Gold News Monitor originally sent to subscribers on May 18, 2015, 7:47 AM.

The end of the past week was full of important economic news, such as April U.S. Industrial Production. What do these new pieces of information tell us about the U.S. economy and how can they affect the gold market?

The U.S. industrial production dropped by 0.3 percent in April, according to the official data. This was a fifth month in a row, being the longest series of declines since the Great Recession. This fall was driven by a 0.8 percent drop in mining and 1.3 percent decline in the output of utilities, while manufacturing was unchanged (however, machinery production fell 0.9 percent, which does not bode well for the future, since less machinery today means less output in the future). Weak industrial production was caused by the strong U.S. dollar that hurt exports, and by the plunge in oil prices which ended the fracking boom. To add to the pain, the capacity utilization for the industrial sector dropped by 0.4 percentage points in April to 78.2 percent, a rate that is almost 2 percentage points below its long-run average.

Another piece of data was published on Friday – the New York Fed’s Empire State Index. The index moved back into positive territory in May, but only barely, inching up to 3.1 from a negative 1.2 in April. Such a low reading reflects weak growth, much more below the expectations and the rebound in activity seen last year. So forget about the quick recovery after the first quarter, especially that the capital expenditures index declined nine points to 15.6. What is also important is that optimism wanes among manufacturers. The six-month outlook worsened to 29.8 in May from 37.1 in April, not far above a two-year low of 25.6 in February.

The same lack of optimism is common also among the consumers. According to the latest data, the University of Michigan’s consumer-sentiment index fell from 95.9 in April to 88.6 in May, hitting a seven-month low. It should not be surprising, given the sluggish wage growth.

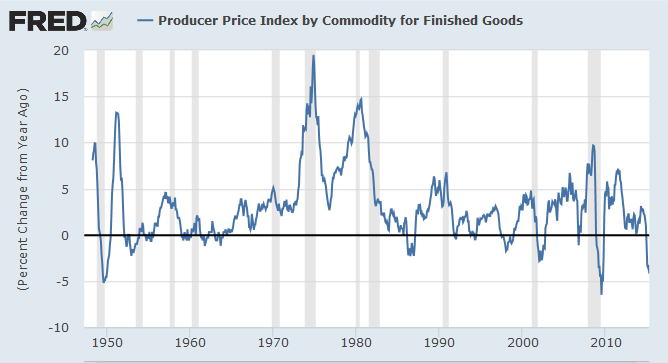

The last piece of news is that the U.S. producer prices dropped by 0.4 percent in April, marking the seventh decline in the last nine months. This fall reflects deflationary forces (weak demand for capital goods because of a contraction in entrepreneurial operations) among producers. The pace of the recent declines paints a rather recessionary picture (see the chart below).

Chart 1: Producer Price Index by Commodity for Finished Goods from 1947 to 2015.

Source: research.stlouisfed.org

Summing up, the weak news from the factory sector, including U.S. industrial production and the Empire State report, will not be pulling forward expectations for the Fed's interest rate hike. Moreover, the FOMC will probably cut their forecasts for economic growth when they gather again next month. This should all be supportive for the gold prices.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview