The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold & silver articles.

The dynamics of international trade and finance are undergoing vigorous transformation. Most particularly in the wake of the recent meltdown, the movement of precious metals against the pitfalls of various currencies and stocks have led many to believe that future world order will be highly dependent on the state of precious metals; their demand, supply and price will be the major determinant of global economic scenario.

Failing in substantial recovery has further led to a widespread debate as to whether the argument forecasted long before bears any resemblance to portray Gold & Silver as the future of money. The nature of both the precious metals though cater distinct purposes and therefore the route that each will adopt to the top will also vary inadvertently.

It may not hit right away and it may not conclude drastic measures such as Zimbabwe's economic breakdown. But the inherent intrinsic nature of value present in precious metals is going to reveal a lot and will be a major indicator of the future trades and international monetary transactions, world over.

The nature with which these two metals may be treated will differ to a great extent. Gold as we know has the ultimate risk protection and will be the major financial tool and indicator of economic activity. Silver will be full of dramatic capabilities with respect to risk, appreciation and its ability to conduct transaction on prevailing level. This may constitute the quality and quantity domains and may cause substantial market chaos based upon the elasticity of its demand and supply.

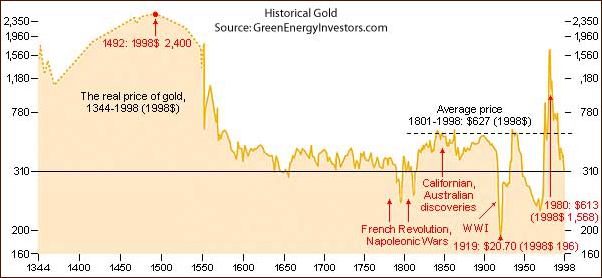

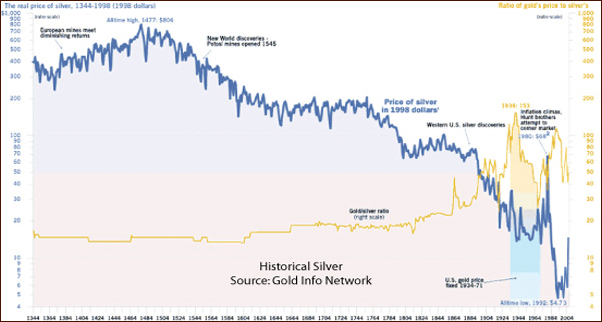

History of Gold & Silver:

Experts call Gold & Silver real money; which itself is based on their long history of serving as currency & a mode of exchange. Since ancient times these two precious metals have been treated as something related to value or worth, whether it is religious purity or jewelry for the purpose of fashion & beautifying, these precious metals were always meant for valuables.

It could be their shine, color or shape that attracted human beings towards it but it was the people in the regions of Transylvanian Alps or in the territory of Mount Pangaion in Thrace who started mining it to use them for decorative purpose that exhibited their prosperity. Till today the financially educated and elites use it to ensure their continuous well-being.

The greatest opportunity in history - Gold Silver Mania:

The recent economic recession has raised concerns for many who thought that they fell prey to unsupervised economic plans and yet there were others who were shielded against it through precious metal buying which always indicated and preached about long-term profits.

Triggered by the success of the precious metal owners; now there is gold & silver buying mania everywhere; as they see these times as the greatest opportunity ever to rebuild on the mistakes of US & western fiscal policies. This way people were not only able to guard themselves but they were also able to capitalize on the profits created by the real intrinsic worth of precious metals.

Now people are converting and securing all their cash and liquid assets into precious metals by buying precious metals such as silver and gold, and there is a world-wide awareness campaign through which people are preparing themselves for future profits while covering up past losses.

Acquire gold, accumulate silver:

Gold is an expensive commodity and the most demanded precious metal. The measure of risk in Gold is bare minimum in longer run and is almost negligible in shorter run as investment compared to other investment tools such as currency & stocks. Even compared to other consumable precious metals, gold has stood its worth for centuries and persevered the tides of time. Many experts convert their fixed assets or long term investments in gold so that they can hedge timely against the inflation.

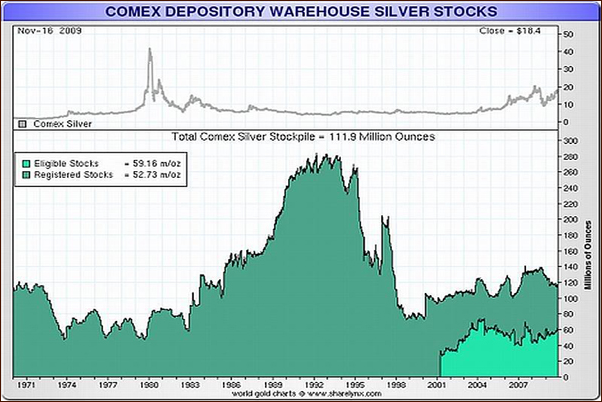

Silver on the contrary has a lesser price bracket but there is tremendous potential present in silver due to its widespread demand. People want to now accumulate silver for various reasons. One particularly is due to the fact that citing reference to the worst economic/hyperinflation scenario in Zimbabwe people have taken notes for a situation where the currency will lose all it purchasing power and then silver will be used as trading commodity for every day consumption. In this event the demand of silver is on an upward consistent curve and supply is speculated to drop due to its high demand in hi-tech IT & electronic industry. Thus silver is considered to carry more potential thus for price shoot.

Scrap & Melt Value:

An important part of gold/silver value is accounted for its melting price. Whether you are buying or selling gold/silver, the net price often includes the melting portion. Apart from the bars, the scrap form often ends up as a loss to individuals. If they are purchasing it in the form of jewelry, this cost adds on the basic gold/silver prices. And when selling (whether in form of scrap or jewelry) this cost is reduced or deducted by the gold/silver distributors. This particular melting price is often manipulated by the distributors and individuals fall prey to these technical aspects of precious metal evaluation.

Globally recognized standard:

The most vital feature of investing in Gold/Silver is its global penetration. This one investment tool is free from the burdens of governmental policies, regulations and geographical frontiers. All its price aspects are transported once these metals migrate with you, depicting a feature of consistency and constant price levels. However in many economies and cases (it is studied) due to political turbulence government does initiate its confiscation, therefore it is only wise to keep its possession the old fashion way.

This investment device is easily liquidated in any part of the world through prevailing rates. In many countries such as UAE, governments have set-up gold bar machines, where you can retrieve gold bars through the use of cash or ATM/credit cards.

Banks in China issues Gold Certificates as investment instruments and is planning to soon issue actual bars creating a widespread gold economy.

Opportunity Cost of Gold/Silver:

When these two precious metals are concerned, for once in the history is a critical time when the opportunity cost of profit and loss is highest. In simpler terminology, if you do not shield yourself through gold/silver, you are ultimately bound to fall in the vicious circle of poor fiscal decision on international trade/finance and governmental level. Following are few of these considerations that can help you achieve safety and can propel your monetary outlook in near future.

Power Quo between Dollar & Euro:

Since the launch of Euro there has been a major drift measured in the face value of the US dollar both as reserve treasury as well as trading currency.

Euro since its inception, which is relatively very new, has shown tremendous potency through its market movement and lack of volatility through stable appreciation most evidently against the British pound. The reasons for this are fairly simple, on a global basis, European countries are politically very stable and the concentration of power is evenly balanced with special reference to economic regulatory bodies and policies. While it has been widely criticized for increasing tax burned on citizens, EU has a history of standardizing social security and health care programs that enrich the purchasing ability of the consumer and their (often) "free" educational system leads to induction of skilled and educated consumers on a continuous level.

