Forex Trading Alert originally sent to subscribers on November 6, 2014, 9:44 AM.

Earlier today, the Labor Department showed that the initial claims for unemployment benefits decreased by 10,000 in the week ended Nov. 1, beating analysts’ forecast. This second lowest level for claims this year supported the greenback and pushed GBP/USD below the barrier of 1.6000. Will we see a fresh multi-month low?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

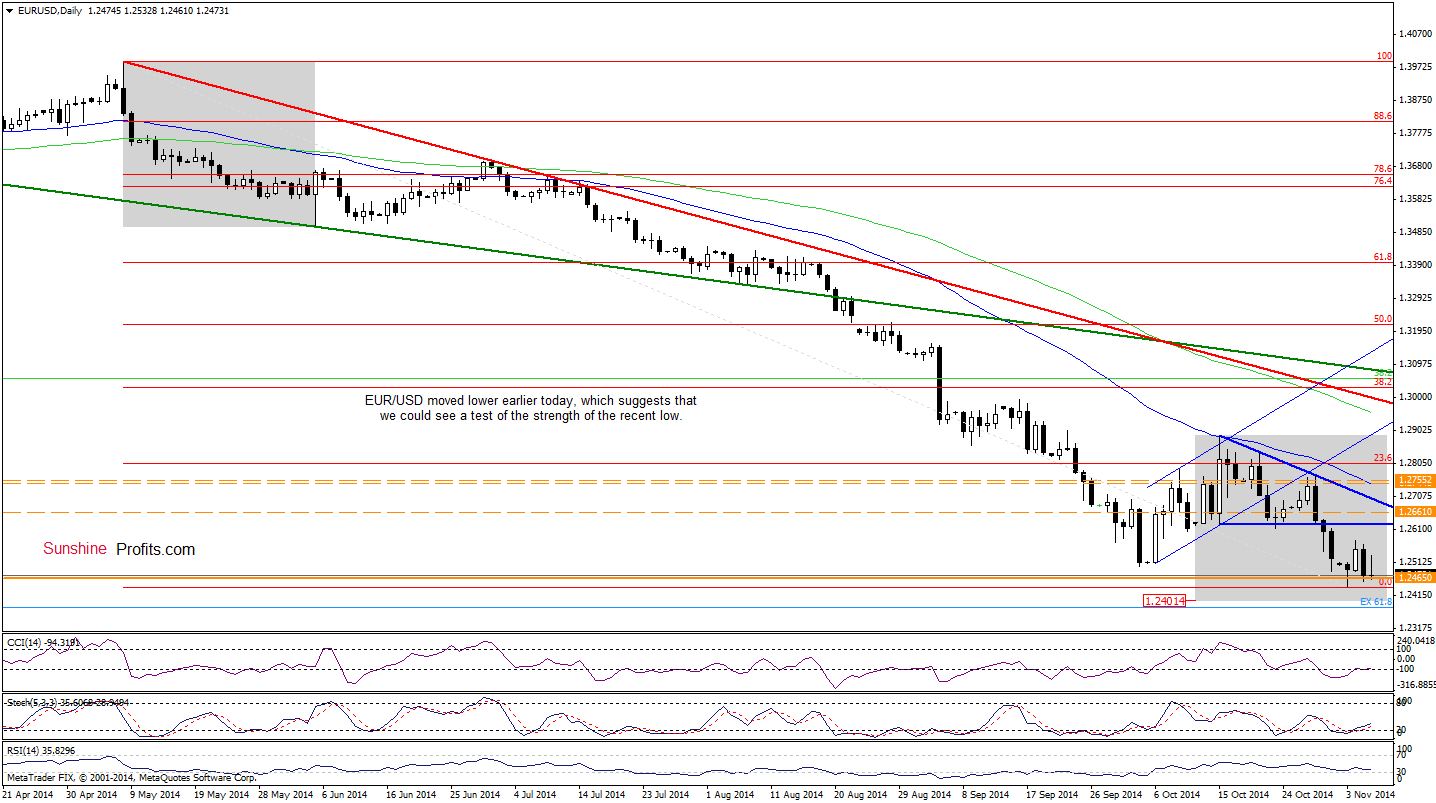

Today, we’ll focus on the very short-term changes as the situation in the medium term remains almost unchanged.

