Based on the May 2014 gold Market Overview report.

There is something horribly wrong both with most economic theories and with macroeconomic policies pursued by governments. The latter is not that surprising since most of those policies are being based on the former. Bad economic theories are driving our policies. The main reason for this is the macroeconomic focus on wrongly chosen and selected data, which blur a proper understanding of how the economy works. It’s not just the fact that the data itself is flawed, like in the case of price indexes and output measurements. The fact is that the approach towards that data is misplaced.

Take the case of any central banking decision done for the purpose of achieving macroeconomic goals. These are most often general final goals, sort of final states of rest such as a certain level of price inflation, or a certain pace of Gross Domestic Product growth. For example – nominal growth should be such and such, or price inflation should be around two percent. How this thing is to be achieved is taken for granted by the computer model of the macroeconomy assuring us that we can exactly find the relationship for example between interest rates set by the central bank and the pace of growth and inflation. Sure, they will tell us; there are some tradeoffs; nothing can be done fully; yet, in general, we can get what is going on, and steer the wheel in the right direction.

The unavoidable cost of such policies is a hidden bubble. Mainstream macroeconomic policies are not really interested in bubbles. Perhaps the reason is that they do not believe the bubbles can be sensibly defined, recognized, and empirically analyzed. Or that they cannot easily conform and be smoothly integrated into the framework of interventionist policies, which support and rationalize big governments. Naturally, when the crisis happens, there is a lot of talk about the bubble permitting certain economic conditions and resulting in “excess capacity”, high unemployment, and so forth. Yet unfortunately it is always the market which is blamed for the bubble, not the institutional framework leading to such bubbles.

The example of how mainstream policies are not eager to include the notions of a bubble in their considerations is the fact that central banks do not really care what happens to the stock market as long as it grows. Why should anyone care? – is a typical approach. If things are going up, then we can be happy about it. Perhaps there may be some overacting going on, but apparently is has nothing to do with the interest rates set by the central bank…

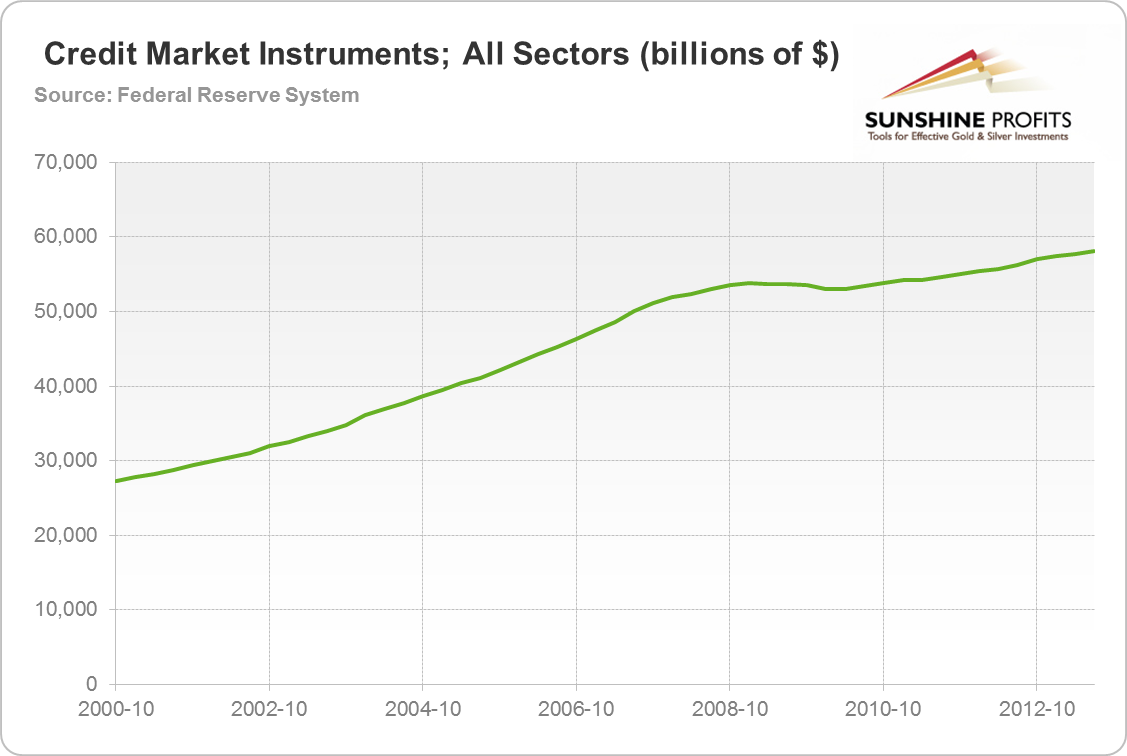

How are we to focus on the bubbles and see the macroeconomy in more realistic terms, and not only in the final macroeconomic goals? Let us consider debt levels. Not only public debt levels, since public debt is not really “debt” in the real sense of the word, because the government is simply printing money to “pay it back”. It does not have to raise money in the real sense, as private entities do. Moreover, this debt is not as responsive to economic conditions as is commercial debt. Therefore let us look at the latter one. How are those levels?

In the last few decades commercial debt has reached record levels. It is justifiable to say that the driving force behind the growth is creation of debt. We actually killed capitalism because of it. Private capital accumulation has been crowded out by the inflationary creed, which wins over private savings.

More importantly (and putting moralizing issues aside) we can see excellent correlations between levels of debt, growth in GDP, and employment. It hits us right between the eyes to see how debt dynamics can show us those insights. Monetarists understood this a bit, since they paid attention to the money supply. They saw similar correlations – between the money supply (defined in some way) and other variables. Since the eighties of the twentieth century this approach had to be dropped. Mostly for technical reasons and measuring limitations. We could not pick one sure way of measuring the money supply, and no universal monetary aggregate could be shown to be correlated with other variables.

Rethinking debt levels is in a way a continuation of this line of thinking, since “debt” can be seen as some version of the monetary aggregate. Those levels show us that there is creeping deleveraging in the system. There is one important thing we should have in mind. The private debt cannot be increased forever without a limit. It cannot go up, and up, and up. It has to stop, and this will also stop the bubble from developing further. Depending on the type of government reaction we will mostly see higher or lower levels of deleveraging. But still, deleveraging.

This is what we see, and even if government is doing all it can to increase its debt, financial deleveraging is a fact. Markets for many financial assets will behave more like zombies rather than growth opportunities.

What can it tell us about the gold market? Crawling deleveraging in the private sector does not create big chances for gold dramatically dropping. Why? Because there are fewer investment options, which are alternatives to commodities, especially gold. It appears that crawling deleveraging should not hurt the shiny market. It should rather strengthen it for the longer run.

The above s based on the May gold Market Overview report. We encourage you to subscribe and read the full version today.

Thank you.

Matt Machaj, PhD

Sunshine Profits‘ Market Overview Editor