One area where the Euro nations are committing same mistakes such as US is their take on overcoming inflation. They too are printing Euro exhaustively without creating premises to further exports and/or optimizing domestic production policies. The growing cost of factors of production (land, labor, capital) is thus creating a further gap without facilitating possibilities to build domestic economy and thereby reducing the imports.

This rally between Dollar and Euro had mostly paid off most profitably for Gold/Silver.

Double Dip:

Economists world over are now forecasting a major hyperinflation predicted to occur by the end of 2011. Many of them like Gerald Celente also predicted similarly for the last economic meltdown. Following are few of the reasons for everyone to have adequate amount of Gold/Silver as financial back-up to fall on in case of contingency.

Unemployment & underemployment:

Unemployment has hit its highest ever all across the globe. Even those who are employed are underemployed thereby the ratio of people quitting their jobs is increasing consistently, this is because there is no on-job satisfaction and the building cost of living is pushing the consumers against the wall. In this event investing in Gold/Silver is providing them a possibility to make profits against the rally of these two precious metals vs. currency and stocks. With Fed failing to provide phenomenal measures Gold is hedging the profits progressively with minor temporary corrections.

Food stamps:

In US alone (the biggest economy of the world) the number of Americans receiving food stamps reached 39.68 million in February 2010, the highest number since the program began in 1962. As of June 2009, the average monthly benefit was $133.12 per person. As of late November 2009, one in eight Americans and one in four children are using food stamps and the program rate is growing at 20,000 people a day. Recipients must have at least near-poverty incomes to qualify for benefits.

The current alarming figures of Food Stamp is the red alert indicator of the first step towards gold/silver predicted to become the substitute for hollow currency (dollar) in the future. Zimbabwe's great downturn was also initiated by similar conditions. Infact all the major famines of the world were triggered by similar hyper-inflation scenarios.

Sooner than later Federal Reserve won't stay in the shape to support programs such as food stamp and the deteriorating value of dollar is going to force producers as well as consumers to switch to gold/silver in the wake of unrealistic phantom price tags.

Economists proclaim that even a 100% tax ratio won't be able to cover the 1.6 trillion budget deficit in the national economy. With virtually no export and expensive domestic production conditions it will become way bleaker.

One can imagine the impacts of such scenario in Africa and Asia when US is affected on such a gigantic scale. Due to these reasons the gold/silver economy is boosting worldwide to prepare against the upcoming hyperinflation scenario which is going to swipe all over the world. Most economies in the world still rely fully on US dollar as their reserve currency all such economies will face similar catastrophes with uncontrollable outcomes. Gold/Silver will act as savior for those who capitalized on its accumulation and switched on it through converting their financial instruments into these precious metals.

Silver will play as the major currency worldwide due to its low price (as compared to Gold), easily exchangeable feature and ability to purchase everyday consumables. It's demand is going to be much more vast as compared to gold, particularly in developing economies silver is going to be replace gold and will be main mode of exchange even on the higher level. Gold will be fundamentally used as saving instrument which will be cashed (for a smaller currency bill) to silver in order to make it viable/convertible for every day buying. Therefore the excruciating demand and limited availability and supply of silver are going to drive its value manifolds and its price will show dramatic movement in the times to come.

Trading in Gold or other precious metals needs high level of expertise with decisive implications that demands careful yet conclusive watch; analysis, evaluation and more importantly experienced professional advice. Sign up today for free our expert insight to gauge the future trends of the market and take advantage of these seasoned studies. As a serious trader you might like to subscribe to our "Elite Money-Minded Offer" that might help you in gaining consistent profits over regular time frames.

Thank you for reading.

Atif Khan, Ph.D.

Sunshine Profits Contributing Author

--

The next Premium Update will be available on Tuesday, June 8th 2010, but today we have send out an important Market Alert to our Subscribers regarding our specific suggestions on how to approach the current difficult situation in gold, silver, and mining stocks.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.