Based on the May 20th, 2011 Premium Update. Visit our archives for more gold & silver articles.

In continuation to our latest free commentary Breakout Or Breakdown Whats Next For Gold? lets have a look at the currency moves and its influence on precious metals market.

Lets begin with some of the recent developments associated with gold. Following George Soros gold selling, precious metals blogosphere was recommending that the U.S. sell its gold reserves to pay off its massive $14 trilling debt. Congressman Ron Paul was asked about the possibility of selling the contents of Fort Knox and he responded that it would be a 'good and moral decision'. While we respect some of Congressman Pauls ideas, this one seems far-fetched. With about 147 million ounces in reserves the value of all that gold if sold would come to $220.95 billion dollars, which would cover only between 2-3% of the national debt. (Of course, selling off that kind of amount would lower the price.) That would leave the U.S. with a huge mountain of debt and little of offer as collateral.

Meanwhile, a Bloomberg report stated that sales of gold coins are on track for the best month in a year and this during a commodity rout. The U.S. Mint sold 85,000 ounces of American Eagle coins since May 1 at the same time that the Standard & Poor's GSCI Index of 24 raw materials fell 9.9 percent. History shows that the last time sales reached that level, bullion rose 21 percent in the following year. In a Bloomberg survey of 31 analysts, traders and investors the median estimate for gold was that the yellow metal gold will advance 17 percent to a record $1,750 an ounce by Dec. 31 and keep gaining in 2012.

Currency depreciation is the unofficial policy of todays monetary leaders, both the American Federal Reserve and the central banks of other countries. Gold is doing what it is supposed to be doing--its price is adjusting upward in correlation to the depreciation of fiat currencies. We believe that governments will continue to debase the currencies and therefore gold still has a long way to go.

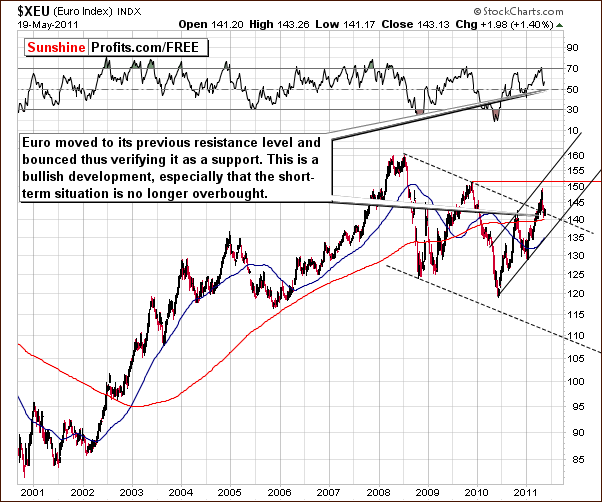

With a lot of things happening with precious metals, lets have an overview of the currency dependence on the metals. Recently gold has been positively correlated with the Euro Index, so lets take a look at the long-term chart featuring the latter (charts courtesy by http://stockcharts.com).

In the long-term Euro Index chart, index levels have moved above the resistance line, declined soon thereafter and verified this line as support. Weve based this support line on weekly closing prices (the most important implications are based on these prices) - 159.35 / July 7th and 149.62 / Nov 23rd.

Although the above chart doesnt allow for much precision because of its long-term nature, taking a closer look at the key support level that is currently in play provides us with a strong support right at the 140 level. This is where euro bottomed on Monday and reversed on Tuesday. This is a bullish development.

Additional bullish phenomenon is seen in the RSI level which is no longer short term overbought. This implies that a rally from here is quite likely. We also note that the index moved below the support line but then quickly reversed; thus what we have seen so far is nothing more than a verification of the breakout. Again, this is bullish phenomenon, not a bearish one. Although not a certainty, it appears that a rally from here is likely.

Since euro has been moving rather in tune with gold and silver in the previous months, the above analysis provides us with bullish implications also for the precious metals sector.

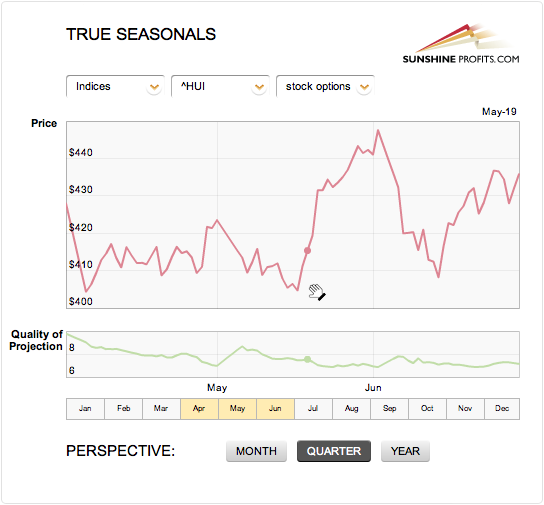

Moving on, lets try to figure out the possible outcome of favorable currency support on gold and silver seasonality. Lets look into Sunshine Profits True Seasonals tool (combining seasonality +derivatives expiration effect).

On the above HUI (gold stocks) seasonal chart, it appears that we are right before a considerable rally that would likely take place until the end of the month. It doesnt seem that gold stocks will move to or above their previous highs (as seen on the above chart), but nonetheless a rally appears likely.

On a side note, if youre interested in examining an analogous chart for gold seasonal pattern, please read our May 17th commentary.

Please note that the pattern for May played out quite reliably so far top at the beginning of the month small correction in the first week of May and then a more significant bottom in the middle of the month.

Again, the local top for mining stocks may not be as high as the prior top but even if it is a bit lower, the situation still appears to be bullish.

Summing up, the situation remains short-term bullish for euro and precious metals and the true seasonal tendencies confirm that a short-term rally is likely.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

The volume seen in the previous days has been very small and we've noticed an out-of-the-box pattern regarding that fact which provides additional insight to today's price analysis. The latest issue includes targets for both: gold and silver.

The USD Index appears to be the key to the current situation in the precious metals market and this week's developments were particularly interesting. Our latest update includes detailed interpretation of the most recent events in both Euro and USD Indices. Additionally, our indicators have once again flashed an important signal. You might want to take that into consideration while making your investment decisionts...

Please note that if the seasonal tendencies play out at least somewhat as expected, it makes a lot of sense to join our Subscribers now, as the following moves could be quite.