This essay is based on the Premium Update posted October 16th, 2009. Visit our archives for more gold articles.

In the previous essays, I've described the technical aspects of gold in other currencies, precious metals ETFs/ETNs and mutual funds, and I've commented on the healthiness of the bull market in gold in general, but none of these essays covered the situation in the junior sector and I would like to write about this important topic this week. Juniors have been disappointing in the previous months, but - are set to shine once again, or should investors dump these stocks immediately?

Before going into details, let me put things into proper perspective - gold stabilizes above the $1,000 level, silver is catching up, and so do big senior gold/silver producers, but the junior gold/silver producers/explorers seem to be left behind. Does it mean that the junior stock market is definitely dead or that one needs to wait for its comeback? I believe the latter is the case and that the extreme volatility of the junior mining stocks will once again become an advantage.

Before I provide you with reasoning, please take a look at the following assumptions:

- Juniors are less likely to be held by institutional investors than individuals (mutual funds, for instance, often are allowed only to invest in big, senior companies),

- Generally (there are exceptions, like to one described on the bottom of this sample page), individual investors tend to depend more on emotions than financial institutions do.

Based on the above statements one might infer that the stock prices of these small junior companies would be highly dependent on the emotional status of the individual precious metals investors. This finding has very important implications.

Juniors are more volatile (!) than big, senior companies. Emotions cause big upswings to become even bigger, when people get euphoric and buy already overvalued stocks. On the other hand when stocks fall, juniors tend to fall harder as investors panic and dump even already undervalued companies. Bigger swings are therefore to be expected in this sector.

Since we had just witnessed a massive plunge in virtually every asset class, the predominant emotion was fear. Taking into account influence the emotions have on the junior sector it is not that strange that they sold off heavily. Yes, the extent of the undervaluation is remarkable, but I expect this situation to improve greatly. Gold is trading above $1,000 and is getting ready (I'm not taking about short term here) to soar much higher. The prevailing emotion will be greed, not fear. This means that the emotional factor will now work in favor of the junior sector.

Keeping in mind the points raised above let's focus on what is often repeated when the structure of a bull market is discussed - "most individual investors are likely to enter the market at the late stage of a particular upleg". If most greedy (!) buyers are yet to enter the market and this is what drives the juniors, then we are currently in the very favorable juncture in this sector.

Therefore, if you were wondering whether to cut your junior positions or to increase it, I believe the answer depends on your risk preferences. If you are risk averse, I would enter the market right away (especially with our SP Junior Indicator that is about to flash a buy signal) - the risk is to be left behind while PMs move higher.

However, if you can bear some risk the best option here might be to wait for the likely pullback back to the $1,000 level / for the first part of the downswing in the general stock market, and monitor juniors' price action during the downswing. If they hold up strongly, it will be an "all aboard, we're going much higher!" signal.

Either way, if you already own juniors and are disappointed with their performance, please note that you know about the PM junior sector much before the other 99% of market participants, which will enter the market much higher (with gold over $1,500 or so) the biggest gains are yet to be made.

As far as juniors are concerned, I've already written it in the Key Principles section, but let me emphasize once again that I believe diversification among many juniors is very important. If you own just one stock it may provide you with astonishing gains, but the emotions involved in owning just one stock, and company-specific risk make the long-term success of your portfolio unlikely in this case. Taking the realistic approach, it is better to own many valuable stocks, which are very likely to provide you with gains in the following months and years, instead of betting on any single company.

Speaking of structuring your portfolio, it is generally a good idea to rebalance your portfolio on a regular basis (monthly or at least quarterly if your perspective is long term). So, if you purchased a stock and then you see that it is not performing well (you would not buy it today), say, for two months in a row), then it may be profitable to sell this company and purchase one of the leaders. The same goes for the senior gold/silver companies. In this case I suggest using our leverage calculators to create ranking according to your preferred investment time frame.

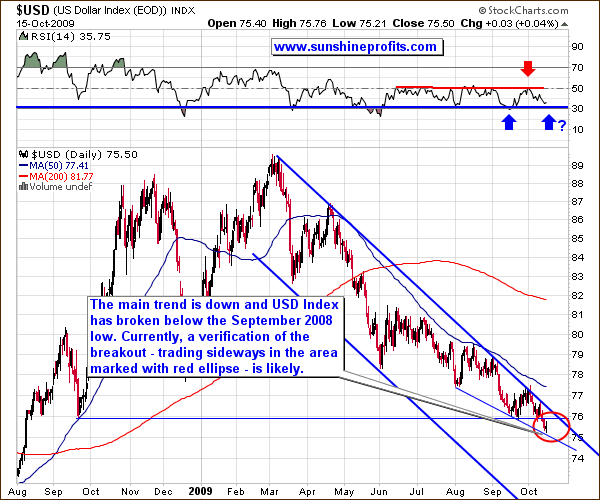

There is one more thing that I would like to write in this essay and that is the situation (chart courtesy of http://stockcharts.com) in the U.S. Dollar, one of the key short-term drivers of the prices of precious metals and corresponding equities that is also important from the long-term point of view. After all, if the situation in the USD Index is bearish, it has bullish implications for precious metals, and since they are already above the crucial $1,000 barrier, any serious breakdown in the dollar would ignite a massive rally in gold and silver. Naturally, this would also be very positive for PM junior mining stocks.

The USD Index moved below its support level created by the September 2008 low, as I suggested previously. The 3-day confirmation rule meaning that we would need to see USD Index close below the September 2008 low also today applies here - the breakdown has been verified. However, it would not surprise me to see the index to enter a small trading range in the area marked on the chart with red ellipse.

The value of the USD Index is still trading near the upper border of the trend channel thus making the following plunge (in tune with the main trend) more likely to be a substantial one. However, from the short-term point of view, USD is just above a support level, and the RSI is getting close to the 30 level, which market a local bottom in the past. Therefore, several days/weeks of consolidation are likely before a significant move down. The latter is still the most probable outcome in the medium-term from my point of view.

Summing up, the performance of the junior sector has been far from amazing if one compares it to other sectors on the precious metals market. However, taking the specifics of this market into account and the facts that gold has now decisively broken into $1,000 thus causing many new investors to enter the market and that the best part of the bull market (for juniors) is still ahead of us, makes me consider PM juniors as one of the best places to invest it. Still, their performance during the coming consolidation in PMs should provide us with additional details.

The USD Index is verifying its recent breakdown. Should the value of the dollar trade sideways, it is likely that PMs would move higher and then correct their recent gains. For now, it is probable (!) that the local top in metals / corresponding indices is not yet in, but we are close to it.

With gold over $1,000 markets are becoming more and more volatile, and I expect this trend to continue, so it is now more important than ever to have access to the premium analysis as soon as possible. Please note that our Premium Updates are now posted on Friday, at least few hours before the market closes so that our Subscribers are able to take critical action before everyone else. The depth of the analysis and the time when it is provided can easily translate into thousands of dollars of gains, especially during the critical parts of the bull market - and we are certainly in one right now. Make sure that have the analysis and tools necessary to make the most of the coming giant upswing in the precious metals and from increased volatility and subscribe today.

Thank you for reading. Have a great and profitable week!

P. Radomski

--

This week's Premium Update is one of the biggest that I've written so far; additionally it contains a follow-up on the last week's analysis of the platinum market, which has been remarkably efficient in timing local tops in the whole precious metals sector during 2009.