Looking at the above chart, we see that although EUR/USD rebounded slightly earlier today, the pair reversed and erased all gains. In our opinion, this is a bearish signal, which suggests that further deterioration is just around the corner. Therefore, what we wrote on Monday is up-to-date:

(…) we could see further deterioration and a drop to the support zone created by the 127.2% Fibonacci extension (based on the Apr 2013 low and the May 2014 high) and the psychological barrier of 1.2400. What’s interesting, when we factor in the Elliott wave theory and compare the current downward move (a potential wave 5) to the one that we saw in May (the first wave to the downside), we clearly see that they will be equal around 1.2401, which increases the probability of further declines.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

GBP/USD

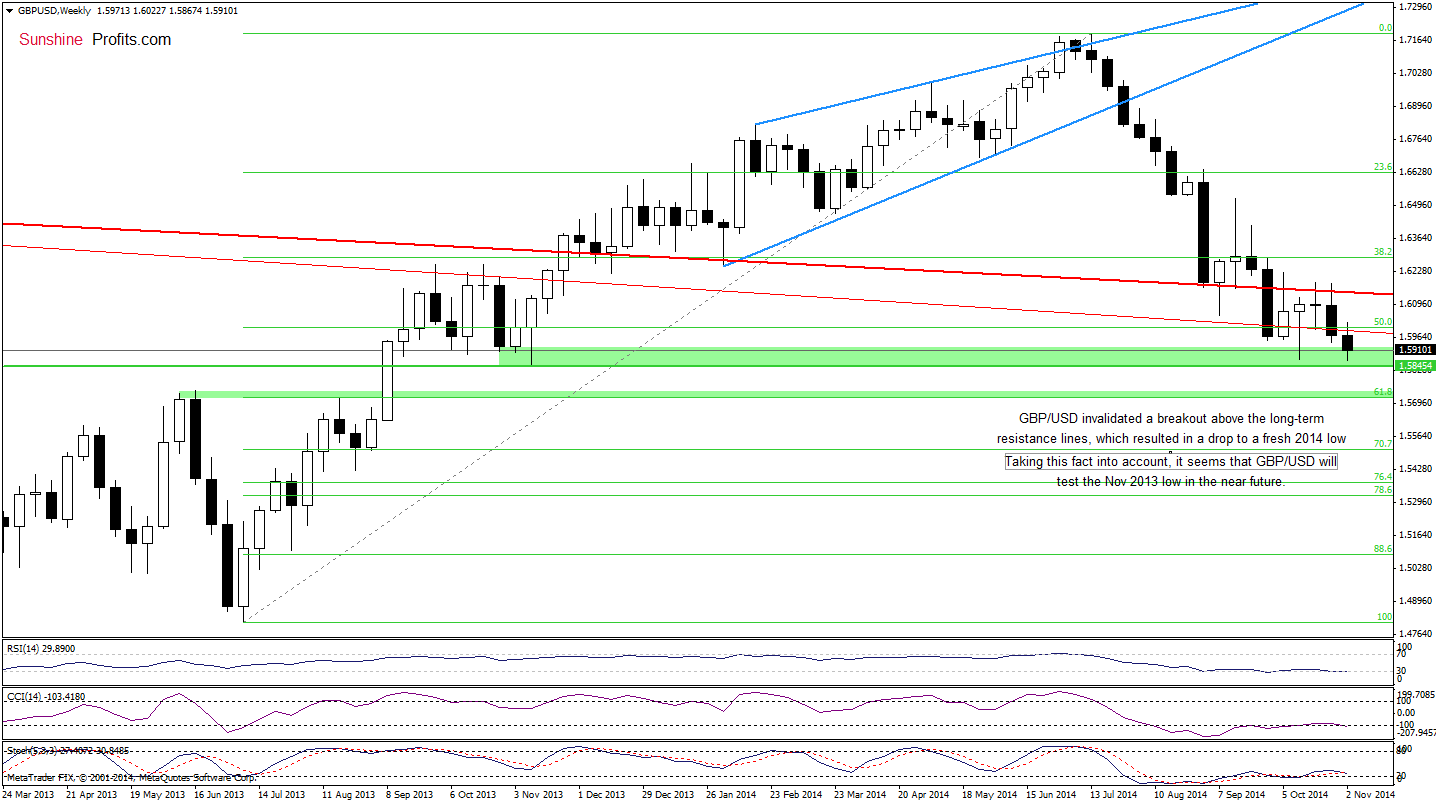

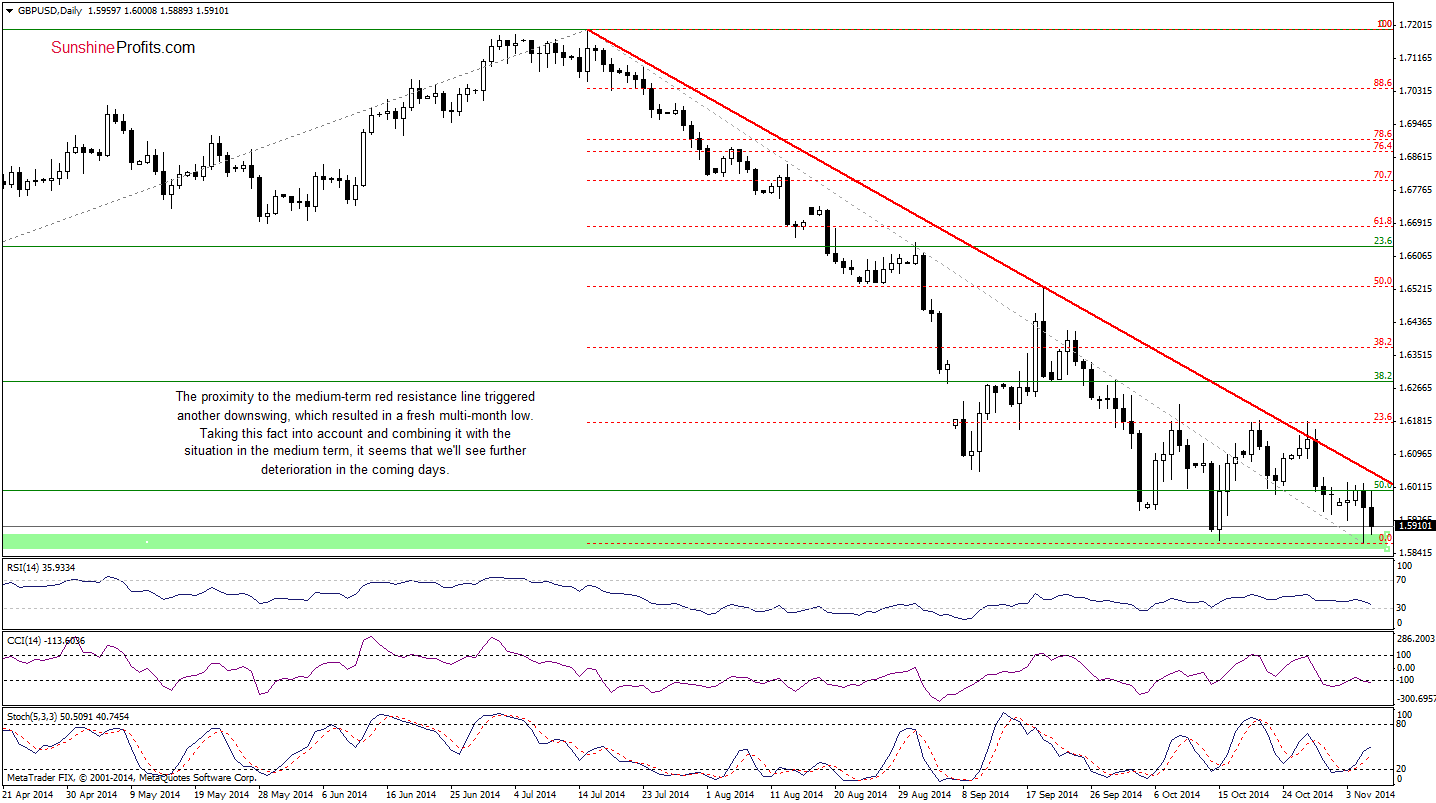

On the daily chart, we see that although GBP/USD moved little higher earlier this week, the proximity to the medium-term red line in combination with the long-term resistance (marked on the weekly chart) encouraged currency bears to act and resulted in a downswing, which took the pair to a fresh multi-month low. As you see on the daily chart, the exchange rate invalidated the breakdown below the previous lows yesterday, but we think that it’s not enough to indicate a rally. In our opinion, as long as there is no invalidation of the breakdown below the above-mentioned key resistance lines further improvement is questionable. Taking this fact into account, it seems to us that the pair will extend losses and test the Nov 2013 low in the coming days.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

AUD/USD

As you see on the above chart, the situation in the very short term has deteriorated significantly as AUD/USD broke below the green support line and dropped below the recent lows. With this downward move, the pair reached the 112.8% Fibonacci extension, which serves as the nearest support. Is it strong enough to withstand the selling pressure? To answer this question, let’s move on to the weekly chart.

From this perspective, we see that he recent downward move took AUD/USD to the 50% Fibonacci retracement based on the entire 2008-2011 rally. In our opinion, this is a solid support, which could trigger a bigger corrective move in the coming week. If this is the case, the initial upside target would be around 0.8641-0.8650, where the previous lows are. Why this area is a key resistance at the moment? Because as long as there is no comeback above these levels, all upswings will be nothing more than a verification of the breakdown and another pullback can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts