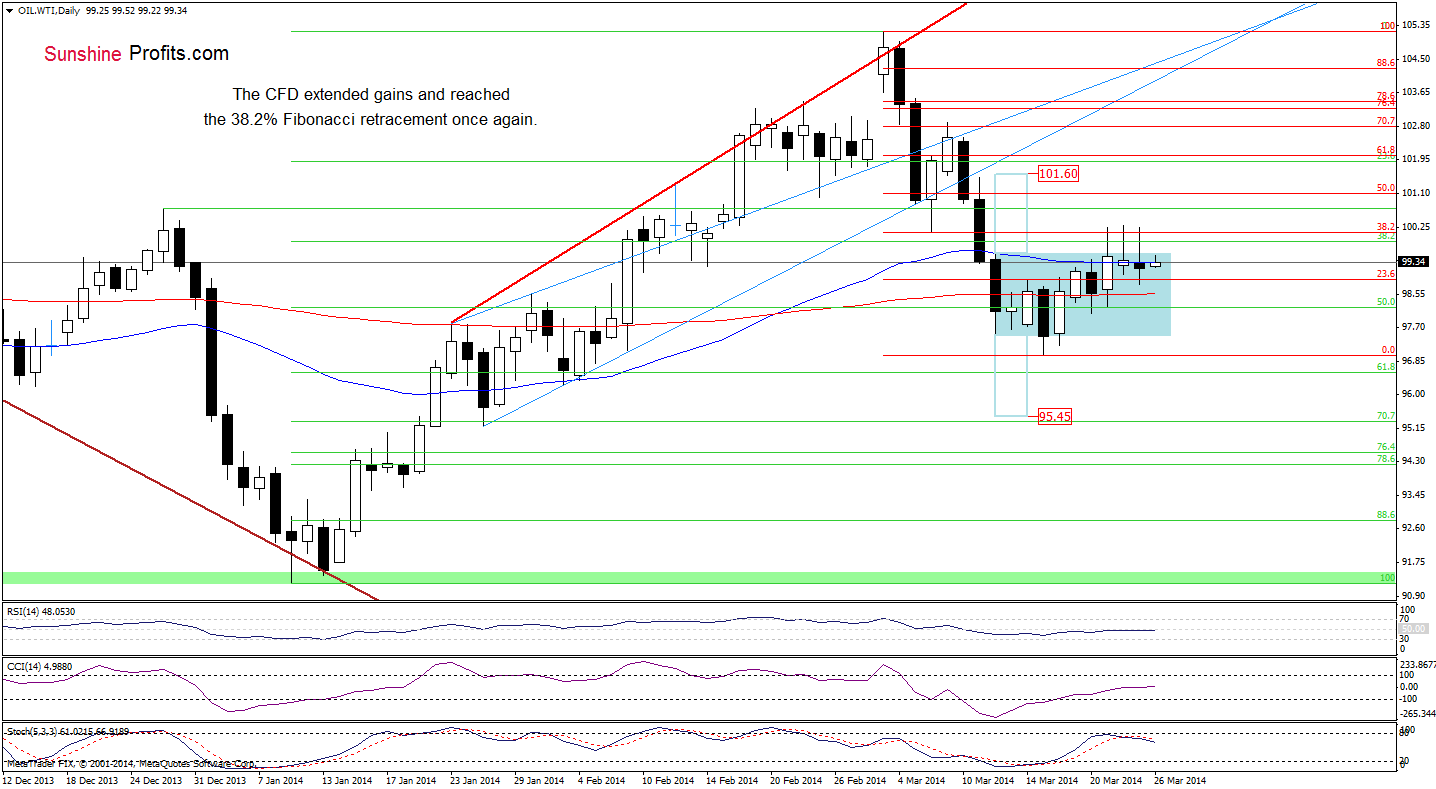

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

As you see on the daily chart, there was another unsuccessful attempt to break above the 38.2% Fibonacci retracement. Similarly to what we saw in the previous days, WTI Crude Oil reversed after an increase to this important resistance and came back to the consolidation range. Additionally, with this downswing, the CFD dropped below the 50-day moving average (which is a bearish signal). However, taking all the above into account, it’s hard to predict future moves at the moment. On one hand, if oil bulls do not give up, we may see another upswing to the 38.2% Fibonacci retracement. If this resistance holds, we will likely see another pullback to the consolidation range. If it is broken, we may see an increase to the 50% Fibonacci retracement (or even to $101.60). On the other hand, if the CFD extends losses, we will likely see a drop to the 200-day moving average (or even to the March 20 low around $98) in the near future.

Summing up, although we saw the third attempt to break above the 200-day moving average and the 38.2% Fibonacci retracement, oil bulls failed and the price declined to the consolidation range once again. Meanwhile, the situation in WTI Crude Oil has deteriorated as the CFD dropped below the 50-day moving average. On one hand, if oil bulls do not manage to push it above this resistance before the market open, we may see further deterioration in crude oil (and a drop below the 50-day moving average). On the other hand, if the buyers push the CFD higher, we will likely see another attempt to break above $100 (in the case of light crude) after the market open. Nevertheless, we should keep in mind that as long as crude oil remains below the resistance zone, a bigger upward move is not likely to be seen.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95. We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts